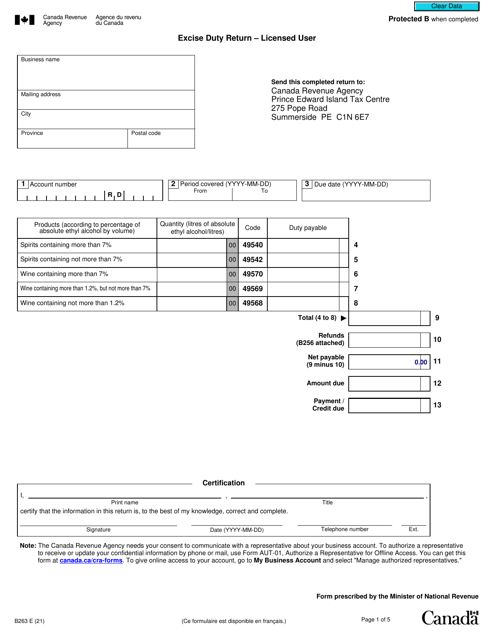

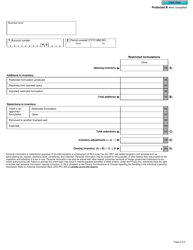

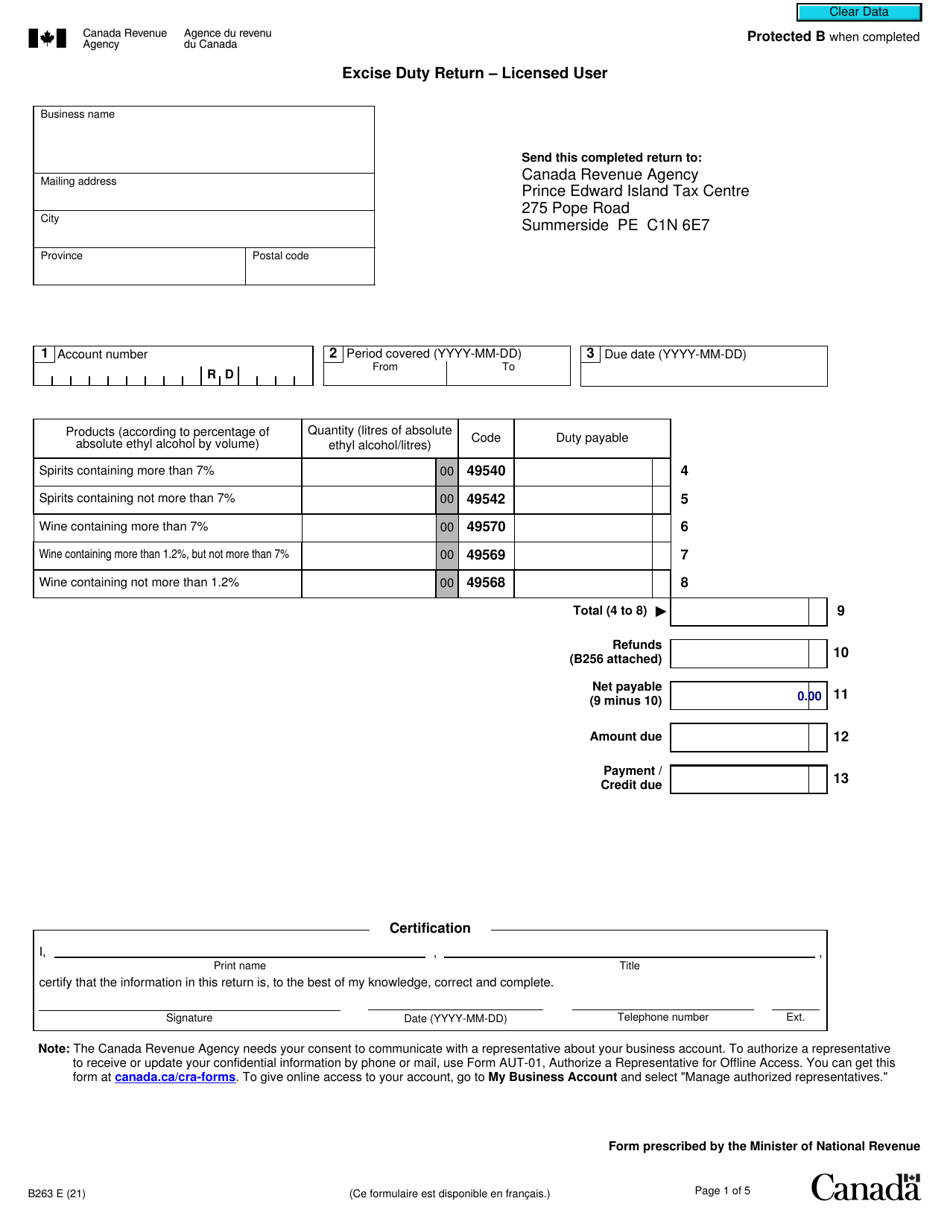

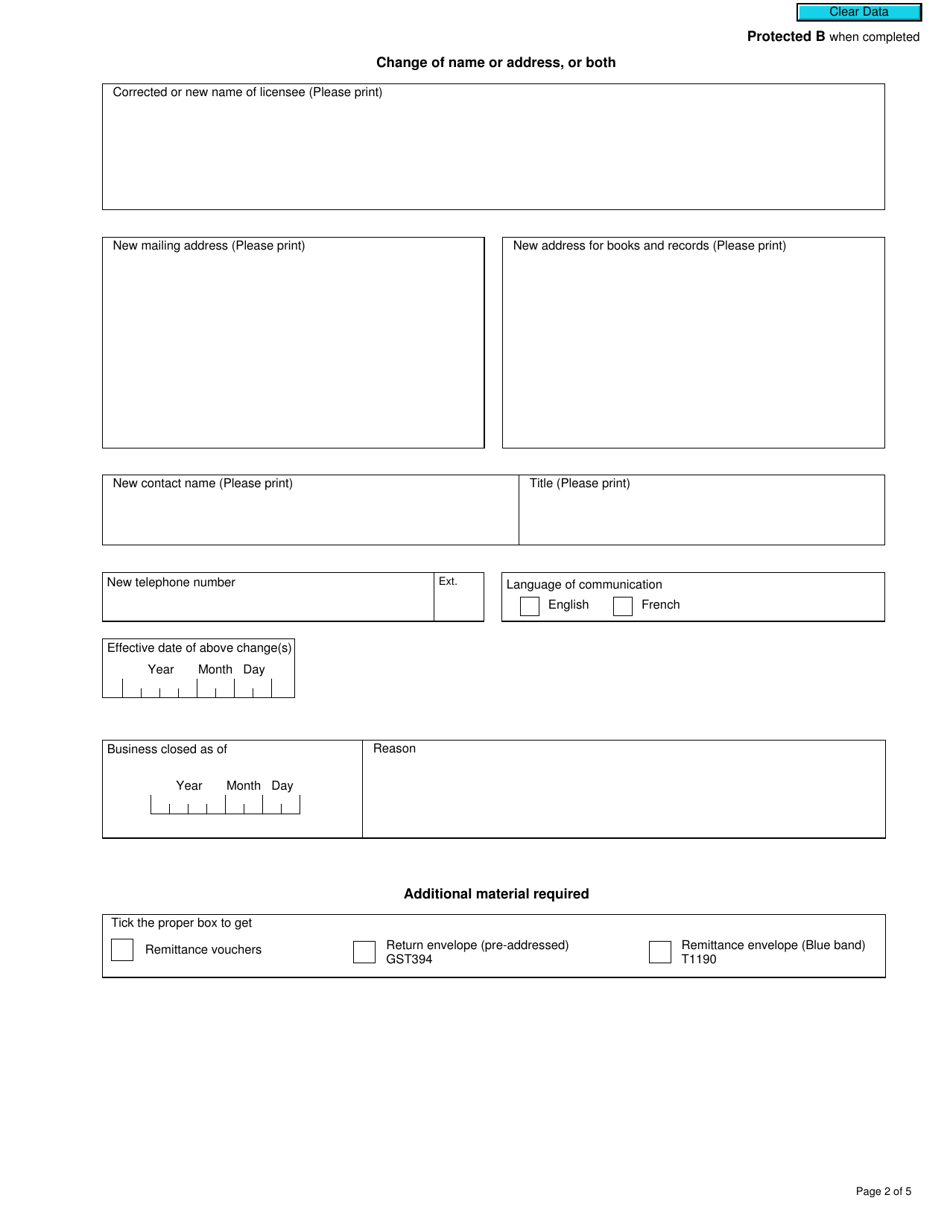

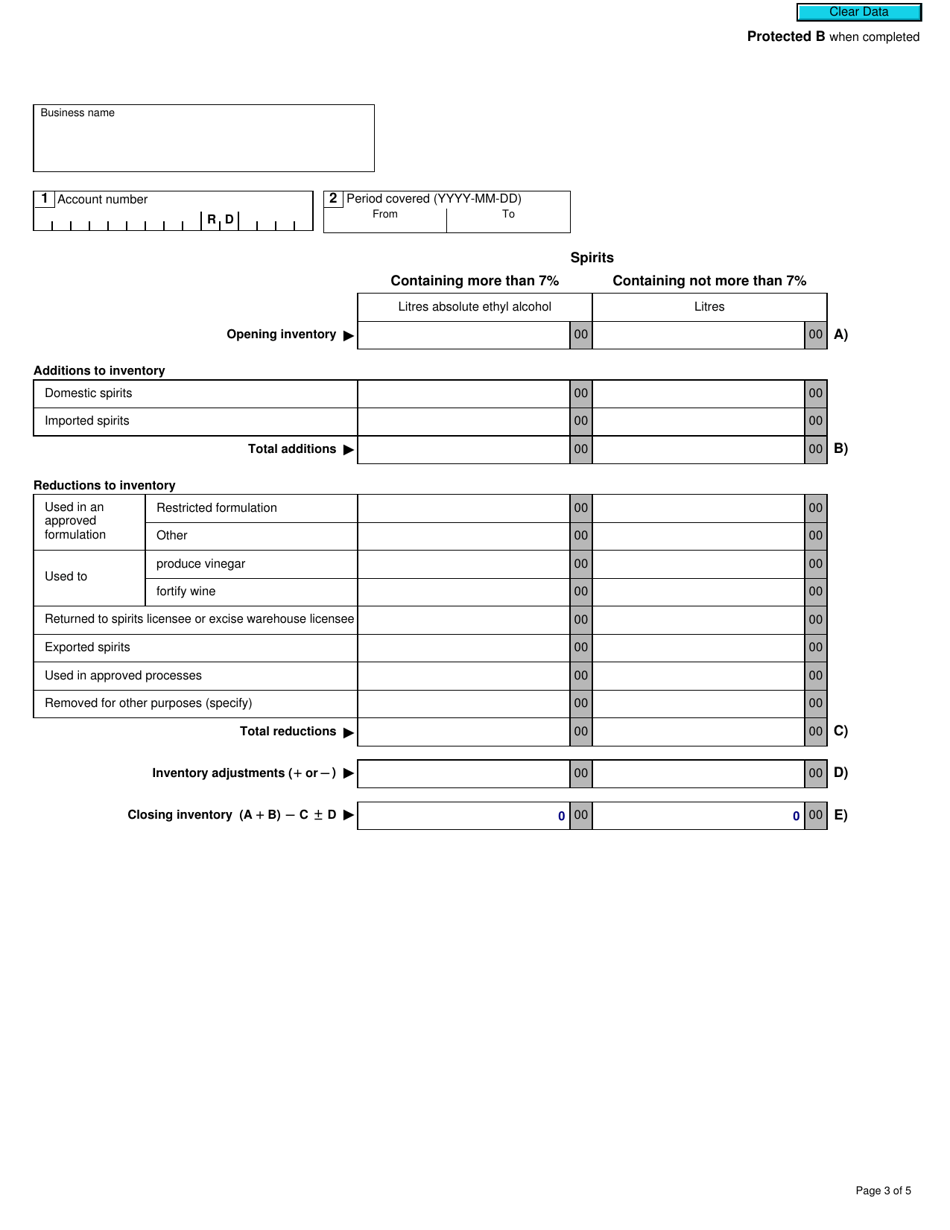

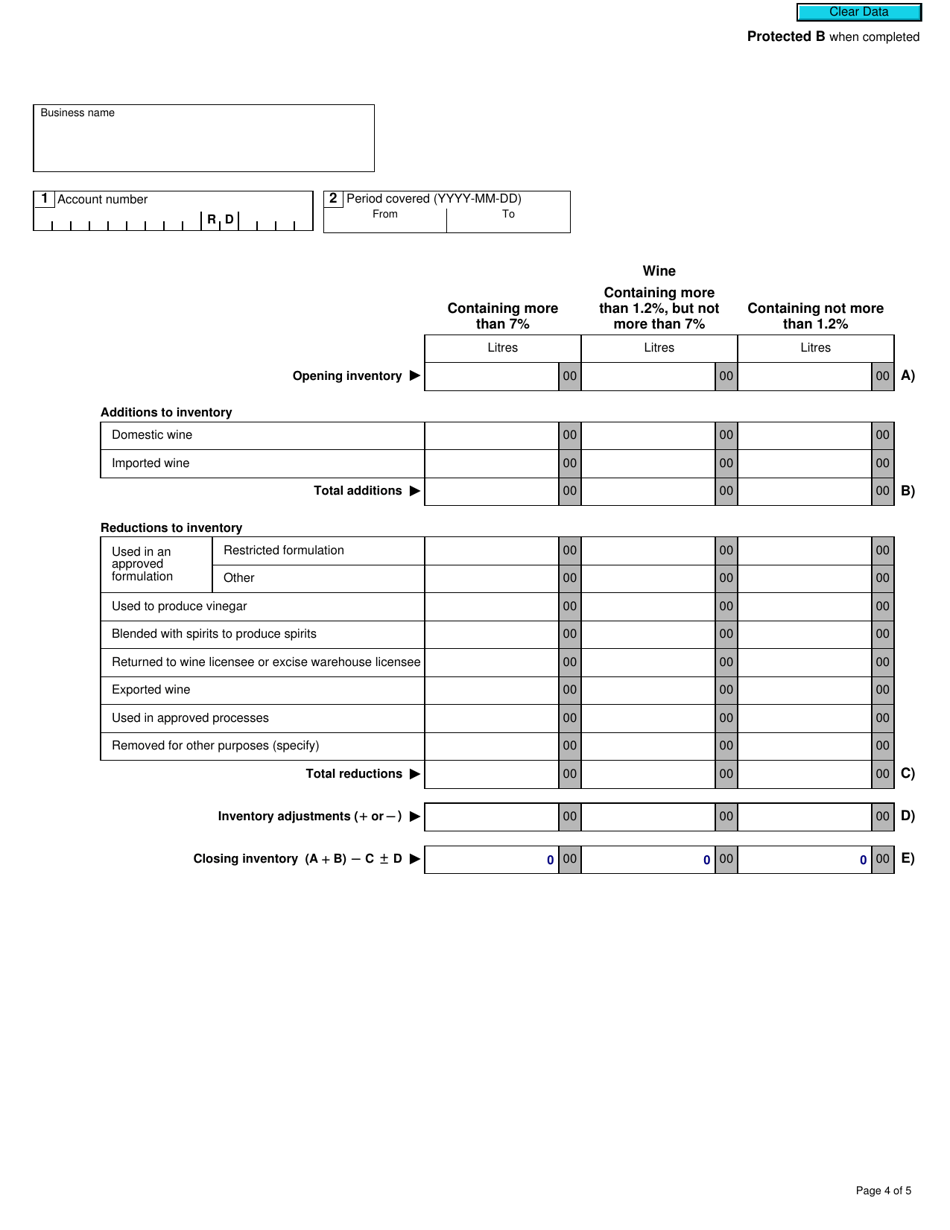

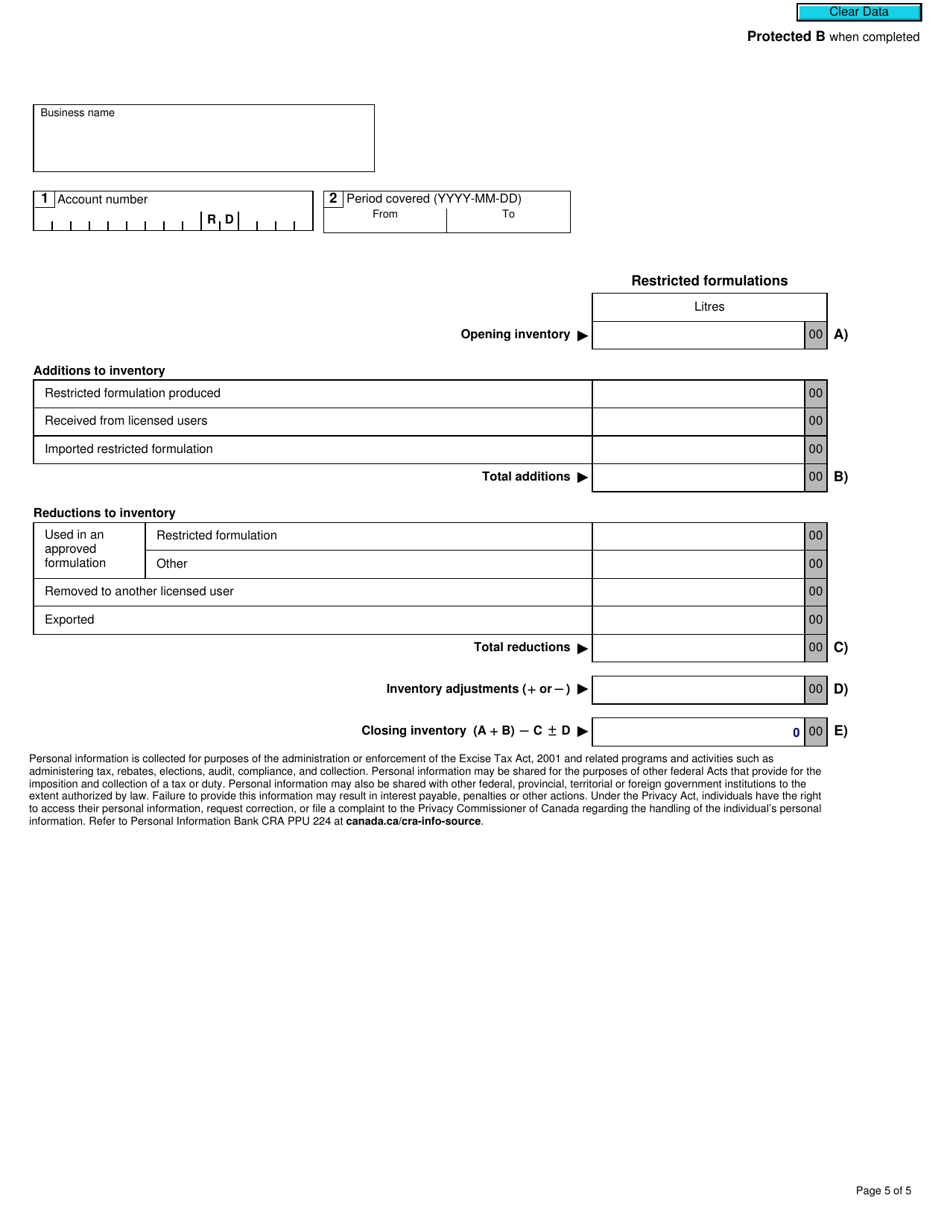

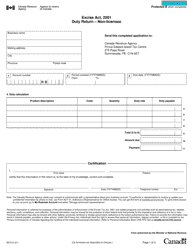

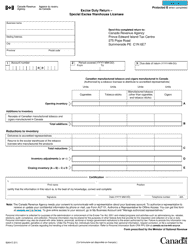

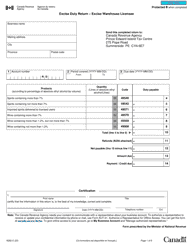

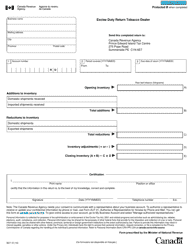

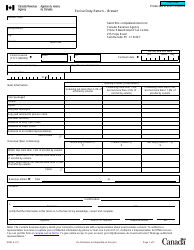

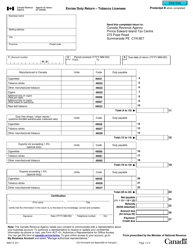

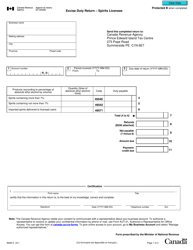

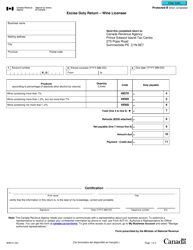

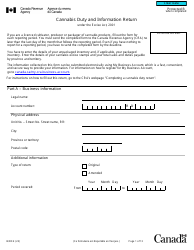

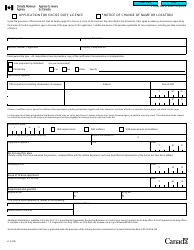

Form B263 Excise Duty Return - Licensed User - Canada

Form B263 Excise Duty Return - Licensed User is a document used in Canada for reporting and paying excise duties. It is primarily used by licensed users who are involved in certain regulated activities such as manufacturing, producing, packaging, or storing excisable goods. The form helps ensure compliance with excise duty regulations and enables the government to collect the appropriate taxes on specific goods.

In Canada, the Form B263 Excise Duty Return is filed by licensed users who are responsible for paying excise duties.

Form B263 Excise Duty Return - Licensed User - Canada - Frequently Asked Questions (FAQ)

Q: What is Form B263? A: Form B263 is an Excise Duty Return.

Q: Who needs to file Form B263? A: Licensed users in Canada need to file Form B263.

Q: What is an Excise Duty? A: Excise Duty is a tax on certain goods produced or manufactured in Canada.

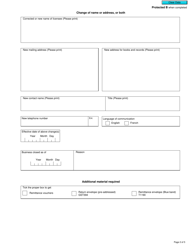

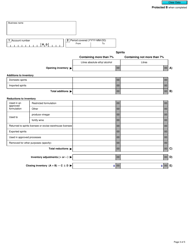

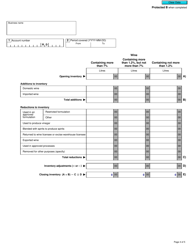

Q: What information is required on Form B263? A: Form B263 requires information such as the amount of goods produced, the amount of duty payable, and any exemptions claimed.

Q: When is Form B263 due? A: Form B263 is due on the last business day of the month following the reporting period.

Q: Are there any penalties for late filing of Form B263? A: Yes, there are penalties for late filing of Form B263, including a late filing penalty and interest charges.

Q: Is there a fee to file Form B263? A: No, there is no fee to file Form B263.

Q: What should I do if I make an error on Form B263? A: If you make an error on Form B263, you should contact the CRA for guidance on how to correct the error.