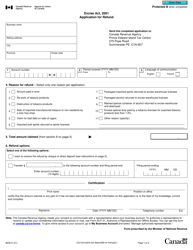

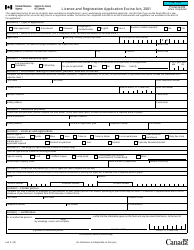

This version of the form is not currently in use and is provided for reference only. Download this version of

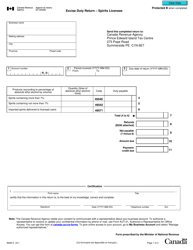

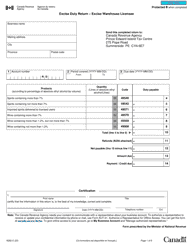

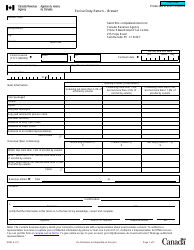

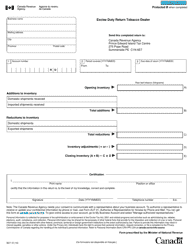

Form B270

for the current year.

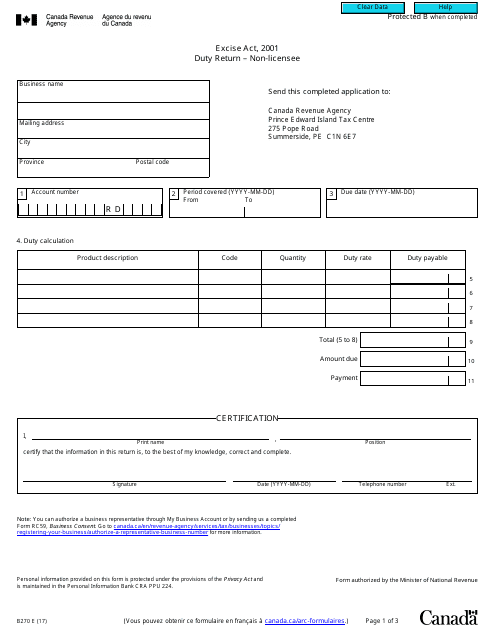

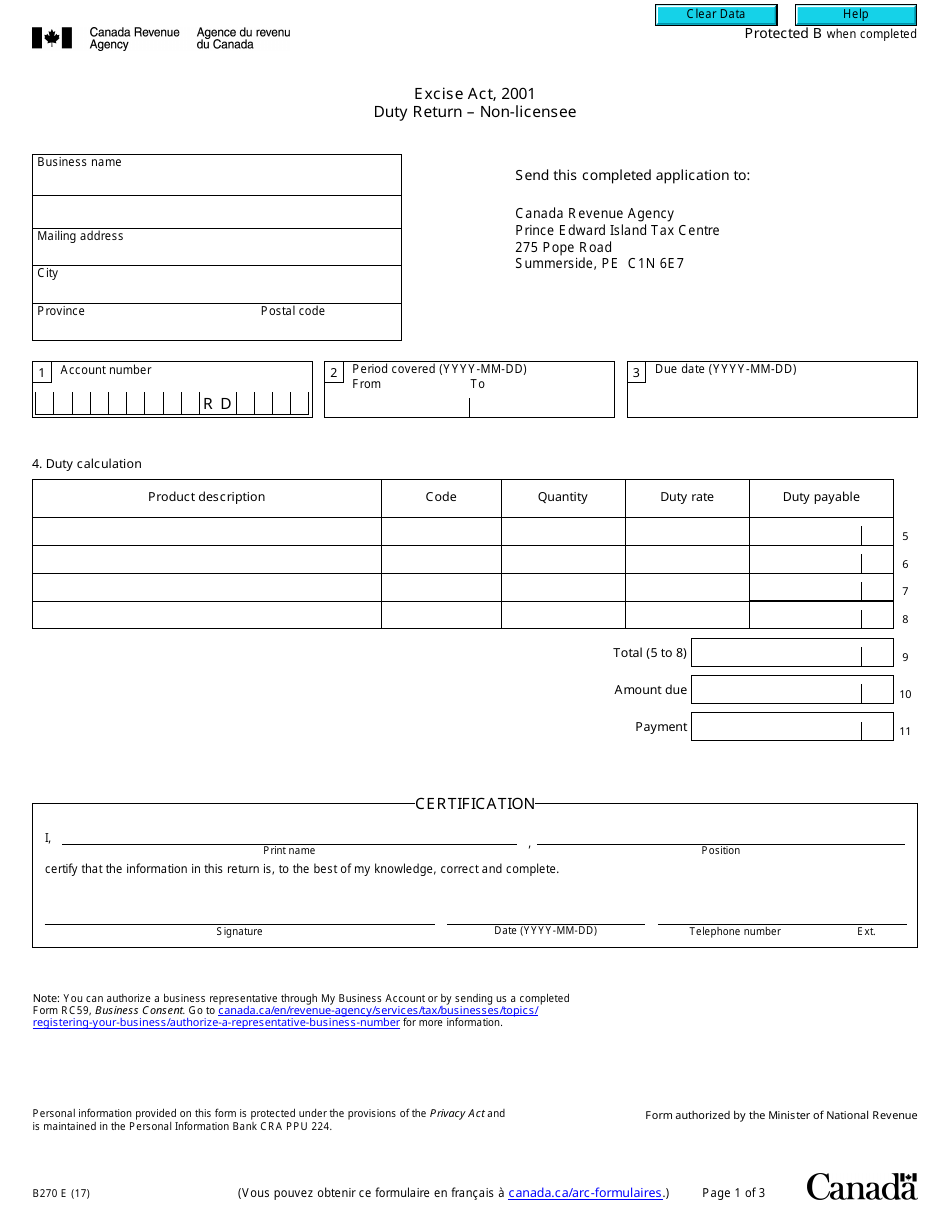

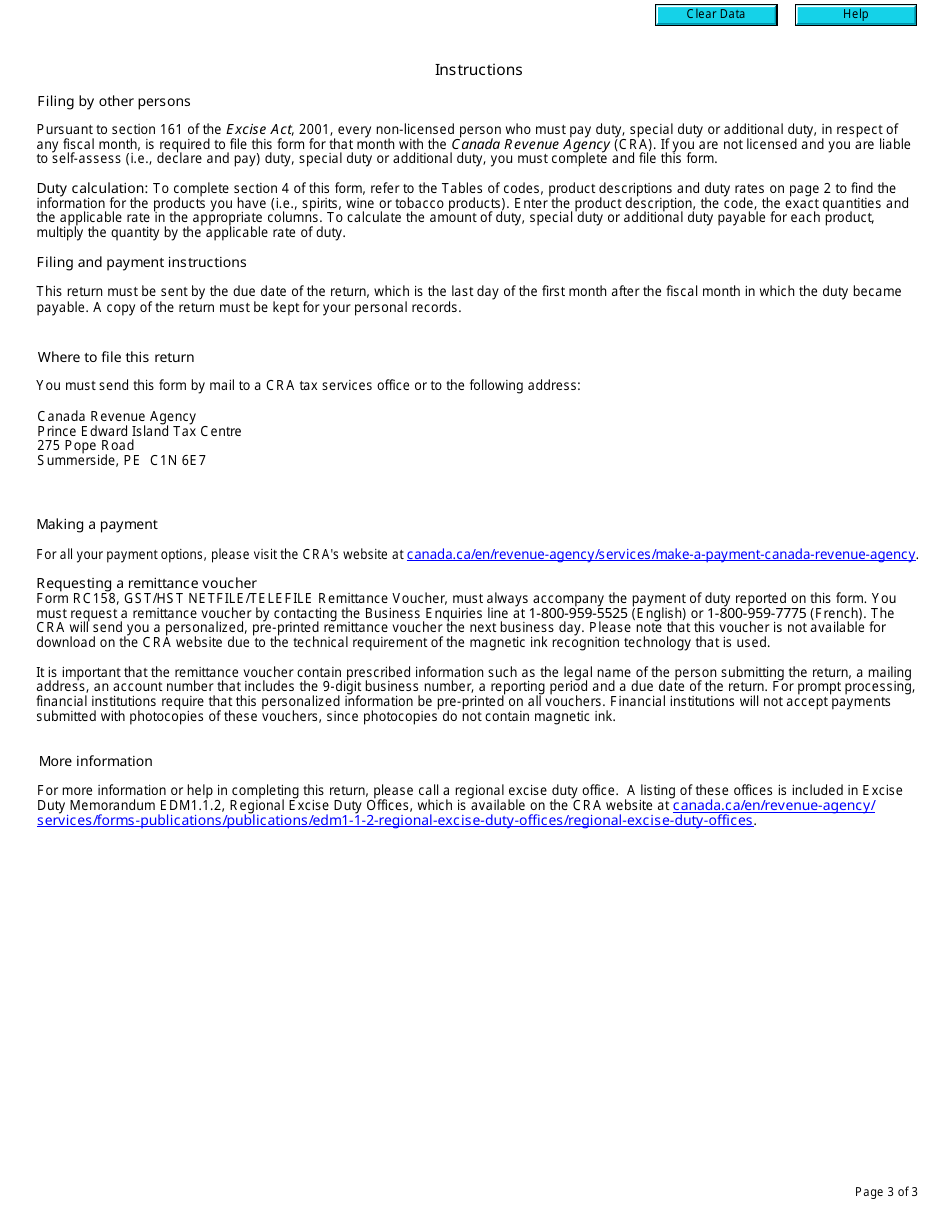

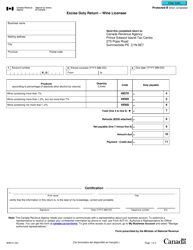

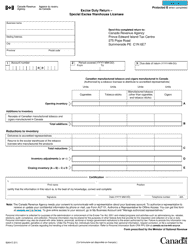

Form B270 Excise Act 2001 - Excise Duty Return - Non-licensee - Canada

Form B270 is a Canadian Revenue Agency form also known as the "Form B270 "excise Act 2001 - Excise Duty Return - Non-licensee" - Canada" . The latest edition of the form was released in January 1, 2017 and is available for digital filing.

Download an up-to-date Form B270 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form B270?

A: Form B270 is an Excise Duty Return for non-licensees in Canada.

Q: What is the Excise Act 2001?

A: The Excise Act 2001 is a Canadian law that governs excise duties on certain goods.

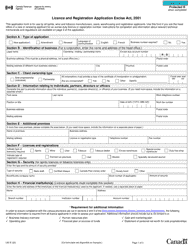

Q: Who needs to file Form B270?

A: Non-licensees in Canada who are liable to pay excise duty need to file Form B270.

Q: What is an excise duty?

A: An excise duty is a tax imposed on specific goods produced or consumed within a country.

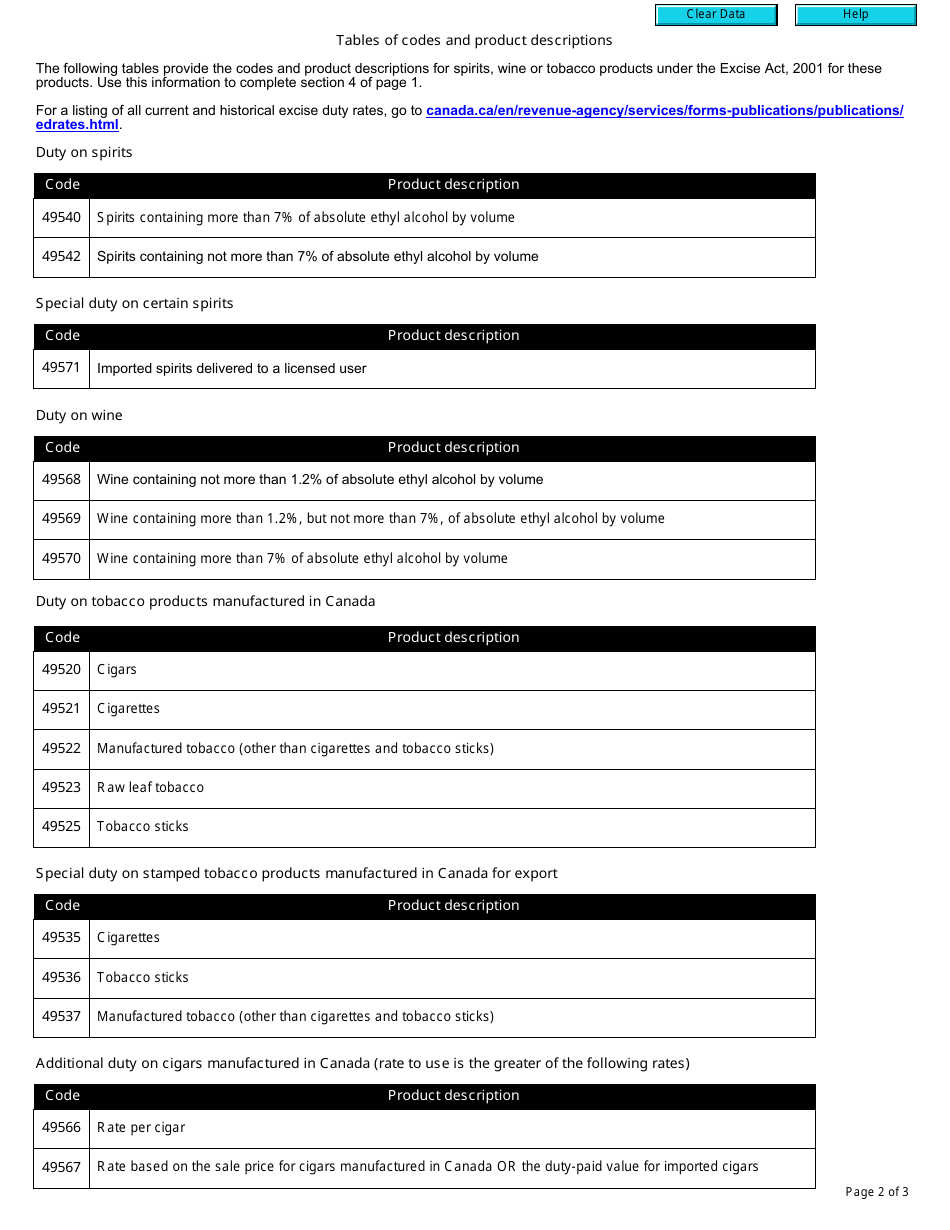

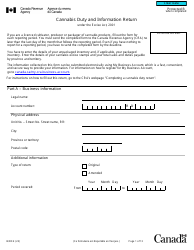

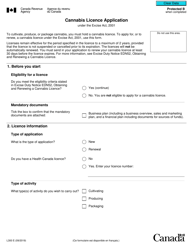

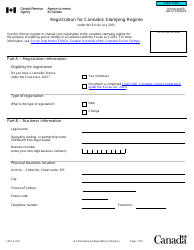

Q: What information is required on Form B270?

A: Form B270 requires information such as the type and quantity of excise goods, the amount of duty payable, and the name and address of the person filing the return.

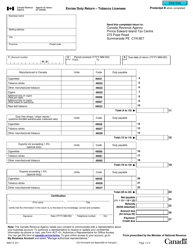

Q: When is Form B270 due?

A: Form B270 is generally due on the last day of the month following the end of the reporting period.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing, including interest charges and potential legal action.

Q: Are there any exemptions or refunds available?

A: There may be exemptions or refunds available for certain excise duties, depending on the nature of the goods and specific circumstances. It is advisable to consult the CRA or a tax professional for guidance.