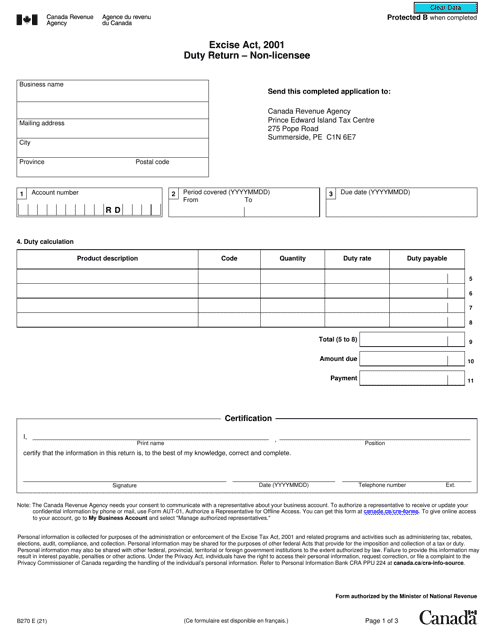

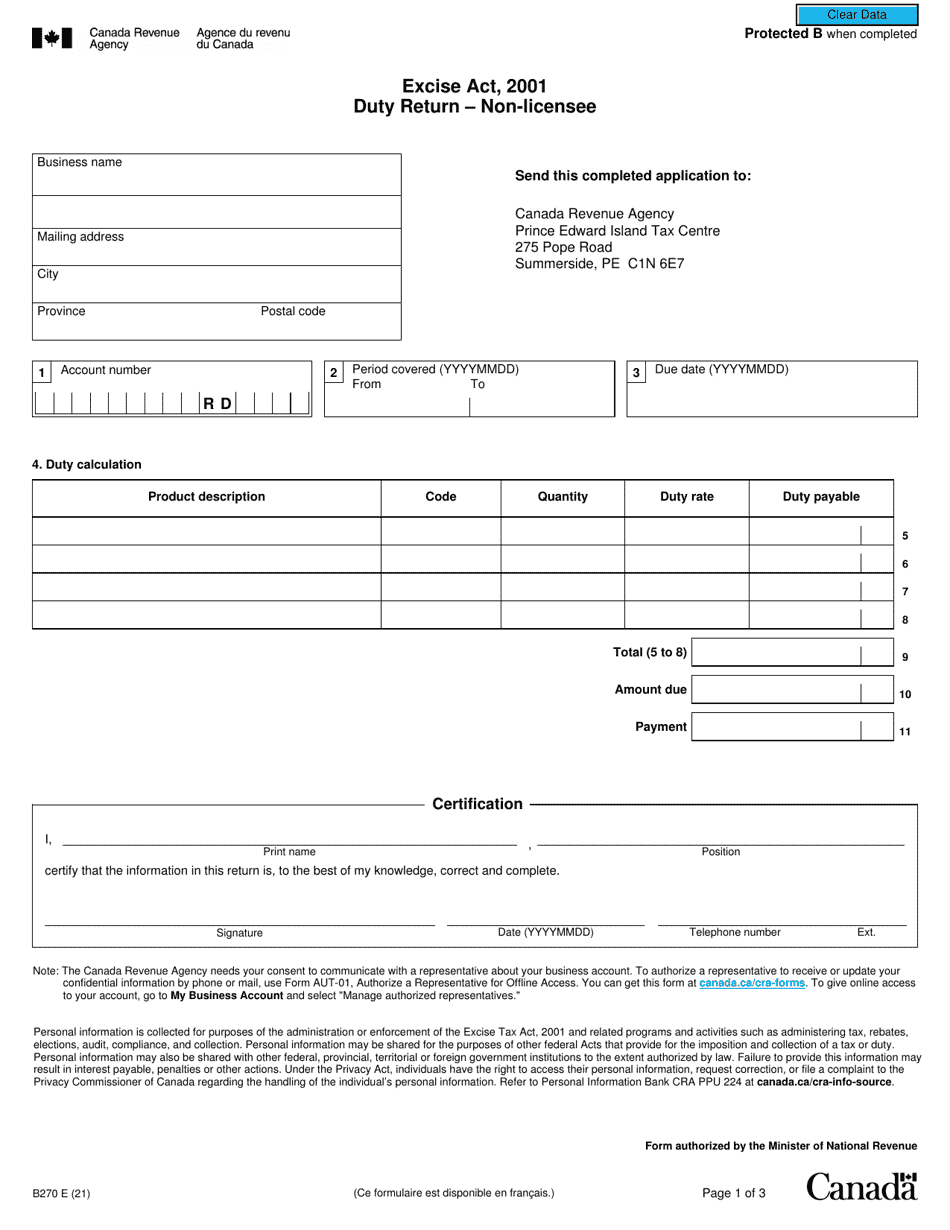

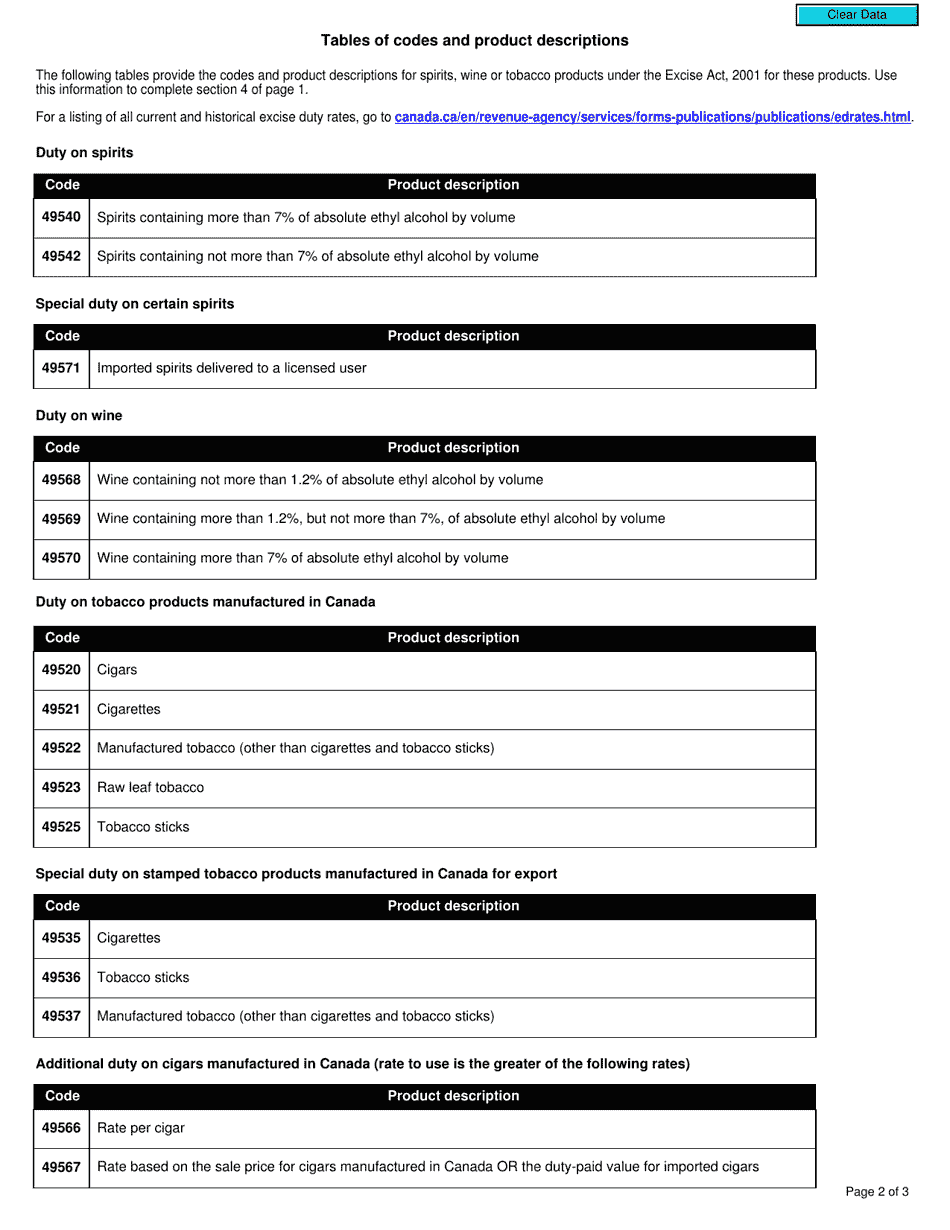

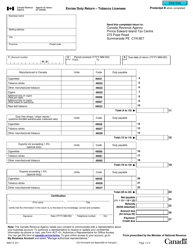

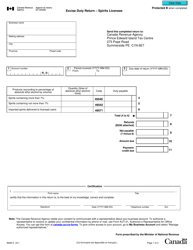

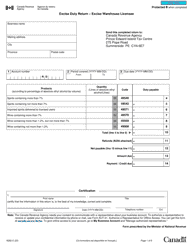

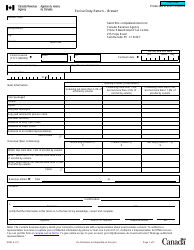

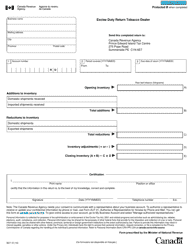

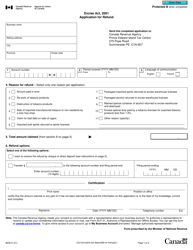

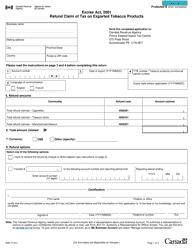

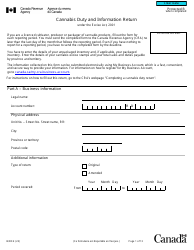

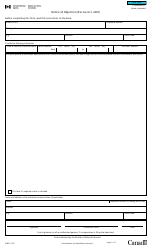

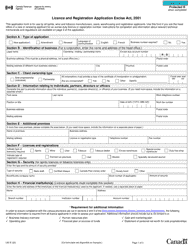

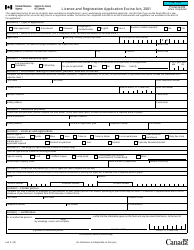

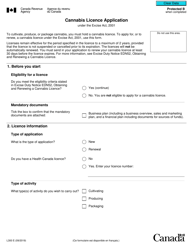

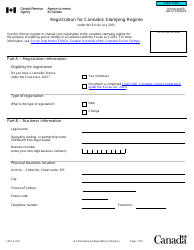

Form B270 Excise Act, 2001 - Duty Return - Non-licensee - Canada

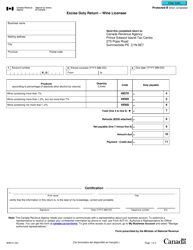

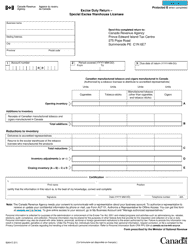

Form B270 Excise Act, 2001 - Duty Return - Non-licensee is a document used in Canada for reporting and paying excise duty by individuals or businesses that are not licensed to engage in specific excise activities. This form ensures compliance with the Excise Act, 2001 and allows non-licensees to fulfill their duty obligations.

The Form B270 Excise Act, 2001 - Duty Return - Non-licensee in Canada is filed by individuals or businesses who are not licensed as an excise licensee.

Form B270 Excise Act, 2001 - Duty Return - Non-licensee - Canada - Frequently Asked Questions (FAQ)

Q: What is Form B270 Excise Act, 2001? A: Form B270 is a duty return form under the Excise Act, 2001 in Canada.

Q: Who is required to file Form B270? A: Non-licensees in Canada are required to file Form B270.

Q: What is the purpose of Form B270? A: The purpose of Form B270 is to report and pay excise duty on goods and services in Canada.

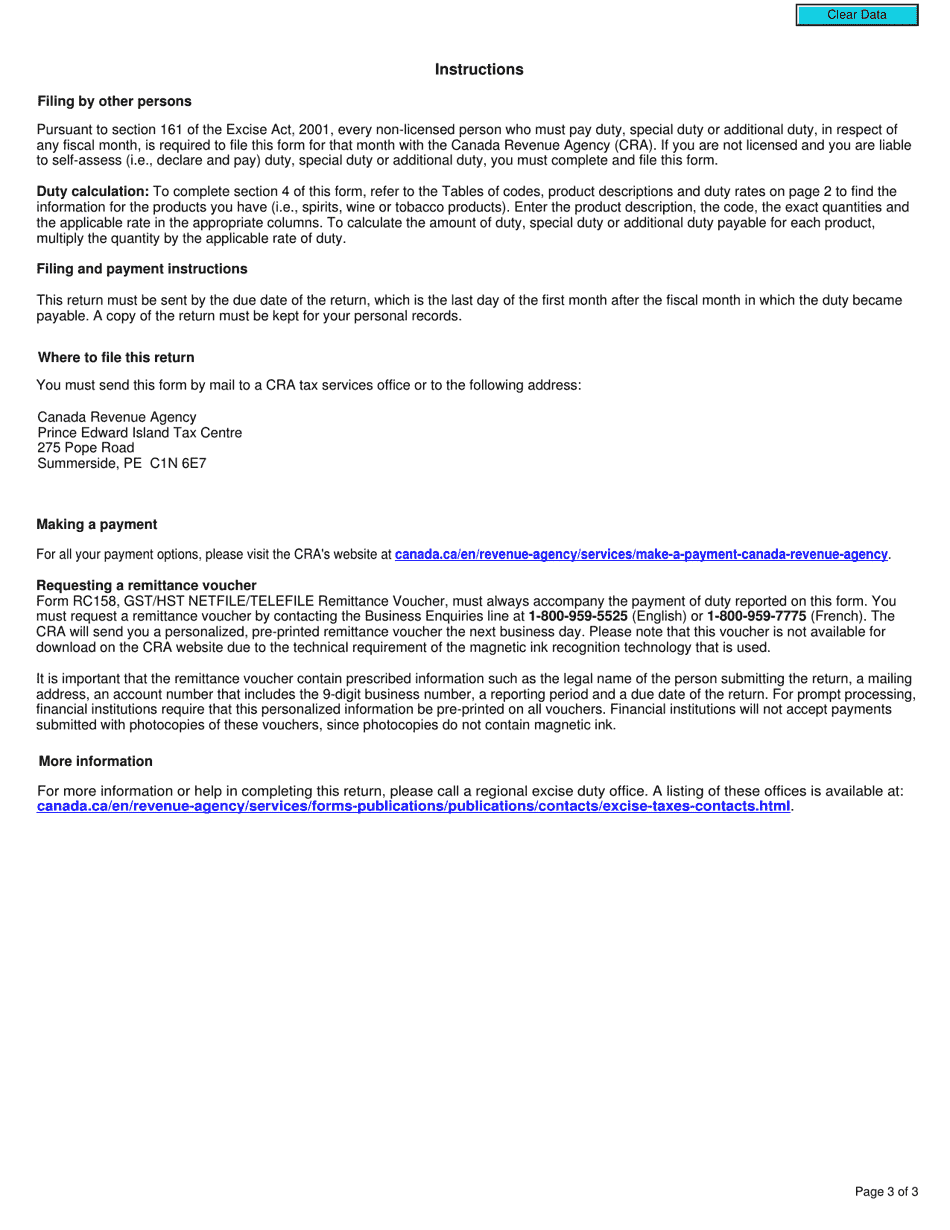

Q: What information is needed to fill out Form B270? A: You will need to provide details about the goods or services subject to excise duty, as well as information about the quantity, value, and other related information.