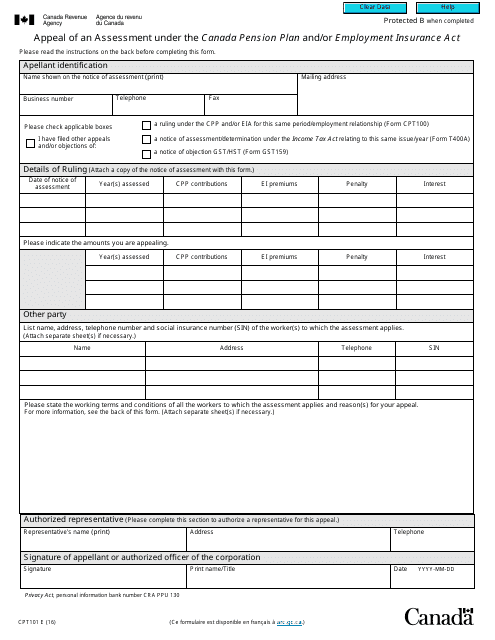

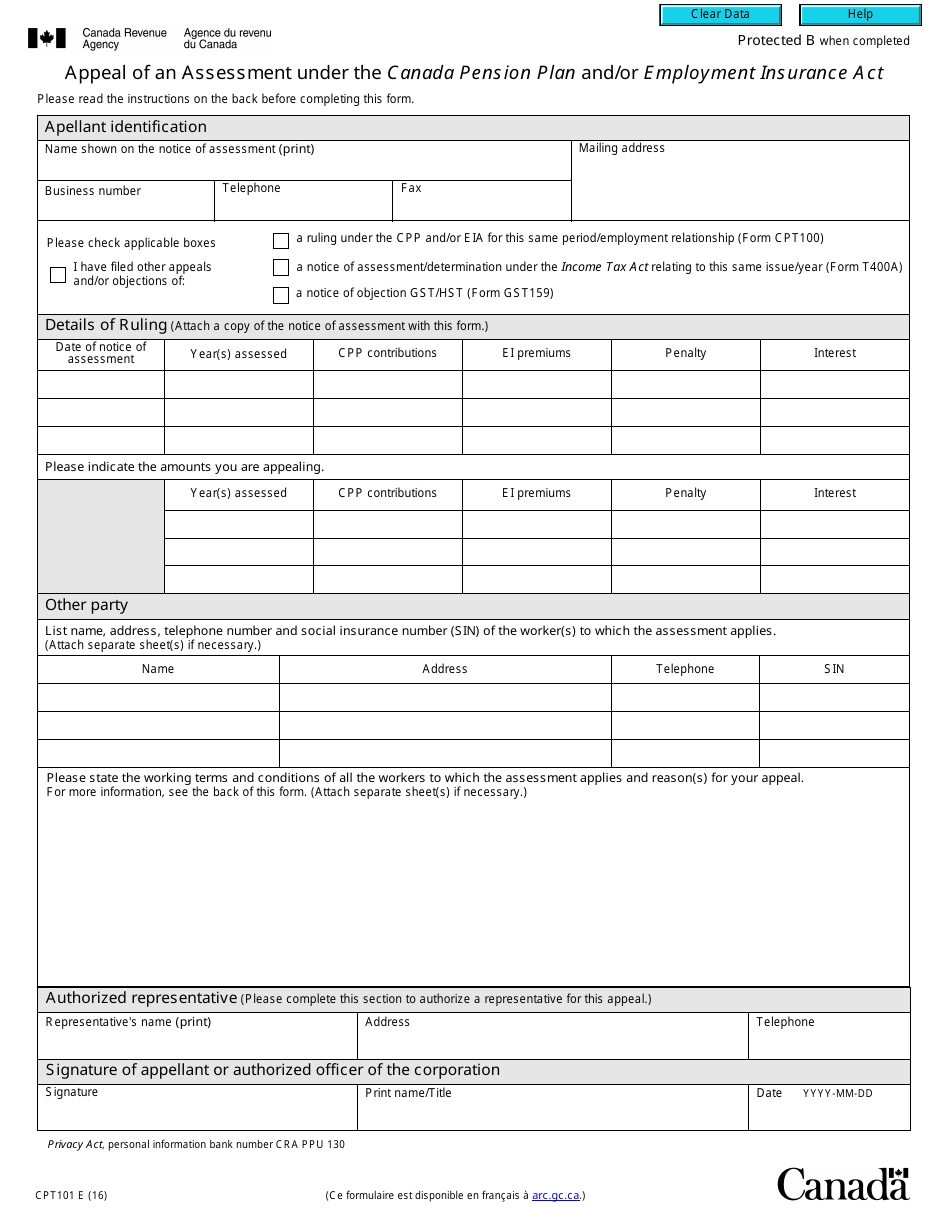

This version of the form is not currently in use and is provided for reference only. Download this version of

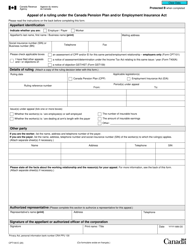

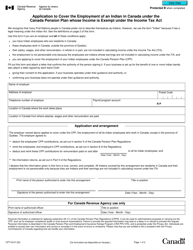

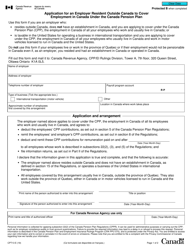

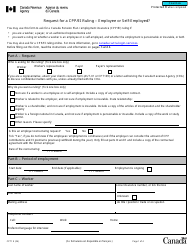

Form CPT101

for the current year.

Form CPT101 Appeal of an Assessment Under the Canada Pension Plan and / or Employment Insurance Act - Canada

Form CPT101 or the "Form Cpt101 "appeal Of An Assessment Under The Canada Employment Insurance Act" - Canada" is a form issued by the Canadian Revenue Agency .

Download a PDF version of the Form CPT101 down below or find it on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form CPT101?

A: Form CPT101 is an appeal form used in Canada to appeal an assessment under the Canada Pension Plan and/or Employment Insurance Act.

Q: When should I use Form CPT101?

A: You should use Form CPT101 when you disagree with an assessment made under the Canada Pension Plan and/or Employment Insurance Act and want to appeal it.

Q: What can I appeal using Form CPT101?

A: You can use Form CPT101 to appeal assessments made under the Canada Pension Plan and/or Employment Insurance Act.

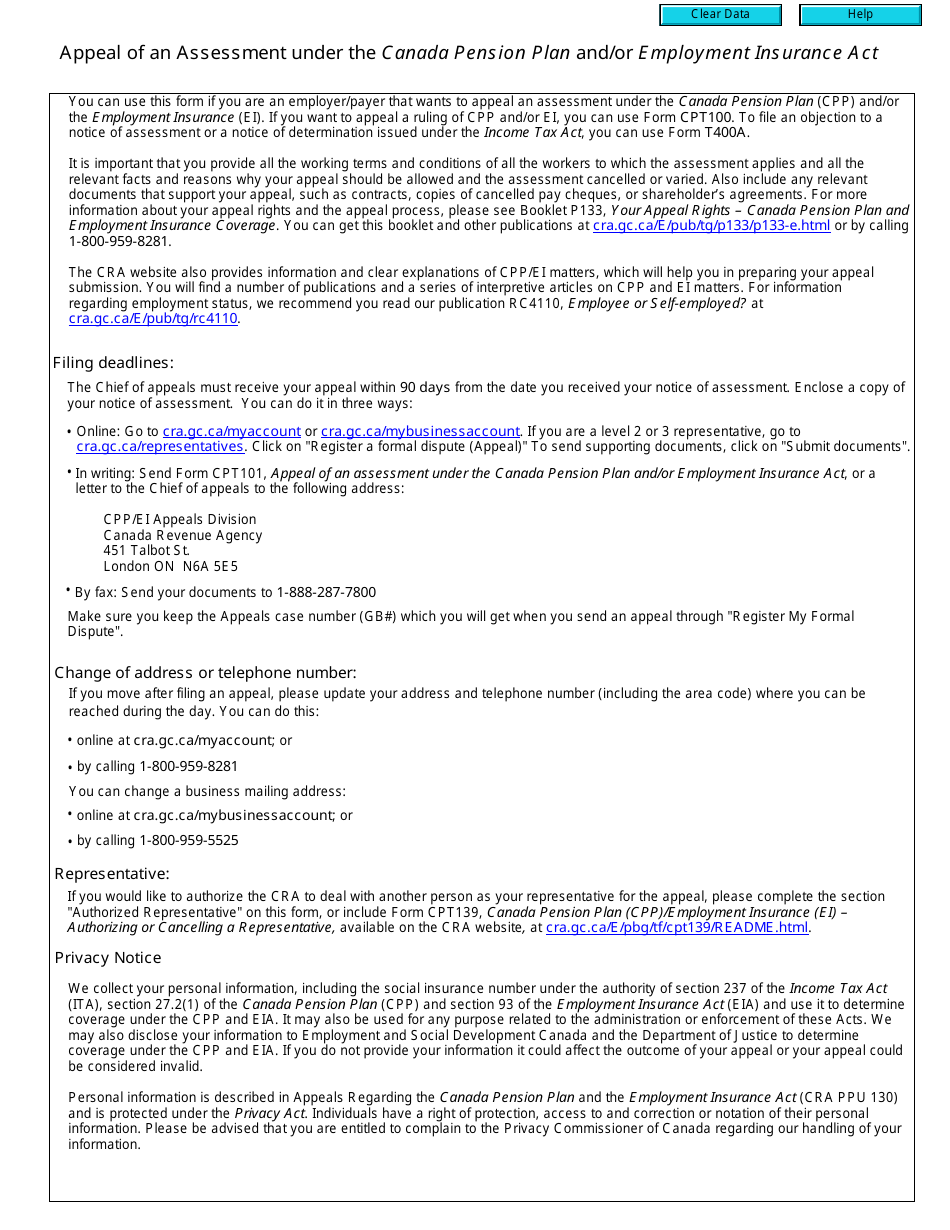

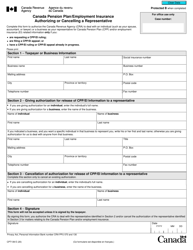

Q: How do I fill out Form CPT101?

A: To fill out Form CPT101, provide your personal information, the reason for the appeal, and any supporting documentation.

Q: Is there a deadline for submitting Form CPT101?

A: Yes, there is a deadline for submitting Form CPT101. The form should be submitted within 90 days of receiving the assessment you are appealing.

Q: What happens after I submit Form CPT101?

A: After you submit Form CPT101, your appeal will be reviewed and a decision will be made. You will be notified of the decision in writing.

Q: Can I request a hearing for my appeal?

A: Yes, you can request a hearing for your appeal. Indicate your request on Form CPT101 and include the reasons.

Q: Can I have someone represent me in the appeal process?

A: Yes, you can have someone represent you in the appeal process. Provide their information on Form CPT101.

Q: Is there a fee to file Form CPT101?

A: No, there is no fee to file Form CPT101.