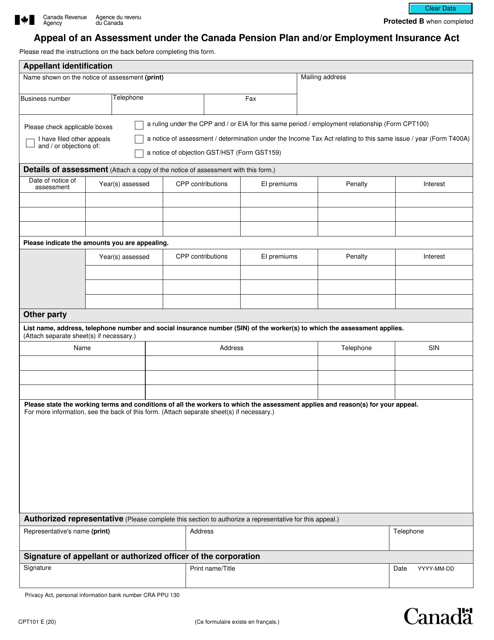

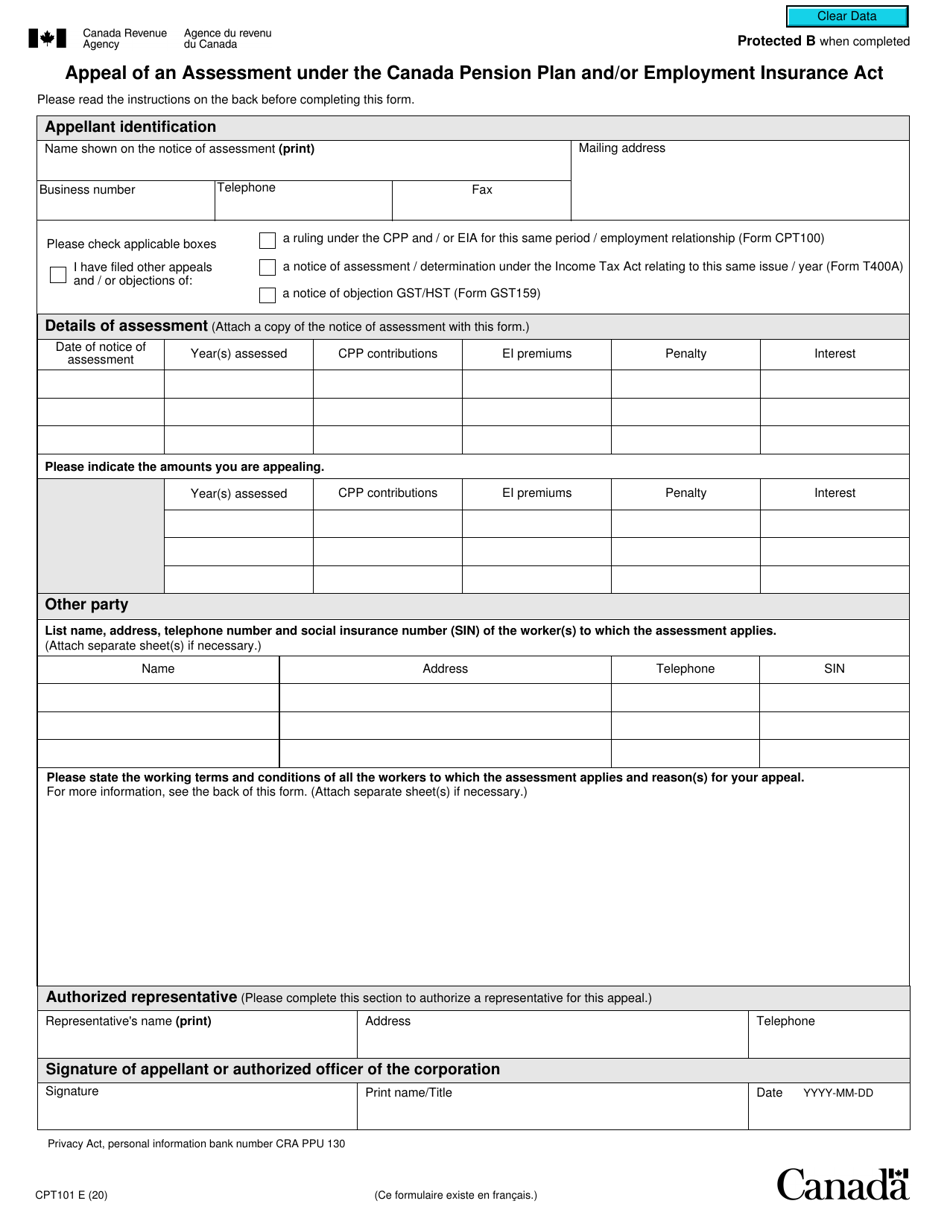

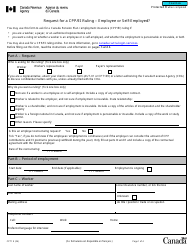

Form CPT101 Appeal of an Assessment Under the Canada Pension Plan and / or Employment Insurance Act - Canada

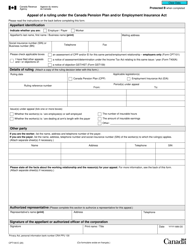

Form CPT101 Appeal of an Assessment Under the Canada Pension Plan and/or Employment Insurance Act is used to appeal an assessment made by the Canada Pension Plan or Employment Insurance Act. It allows individuals to dispute the determination made by these programs and present their case for reconsideration.

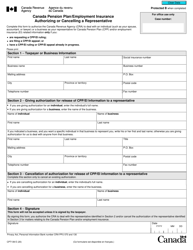

The individual or an authorized representative can file the Form CPT101 Appeal of an Assessment under the Canada Pension Plan and/or Employment Insurance Act.

Form CPT101 Appeal of an Assessment Under the Canada Pension Plan and/or Employment Insurance Act - Canada - Frequently Asked Questions (FAQ)

Q: What is Form CPT101?

A: Form CPT101 is used to appeal an assessment under the Canada Pension Plan (CPP) and/or Employment Insurance (EI) Act in Canada.

Q: What can I use Form CPT101 for?

A: You can use Form CPT101 to appeal an assessment related to your CPP or EI benefits in Canada.

Q: How do I appeal an assessment under CPP or EI?

A: To appeal an assessment under CPP or EI, you need to fill out and submit Form CPT101 to the Canada Revenue Agency (CRA).

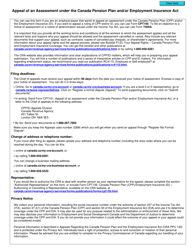

Q: Is there a deadline to submit Form CPT101?

A: Yes, there is a deadline to submit Form CPT101, and it is usually within 90 days from the date of the assessment.

Q: What happens after I submit Form CPT101?

A: After you submit Form CPT101, the CRA will review your appeal and notify you of their decision.

Q: Can I get help with filling out Form CPT101?

A: Yes, you can seek assistance from the CRA or a professional tax advisor to help you with filling out Form CPT101.

Q: Is there a fee for submitting Form CPT101?

A: No, there is no fee for submitting Form CPT101 to appeal an assessment under CPP or EI.

Q: Can I appeal an assessment if I disagree with the decision?

A: Yes, you can appeal an assessment if you disagree with the decision by submitting Form CPT101 to the CRA.

Q: What supporting documents do I need to submit with Form CPT101?

A: You may need to submit supporting documents such as pay stubs, bank statements, or other relevant documents to support your appeal.