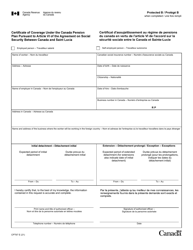

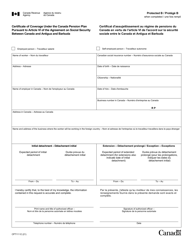

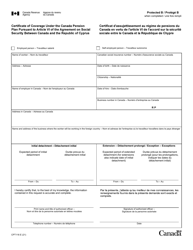

This version of the form is not currently in use and is provided for reference only. Download this version of

Form CPT64

for the current year.

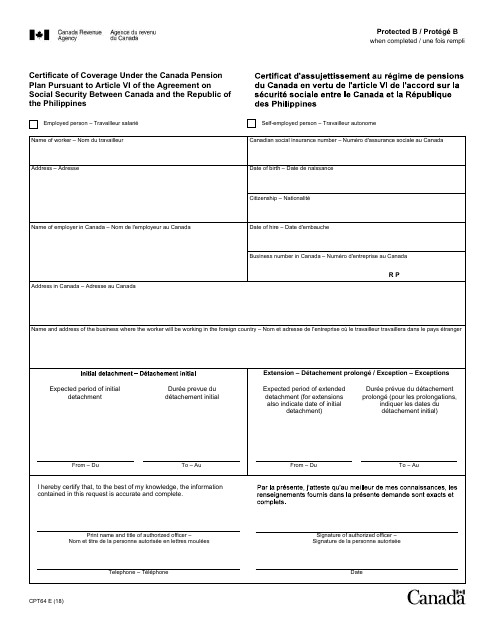

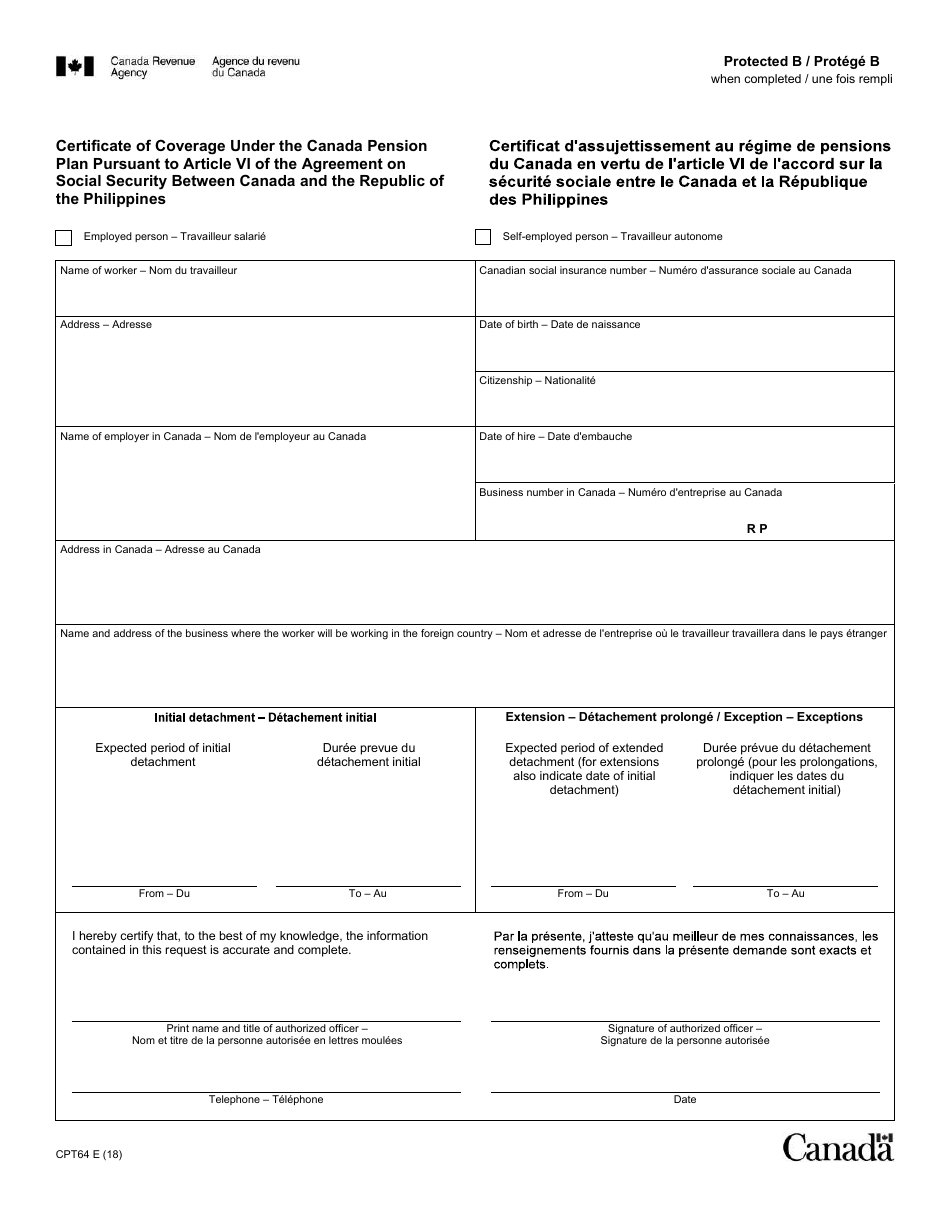

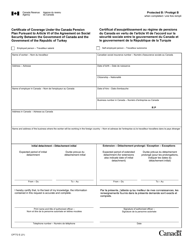

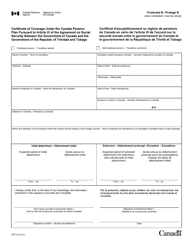

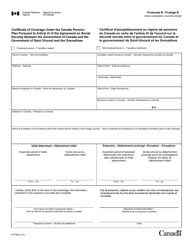

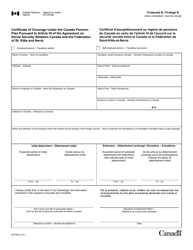

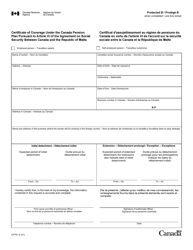

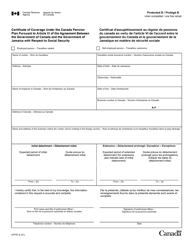

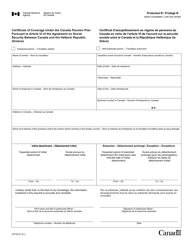

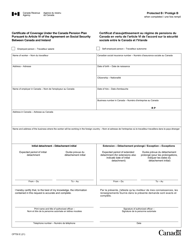

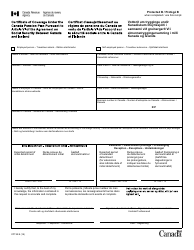

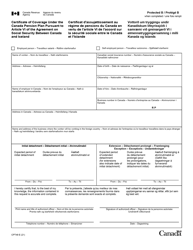

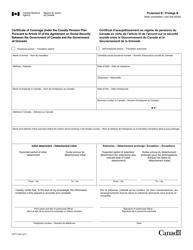

Form CPT64 Certificate of Coverage Under the Canada Pension Plan Pursuant to Article VI of the Agreement on Social Security Between Canada and the Republic of the Philippines - Canada (English / French)

Form CPT64 is a certificate of coverage under the Canada Pension Plan, which is used for individuals who are working temporarily in Canada but are covered under the social security program of another country, in this case, the Republic of the Philippines. The certificate is issued to ensure that these individuals continue to make contributions to their home country's social security system while working in Canada, thus protecting their social security benefits. The form is available in both English and French to accommodate individuals from different language backgrounds.

The Form CPT64 Certificate of Coverage under the Canada Pension Plan pursuant to Article VI of the Agreement on Social Security between Canada and the Republic of the Philippines is filed by individuals who are covered by the Canada Pension Plan and are seeking coverage exemption in the Philippines. The form is typically completed and submitted by the individual themselves.

FAQ

Q: What is the CPT64 Certificate of Coverage?

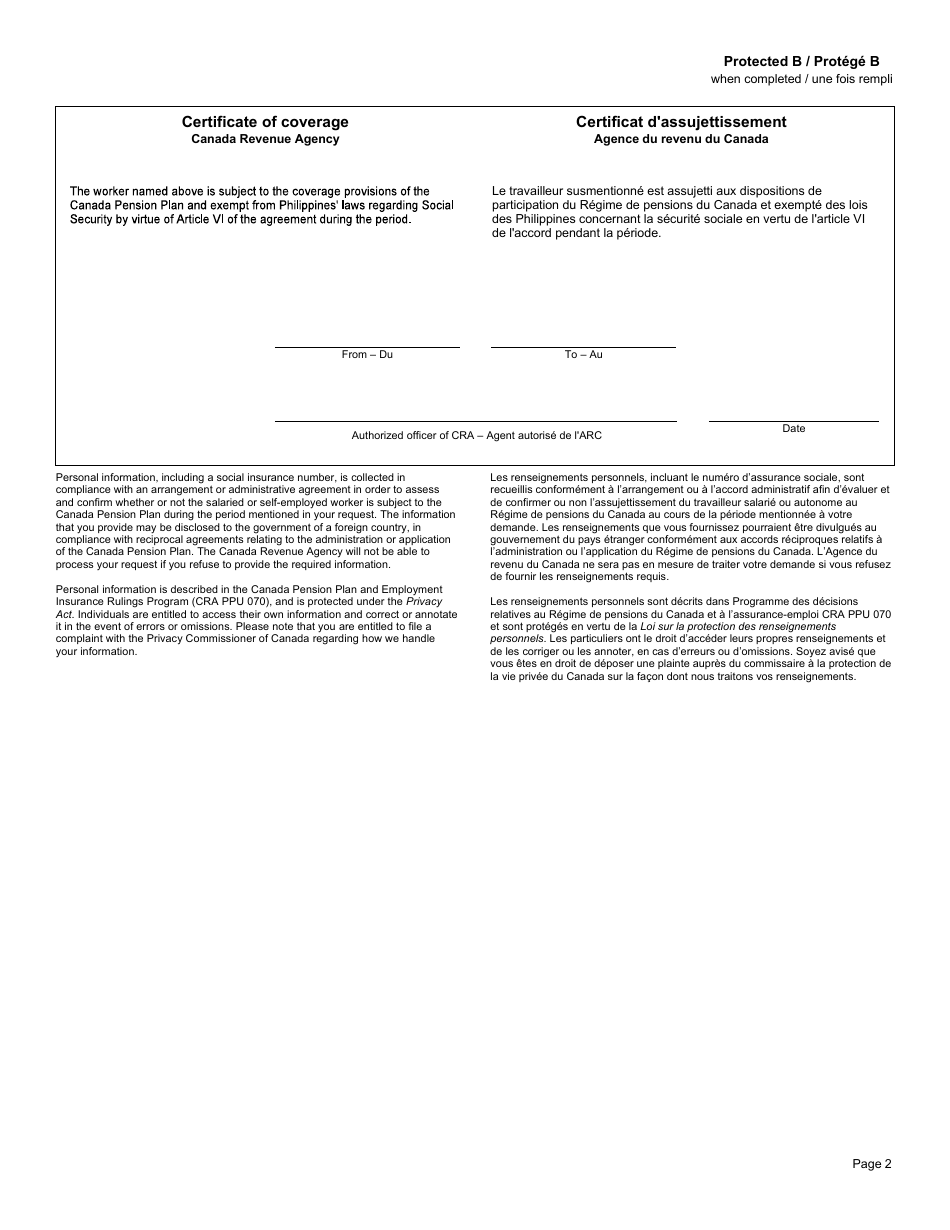

A: The CPT64 Certificate of Coverage is a document issued to employees who are temporarily working in Canada but are still covered under the social security system of their home country, in this case, the Republic of the Philippines.

Q: What is the purpose of the CPT64 Certificate of Coverage?

A: The purpose of the CPT64 Certificate of Coverage is to provide proof that the employee is exempt from making contributions to the Canada Pension Plan (CPP) during their temporary work period in Canada.

Q: Who can apply for the CPT64 Certificate of Coverage?

A: Employees who are citizens of the Republic of the Philippines and are temporarily working in Canada can apply for the CPT64 Certificate of Coverage.

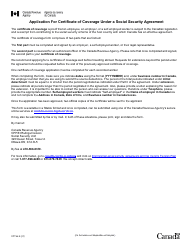

Q: How can I apply for the CPT64 Certificate of Coverage?

A: To apply for the CPT64 Certificate of Coverage, you need to contact the Philippines Social Security System (SSS) and submit the necessary documents, including the completed application form and supporting employment documents.

Q: What documents do I need to submit with my CPT64 Certificate of Coverage application?

A: You need to submit a completed application form, proof of Philippine citizenship, a copy of your employment contract or confirmation of employment in Canada, and any other supporting documents required by the Philippines Social Security System (SSS).

Q: How long does it take to get the CPT64 Certificate of Coverage?

A: The processing time for the CPT64 Certificate of Coverage can vary. It is recommended to contact the Philippines Social Security System (SSS) for more information on processing times.

Q: Do I need to pay any fees to obtain the CPT64 Certificate of Coverage?

A: Yes, there may be fees associated with obtaining the CPT64 Certificate of Coverage. The fee amount can vary, so it's best to check with the Philippines Social Security System (SSS) for the current fee schedule.

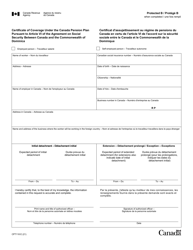

Q: How long is the CPT64 Certificate of Coverage valid for?

A: The CPT64 Certificate of Coverage is typically valid for a maximum period of five years. However, the actual validity period may depend on the specific agreement between Canada and the Republic of the Philippines.

Q: What should I do with the CPT64 Certificate of Coverage once I receive it?

A: Once you receive the CPT64 Certificate of Coverage, you should provide a copy to your employer in Canada. This document serves as proof that you are exempt from making CPP contributions during your temporary work period.

Q: Can I use the CPT64 Certificate of Coverage for any other purpose?

A: The CPT64 Certificate of Coverage is specifically issued for the purpose of exemption from CPP contributions. It may not be applicable for other social security or tax-related matters. If you have questions about other benefits or obligations, it's best to consult with the relevant authorities in Canada or the Republic of the Philippines.