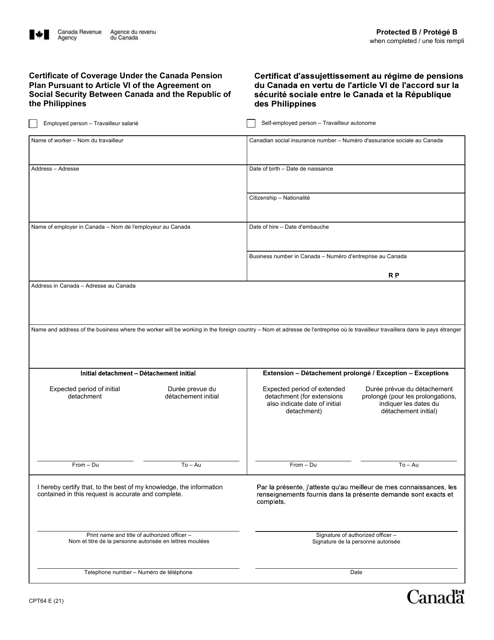

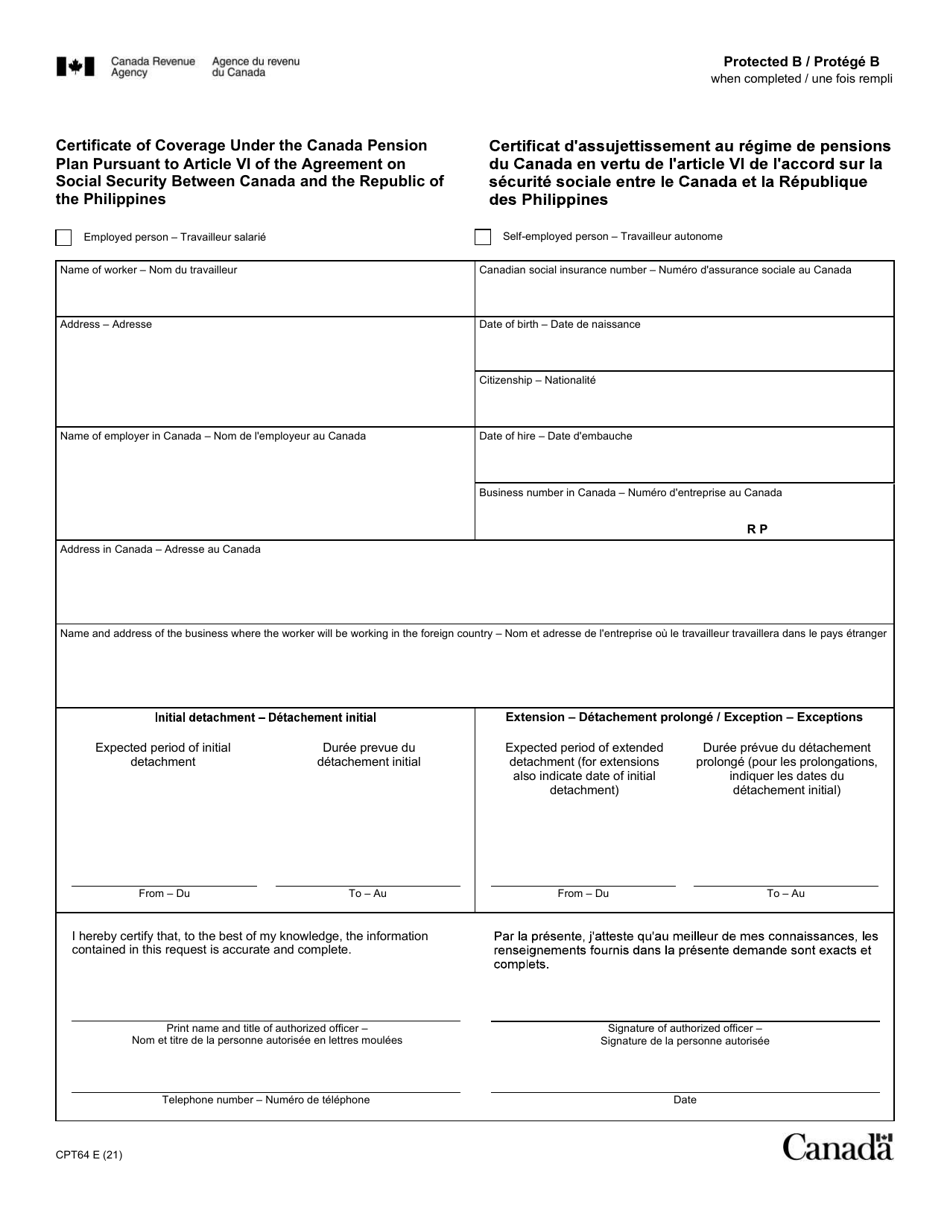

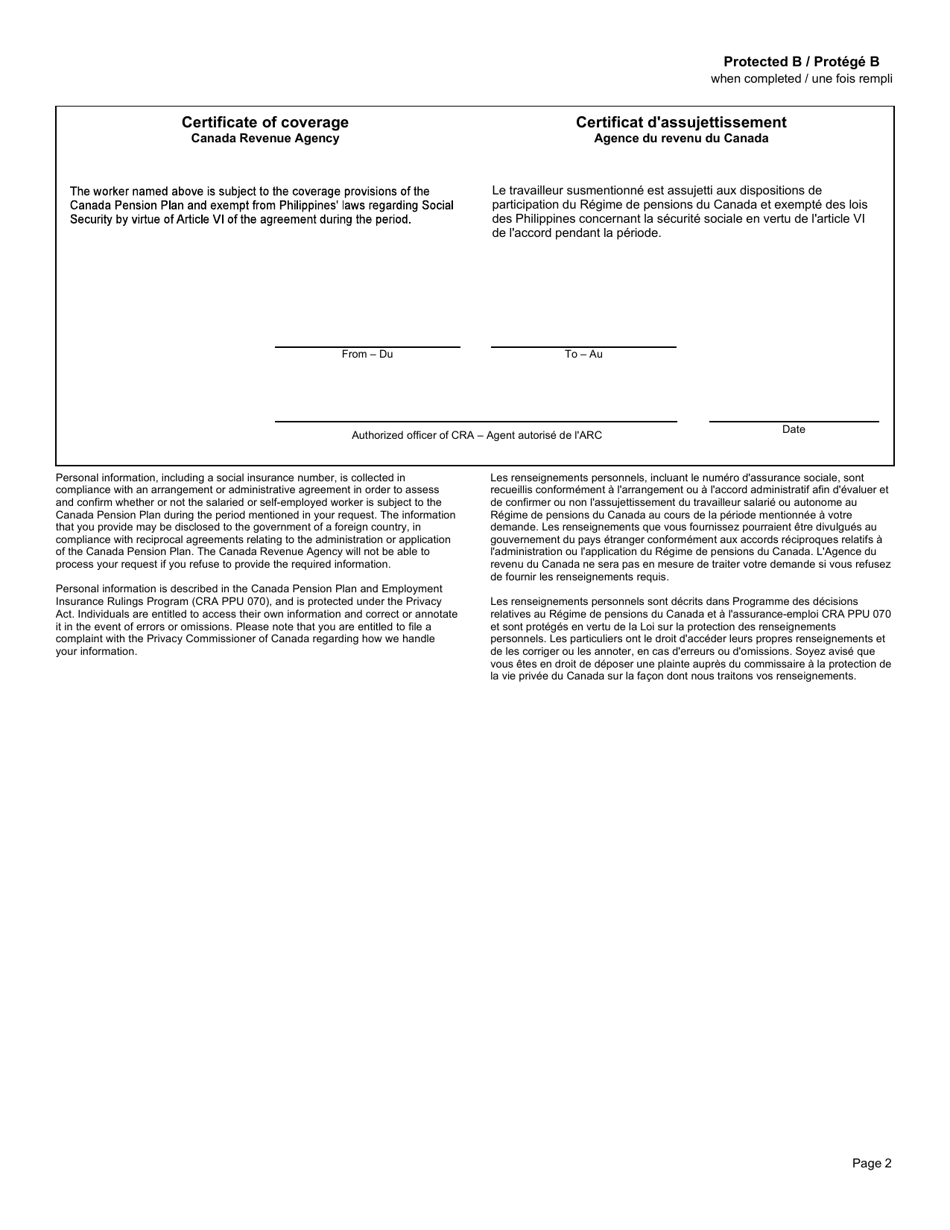

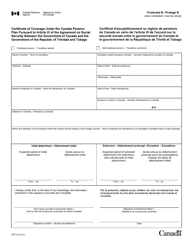

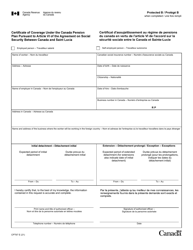

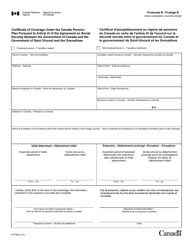

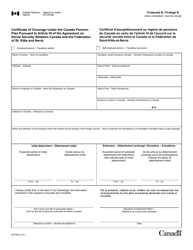

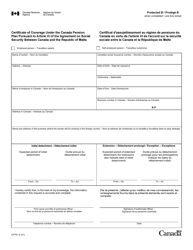

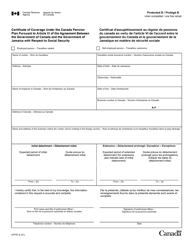

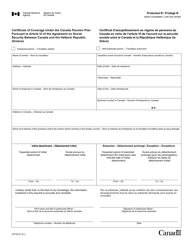

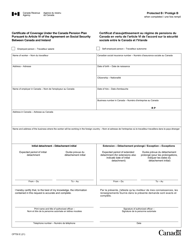

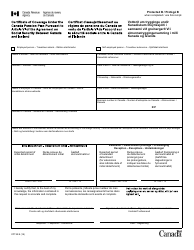

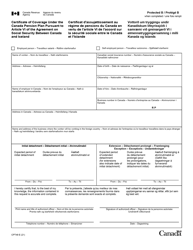

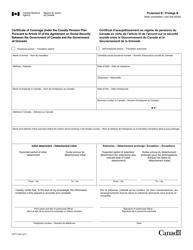

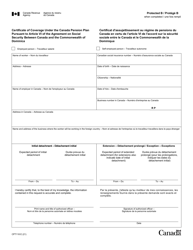

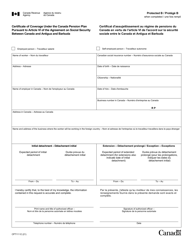

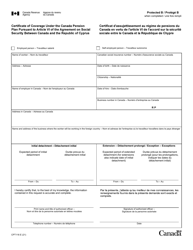

Form CPT64 Certificate of Coverage Under the Canada Pension Plan Pursuant to Article VI of the Agreement on Social Security Between Canada and the Republic of the Philippines - Canada (English / French)

Form CPT64 Certificate of Coverage Under the Canada Pension Plan Pursuant to Article VI of the Agreement on Social Security Between Canada and the Republic of the Philippines - Canada (English/French) is a document used to establish a person's eligibility for certain social security benefits under the Canada Pension Plan. This form is specifically meant for individuals who have worked in both Canada and the Republic of the Philippines, and it helps determine if they are eligible for pension benefits from both countries. The form is available in both English and French to cater to the bilingual nature of Canada.

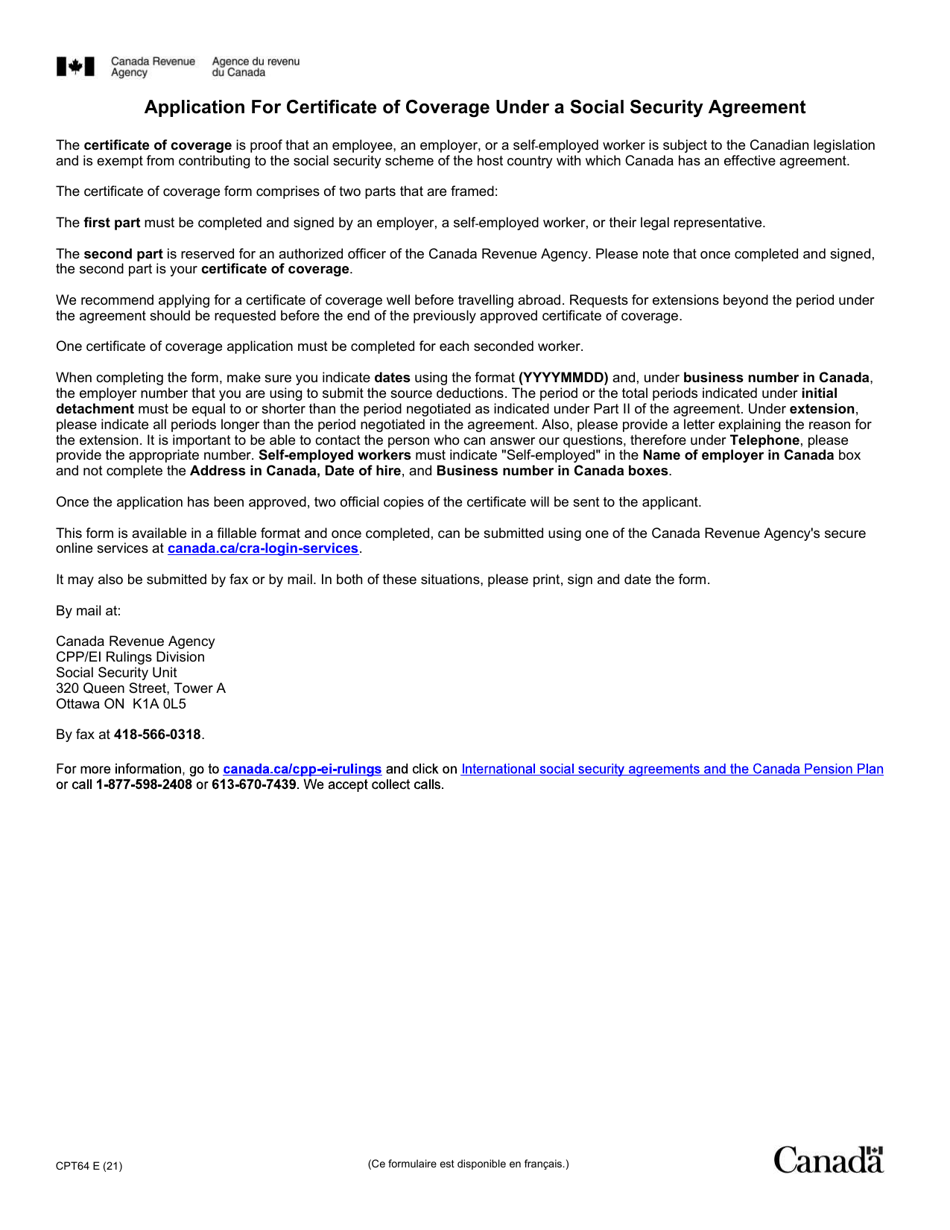

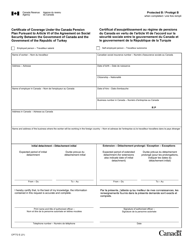

The Form CPT64 Certificate of Coverage under the Canada Pension Plan pursuant to Article VI of the Agreement on Social Security between Canada and the Republic of the Philippines is filed by individuals who are covered by the Canada Pension Plan and are temporarily working in the Republic of the Philippines. This form is used to apply for a certificate of coverage, which helps ensure that social security contributions made in the Philippines will be recognized by the Canada Pension Plan. The form can be filed by the individual themselves or by their employer.

Form CPT64 Certificate of Coverage Under the Canada Pension Plan Pursuant to Article VI of the Agreement on Social Security Between Canada and the Republic of the Philippines - Canada (English/French) - Frequently Asked Questions (FAQ)

Q: What is the CPT64 Certificate of Coverage Under the Canada Pension Plan?

A: The CPT64 Certificate of Coverage Under the Canada Pension Plan is a document that serves as proof that a person is exempt from paying contributions to the Canada Pension Plan (CPP) due to an agreement between Canada and the Republic of the Philippines.

Q: What does the CPT64 Certificate of Coverage Under the Canada Pension Plan entitle you to?

A: The CPT64 Certificate of Coverage Under the Canada Pension Plan entitles you to continued coverage under the social security program of the Republic of the Philippines, while being exempt from making CPP contributions in Canada.

Q: Who is eligible to receive the CPT64 Certificate of Coverage Under the Canada Pension Plan?

A: Individuals who are employed or self-employed and are covered by the Canada Pension Plan, but are temporarily working in the Philippines for a Canadian employer and contributing to the Canada Pension Plan, may be eligible for the CPT64 Certificate of Coverage under the Canada Pension Plan.

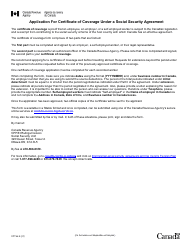

Q: How can I obtain a CPT64 Certificate of Coverage Under the Canada Pension Plan?

A: To obtain a CPT64 Certificate of Coverage Under the Canada Pension Plan, you must complete and submit form CPT64 to the designated agency in the country where you are employed. The Canadian employer must also provide information regarding the terms and duration of your employment.

Q: Is there a fee for obtaining the CPT64 Certificate of Coverage Under the Canada Pension Plan?

A: No, there is no fee for obtaining the CPT64 Certificate of Coverage Under the Canada Pension Plan.

Q: How long is the CPT64 Certificate of Coverage Under the Canada Pension Plan valid for?

A: The CPT64 Certificate of Coverage Under the Canada Pension Plan is generally valid for a maximum of five years. However, the duration may vary depending on the terms of the agreement between Canada and the Republic of the Philippines.

Q: Can the CPT64 Certificate of Coverage Under the Canada Pension Plan be renewed?

A: Yes, the CPT64 Certificate of Coverage Under the Canada Pension Plan can be renewed if you continue to meet the eligibility criteria and the terms of the agreement between Canada and the Republic of the Philippines remain in effect.

Q: What happens if I do not have a CPT64 Certificate of Coverage Under the Canada Pension Plan?

A: If you do not have a CPT64 Certificate of Coverage Under the Canada Pension Plan, you may be required to make contributions to the Canada Pension Plan even if you are temporarily working in the Philippines for a Canadian employer.

Q: Can I use the CPT64 Certificate of Coverage Under the Canada Pension Plan for other purposes?

A: The CPT64 Certificate of Coverage Under the Canada Pension Plan is specific to the exemption from CPP contributions and may not be used for other purposes or as proof of eligibility for other benefits or programs.