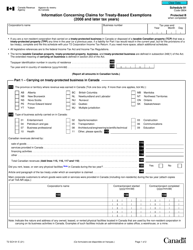

This version of the form is not currently in use and is provided for reference only. Download this version of

Form E681

for the current year.

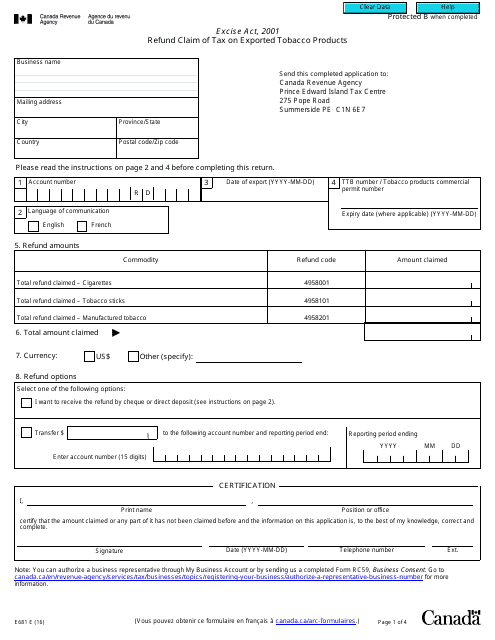

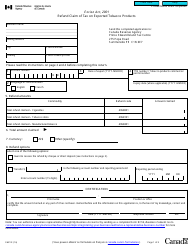

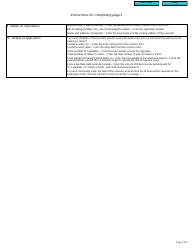

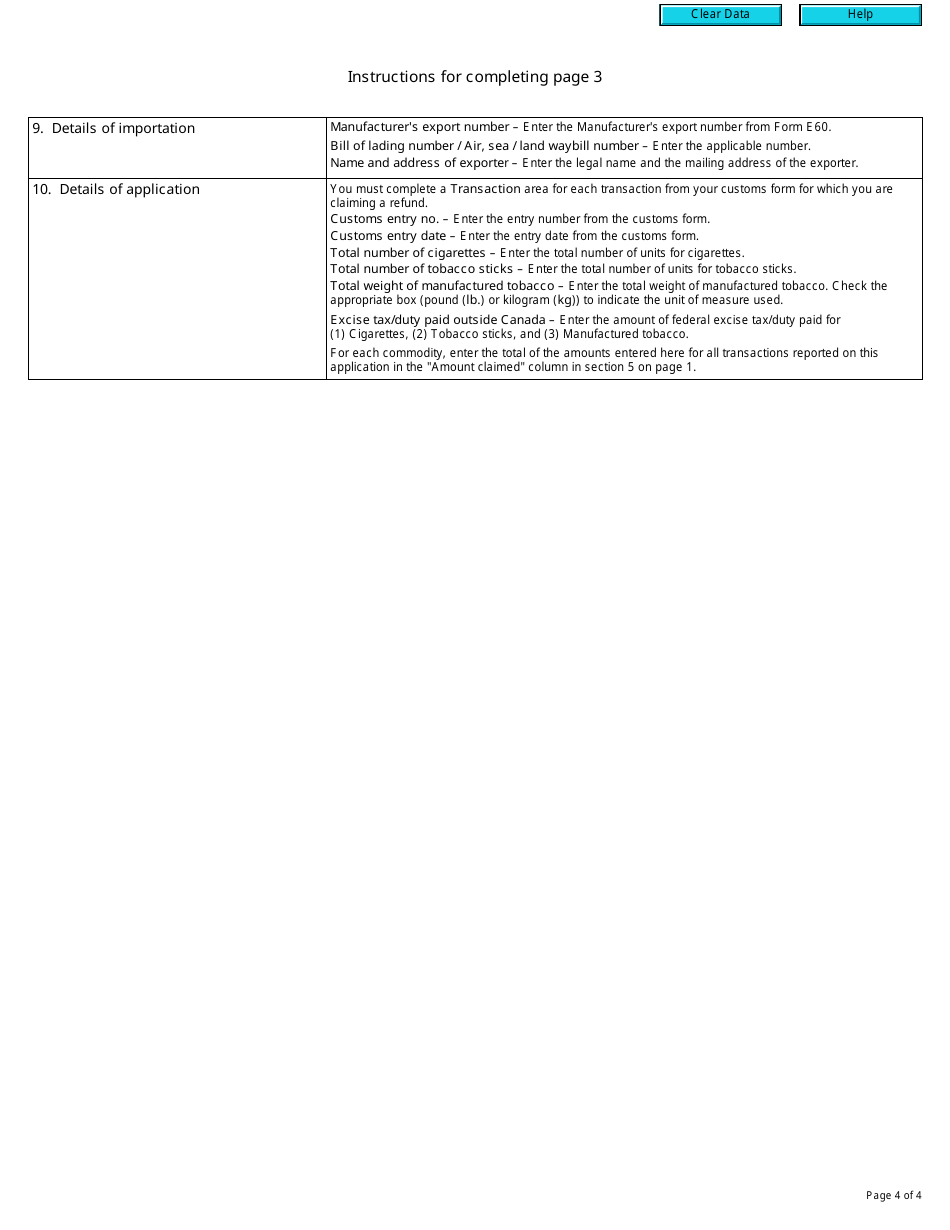

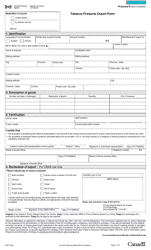

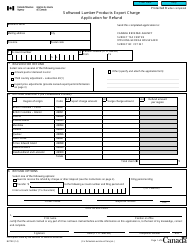

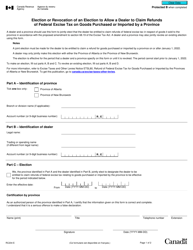

Form E681 Refund Claim of Tax on Exported Tobacco Products - Canada

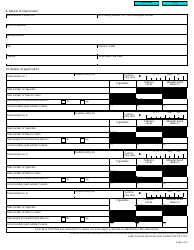

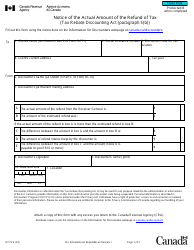

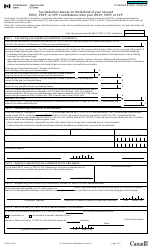

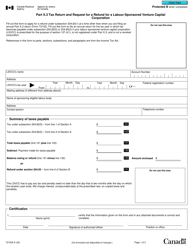

Form E681 Refund Claim of Tax on Exported Tobacco Products - Canada is used for claiming a refund of tax paid on tobacco products that are exported out of Canada. This form allows individuals or businesses to apply for a refund of the applicable tax amount.

The Form E681 Refund Claim of Tax on Exported Tobacco Products in Canada is usually filed by the tobacco product manufacturers who have exported their products.

FAQ

Q: What is a Form E681?

A: Form E681 is a document used in Canada to claim a refund on tax paid on exported tobacco products.

Q: Who can use Form E681?

A: Form E681 can be used by individuals or businesses who have exported tobacco products from Canada and want to claim a refund on the tax they paid on those products.

Q: What is the purpose of Form E681?

A: The purpose of Form E681 is to allow individuals or businesses to claim a refund on the tax they paid on tobacco products that were exported from Canada.

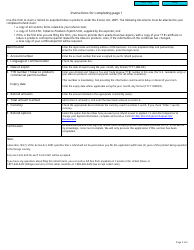

Q: How do I file a Form E681?

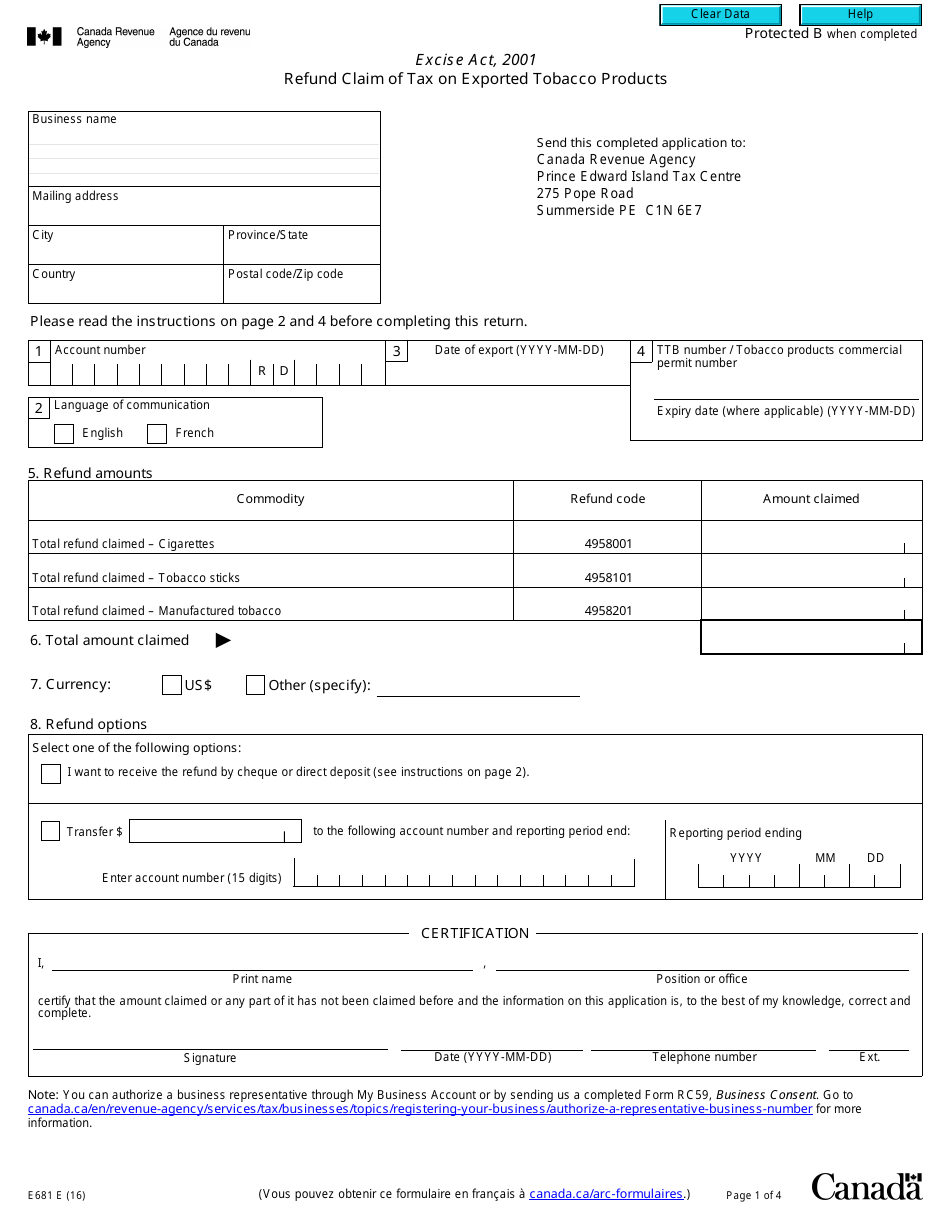

A: To file a Form E681, you need to complete the form with the required information and submit it to the Canada Border Services Agency.

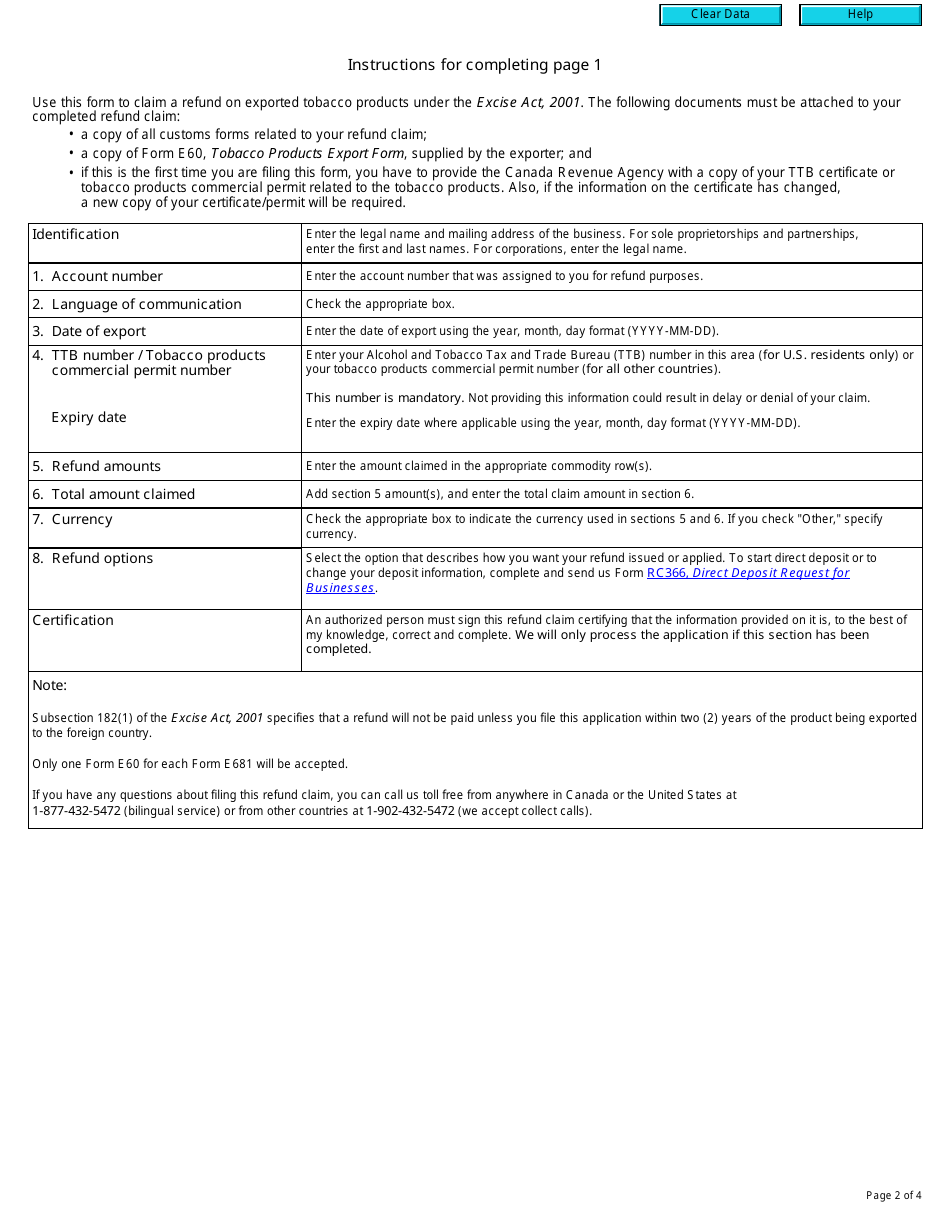

Q: What information is required on Form E681?

A: Form E681 requires information such as the type and quantity of tobacco products exported, the date of export, and details about the purchaser of the products.

Q: Is there a deadline for filing Form E681?

A: Yes, Form E681 must be filed within one year from the date of export in order to claim a refund on the tax paid on exported tobacco products.

Q: How long does it take to process a Form E681 refund claim?

A: Processing times for Form E681 refund claims can vary, but generally it takes several weeks to months to process and receive a refund.

Q: Can I file a Form E681 electronically?

A: No, at this time, Form E681 cannot be filed electronically and must be submitted in paper format.