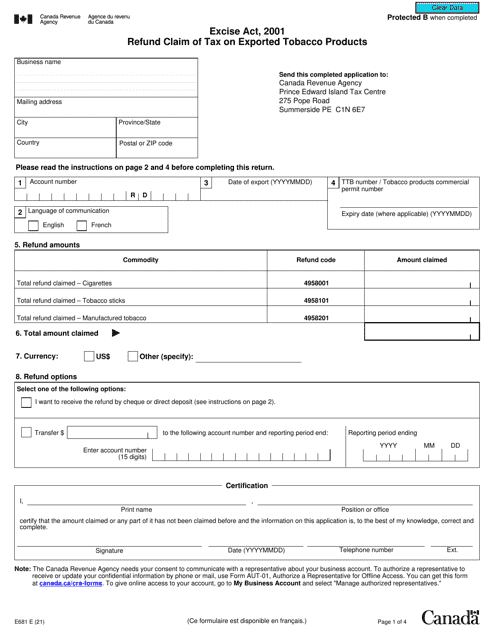

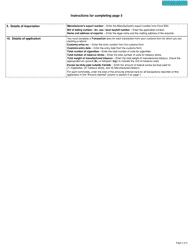

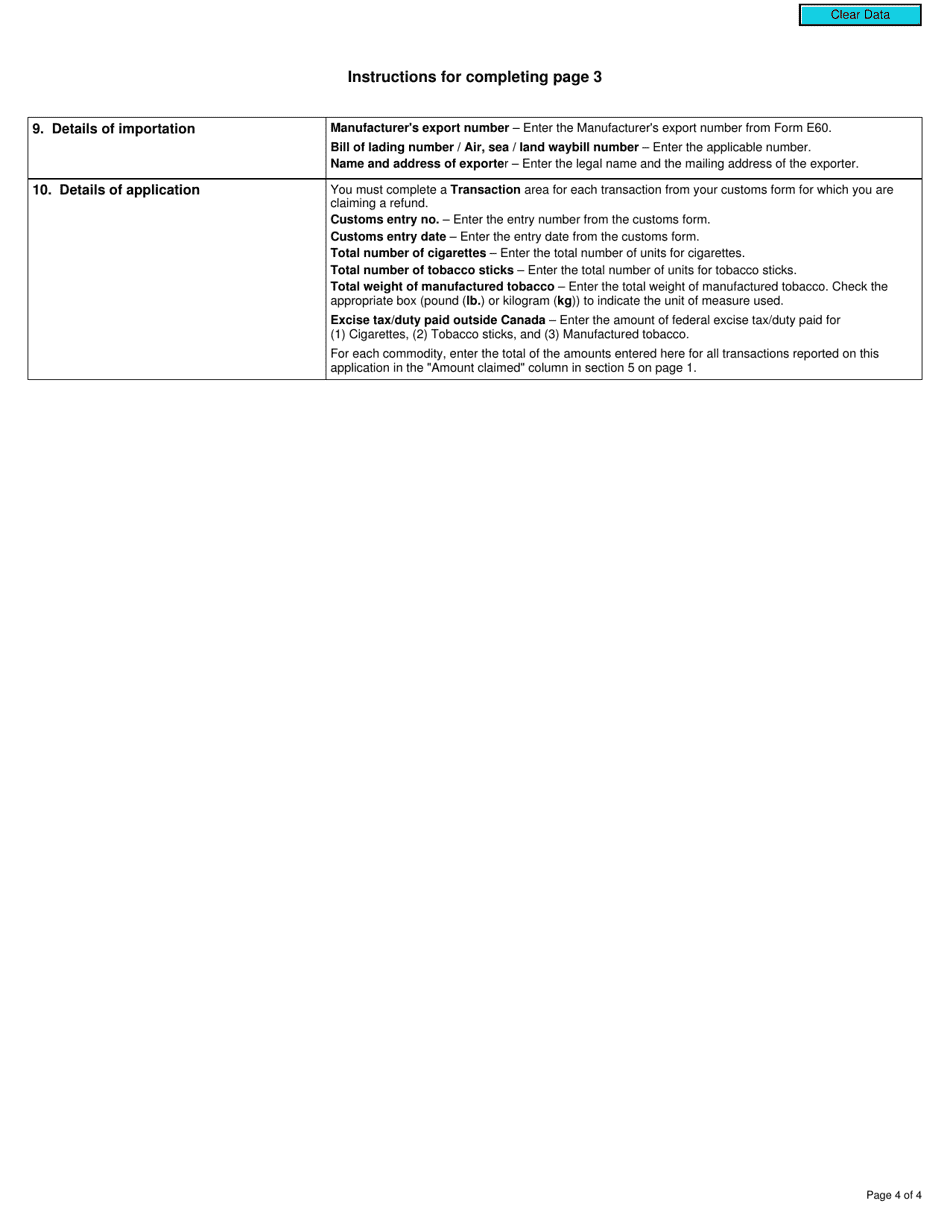

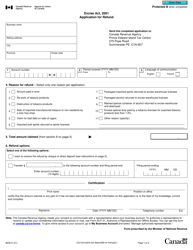

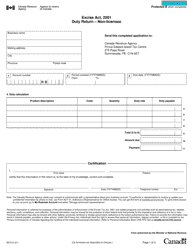

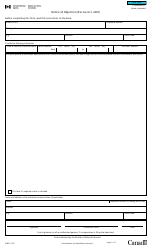

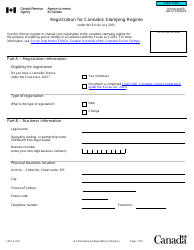

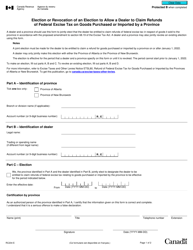

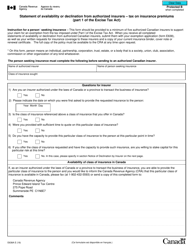

Form E681 Excise Act, 2001 - Refund Claim of Tax on Exported Tobacco Products - Canada

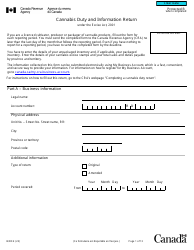

Form E681 Excise Act, 2001 - Refund Claim of Tax on Exported Tobacco Products - Canada is used to claim a refund on the tax paid on tobacco products that are exported from Canada. It allows exporters to seek reimbursement for the excise tax they paid on these products.

The Form E681 Excise Act, 2001 - Refund Claim of Tax on Exported Tobacco Products in Canada is typically filed by the tobacco product exporter.

Form E681 Excise Act, 2001 - Refund Claim of Tax on Exported Tobacco Products - Canada - Frequently Asked Questions (FAQ)

Q: What is Form E681?

A: Form E681 is a form used in Canada to claim a refund of the tax paid on exported tobacco products.

Q: What is the Excise Act, 2001?

A: The Excise Act, 2001 is a law in Canada that governs the taxation of various goods, including tobacco products.

Q: Who can use Form E681?

A: Form E681 can be used by individuals or businesses who have exported tobacco products and want to claim a refund of the tax paid on those products.

Q: What is a refund claim?

A: A refund claim is a request for a return of tax that has been paid.

Q: What is the purpose of the tax on tobacco products?

A: The tax on tobacco products is intended to help fund government programs and discourage smoking.

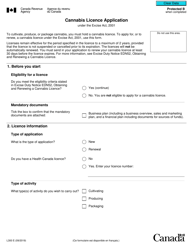

Q: Are there any eligibility criteria for claiming a refund of the tax on exported tobacco products?

A: Yes, there are eligibility criteria that must be met in order to claim a refund of the tax on exported tobacco products. These criteria may vary depending on the specific circumstances.

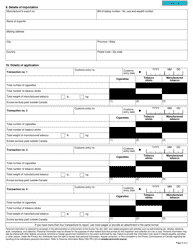

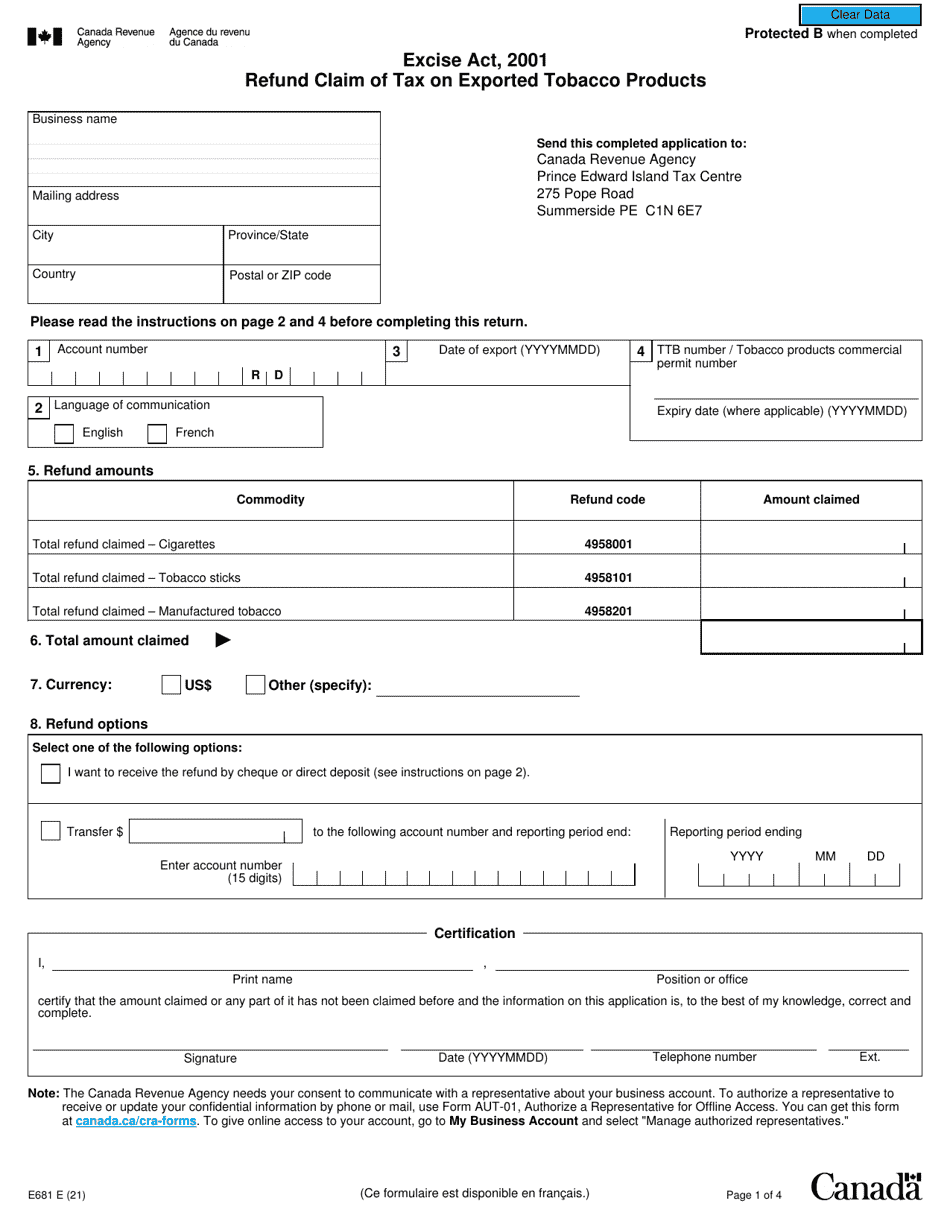

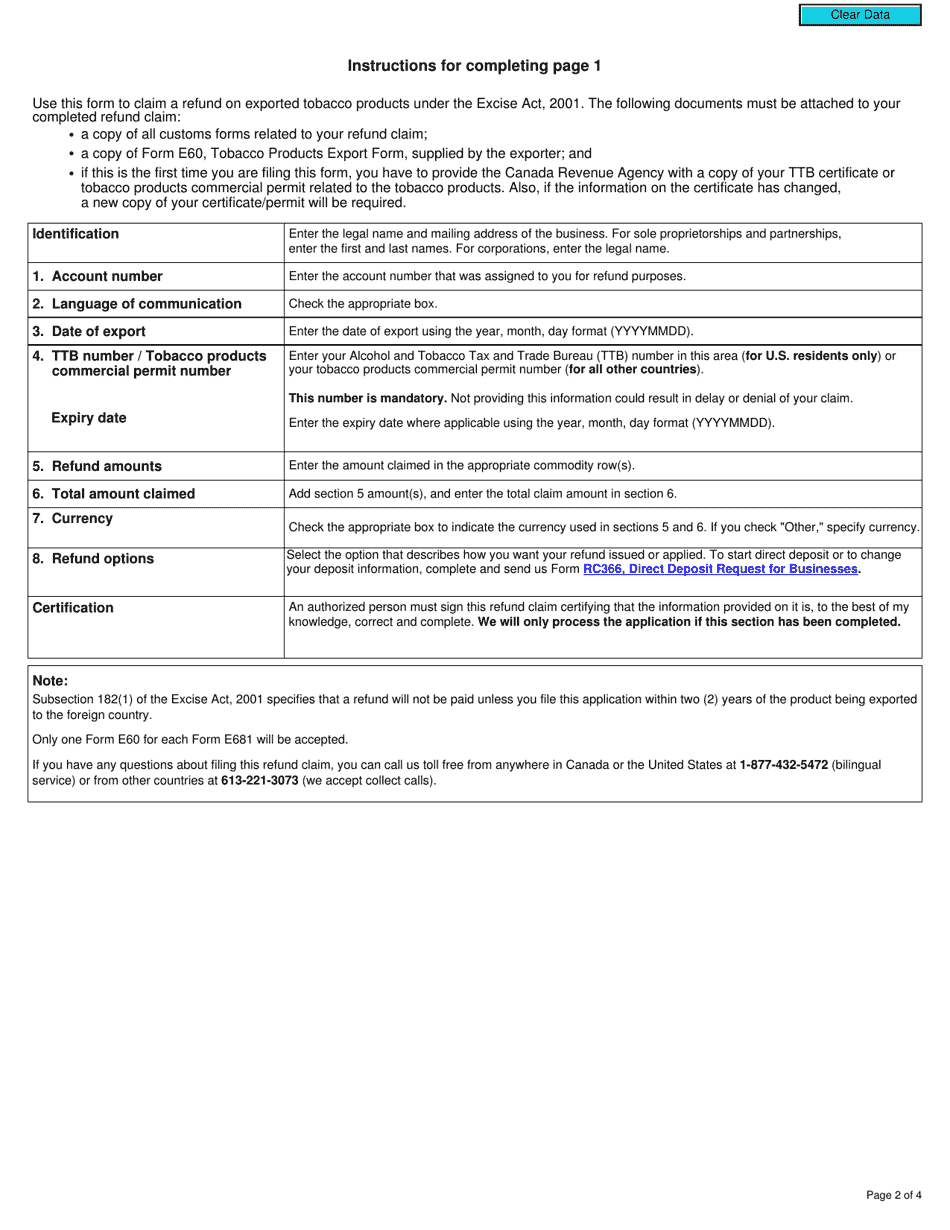

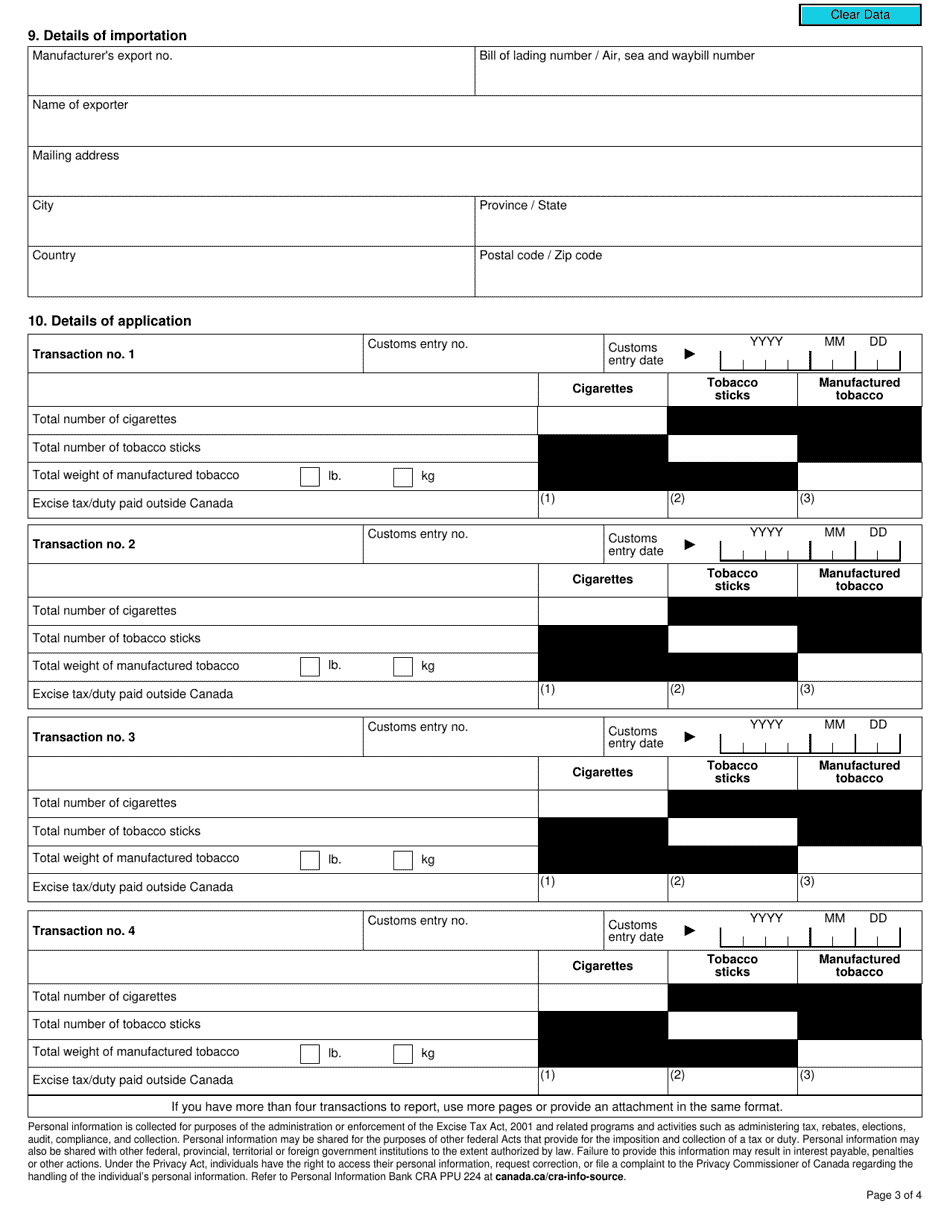

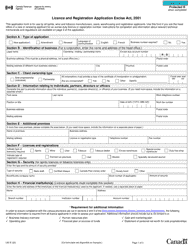

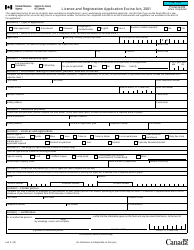

Q: What information is required on Form E681?

A: Form E681 requires specific information about the exporter, the tobacco products being exported, and the tax that was paid on those products.

Q: How long does it take to process a refund claim for tax on exported tobacco products?

A: The processing time for a refund claim can vary, but it generally takes several weeks to several months.

Q: Are there any penalties for making a false or fraudulent refund claim?

A: Yes, there are penalties for making a false or fraudulent refund claim. These penalties can include fines and even criminal charges.