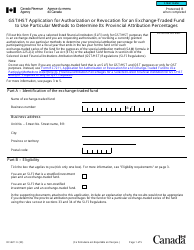

This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST10

for the current year.

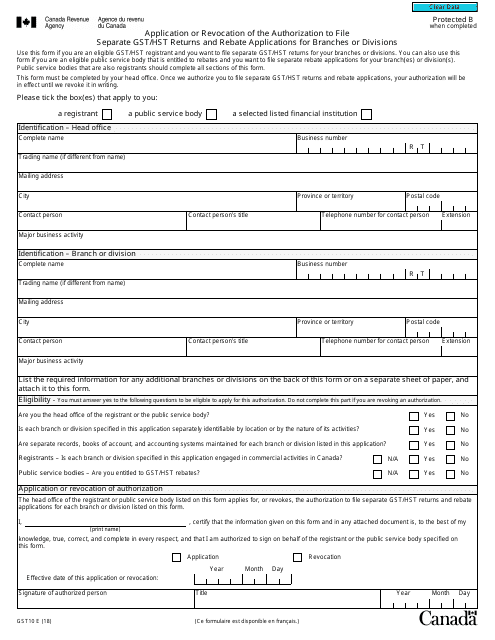

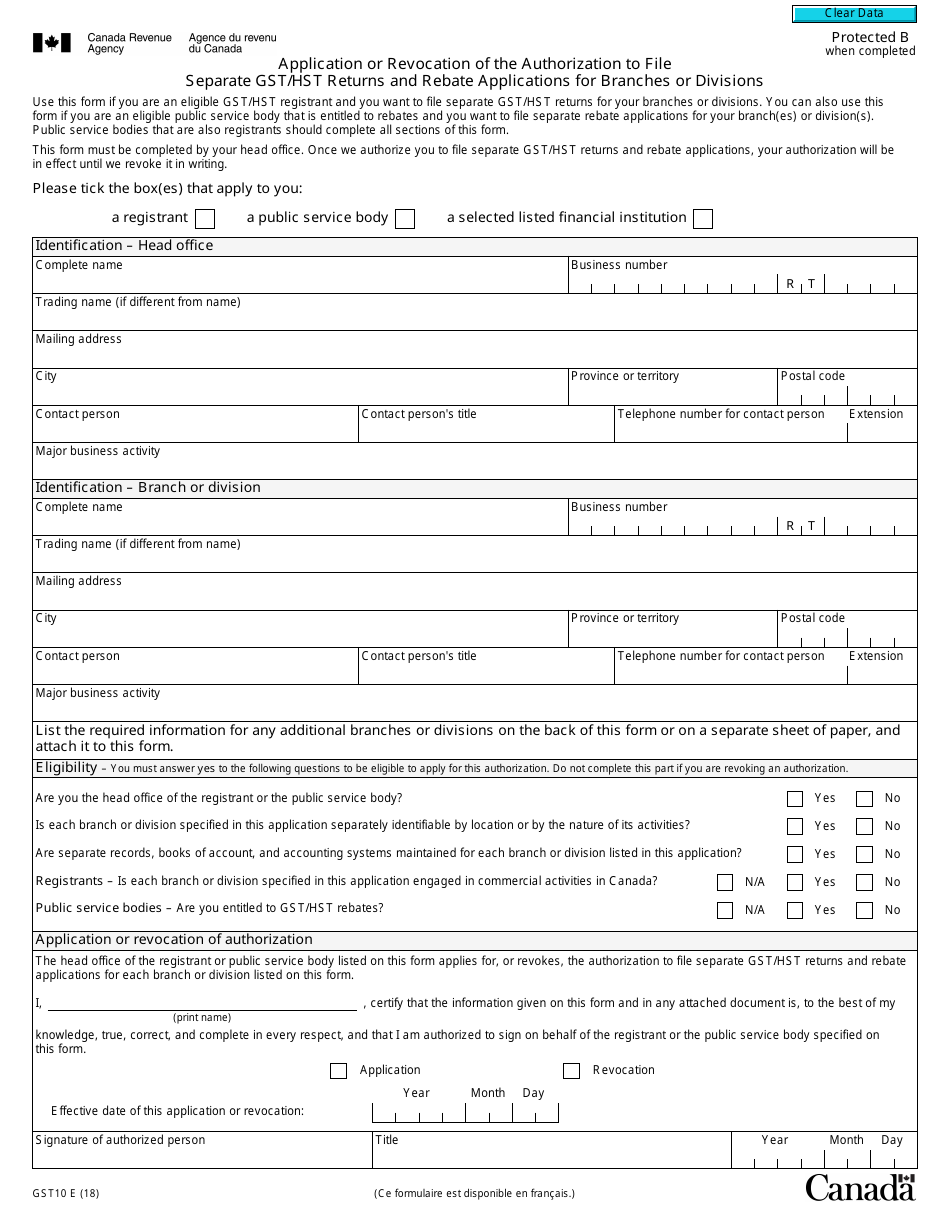

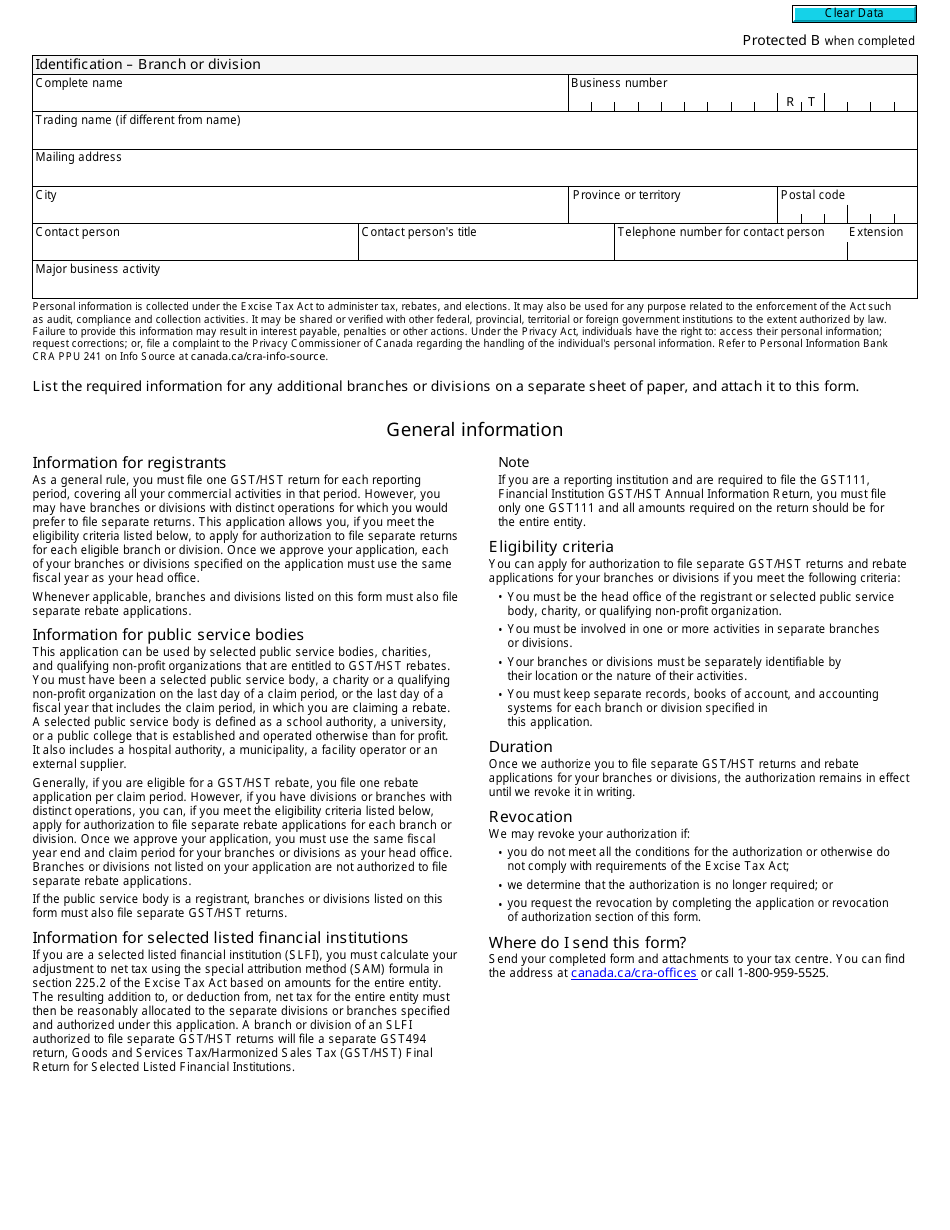

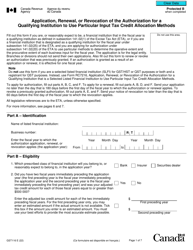

Form GST10 Application or Revocation of the Authorization to File Separate Gst / Hst Returns and Rebate Applications for Branches or Divisions - Canada

Form GST10 or the "Form Gst10 "application Or Revocation Of The Authorization To File Separate Gst/hst Returns And Rebate Applications For Branches Or Divisions" - Canada" is a form issued by the Canadian Revenue Agency .

Download a PDF version of the Form GST10 down below or find it on the Canadian Revenue Agency Forms website.

FAQ

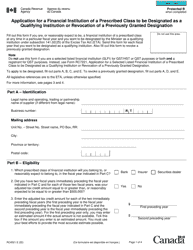

Q: What is Form GST10?

A: Form GST10 is used for the application or revocation of the authorization to file separate GST/HST returns and rebate applications for branches or divisions in Canada.

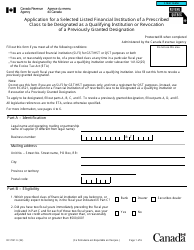

Q: What does GST/HST stand for?

A: GST stands for Goods and Services Tax, and HST stands for Harmonized Sales Tax.

Q: Who uses Form GST10?

A: Businesses in Canada that have different branches or divisions and want to file separate GST/HST returns and rebate applications use Form GST10.

Q: What is the purpose of filing separate GST/HST returns and rebate applications?

A: Filing separate returns and applications allows businesses with multiple branches or divisions to track and report GST/HST amounts separately.

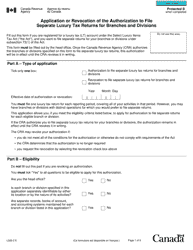

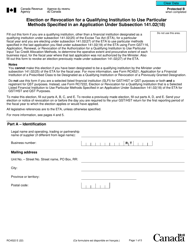

Q: Can I revoke the authorization to file separate GST/HST returns and rebate applications?

A: Yes, Form GST10 can also be used to revoke the authorization if a business no longer wishes to file separate returns and applications.