This version of the form is not currently in use and is provided for reference only. Download this version of

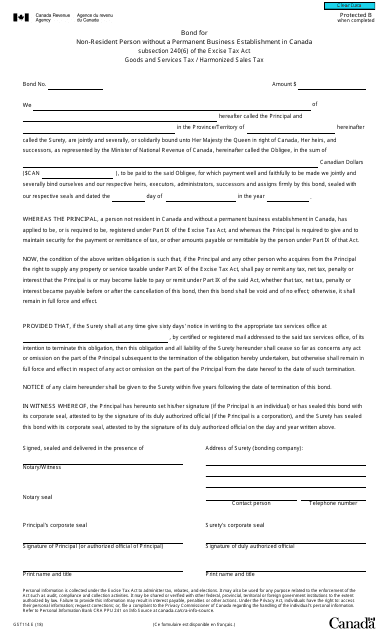

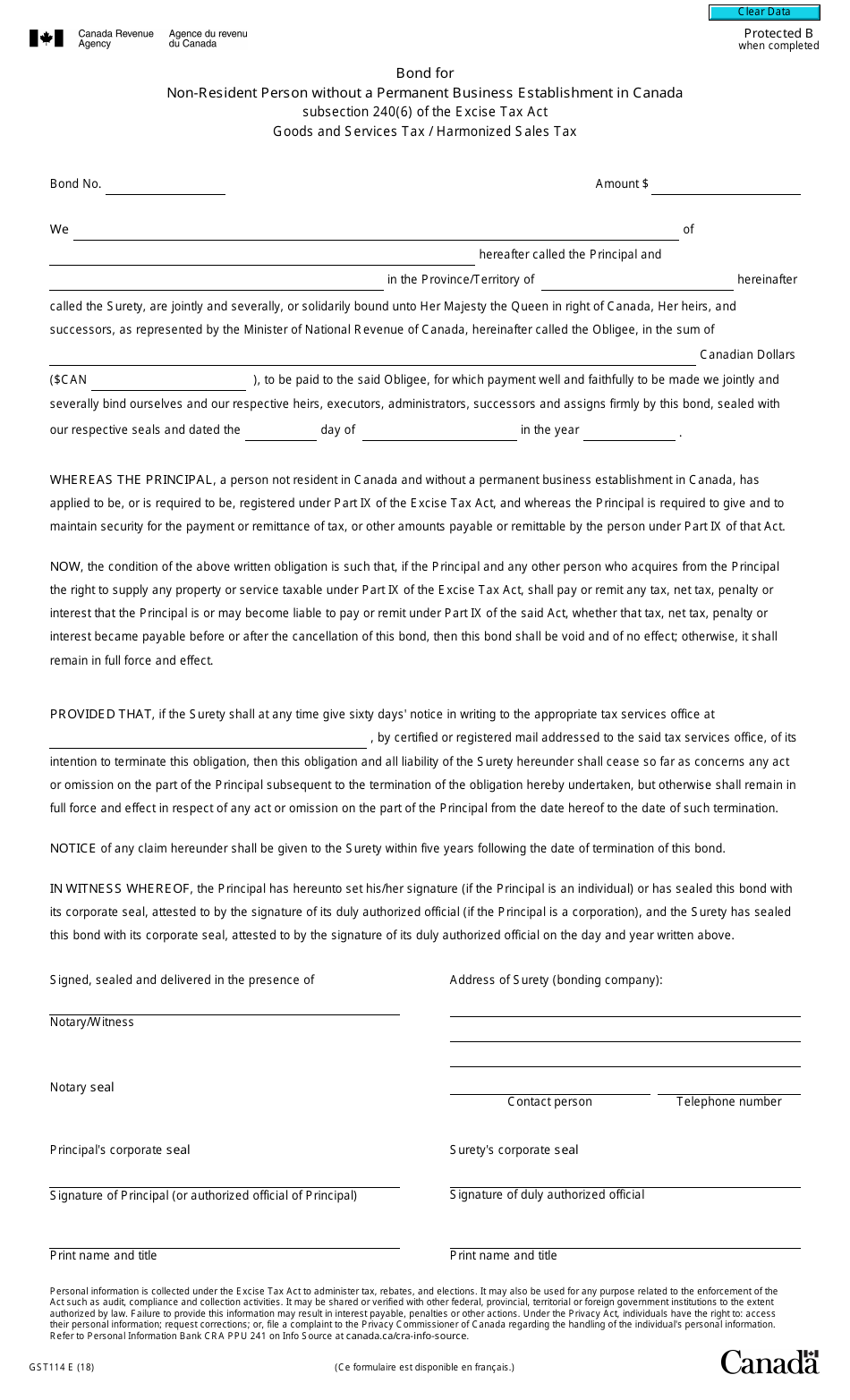

Form GST114

for the current year.

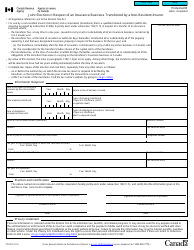

Form GST114 Bond for Non-resident Person Without a Permanent Business Establishment in Canada - Canada

The Form GST114 Bond for Non-resident Person Without a Permanent Business Establishment in Canada is used for non-resident individuals or businesses who do not have a permanent establishment in Canada but are required to post a bond for certain tax obligations.

The non-resident person without a permanent business establishment in Canada files the Form GST114 Bond.

FAQ

Q: What is the Form GST114?

A: The Form GST114 is a bond for non-resident persons without a permanent business establishment in Canada.

Q: Who needs to use Form GST114?

A: Non-resident persons without a permanent business establishment in Canada need to use Form GST114.

Q: What is the purpose of the bond?

A: The bond is used to guarantee any unpaid goods and services tax/harmonized sales tax (GST/HST) obligations of the non-resident person.

Q: What information is required to complete Form GST114?

A: You will need to provide your name, address, and contact information, as well as details about your business activities and estimated GST/HST liability.

Q: What happens if I don't submit Form GST114?

A: If you are required to submit Form GST114 and fail to do so, you may be subject to penalties and interest charges.

Q: Are there any fees associated with the bond?

A: Yes, there may be fees associated with the bond. You should contact the CRA for more information.

Q: How long is the bond valid?

A: The bond is valid for a period of two years, after which it may need to be renewed.

Q: Can the bond be cancelled or discharged?

A: Yes, the bond can be cancelled or discharged if you are no longer liable for GST/HST obligations in Canada. You should contact the CRA for instructions on how to cancel or discharge the bond.