This version of the form is not currently in use and is provided for reference only. Download this version of

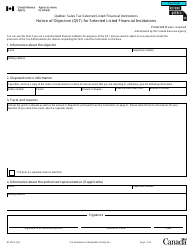

Form GST159

for the current year.

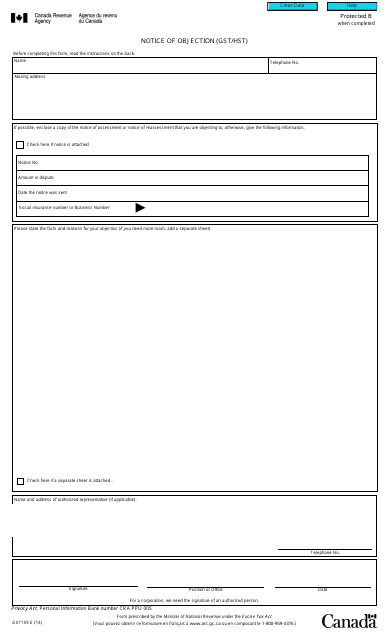

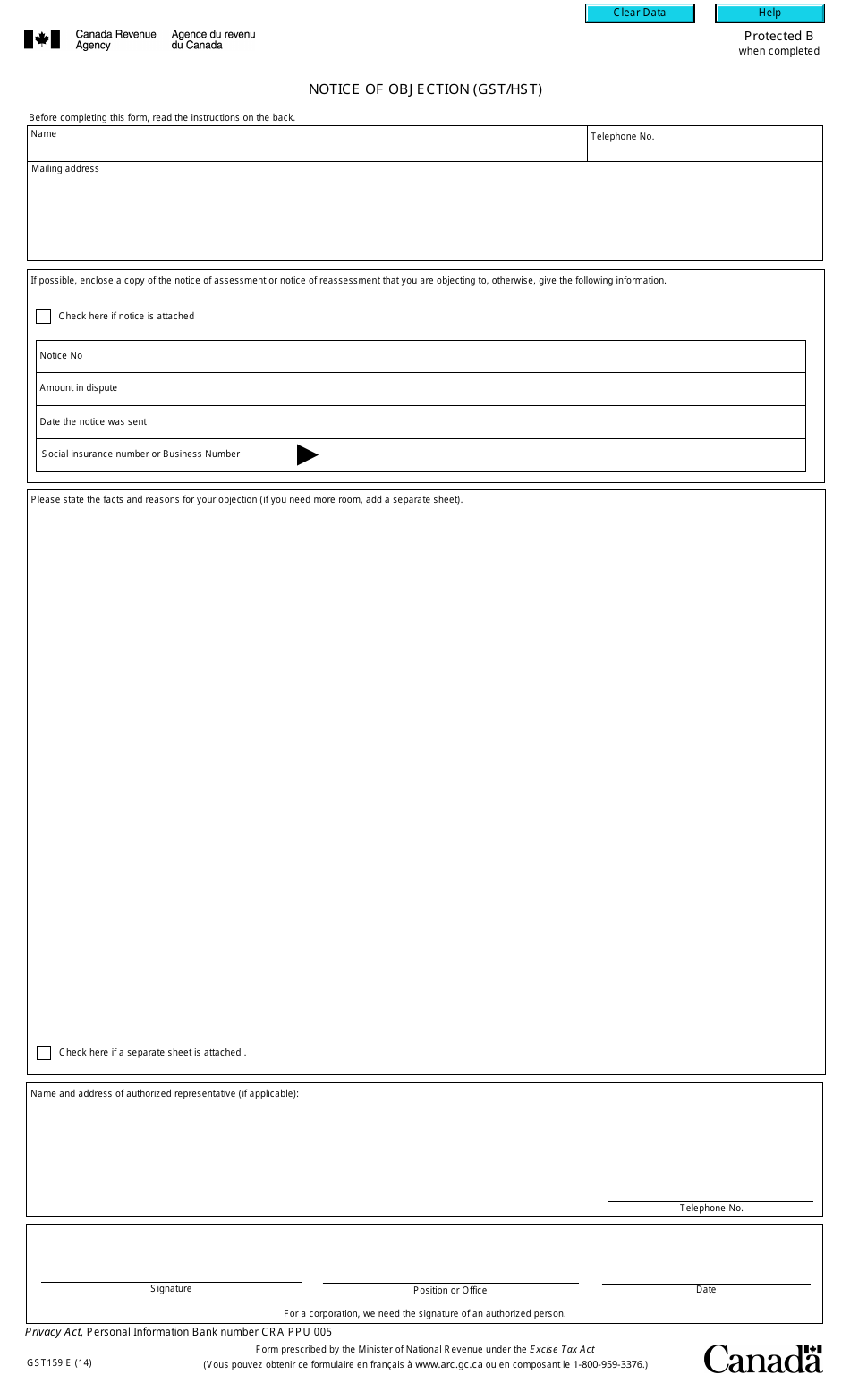

Form GST159 Notice of Objection (Gst / Hst) - Canada

Form GST159 is a Canadian Revenue Agency form also known as the "Form Gst159 "notice Of Objection (gst/hst)" - Canada" . The latest edition of the form was released in January 1, 2014 and is available for digital filing.

Download an up-to-date Form GST159 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is GST159?

A: GST159 is a Notice of Objection form used in Canada to dispute GST/HST assessments.

Q: What is the purpose of GST159?

A: The purpose of GST159 is to notify the Canada Revenue Agency (CRA) that you disagree with their assessment of your GST/HST obligations.

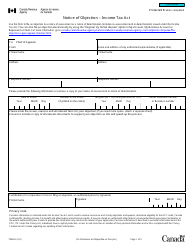

Q: How do I fill out GST159?

A: To fill out GST159, you need to provide your contact information, indicate the tax period and amount being objected, explain the reasons for your objection, and include any supporting documents.

Q: What happens after I submit GST159?

A: After you submit GST159, the CRA will review your objection and may request additional information or documentation. They will then issue a decision on your objection.

Q: Can I appeal the CRA's decision on my objection?

A: Yes, if you are not satisfied with the CRA's decision, you can appeal to the Tax Court of Canada within 90 days of receiving the decision.

Q: Is there a time limit to file a Notice of Objection?

A: Yes, you generally have 90 days from the date of the assessment to file a Notice of Objection.

Q: Do I need to pay the disputed amount while my objection is being reviewed?

A: In most cases, you are still required to pay the disputed amount while your objection is being reviewed. However, you may be eligible for a stay of collection if you can demonstrate financial hardship.

Q: Are there any fees associated with filing a Notice of Objection?

A: No, there are no fees to file a Notice of Objection with the CRA.

Q: Can I get assistance in filling out GST159?

A: Yes, you can seek assistance from a tax professional or contact the CRA for guidance in filling out GST159.