This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST191-WS

for the current year.

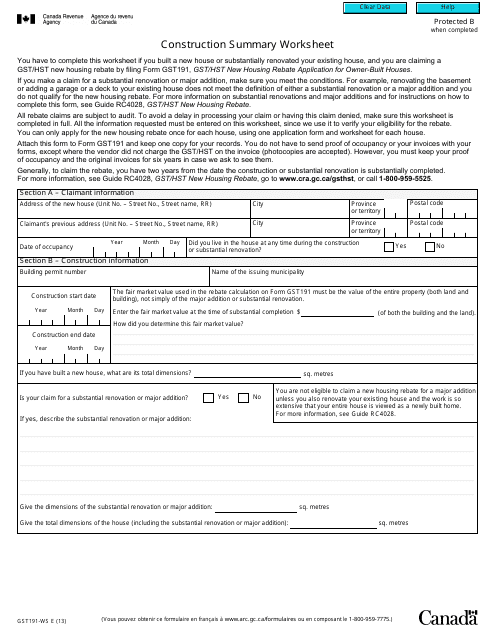

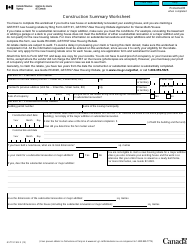

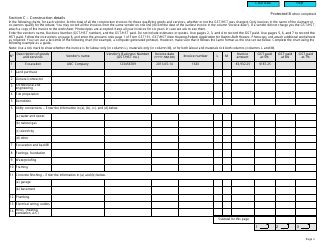

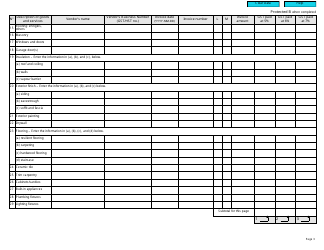

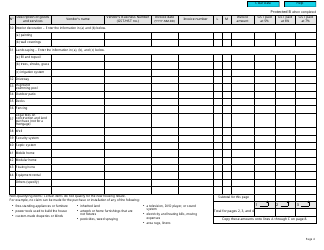

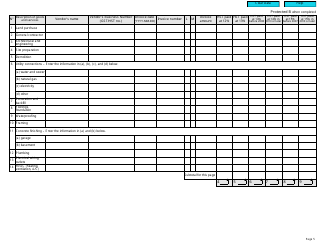

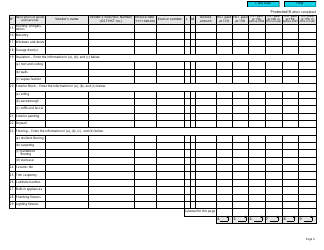

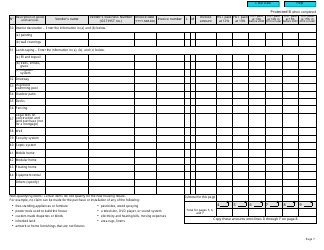

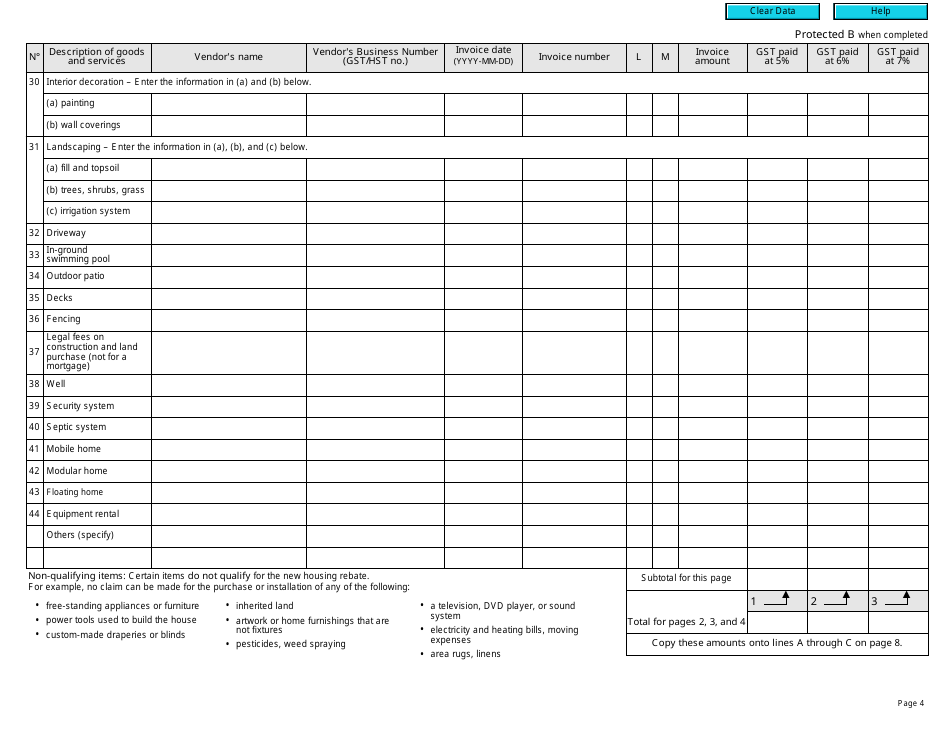

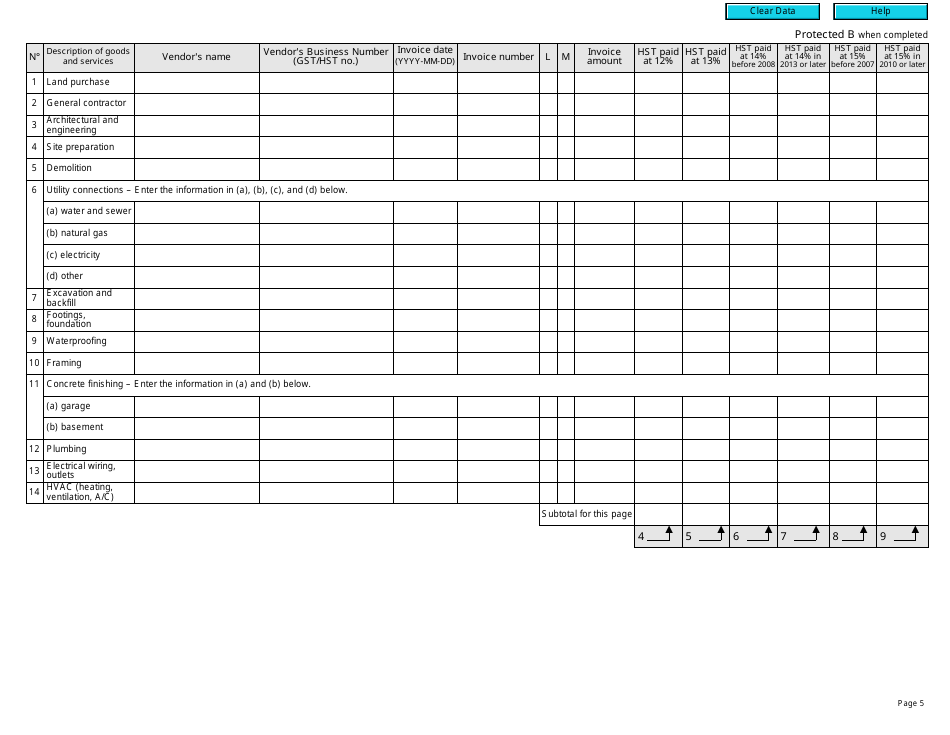

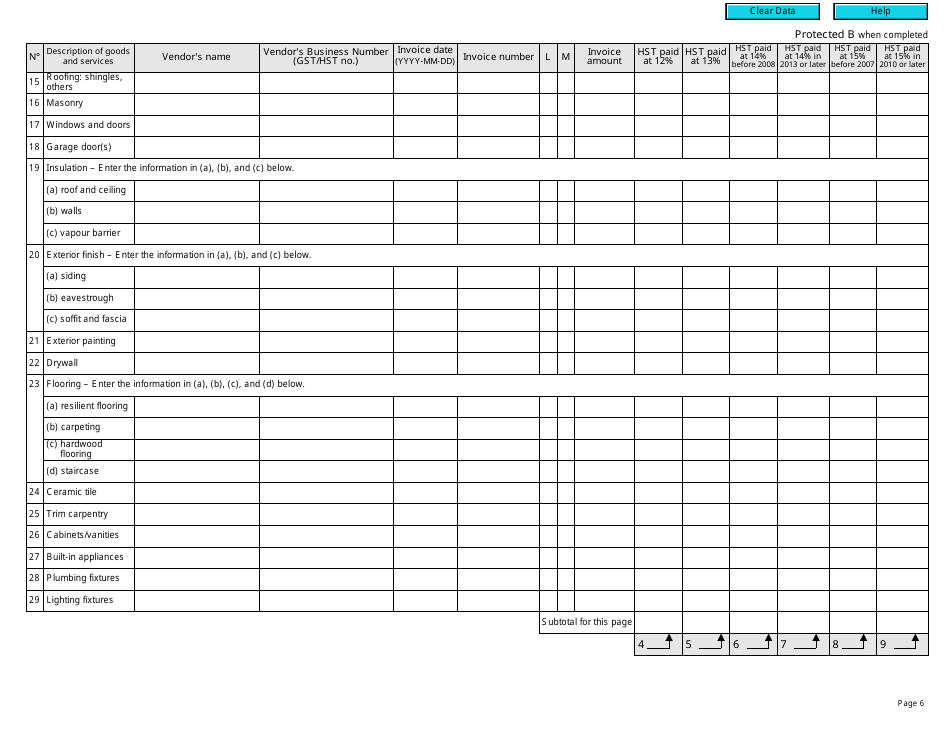

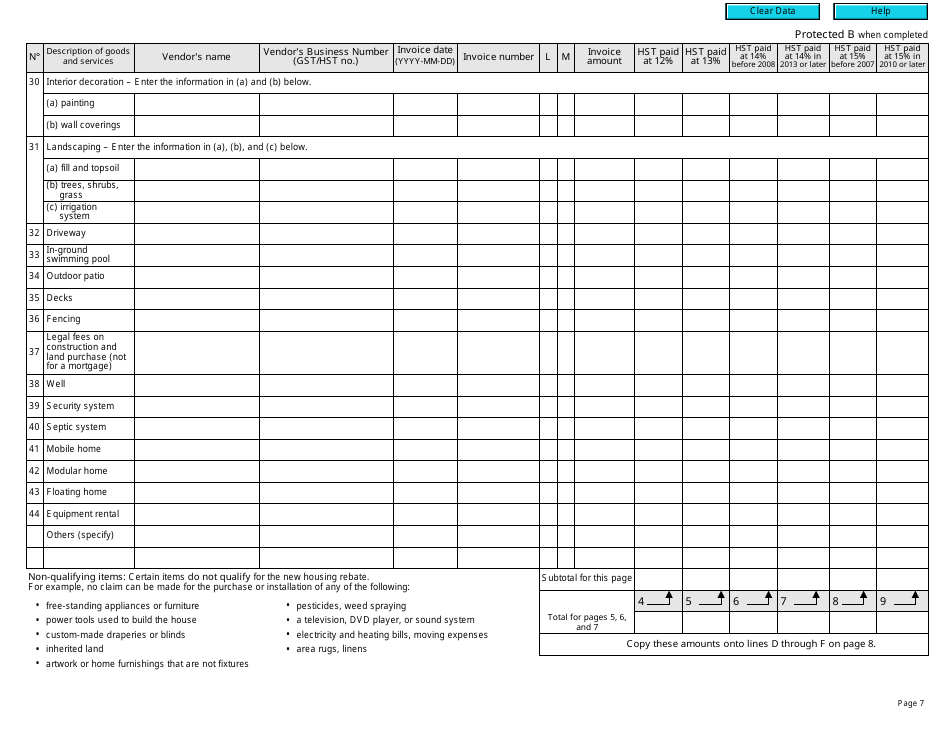

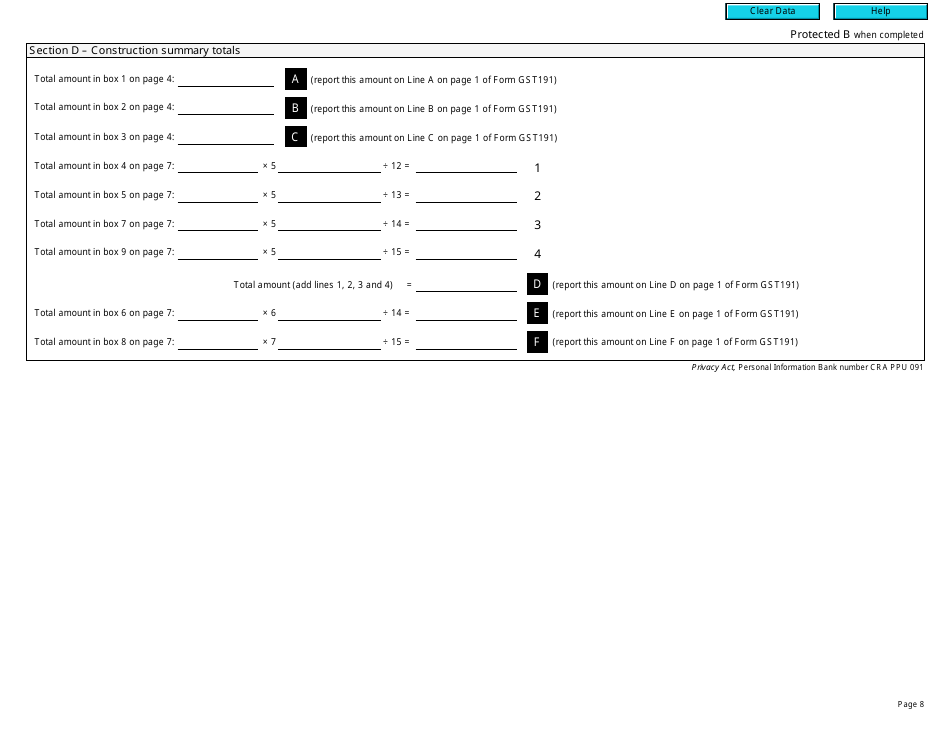

Form GST191-WS Construction Summary Worksheet - Canada

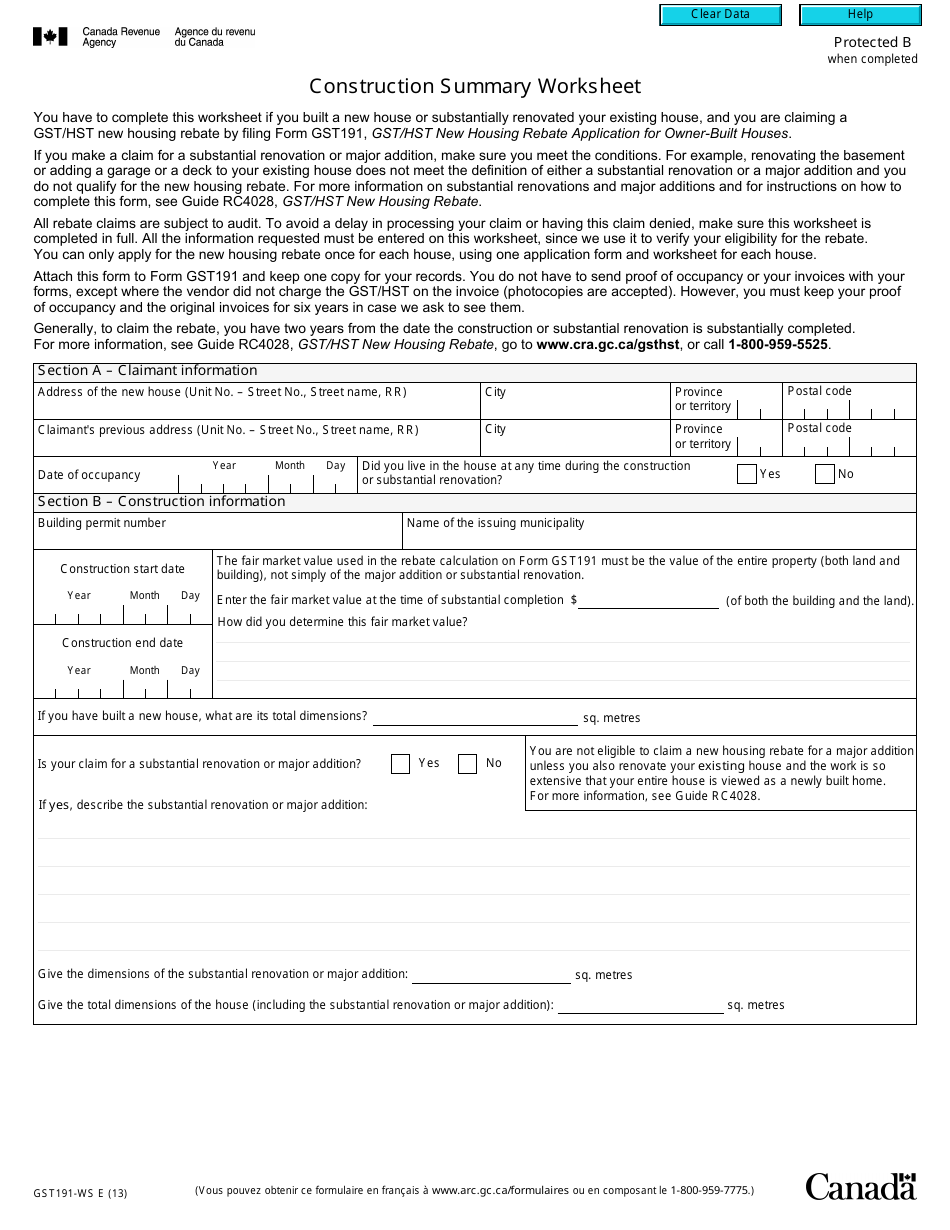

Form GST191-WS or the "Form Gst191-ws "construction Summary Worksheet" - Canada" is a form issued by the Canadian Revenue Agency .

The form was last revised in January 1, 2013 and is available for digital filing. Download an up-to-date Form GST191-WS in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form GST191-WS?

A: Form GST191-WS is a Construction Summary Worksheet used in Canada.

Q: What is the purpose of Form GST191-WS?

A: The purpose of Form GST191-WS is to provide a summary of construction activities for sales tax reporting.

Q: Who uses Form GST191-WS?

A: Form GST191-WS is used by individuals and businesses in the construction industry in Canada.

Q: Do I need to file Form GST191-WS?

A: If you are engaged in construction activities in Canada, you may need to file Form GST191-WS.

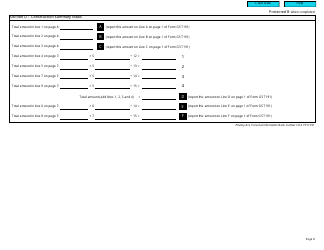

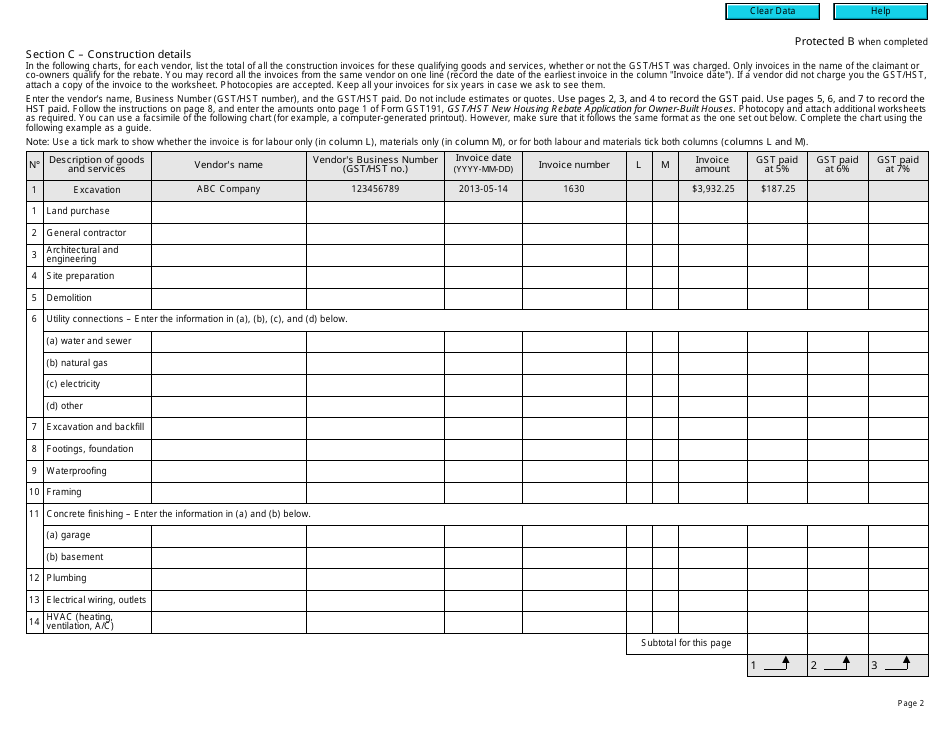

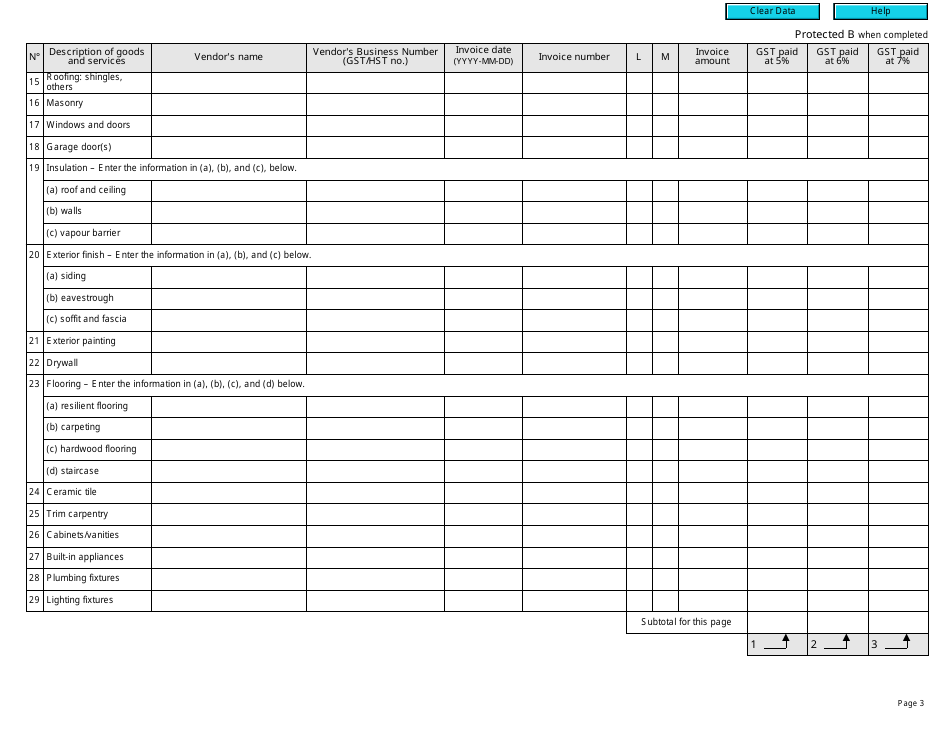

Q: What information is required on Form GST191-WS?

A: Form GST191-WS requires information on the type of construction activities, sales tax rates, and total amounts.

Q: Are there any deadlines for filing Form GST191-WS?

A: The deadlines for filing Form GST191-WS may vary depending on your reporting period. It is important to check with the CRA for specific deadlines.

Q: Are there any penalties for not filing Form GST191-WS?

A: Failure to file Form GST191-WS or submitting incorrect information may result in penalties or fines imposed by the CRA.