This version of the form is not currently in use and is provided for reference only. Download this version of

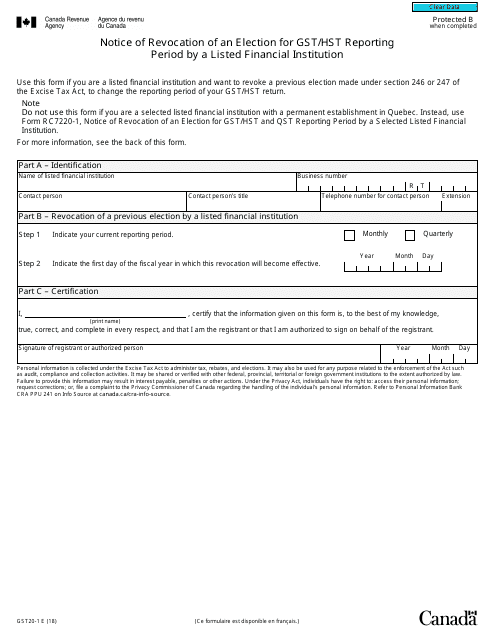

Form GST20-1

for the current year.

Form GST20-1 Notice of Revocation of an Election for Gst / Hst Reporting Period by a Listed Financial Institution - Canada

Form GST20-1 is a Canadian Revenue Agency form also known as the "Form Gst20-1 "notice Of Revocation Of An Election For Gst/hst Reporting Period By A Listed Financial Institution" - Canada" . The latest edition of the form was released in January 1, 2018 and is available for digital filing.

Download an up-to-date Form GST20-1 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form GST20-1?

A: Form GST20-1 is a Notice of Revocation of an Election for GST/HST reporting period by a Listed Financial Institution.

Q: Who uses Form GST20-1?

A: Listed Financial Institutions in Canada use Form GST20-1.

Q: What purpose does Form GST20-1 serve?

A: Form GST20-1 is used to notify the Canada Revenue Agency (CRA) about the revocation of an election for GST/HST reporting period by a Listed Financial Institution.

Q: What is the significance of revoking an election?

A: Revoking an election means the Listed Financial Institution will no longer be reporting its GST/HST liability on its regular reporting period.

Q: Are there any fees associated with filing Form GST20-1?

A: There are no fees associated with filing Form GST20-1.

Q: Is Form GST20-1 applicable only to Listed Financial Institutions?

A: Yes, Form GST20-1 is specifically designed for Listed Financial Institutions in Canada.

Q: What is the deadline for filing Form GST20-1?

A: The deadline for filing Form GST20-1 depends on the specific circumstances. It is advised to consult the CRA or refer to the instructions provided with the form.

Q: What should I do if I need assistance in filling out Form GST20-1?

A: If you need assistance in filling out Form GST20-1, you can contact the Canada Revenue Agency (CRA) directly or seek guidance from a tax professional.