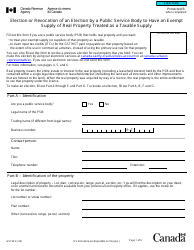

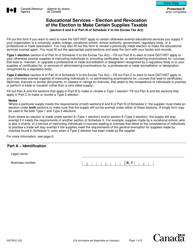

This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST23

for the current year.

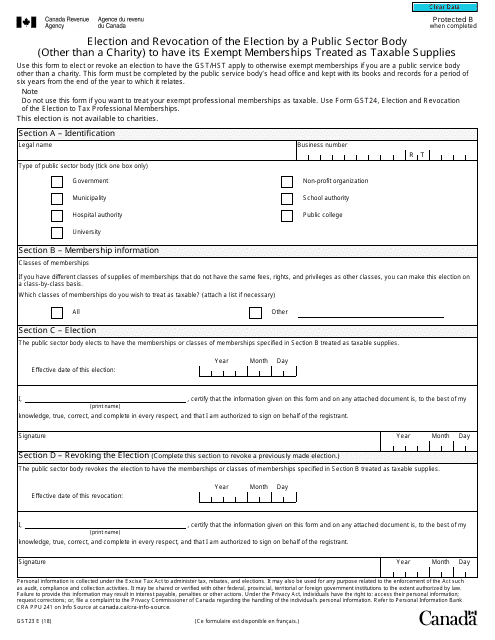

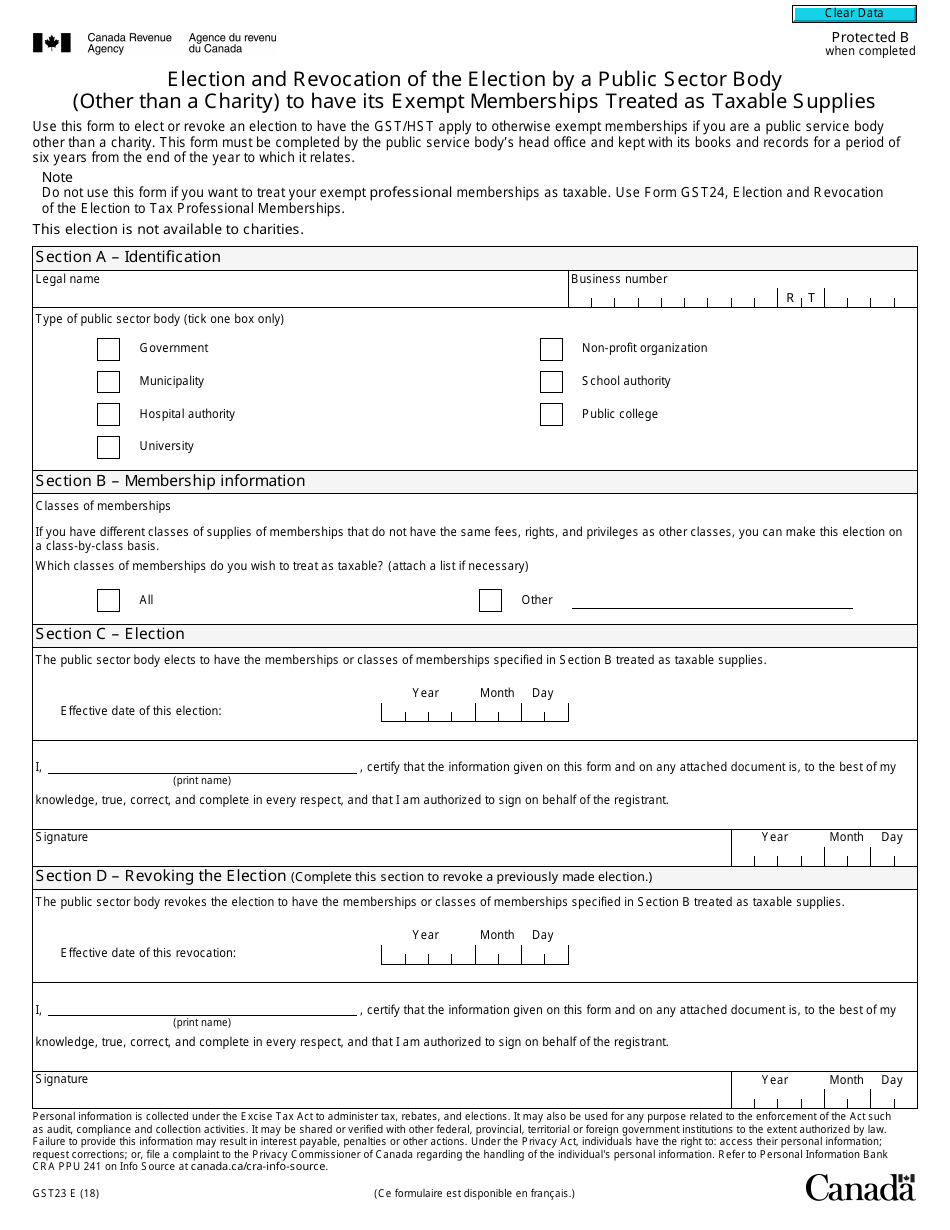

Form GST23 Election and Revocation of the Election by a Public Sector Body (Other Than a Charity) to Have Its Exempt Memberships Treated as Taxable Supplies - Canada

Form GST23 Election and Revocation of the Election by a Public Sector Body (Other Than a Charity) to Have Its Exempt Memberships Treated as Taxable Supplies is used in Canada for public sector bodies to elect or revoke the election to treat their exempt memberships as taxable supplies for Goods and Services Tax (GST) purposes. This form helps determine the tax treatment of the memberships for tax reporting.

FAQ

Q: What is Form GST23?

A: Form GST23 is a form used in Canada for public sector bodies (other than charities) to elect or revoke the election to have their exempt memberships treated as taxable supplies.

Q: Who can use Form GST23?

A: Form GST23 can be used by public sector bodies in Canada, excluding charities.

Q: What is the purpose of Form GST23?

A: The purpose of Form GST23 is to elect or revoke the election to have exempt memberships of a public sector body treated as taxable supplies for GST purposes in Canada.

Q: What are exempt memberships?

A: Exempt memberships are memberships that are usually not subject to Goods and Services Tax (GST) in Canada.

Q: What is the process for using Form GST23?

A: The process involves completing the form and submitting it to the Canada Revenue Agency (CRA) to either elect or revoke the election.

Q: Is Form GST23 only applicable to public sector bodies?

A: Yes, Form GST23 is only applicable to public sector bodies in Canada, excluding charities.

Q: Are there any fees associated with using Form GST23?

A: No, there are no fees associated with using Form GST23.

Q: Can Form GST23 be used by charities?

A: No, Form GST23 cannot be used by charities. It is specifically for public sector bodies (other than charities).

Q: What is the penalty for providing incorrect information on Form GST23?

A: Providing incorrect information on Form GST23 may result in penalties, including fines and interest charges, imposed by the Canada Revenue Agency (CRA).