This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST26

for the current year.

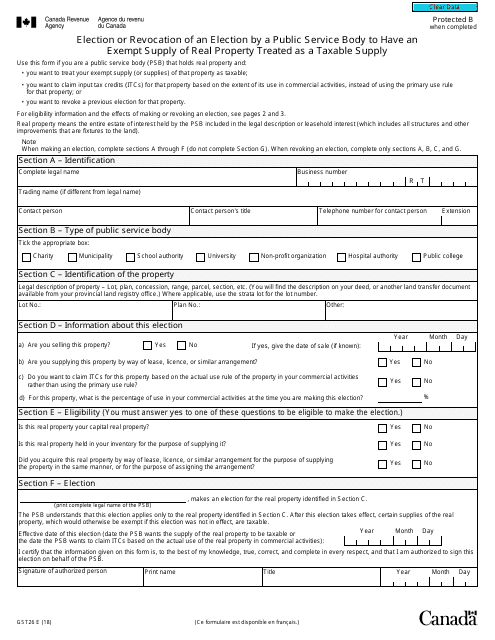

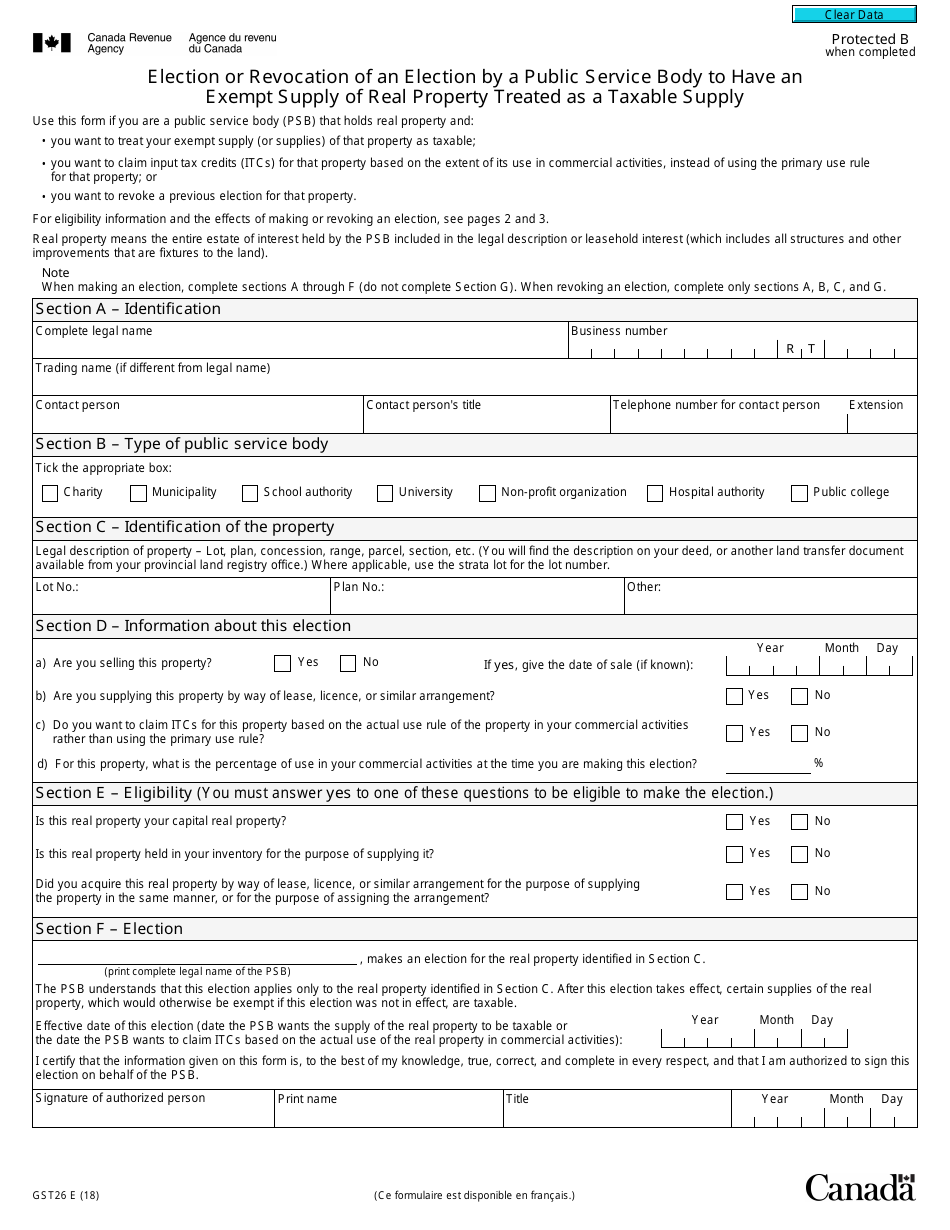

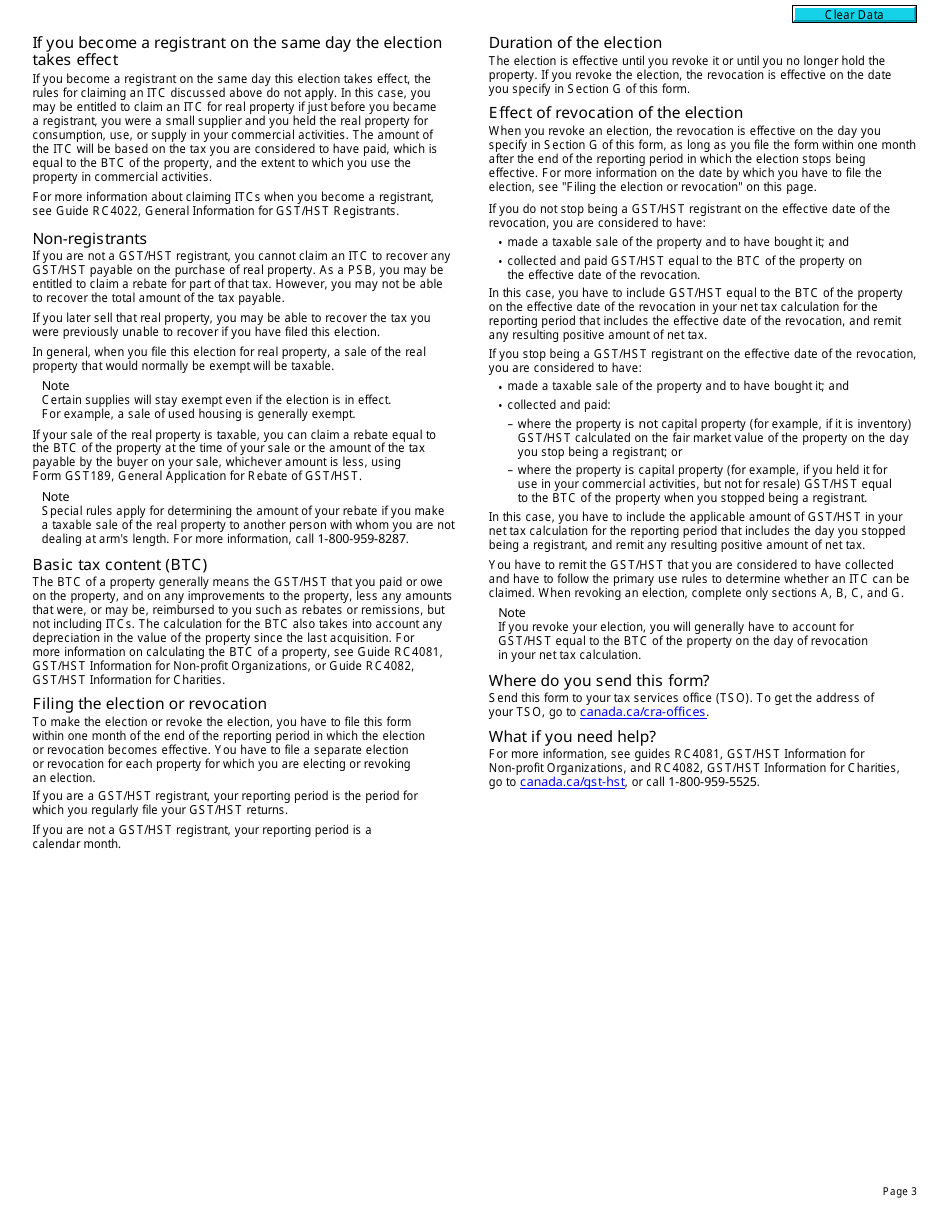

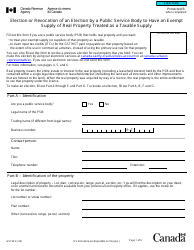

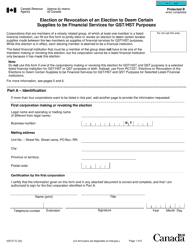

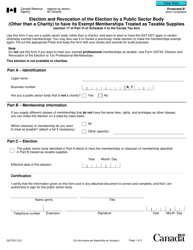

Form GST26 Election or Revocation of an Election by a Public Service Body to Have an Exempt Supply of Real Property Treated as a Taxable Supply - Canada

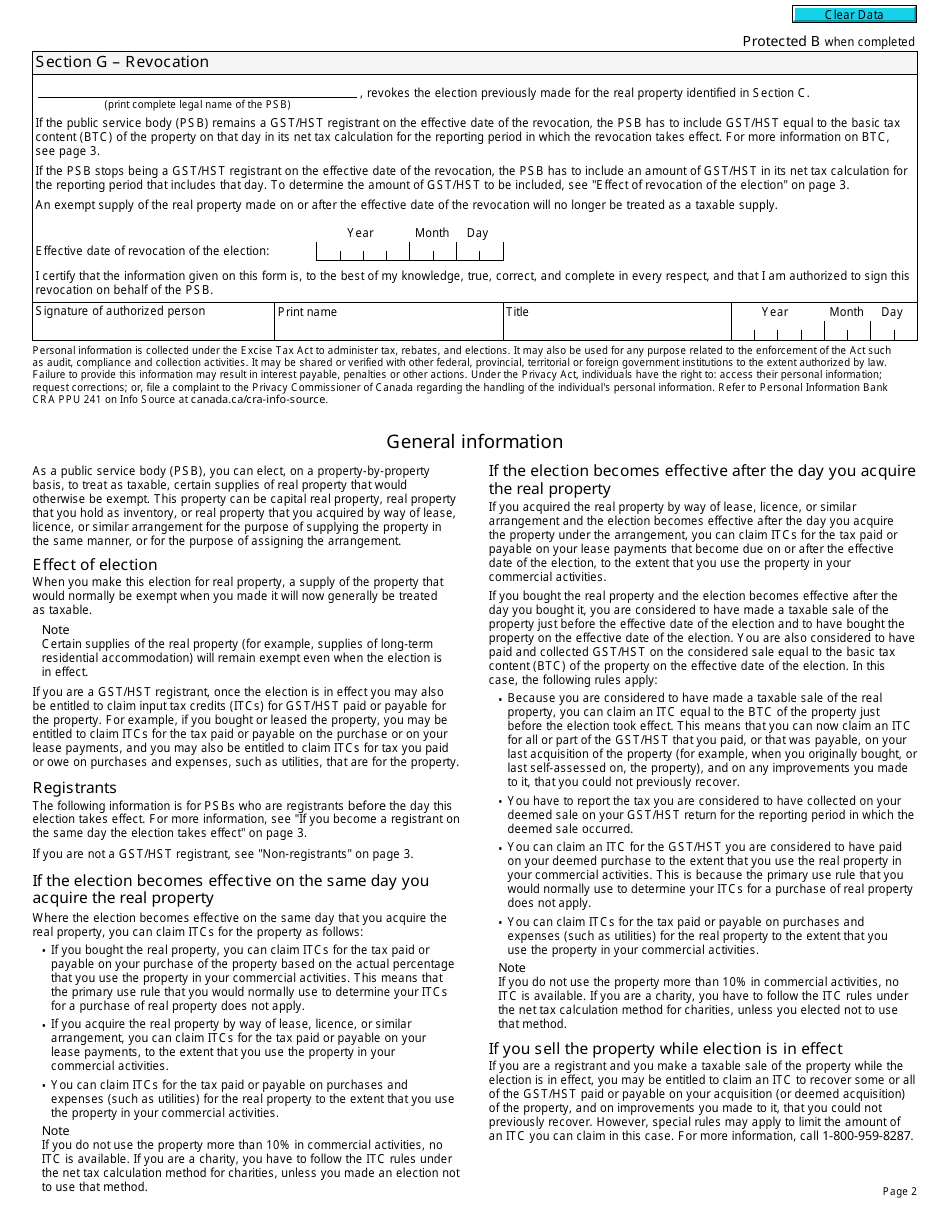

Form GST26 is used in Canada by public service bodies to either make an election or revoke an election regarding the treatment of an exempt supply of real property as a taxable supply for goods and services tax/harmonized sales tax (GST/HST) purposes. It allows public service bodies to choose whether to charge and remit GST/HST on a particular real property transaction that would otherwise be exempt.

The Form GST26 Election or Revocation of an Election by a Public Service Body to Have an Exempt Supply of Real Property Treated as a Taxable Supply in Canada is filed by a Public Service Body.

FAQ

Q: What is Form GST26?

A: Form GST26 is a form used in Canada by a public service body to make an election or revoke an election to have an exempt supply of real property treated as a taxable supply.

Q: Who needs to use Form GST26?

A: Public service bodies in Canada who want to make an election or revoke an election regarding the treatment of an exempt supply of real property as a taxable supply.

Q: What is an exempt supply of real property?

A: An exempt supply of real property refers to a transaction involving the sale, lease, or rental of real property that is not subject to Goods and Services Tax (GST) in Canada.

Q: What does it mean to treat an exempt supply of real property as a taxable supply?

A: Treating an exempt supply of real property as a taxable supply means that GST will be applicable on the transaction, and the public service body will be able to claim input tax credits.

Q: How do I complete Form GST26?

A: The form requires information such as the public service body's name, registration number, details of the election or revocation, and a declaration of the accuracy of the information provided.

Q: Are there any filing fees for Form GST26?

A: No, there are no filing fees associated with Form GST26.

Q: What should I do after completing Form GST26?

A: After completing the form, you should submit it to the CRA as instructed on the form.