This version of the form is not currently in use and is provided for reference only. Download this version of

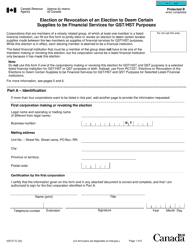

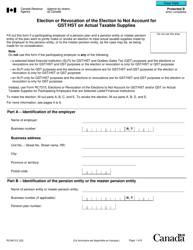

Form GST29

for the current year.

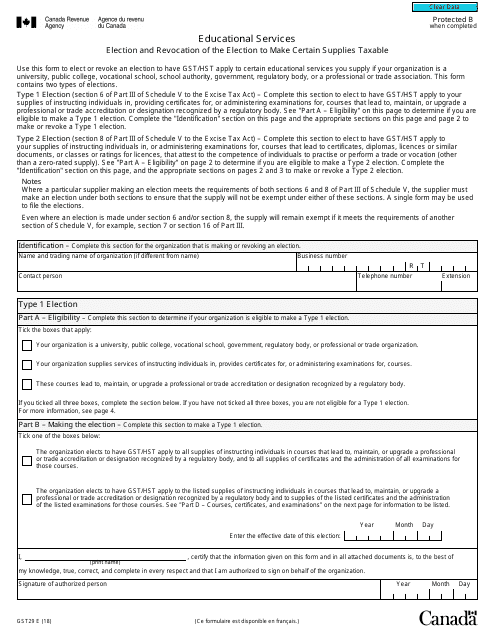

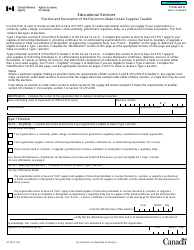

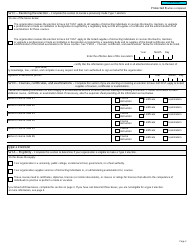

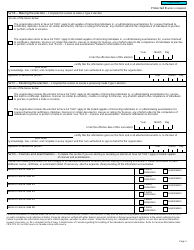

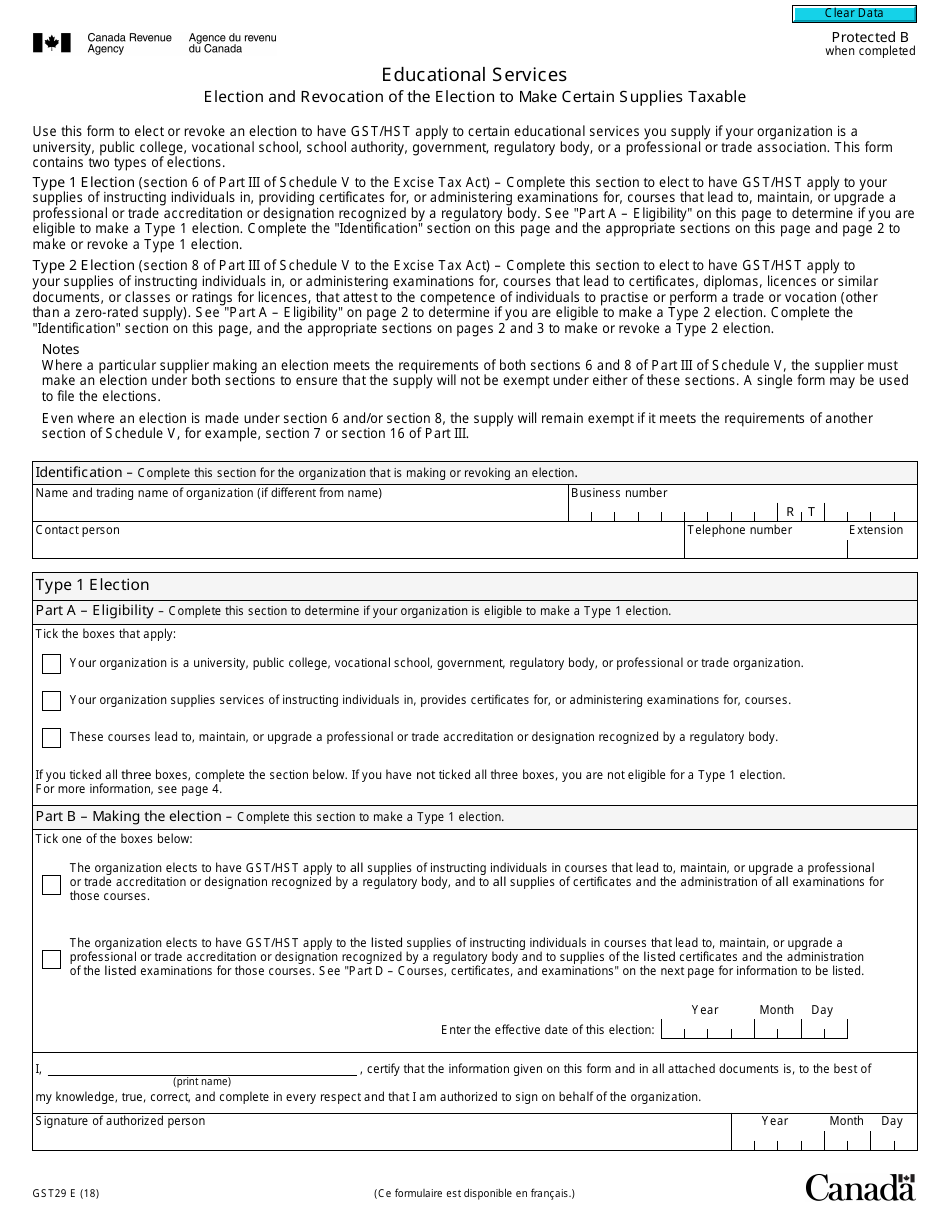

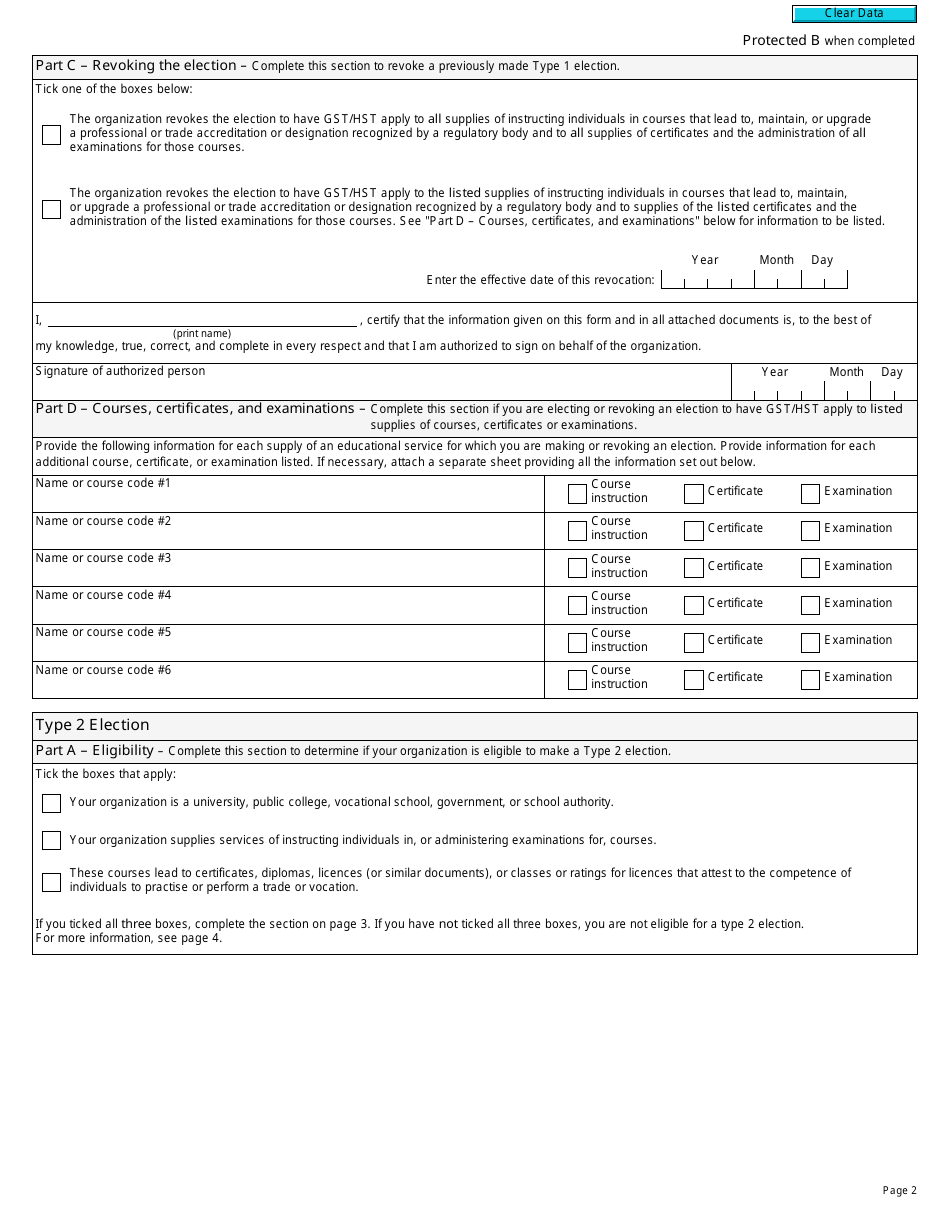

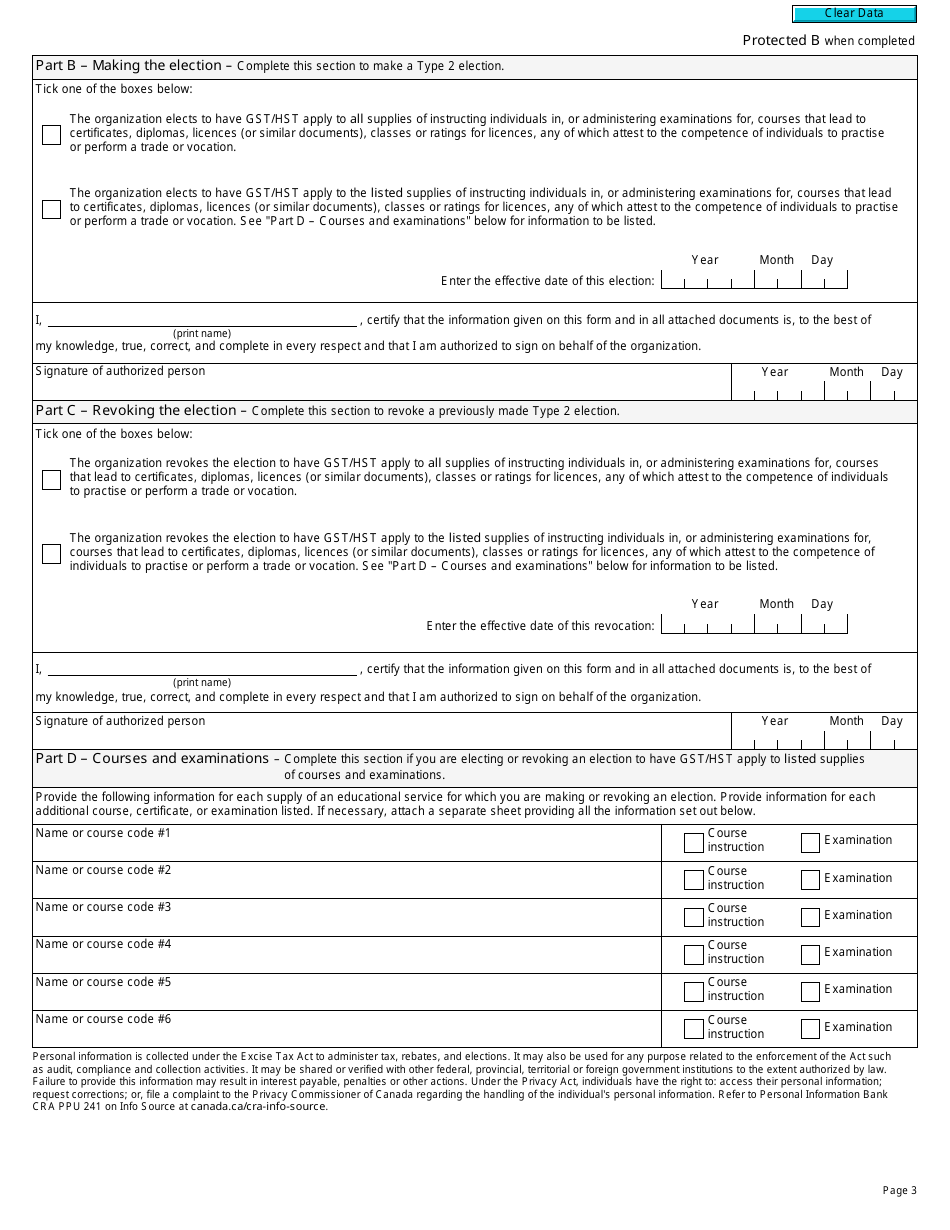

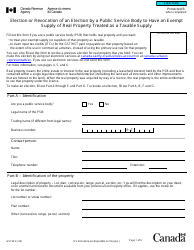

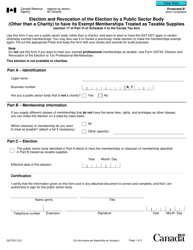

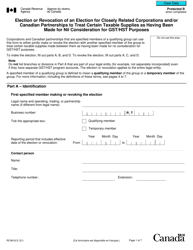

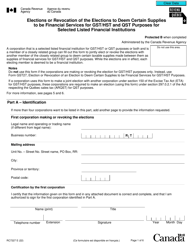

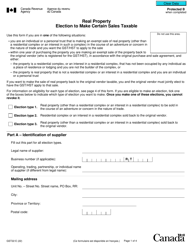

Form GST29 Educational Services - Election and Revocation of the Election to Make Certain Supplies Taxable - Canada

Form GST29 Educational Services - Election and Revocation of the Election to Make Certain Supplies Taxable in Canada is used for educational service providers to elect or revoke an election to make certain supplies taxable for Goods and Services Tax/Harmonized Sales Tax (GST/HST) purposes. It allows these providers to choose whether to charge and collect GST/HST on their services.

The Form GST29 for Educational Services - Election and Revocation of the Election to Make Certain Supplies Taxable in Canada is filed by educational service providers.

FAQ

Q: What is Form GST29?

A: Form GST29 is a form used in Canada to make an election or revoke an election to make certain supplies taxable for educational services.

Q: What is the purpose of Form GST29?

A: The purpose of Form GST29 is to elect or revoke the election to charge GST/HST on certain supplies of educational services.

Q: Who needs to fill out Form GST29?

A: Any person or organization that wants to make an election or revoke an election to charge GST/HST on certain supplies of educational services needs to fill out Form GST29.

Q: What are taxable supplies of educational services?

A: Taxable supplies of educational services refer to supplies of educational services that are subject to GST/HST.

Q: How do I fill out Form GST29?

A: To fill out Form GST29, you need to provide your business information, indicate whether you are making an election or revoking an election, and provide details about the educational services that are subject to the election or revocation.

Q: Are there any fees for filing Form GST29?

A: No, there are no fees for filing Form GST29.

Q: When should I file Form GST29?

A: Form GST29 should be filed before the first day of the reporting period for which the election or revocation is to be effective.

Q: Can I change my election after filing Form GST29?

A: Yes, you can change your election by filing a new Form GST29 before the effective date of the change.

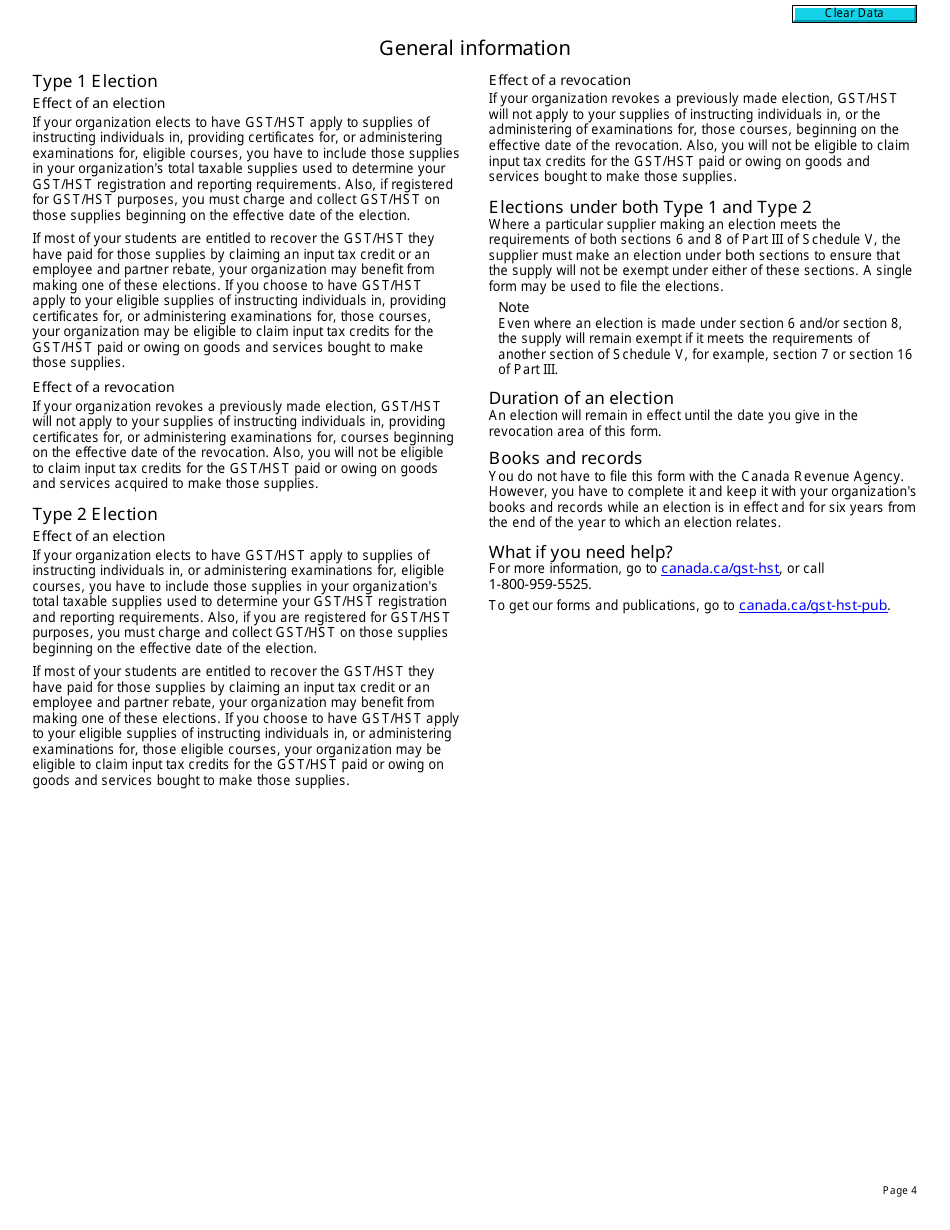

Q: What are the consequences of making an election?

A: Making an election means that you will have to charge and remit GST/HST on the taxable supplies of educational services specified in the election.

Q: What are the consequences of revoking an election?

A: Revoking an election means that you will no longer have to charge or remit GST/HST on the taxable supplies of educational services specified in the revocation.