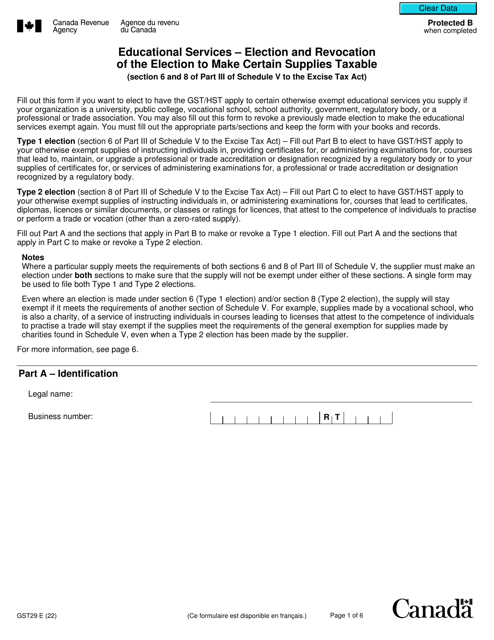

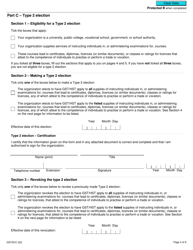

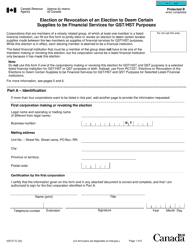

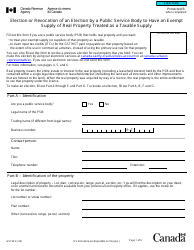

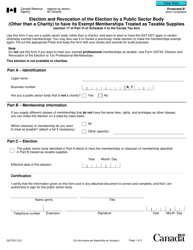

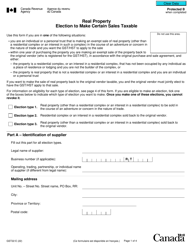

Form GST29 Educational Services - Election and Revocation of the Election to Make Certain Supplies Taxable - Canada

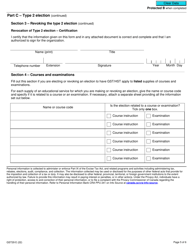

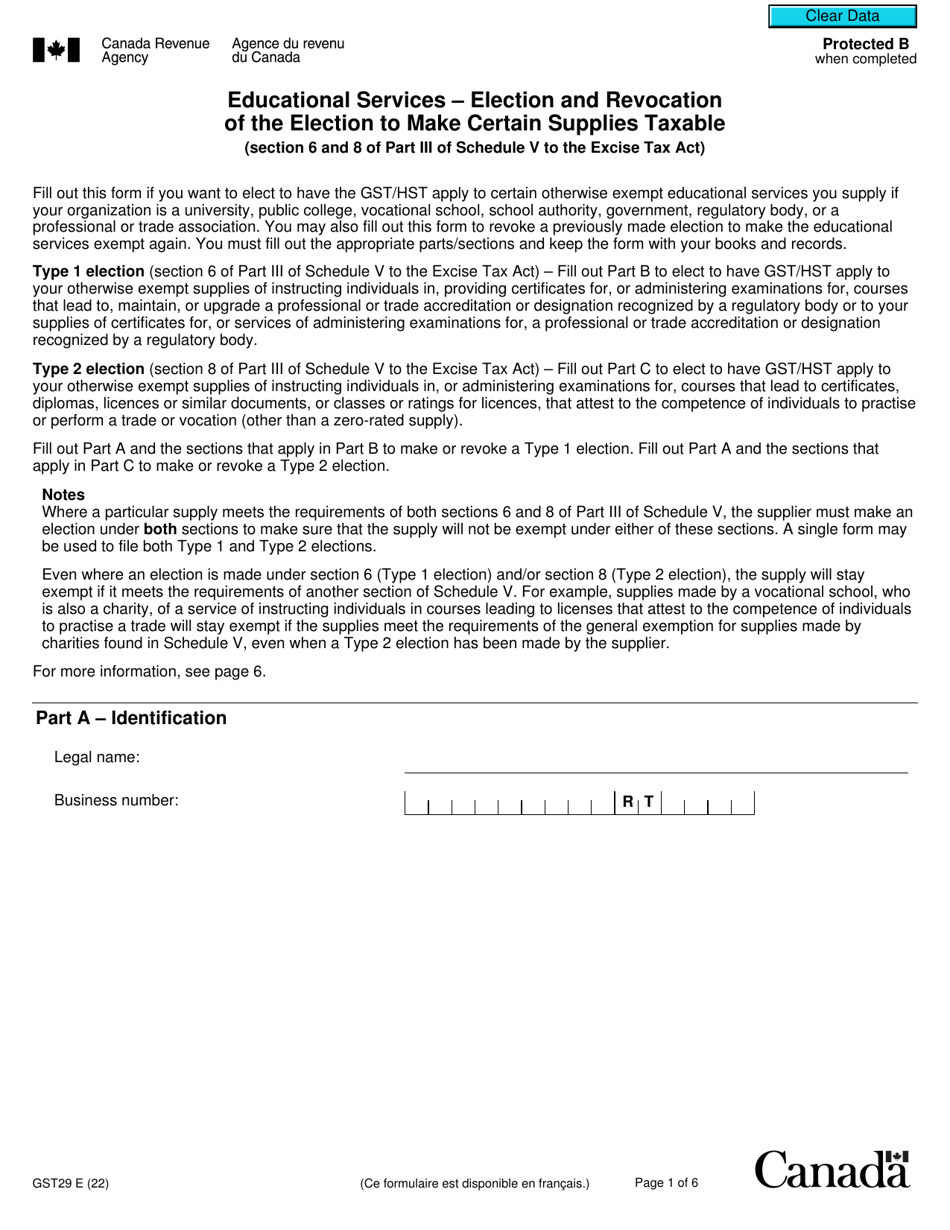

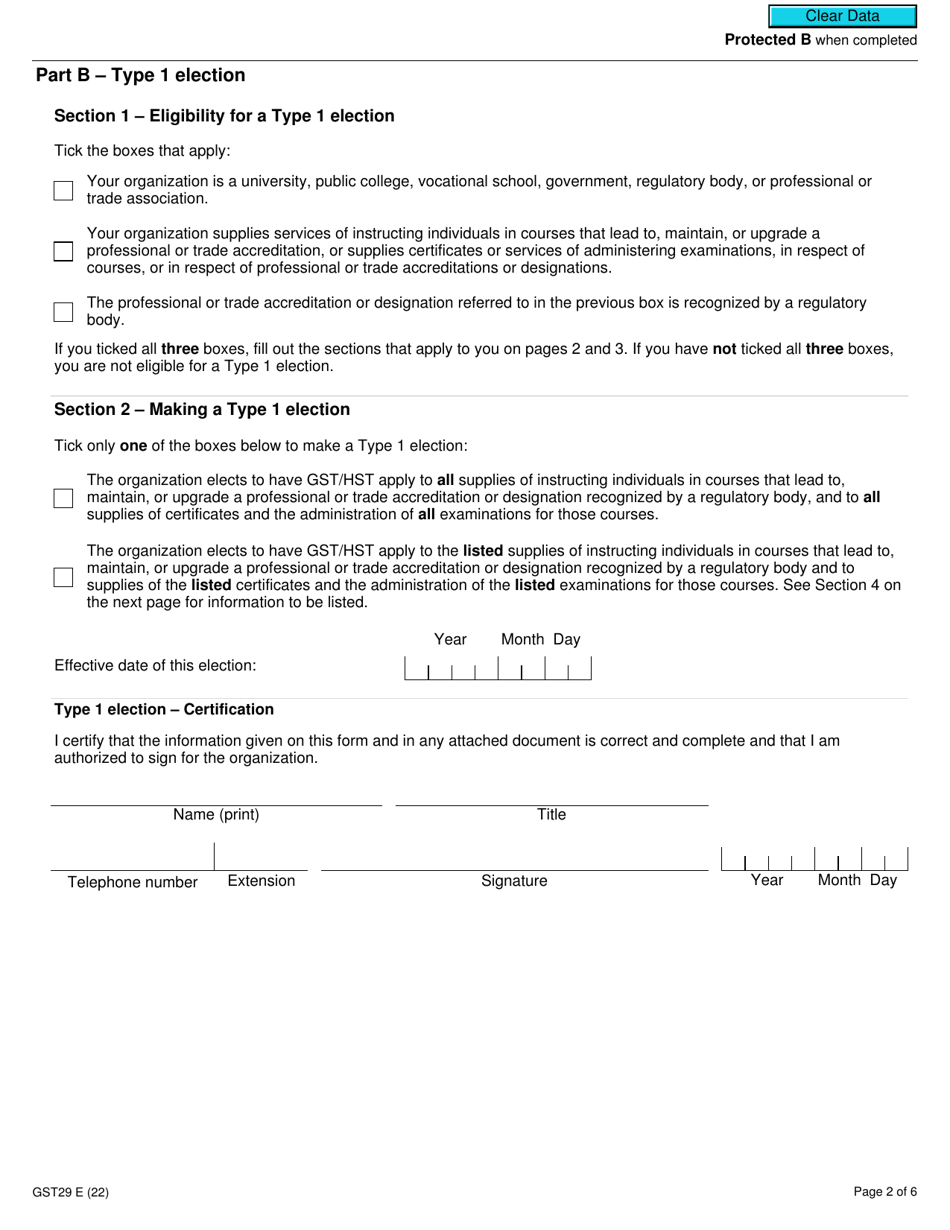

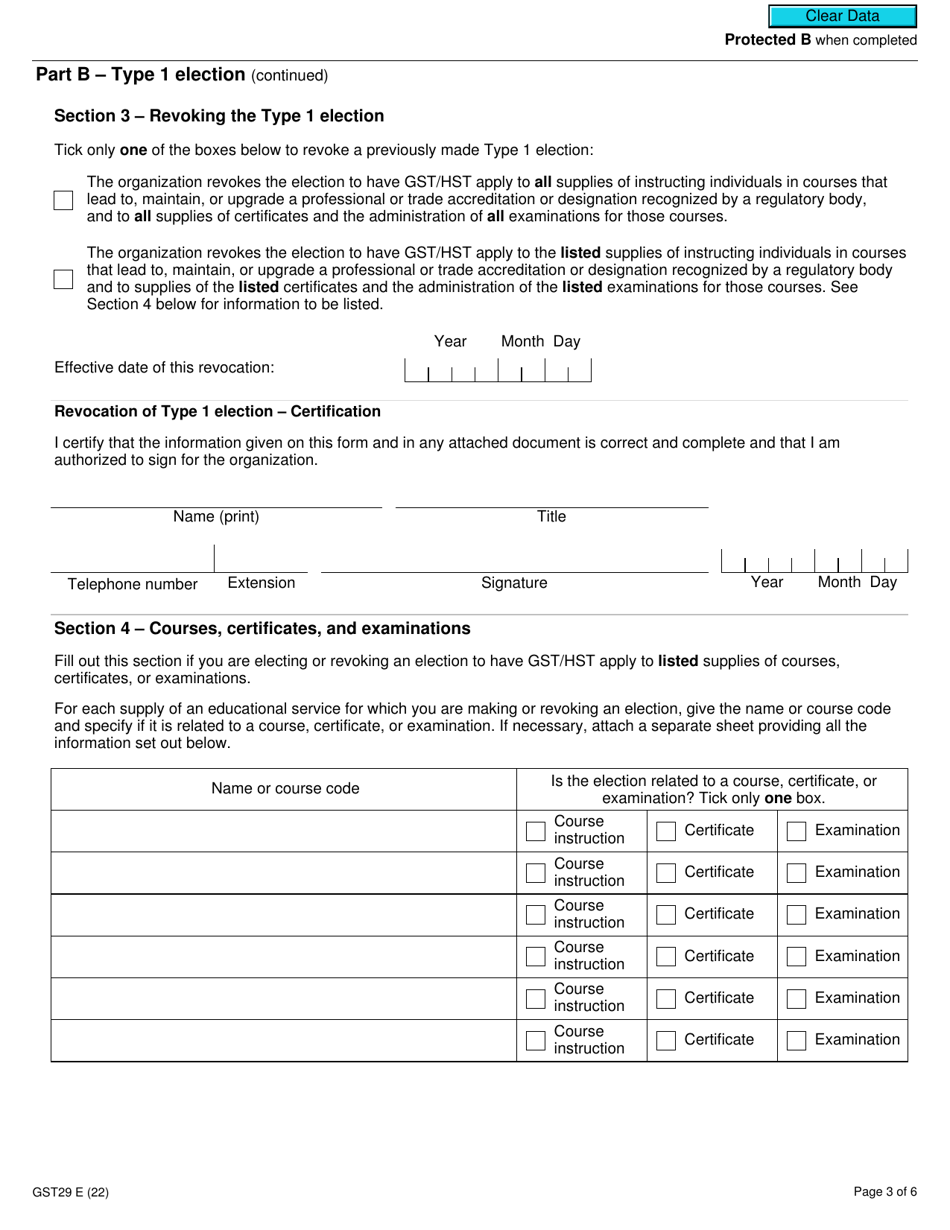

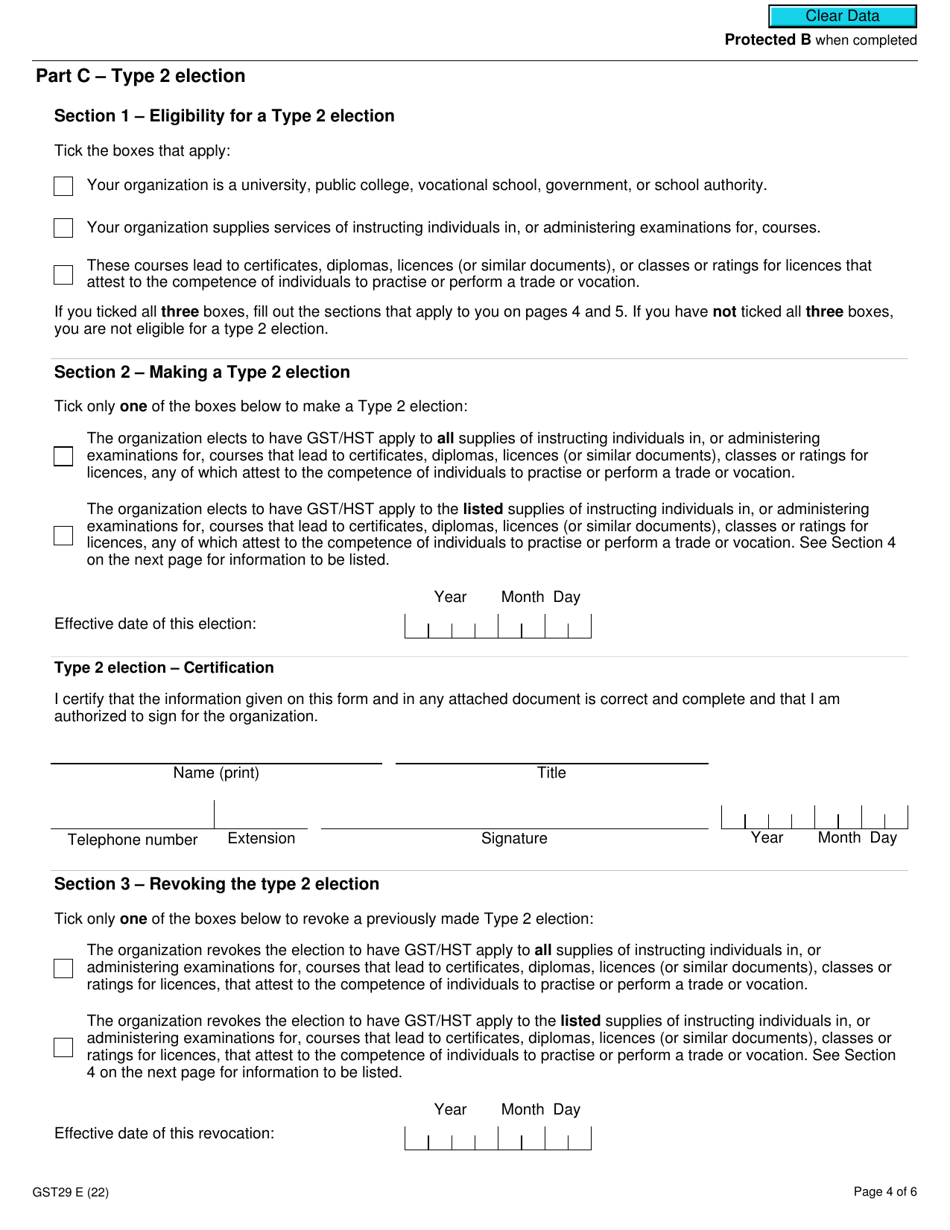

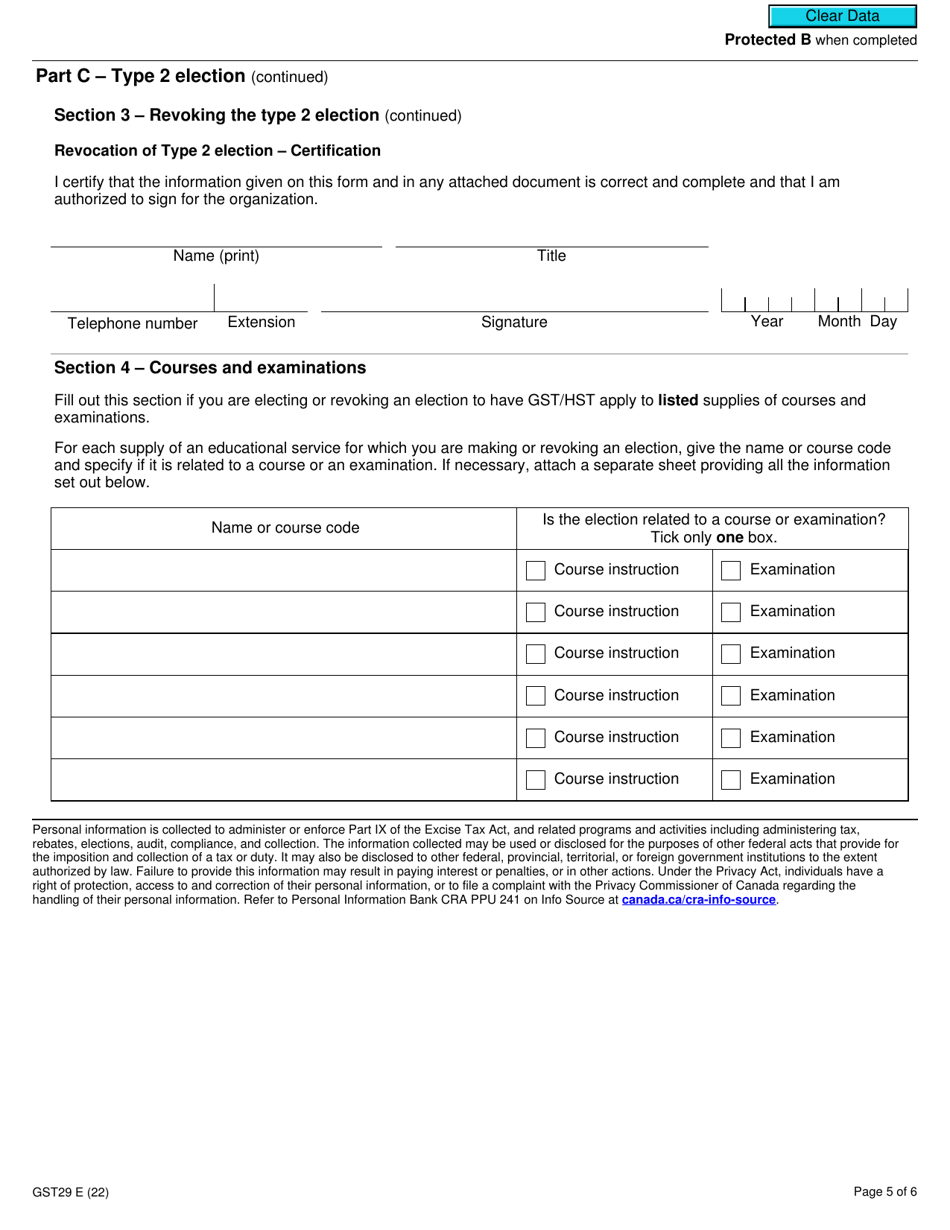

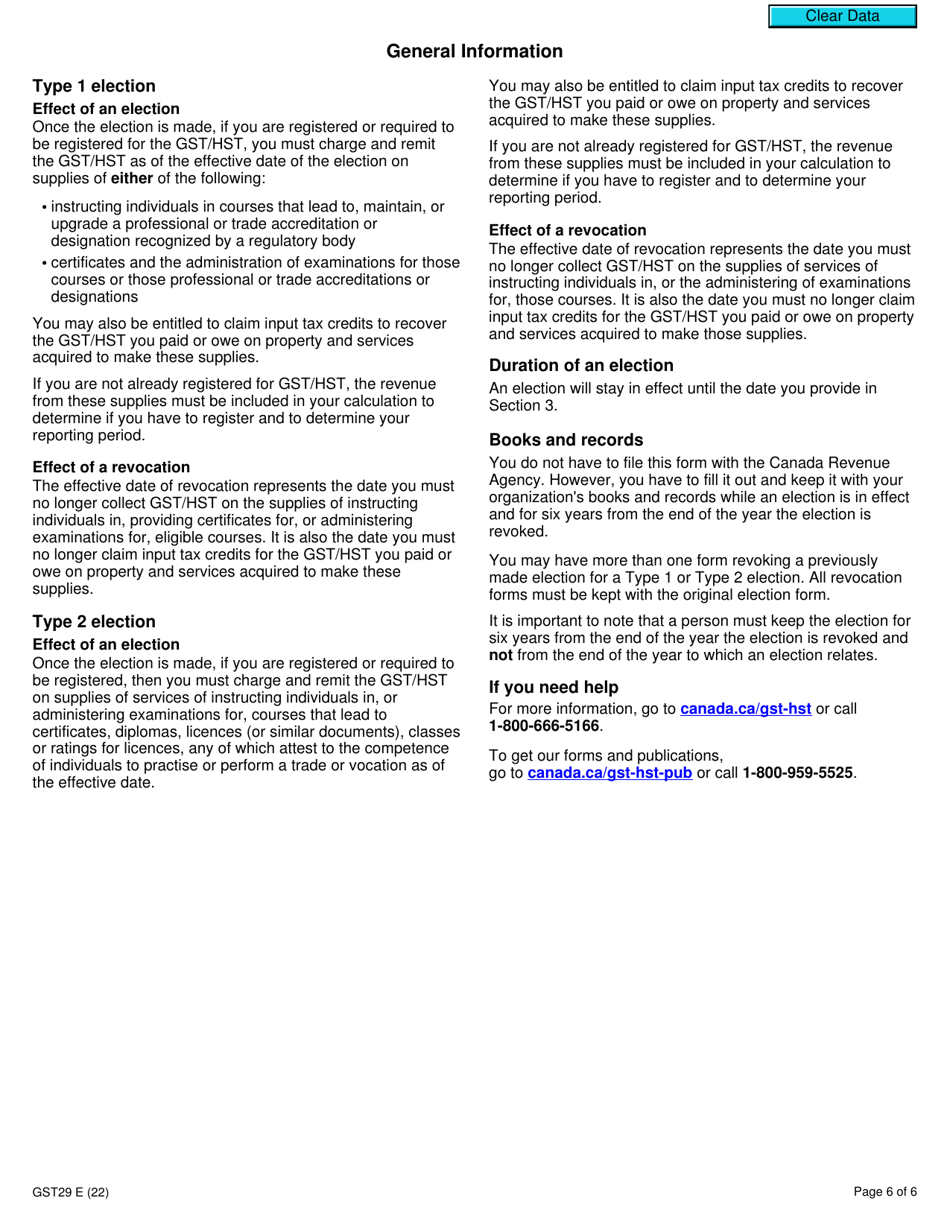

Form GST29 "Educational Services - Election and Revocation of the Election to Make Certain Supplies Taxable" in Canada is used to make an election or revoke the election to make certain supplies of educational services taxable under the Goods and Services Tax/Harmonized Sales Tax (GST/HST) system. This form allows educational institutions to determine whether to charge GST/HST on specific types of educational services provided.

The educational service provider files the Form GST29 in Canada.

Form GST29 Educational Services - Election and Revocation of the Election to Make Certain Supplies Taxable - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST29?

A: Form GST29 is a form used in Canada for electing or revoking the election to make certain supplies taxable.

Q: What is the purpose of Form GST29?

A: The purpose of Form GST29 is to allow educational service providers to elect or revoke the election to make certain supplies taxable.

Q: Who needs to fill out Form GST29?

A: Educational service providers in Canada who want to elect or revoke the election to make certain supplies taxable need to fill out Form GST29.

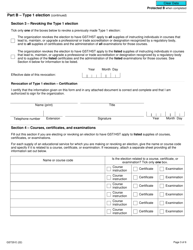

Q: What are the certain supplies mentioned in Form GST29?

A: The certain supplies mentioned in Form GST29 refer to supplies related to educational services.

Q: How can Form GST29 be used?

A: Form GST29 can be used to either elect or revoke the election to make certain supplies taxable.

Q: Are there any specific requirements for filling out Form GST29?

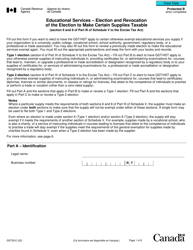

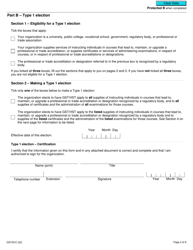

A: Yes, there are specific requirements for filling out Form GST29. These requirements are outlined in the form's instructions and guidelines.