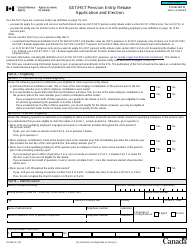

This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST386

for the current year.

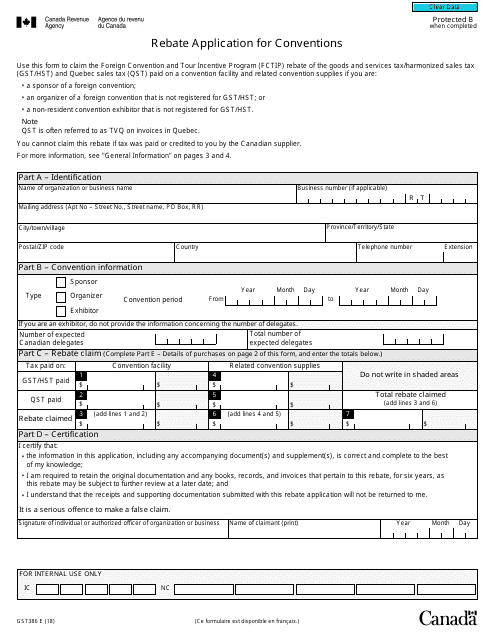

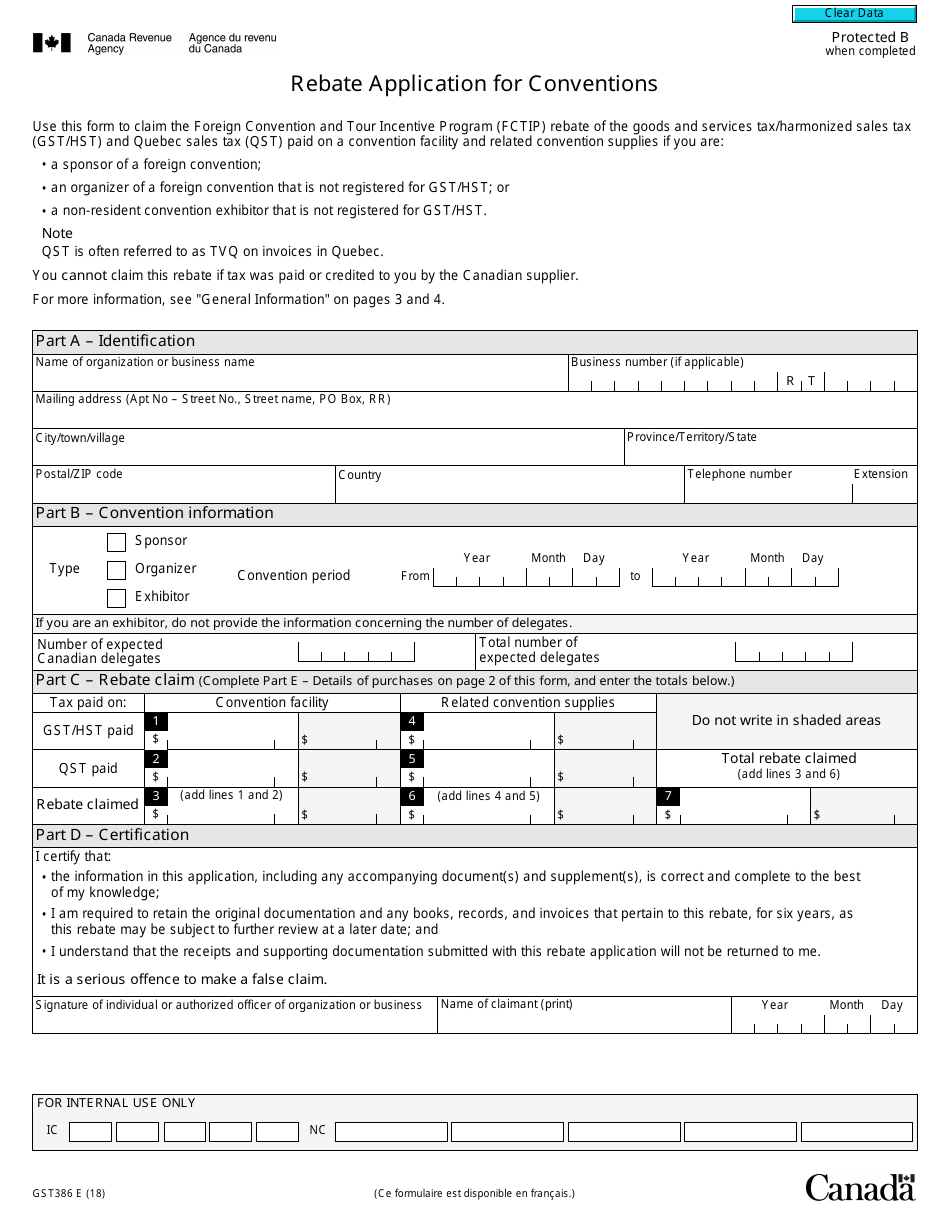

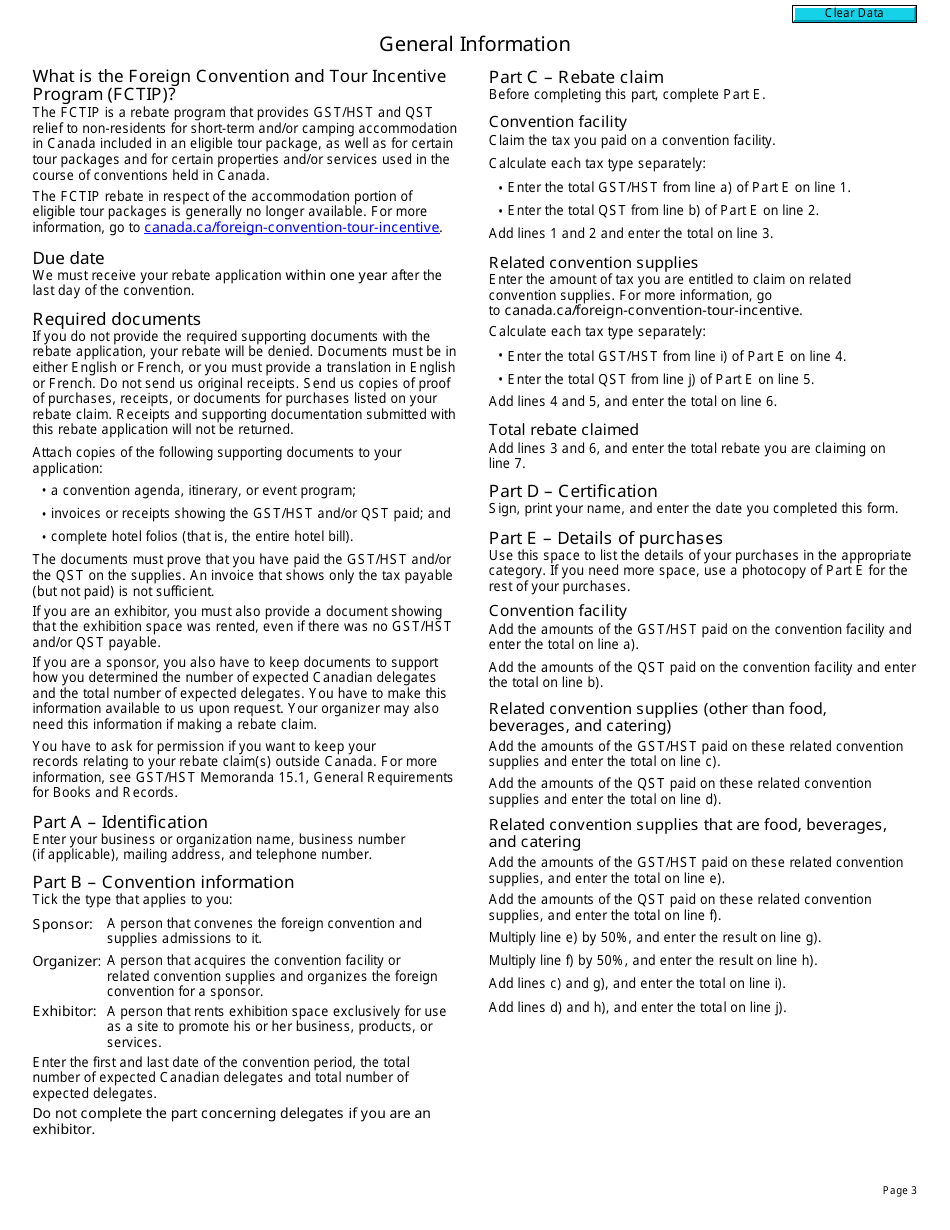

Form GST386 Rebate Application for Conventions - Canada

Form GST386 is a Canadian Revenue Agency form also known as the "Form Gst386 "rebate Application For Conventions" - Canada" . The latest edition of the form was released in January 1, 2018 and is available for digital filing.

Download a PDF version of the Form GST386 down below or find it on Canadian Revenue Agency Forms website.

FAQ

Q: What is Form GST386?

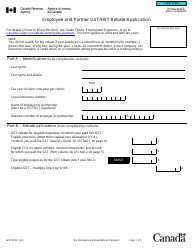

A: Form GST386 is an application for rebates on goods and services tax/harmonized sales tax (GST/HST) paid on expenses related to conventions held in Canada.

Q: Who can use Form GST386?

A: Individuals, partnerships, corporations, or other organizations that have paid GST/HST on convention expenses in Canada can use Form GST386.

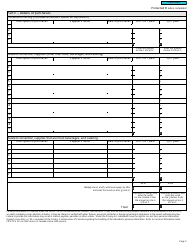

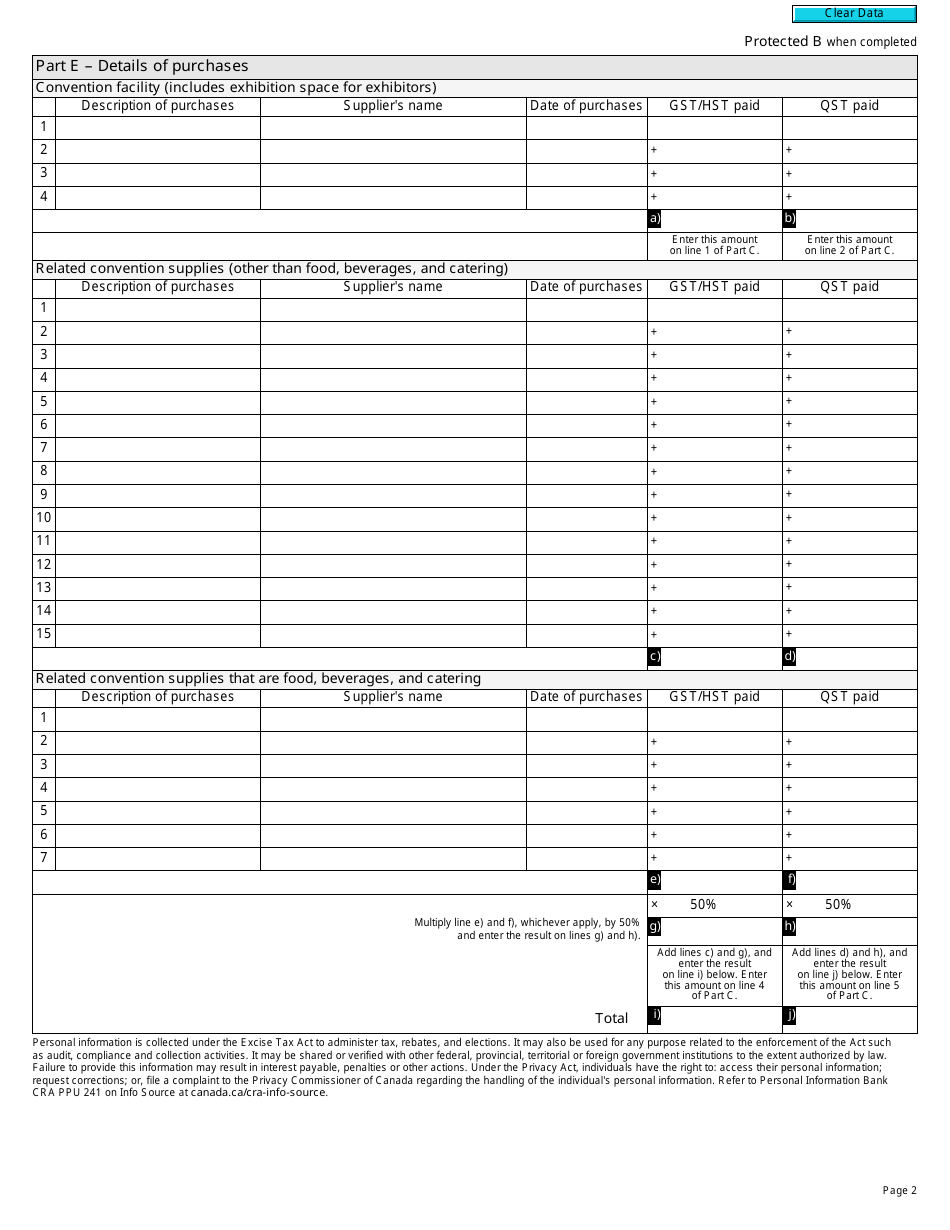

Q: What expenses are eligible for the rebate?

A: Eligible expenses include registration fees, accommodation expenses at a designated place, and certain meal and entertainment expenses.

Q: How much of the GST/HST can be claimed as a rebate?

A: You can claim a 50% rebate of the GST or 87% rebate of the HST paid on eligible expenses.

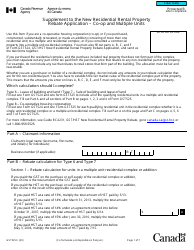

Q: What supporting documents are required?

A: You need to submit the original receipts or invoices for convention expenses, as well as proof of payment, such as credit card statements or cancelled checks.

Q: What is the deadline for submitting Form GST386?

A: Form GST386 should be filed within two years after the end of the calendar year in which the expenses were incurred.

Q: Can I claim a rebate for conventions held outside of Canada?

A: No, Form GST386 is specifically for rebates on conventions held in Canada.

Q: Are there any exceptions or special rules for claiming the rebate?

A: Yes, there are specific rules for claiming rebates on expenses related to charitable conventions, political conventions, and conventions held by non-resident entities.