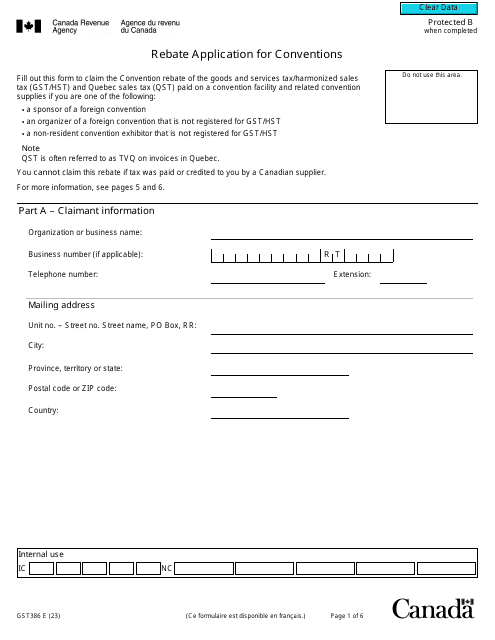

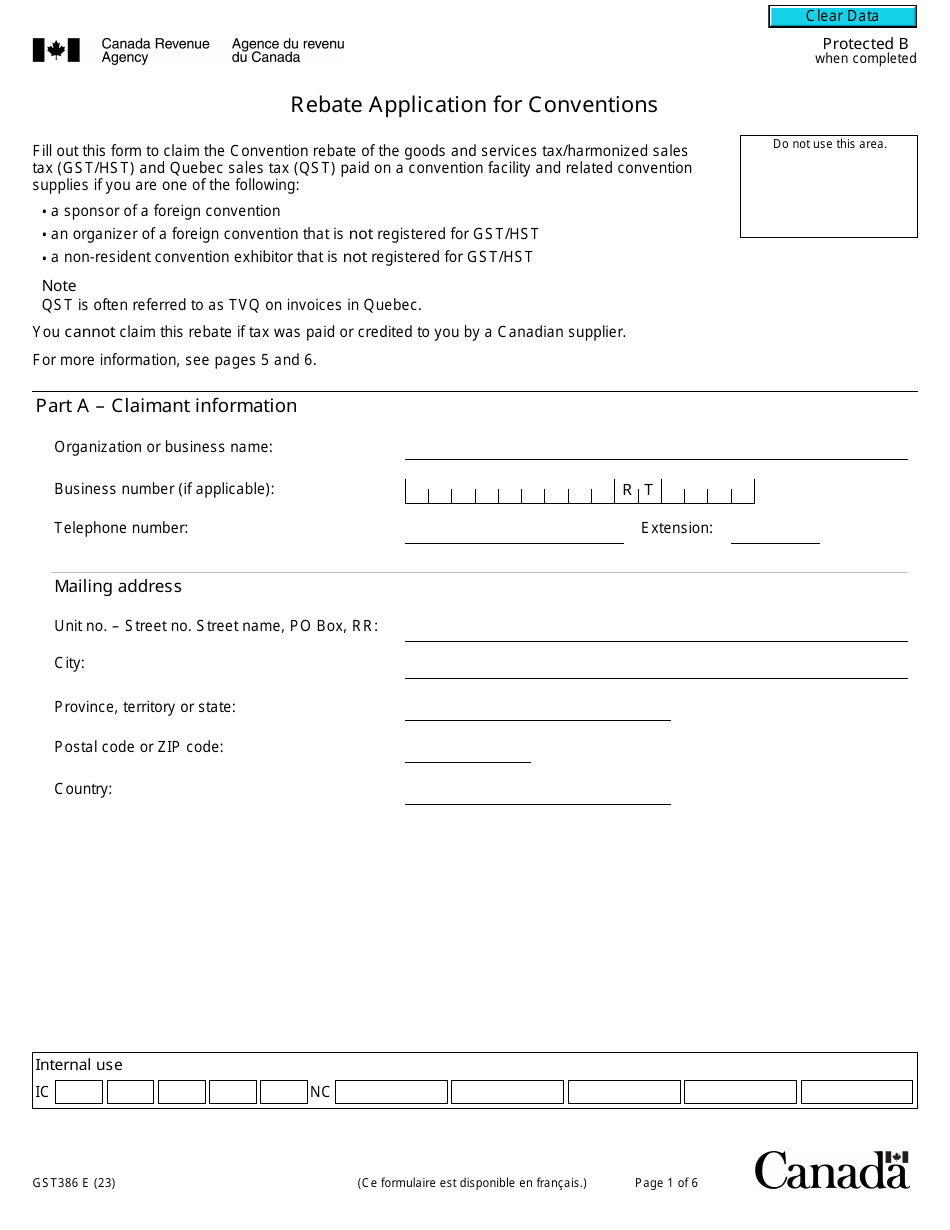

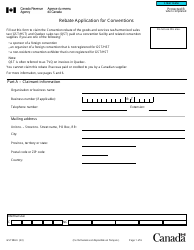

Form GST386 Rebate Application for Conventions - Canada

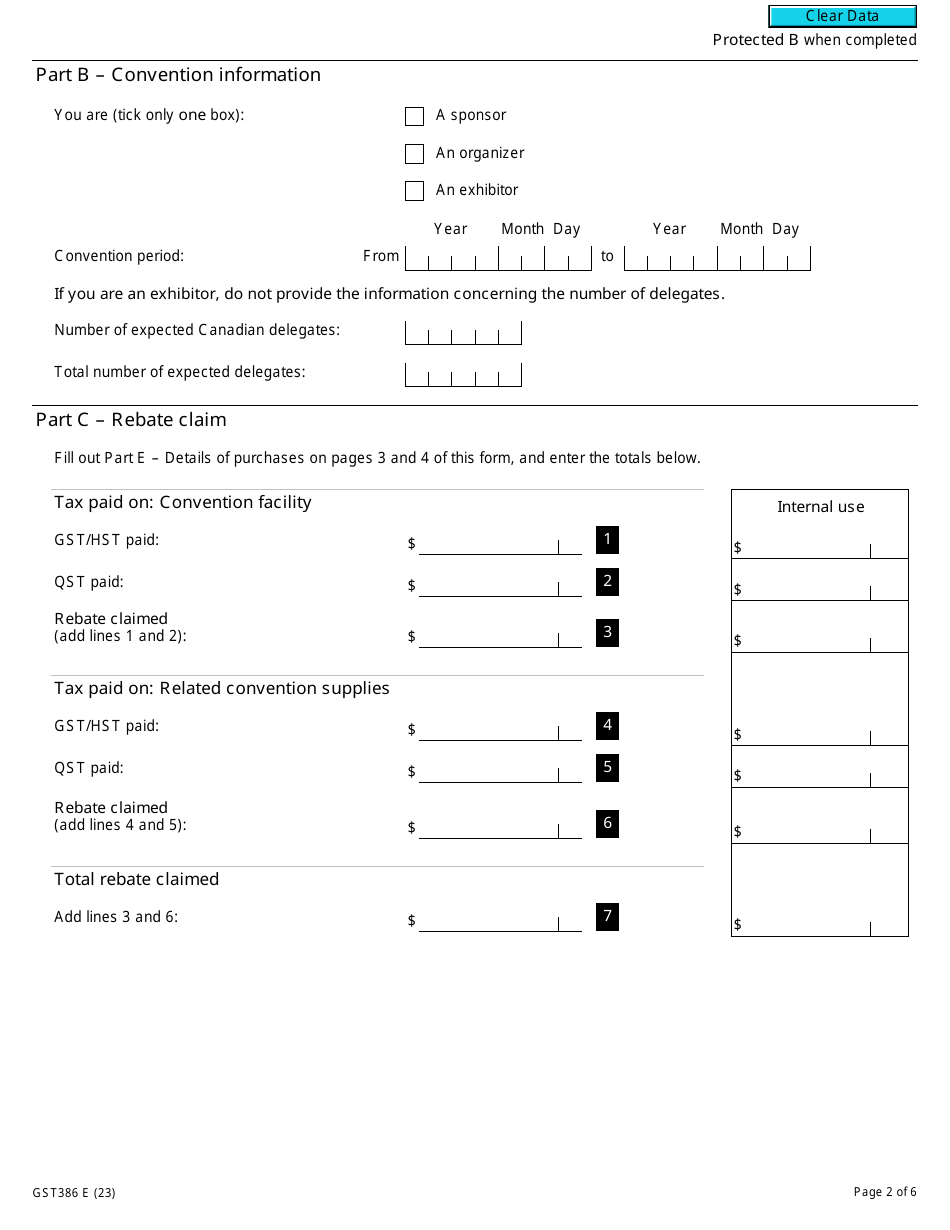

Form GST386 is a rebate application form in Canada used for claiming a Goods and Services Tax/Harmonized Sales Tax (GST/HST) rebate for expenses related to conventions. It is for individuals or organizations that qualify for the rebate based on specific criteria.

The Form GST386 Rebate Application for Conventions in Canada is typically filed by the individual or organization hosting the convention.

Form GST386 Rebate Application for Conventions - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST386? A: Form GST386 is a rebate application for conventions in Canada.

Q: Who can use Form GST386? A: Anyone organizing a convention in Canada can use Form GST386.

Q: What is the purpose of Form GST386? A: The purpose of Form GST386 is to claim a rebate for the Goods and Services Tax (GST) paid on convention expenses.

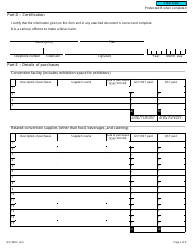

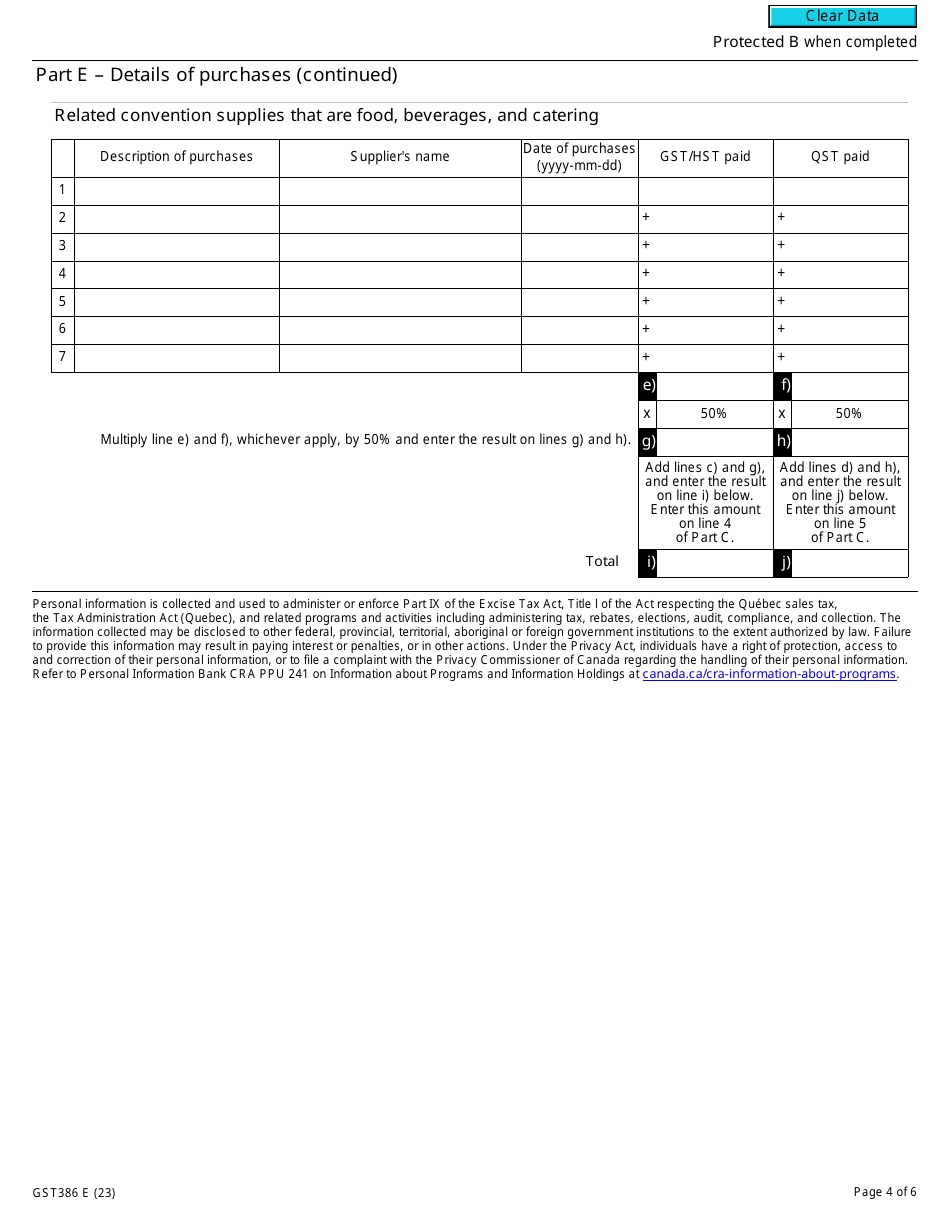

Q: What are convention expenses? A: Convention expenses include things like registration fees, meals, and accommodations.

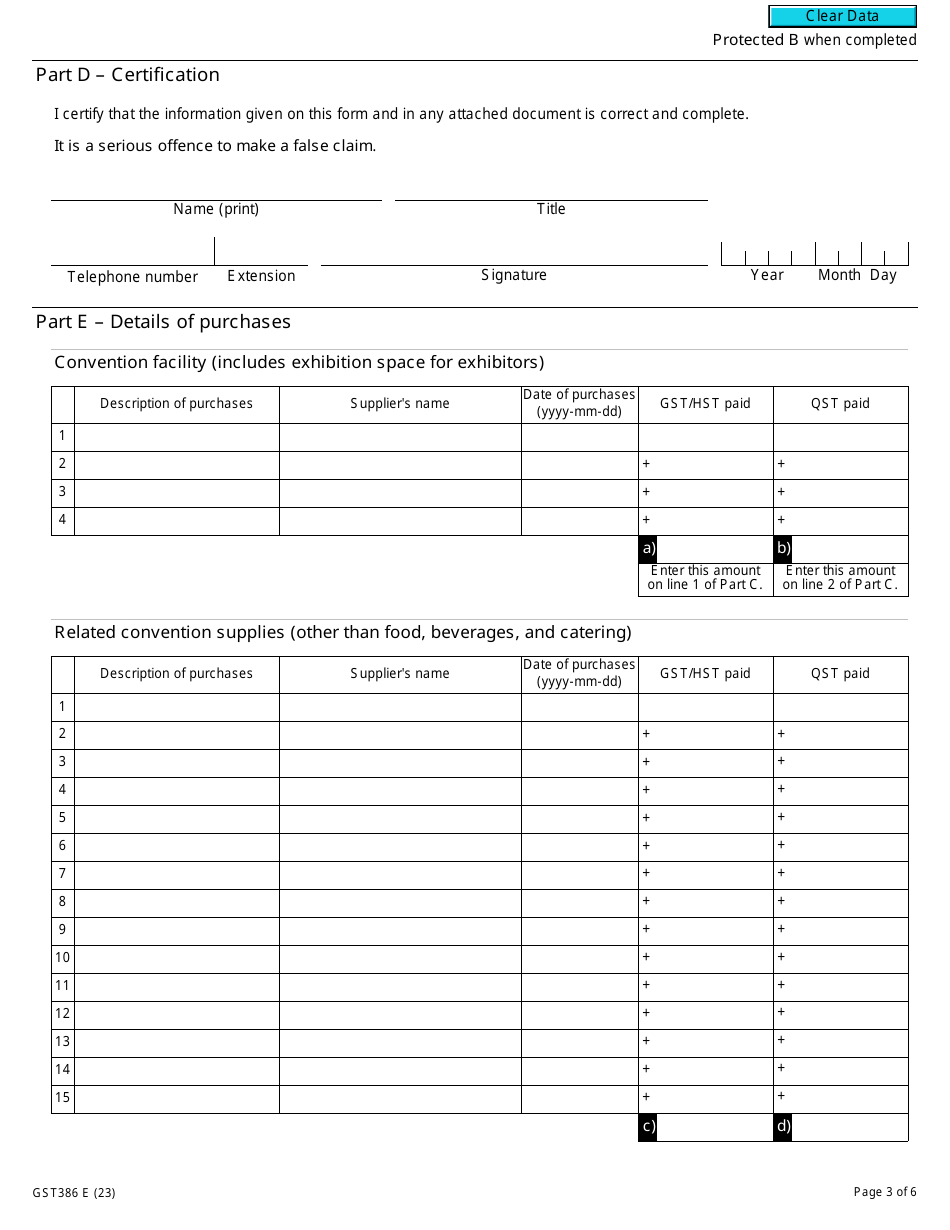

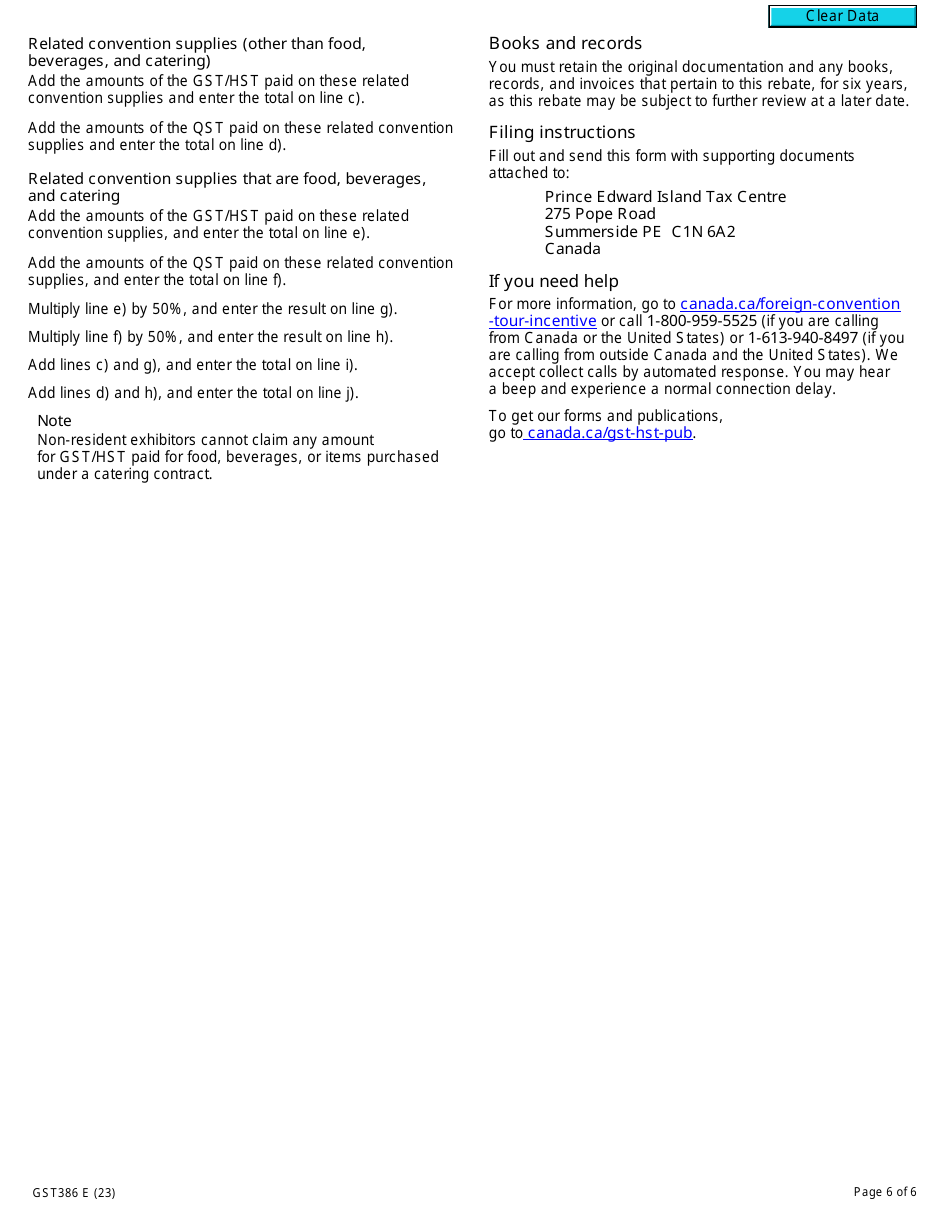

Q: How do I fill out Form GST386? A: To fill out Form GST386, you will need to provide information about the convention, the expenses incurred, and the amount of GST paid.

Q: Are there any eligibility requirements for the rebate? A: Yes, there are eligibility requirements for the rebate. The convention must meet certain criteria, and there may be restrictions on the types of expenses that can be claimed.

Q: When should I submit Form GST386? A: Form GST386 should be submitted within four years from the end of the reporting period in which the convention took place.

Q: How long does it take to receive the rebate? A: The processing time for the rebate application can vary, but it typically takes several weeks to receive the rebate.

Q: What should I do if my rebate application is denied? A: If your rebate application is denied, you have the option to appeal the decision.

Q: Can I claim a rebate for multiple conventions? A: Yes, you can claim a rebate for multiple conventions as long as they meet the eligibility requirements.

Q: Is there a fee to submit Form GST386? A: No, there is no fee to submit Form GST386.