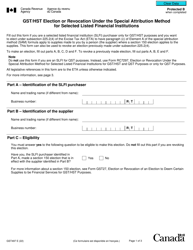

This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST44

for the current year.

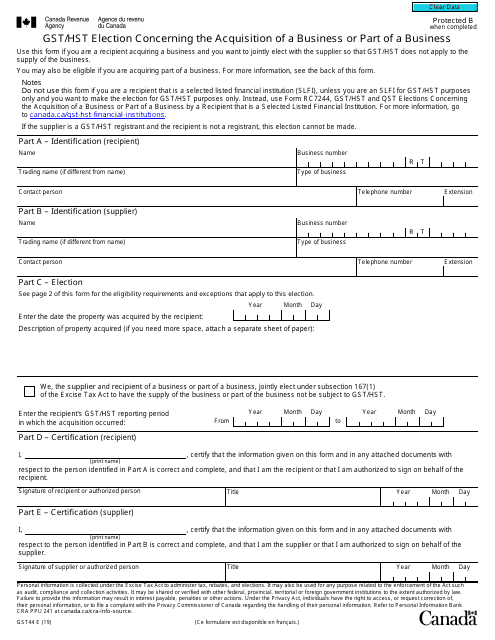

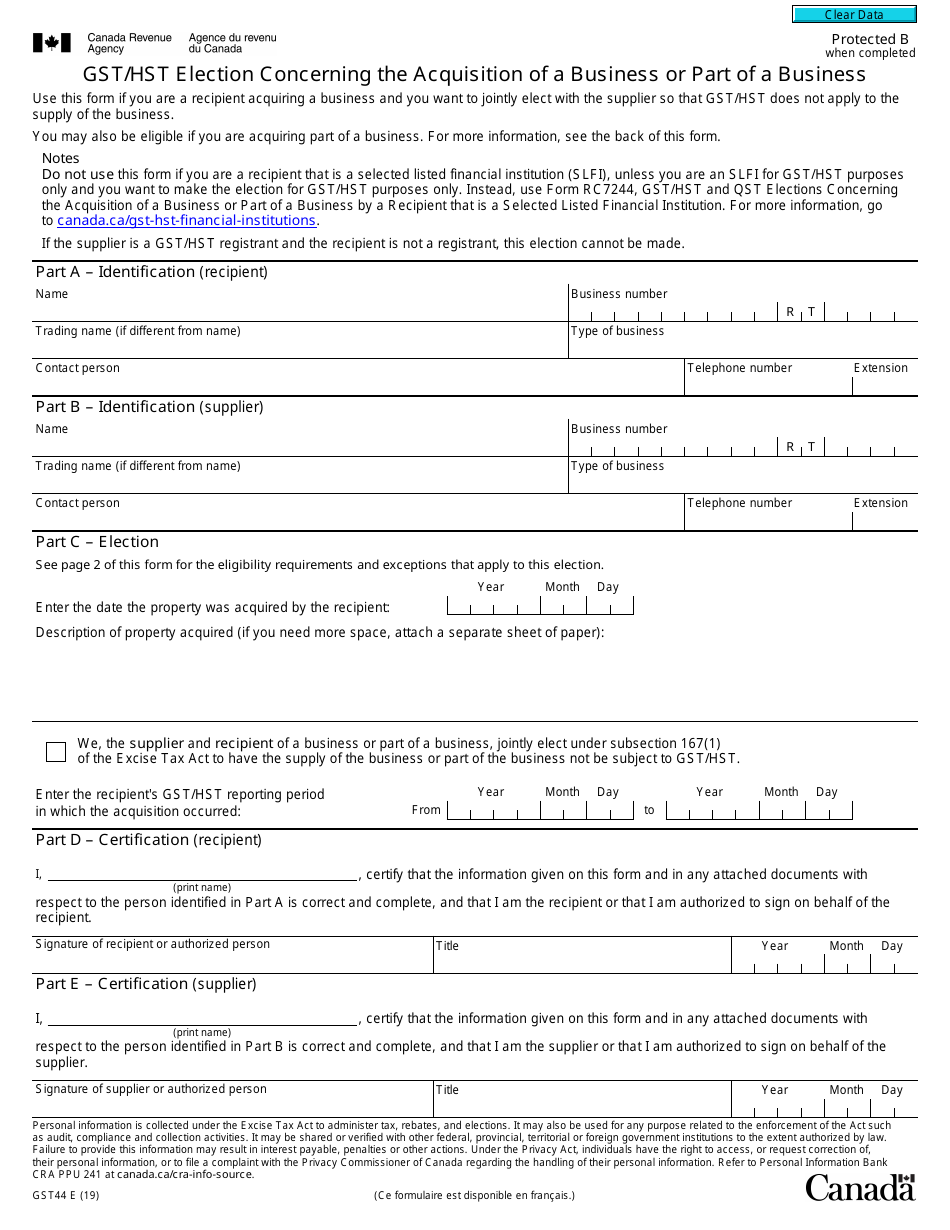

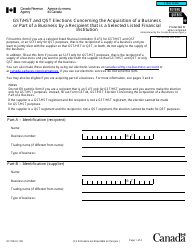

Form GST44 Gst / Hst Election Concerning the Acquisition of a Business or Part of a Business - Canada

Form GST44 is a Canadian Revenue Agency form also known as the "Form Gst44 "gst/hst Election Concerning The Acquisition Of A Business Or Part Of A Business" - Canada" . The latest edition of the form was released in January 1, 2019 and is available for digital filing.

Download a PDF version of the Form GST44 down below or find it on Canadian Revenue Agency Forms website.

FAQ

Q: What is Form GST44?

A: Form GST44 is a GST/HST election form.

Q: What is the purpose of Form GST44?

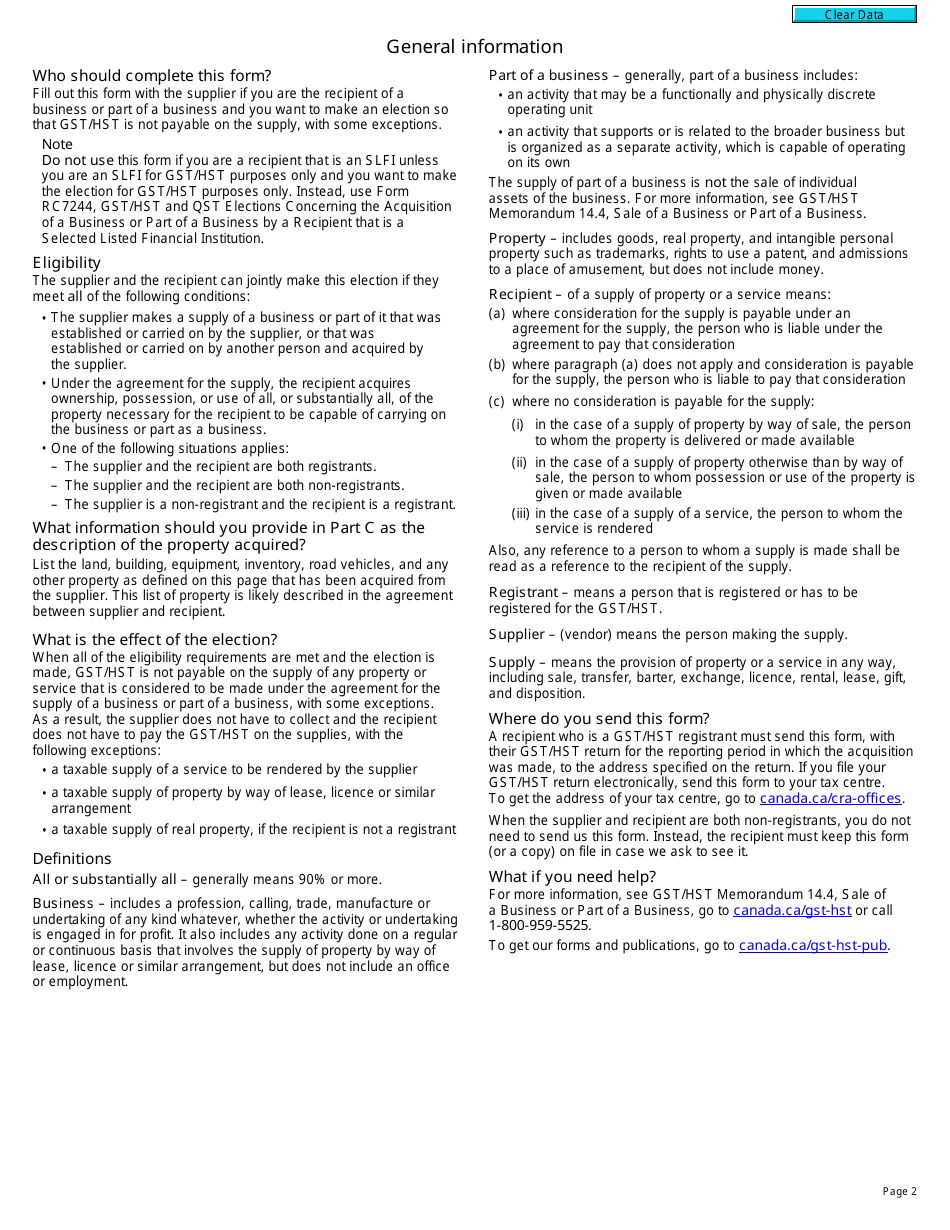

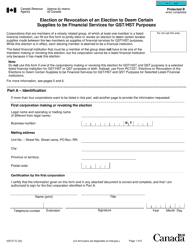

A: Form GST44 is used for making an election concerning the acquisition of a business or part of a business for GST/HST purposes.

Q: Who can use Form GST44?

A: Any person who acquires a business or part of a business can use Form GST44 to make an election.

Q: What is the benefit of making an election using Form GST44?

A: Making an election using Form GST44 allows the purchaser to use the acquired business’s existing GST/HST registration number and claim input tax credits.

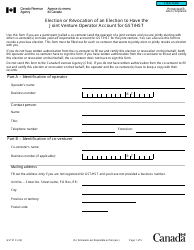

Q: What information is required on Form GST44?

A: Form GST44 requires information such as the names and addresses of the purchaser and the vendor, the acquisition date, and details about the acquired business.

Q: Is there a deadline for submitting Form GST44?

A: Yes, Form GST44 must be filed with the CRA within 90 days from the day the election was made.

Q: Are there any additional requirements or considerations for using Form GST44?

A: Yes, there are additional requirements and considerations for using Form GST44, such as notifying the vendor and obtaining their consent.

Q: Can Form GST44 be amended or revoked?

A: Yes, Form GST44 can be amended or revoked, but there are specific procedures and deadlines for doing so.