This version of the form is not currently in use and is provided for reference only. Download this version of

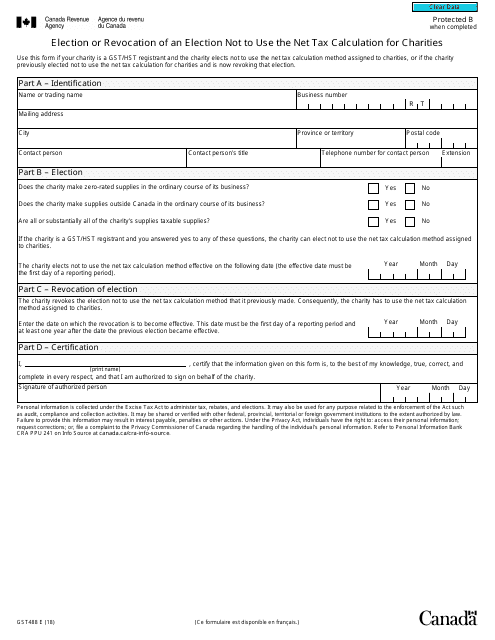

Form GST488

for the current year.

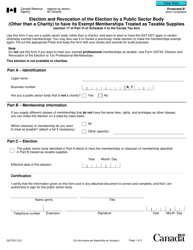

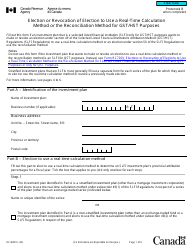

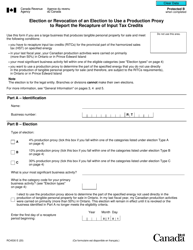

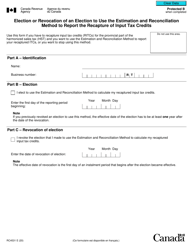

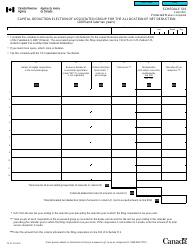

Form GST488 Election or Revocation of an Election Not to Use the Net Tax Calculation for Charities - Canada

Form GST488 or the "Form Gst488 "election Or Revocation Of An Election Not To Use The Net Tax Calculation For Charities" - Canada" is a form issued by the Canadian Revenue Agency .

Download a PDF version of the Form GST488 down below or find it on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form GST488?

A: Form GST488 is a document used in Canada for making an election or revoking an election not to use the net tax calculation for charities.

Q: What does the Form GST488 do?

A: The Form GST488 allows charities to elect or revoke an election not to use the net tax calculation for reporting their goods and services tax (GST) or harmonized sales tax (HST) obligations.

Q: Who needs to fill out Form GST488?

A: Charities in Canada who want to elect or revoke an election not to use the net tax calculation for reporting their GST or HST obligations need to fill out Form GST488.

Q: What is the net tax calculation for charities?

A: The net tax calculation for charities is a method used to calculate the amount of GST or HST that charities are required to remit to the Canada Revenue Agency (CRA).

Q: Are there any fees or charges associated with filing Form GST488?

A: No, there are no fees or charges associated with filing Form GST488.

Q: What are the consequences of electing or revoking the net tax calculation for charities?

A: The consequences of electing or revoking the net tax calculation for charities depend on the specific circumstances and tax implications of the charity. It is recommended to consult with a tax professional or the Canada Revenue Agency (CRA) for guidance.

Q: Is Form GST488 applicable only to registered charities?

A: No, Form GST488 is applicable to both registered charities and other types of qualified donees in Canada.