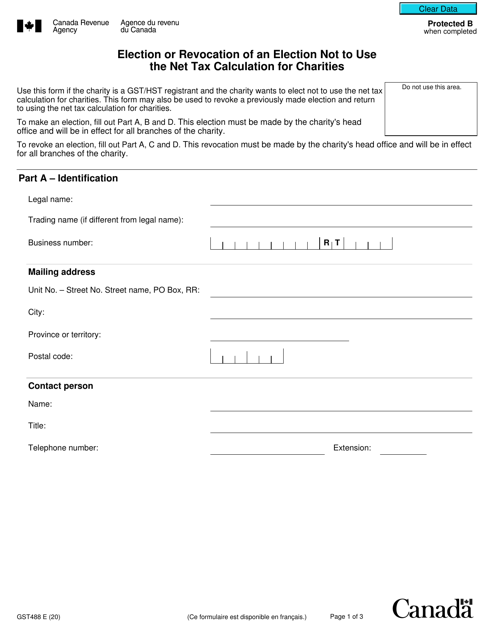

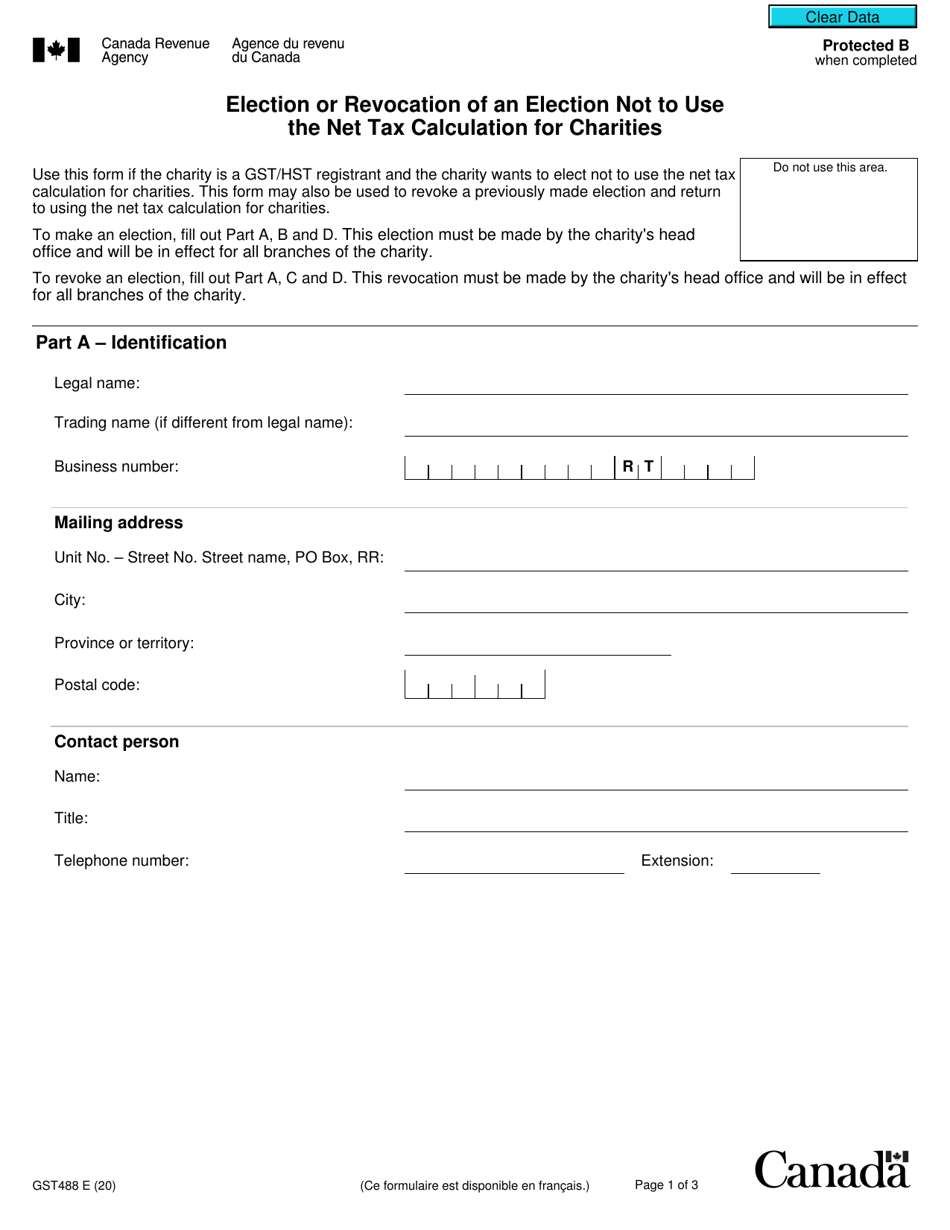

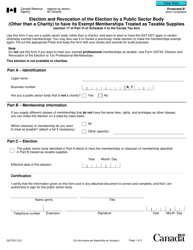

Form GST488 Election or Revocation of an Election Not to Use the Net Tax Calculation for Charities - Canada

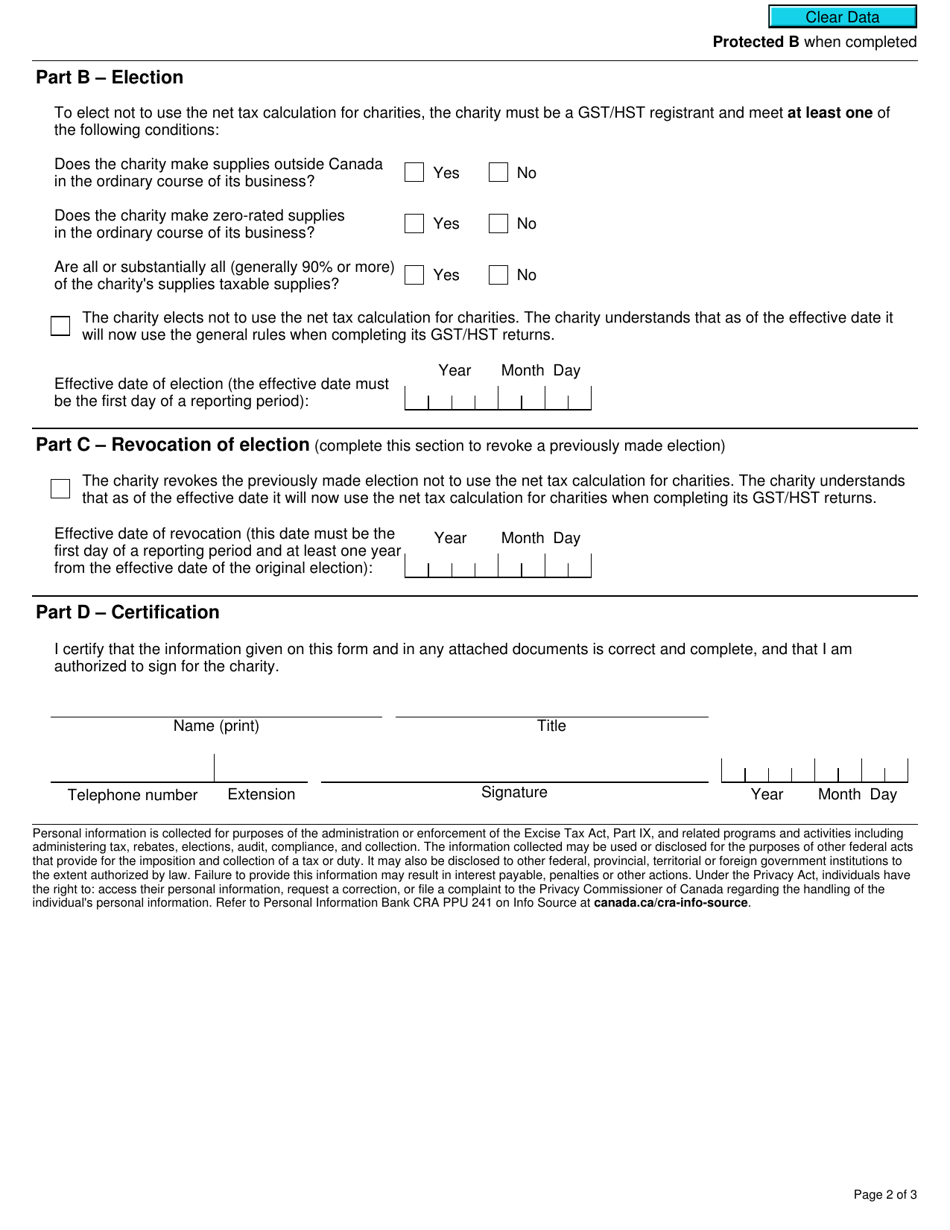

Form GST488 is used in Canada for charities to make an election or revoke an election to not use the net tax calculation method for Goods and Services Tax/Harmonized Sales Tax (GST/HST) purposes. It allows charities to choose whether they want to calculate the net tax by subtracting the input tax credits from their total tax for the reporting period.

The Form GST488 is filed by charities in Canada to either make an election or revoke an election not to use the net tax calculation.

Form GST488 Election or Revocation of an Election Not to Use the Net Tax Calculation for Charities - Canada - Frequently Asked Questions (FAQ)

Q: What is GST488?

A: GST488 is a form used in Canada for charities to elect or revoke the election to not use the net tax calculation.

Q: What is the purpose of GST488?

A: The purpose of GST488 is to allow charities to choose whether or not to use the net tax calculation for calculating their Goods and Services Tax (GST/HST) liability.

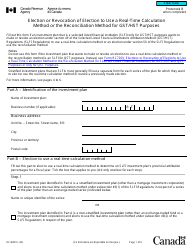

Q: How is GST/HST liability calculated?

A: GST/HST liability is usually calculated by applying the applicable tax rate to the taxable supplies made by the charity.

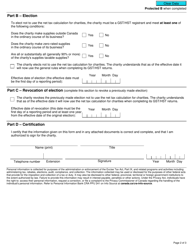

Q: What is the net tax calculation?

A: The net tax calculation is an alternative method of calculating GST/HST liability that takes into account the input tax credits available to the charity.

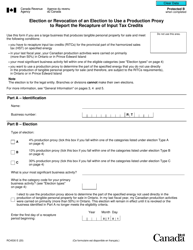

Q: Why would a charity elect not to use the net tax calculation?

A: A charity may choose not to use the net tax calculation if it does not have significant input tax credits or if it finds the net tax calculation method more complex.

Q: Can a charity change its election on Form GST488?

A: Yes, a charity can change its election on Form GST488 by completing a new form and submitting it to the Canada Revenue Agency (CRA).

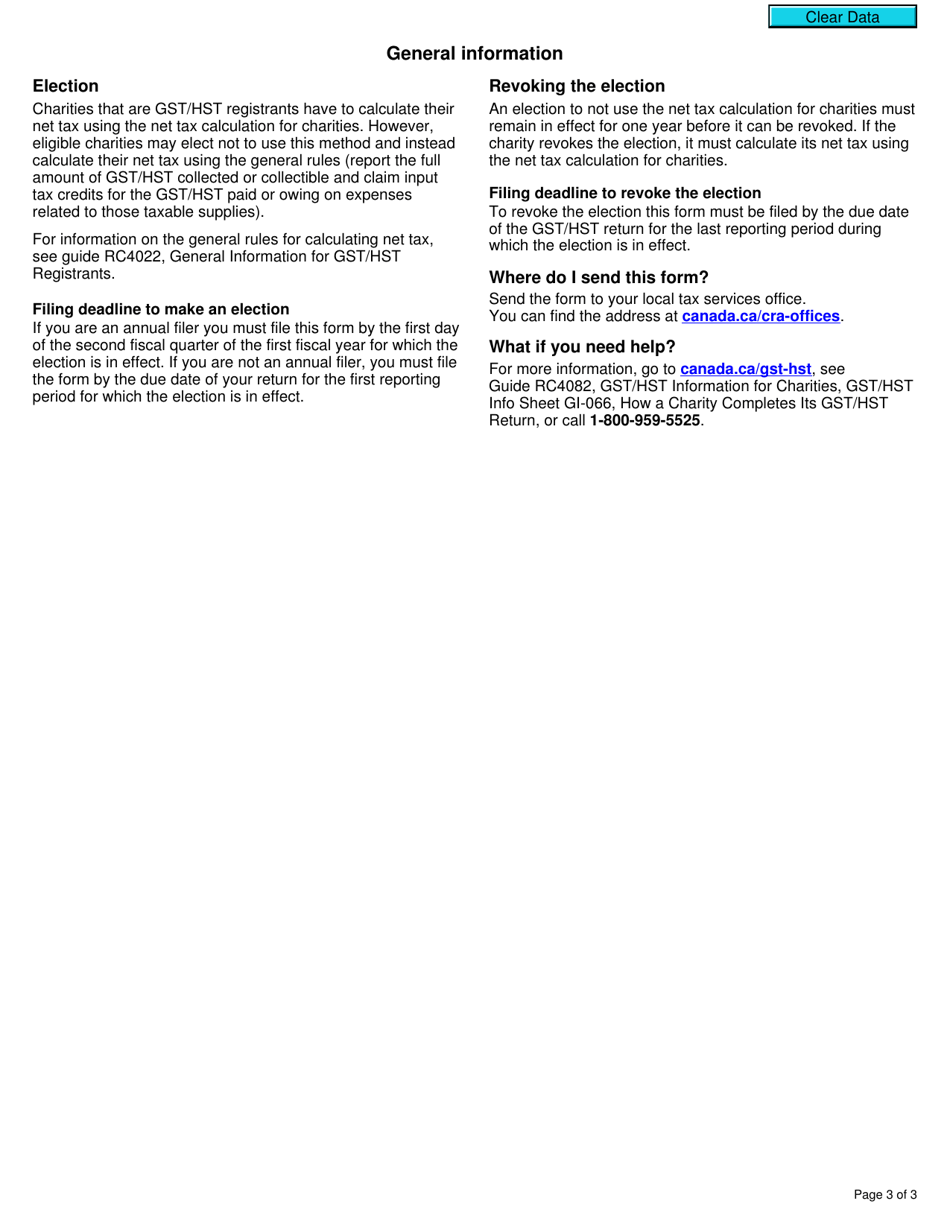

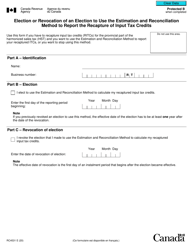

Q: Is there a deadline for filing Form GST488?

A: There is no specific deadline for filing Form GST488, but it is recommended to file the form as soon as possible to ensure the election or revocation is in effect for the desired reporting period.

Q: Are there any fees associated with filing Form GST488?

A: There are no fees associated with filing Form GST488.