This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST498

for the current year.

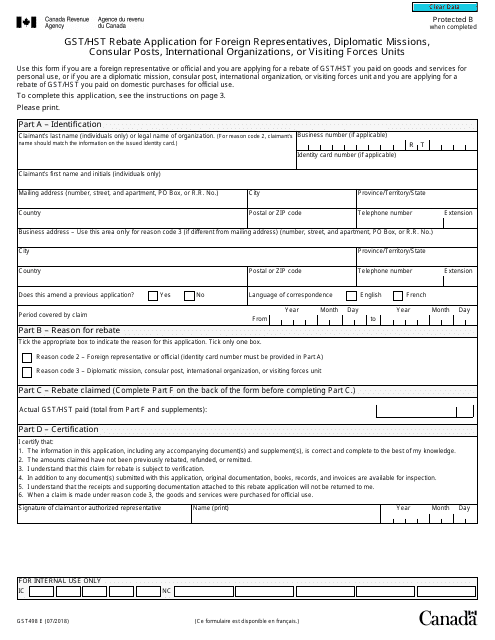

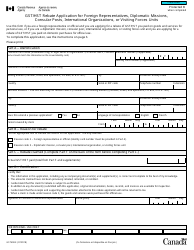

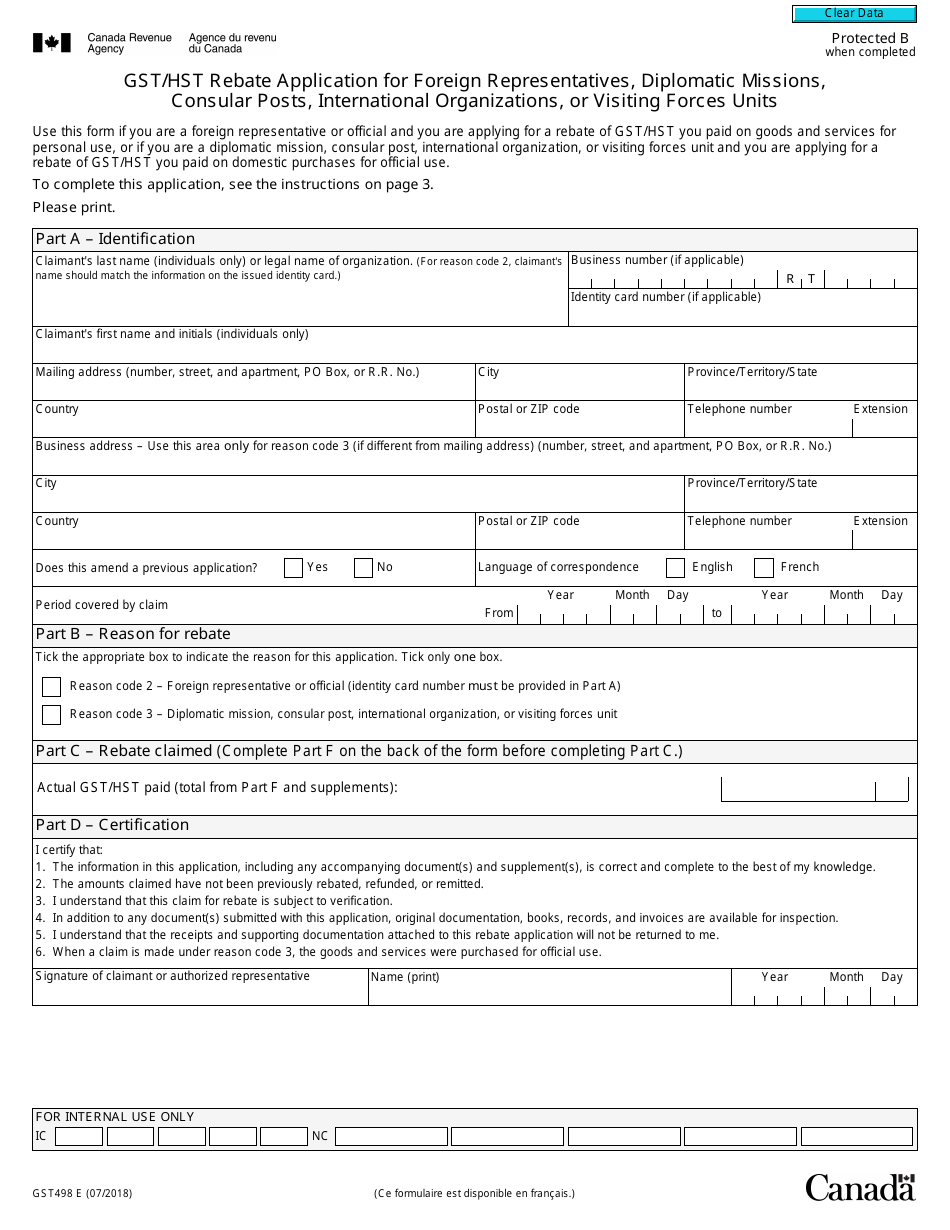

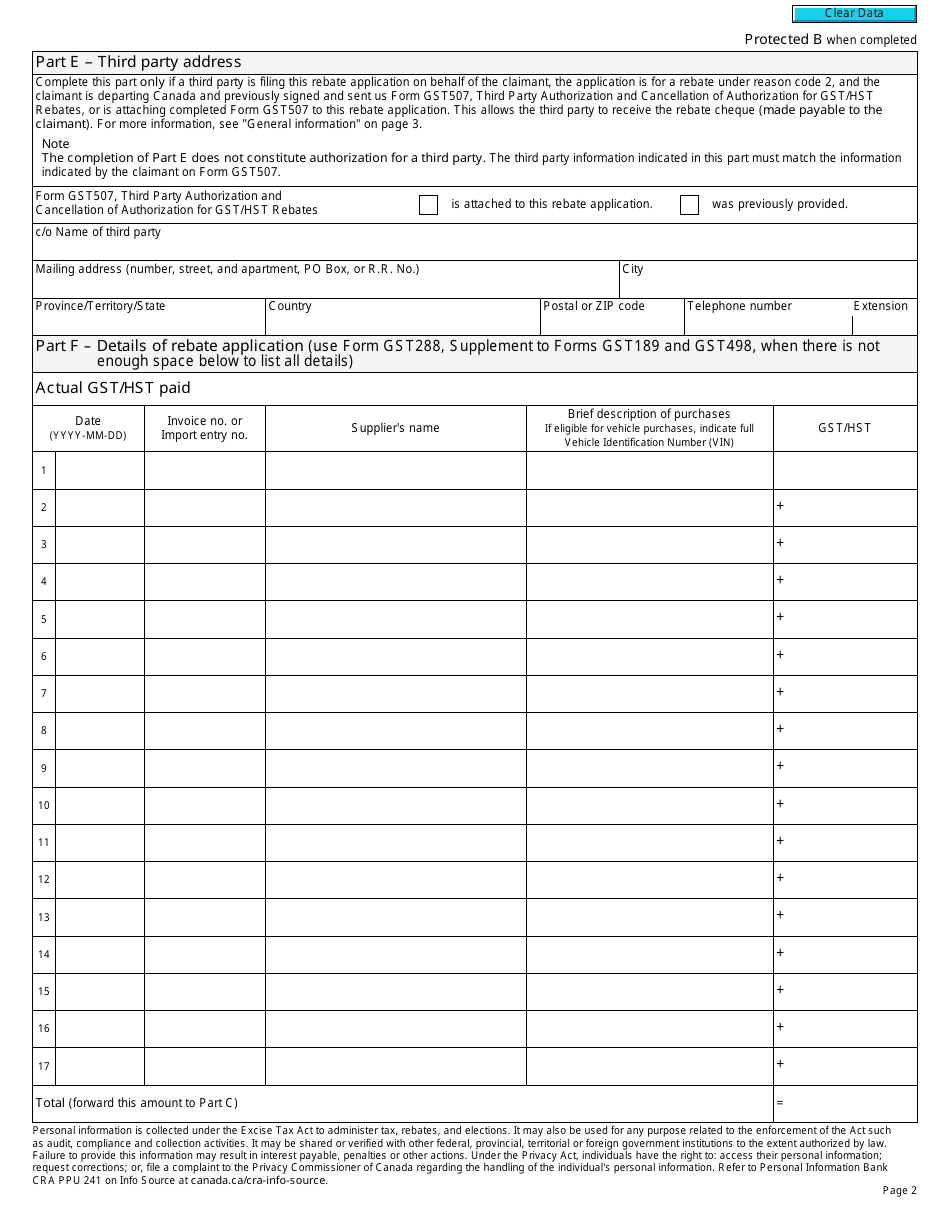

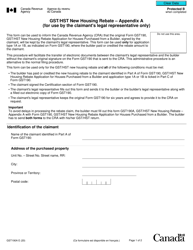

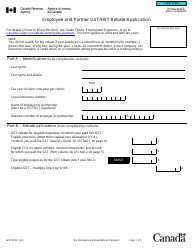

Form GST498 Gst / Hst Rebate Application for Foreign Representatives, Diplomatic Missions, Consular Posts, International Organizations, or Visiting Forces Units - Canada

Form GST498 is a Canadian Revenue Agency form also known as the "Form Gst498 "gst/hst Rebate Application For Foreign Representatives, Diplomatic Missions, Consular Posts, International Organizations, Or Visiting Forces Units" - Canada" . The latest edition of the form was released in July 1, 2018 and is available for digital filing.

Download an up-to-date Form GST498 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is GST498?

A: GST498 is a form for claiming GST/HST rebate in Canada for foreign representatives, diplomatic missions, consular posts, international organizations, or visiting forces units.

Q: Who can use GST498?

A: Foreign representatives, diplomatic missions, consular posts, international organizations, or visiting forces units can use GST498 to claim GST/HST rebate in Canada.

Q: What is the purpose of GST/HST rebate?

A: The purpose of GST/HST rebate is to provide relief from Goods and Services Tax (GST) and Harmonized Sales Tax (HST) for eligible individuals and organizations.

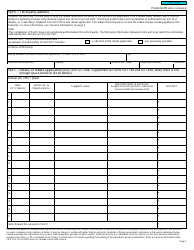

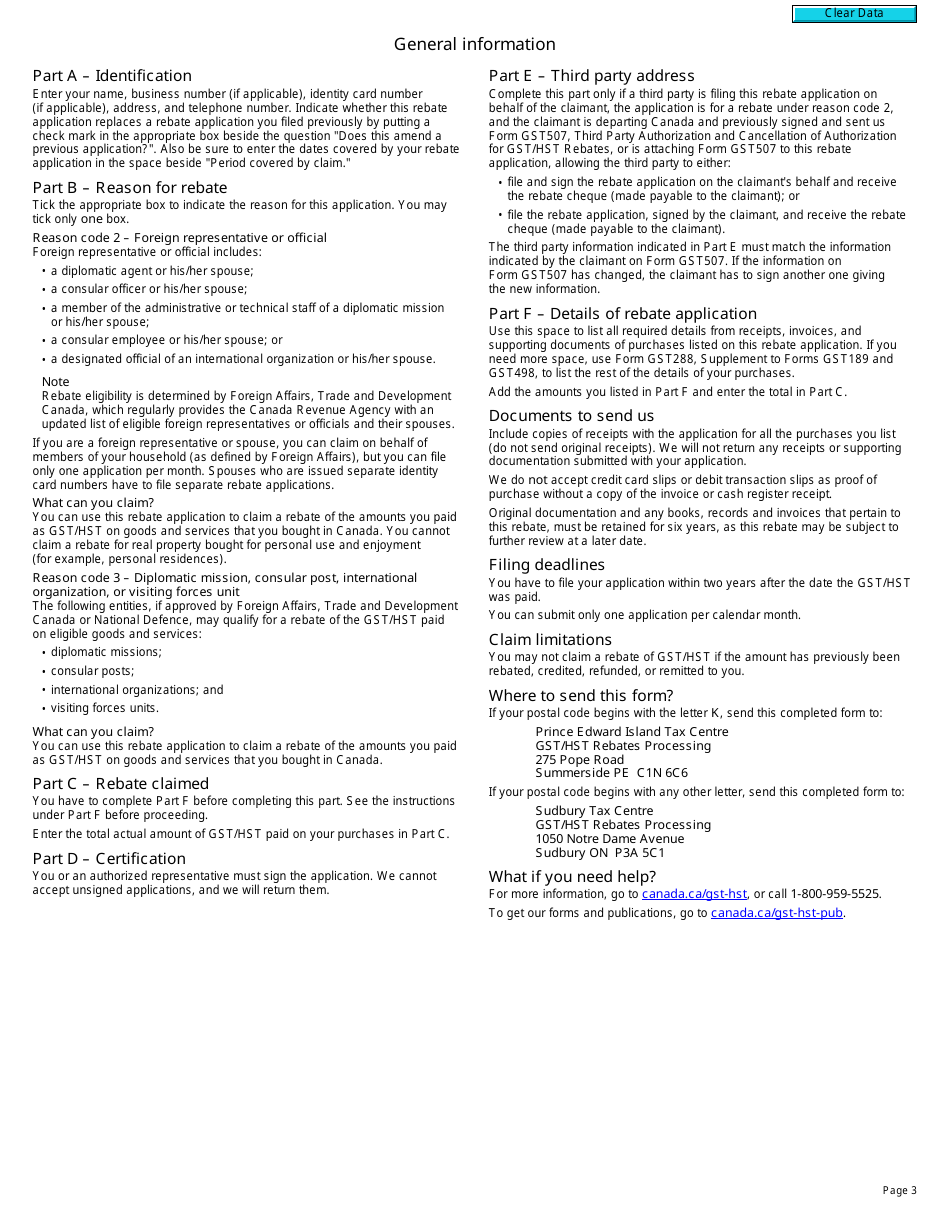

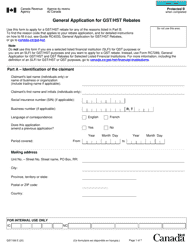

Q: How do I fill out GST498?

A: You need to fill out the GST498 form with accurate information and submit it to the Canada Revenue Agency (CRA) to claim a rebate.

Q: What documents do I need to include with GST498?

A: You need to include supporting documents such as invoices, receipts, and other relevant documents with your GST498 form.

Q: Can I claim a rebate for purchases made outside of Canada?

A: No, GST/HST rebates are only applicable for purchases made within Canada.

Q: How long does it take to process the rebate?

A: The processing time for the rebate varies, and it can take several weeks to receive a response from the Canada Revenue Agency.

Q: Is the rebate amount taxable?

A: No, GST/HST rebate amounts are not taxable.