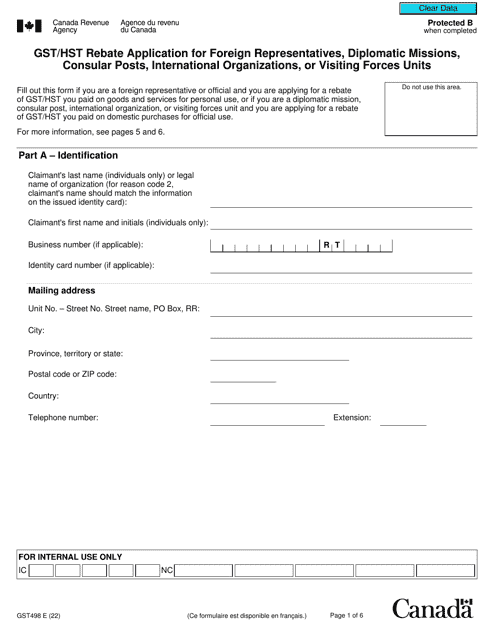

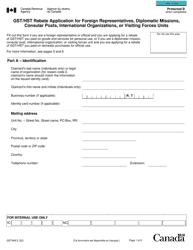

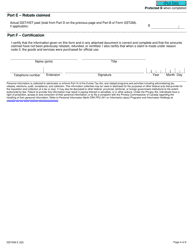

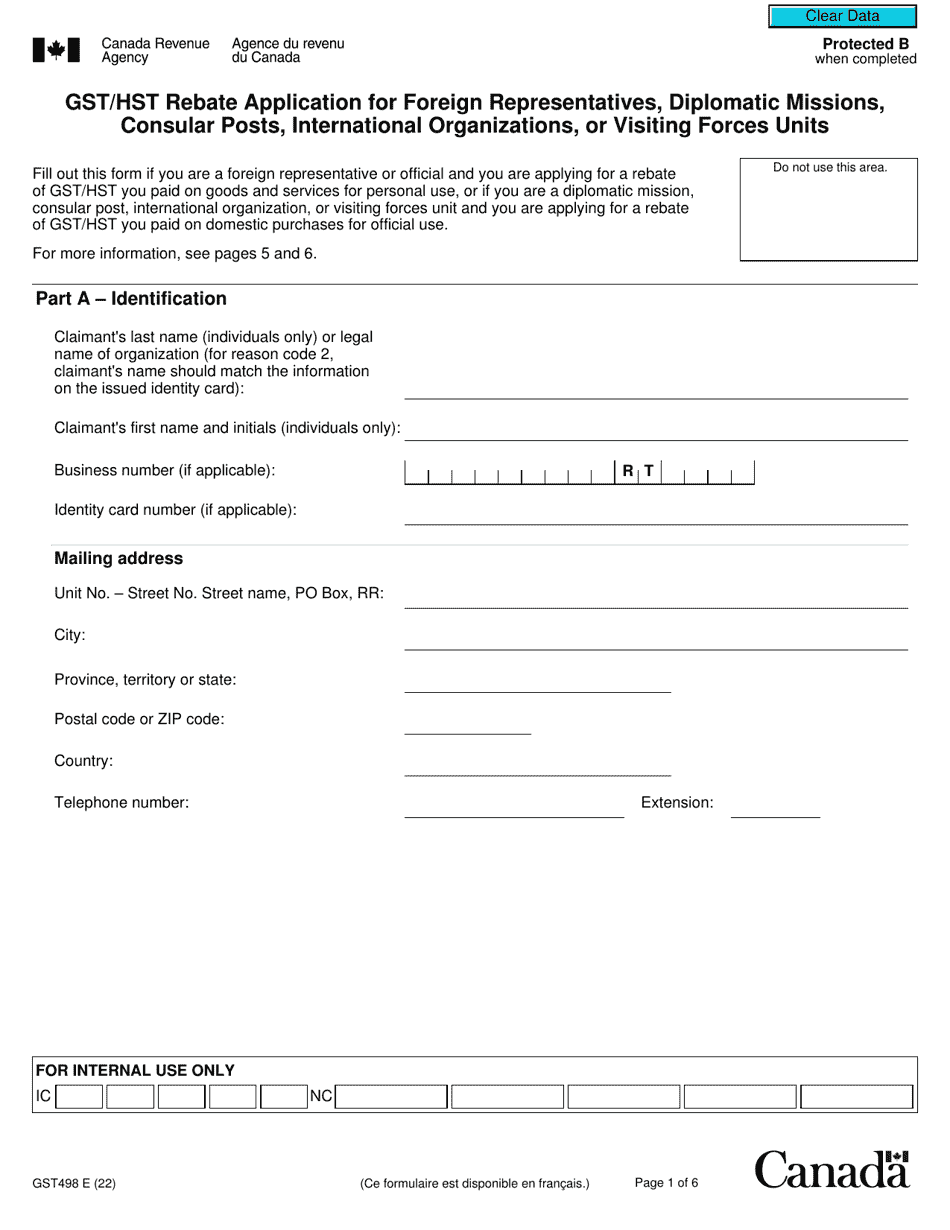

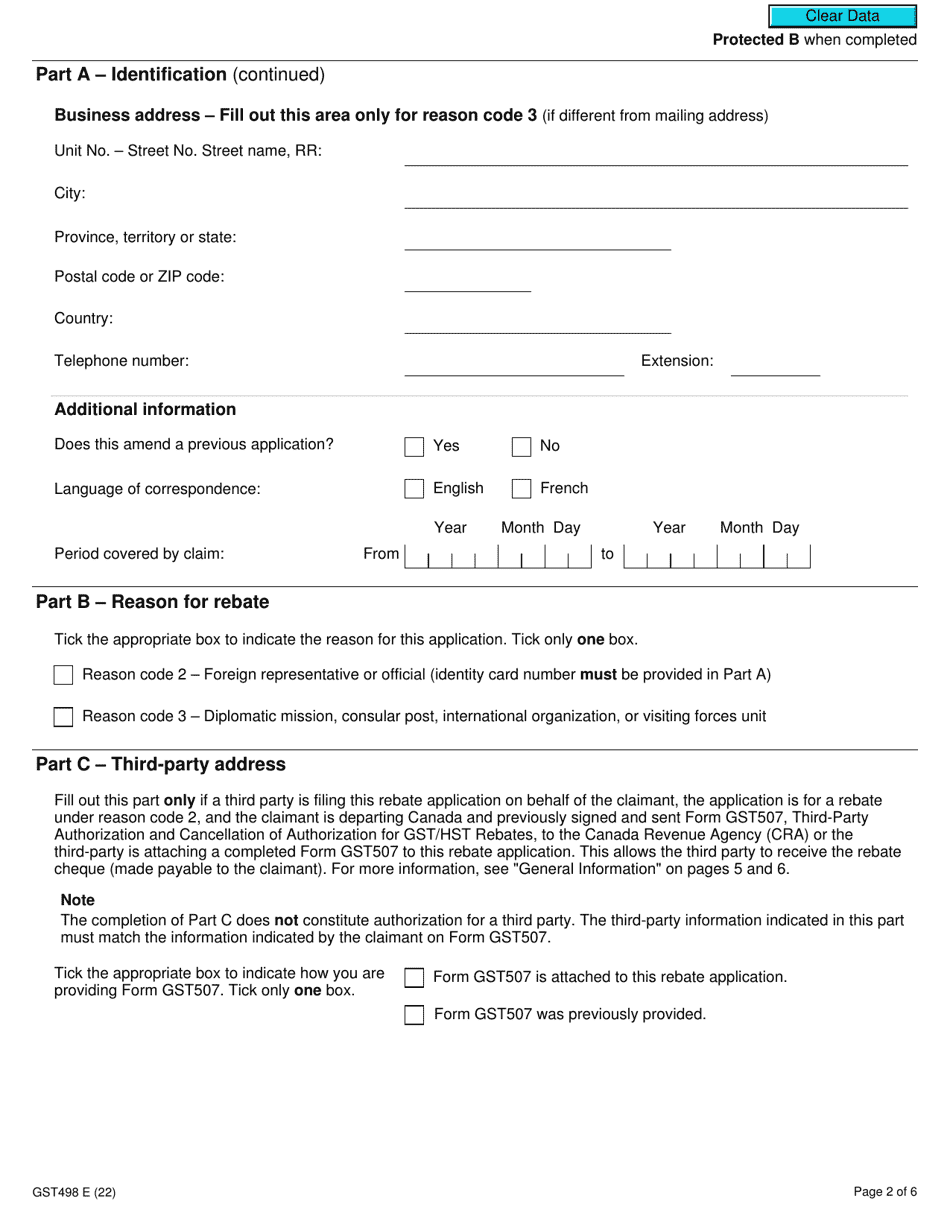

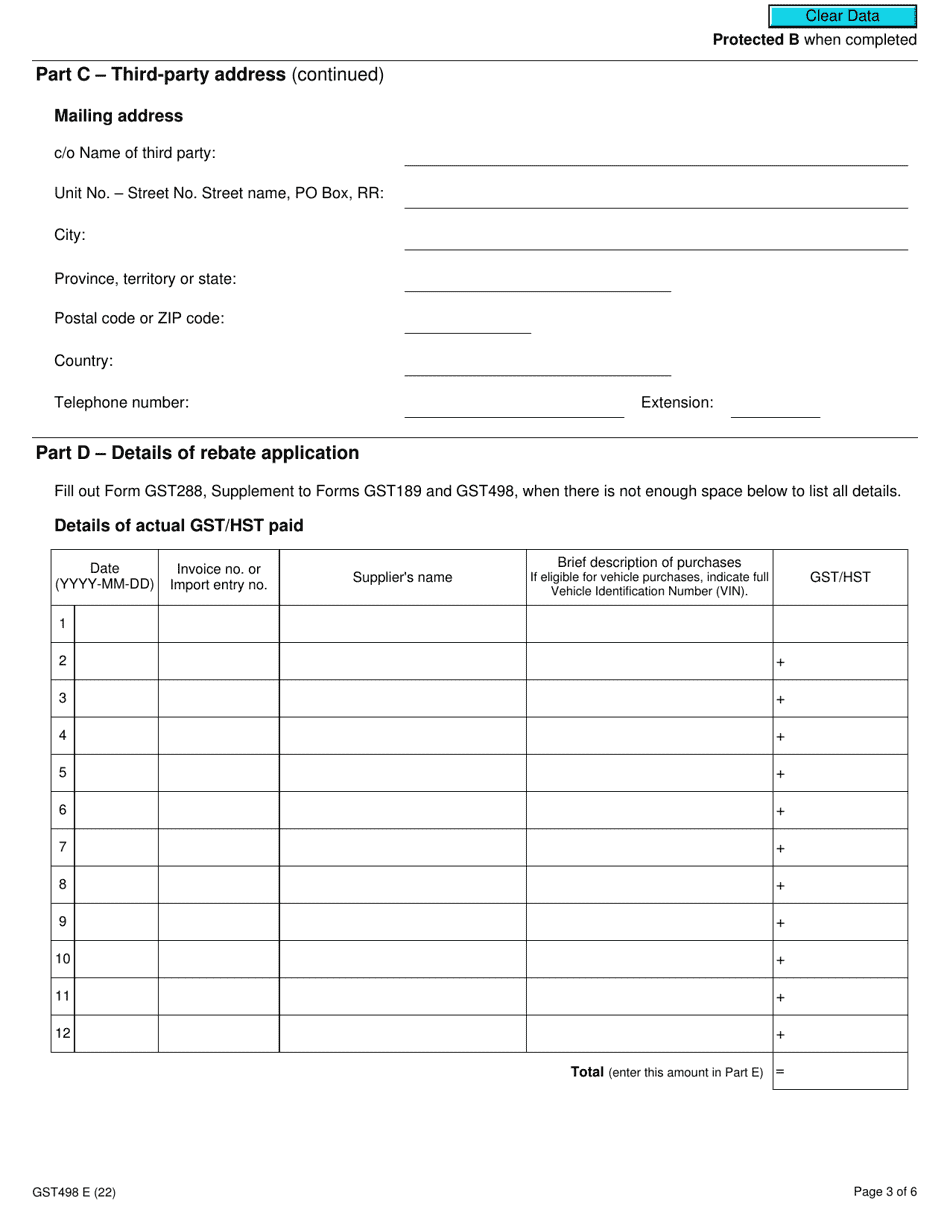

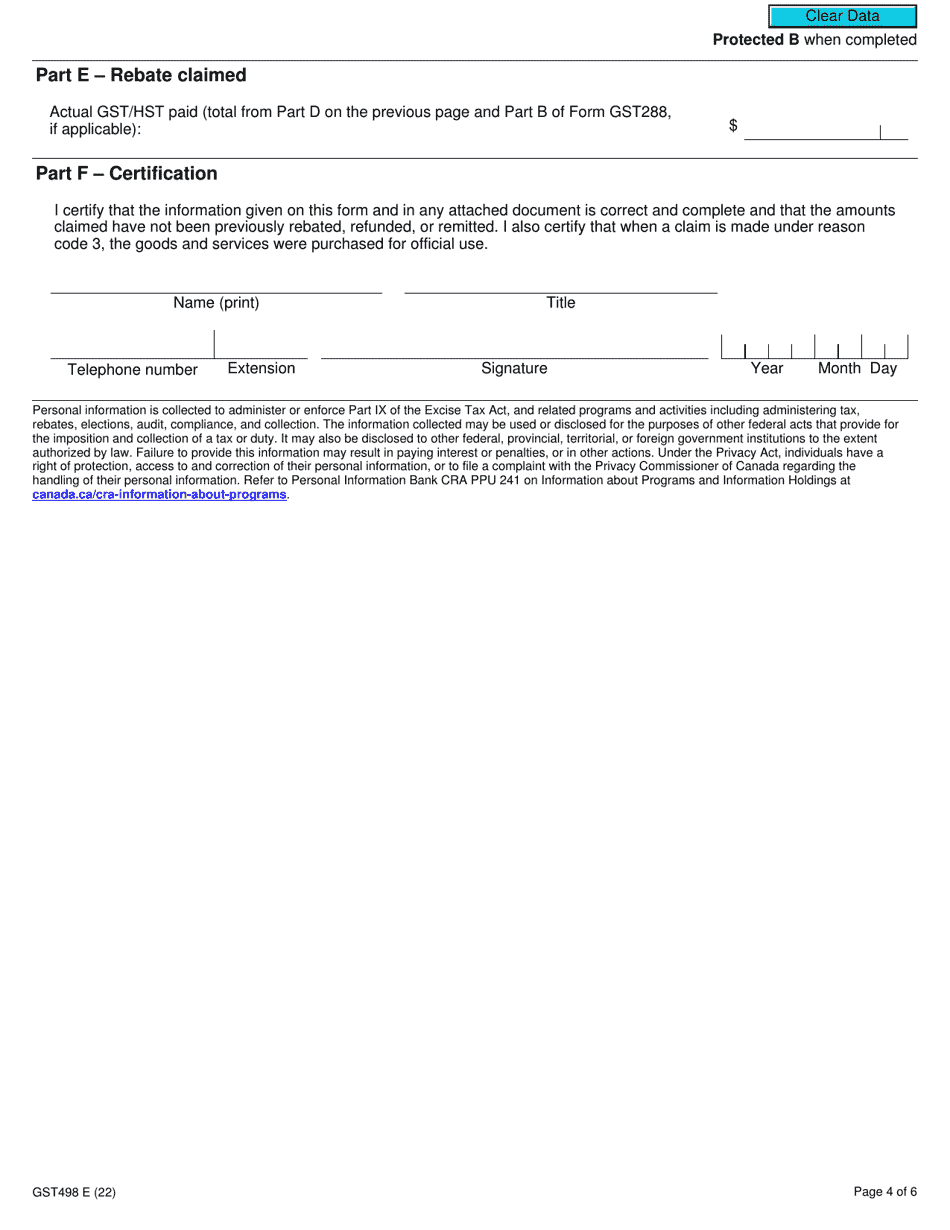

Form GST498 Gst / Hst Rebate Application for Foreign Representatives, Diplomatic Missions, Consular Posts, International Organizations, or Visiting Forces Units - Canada

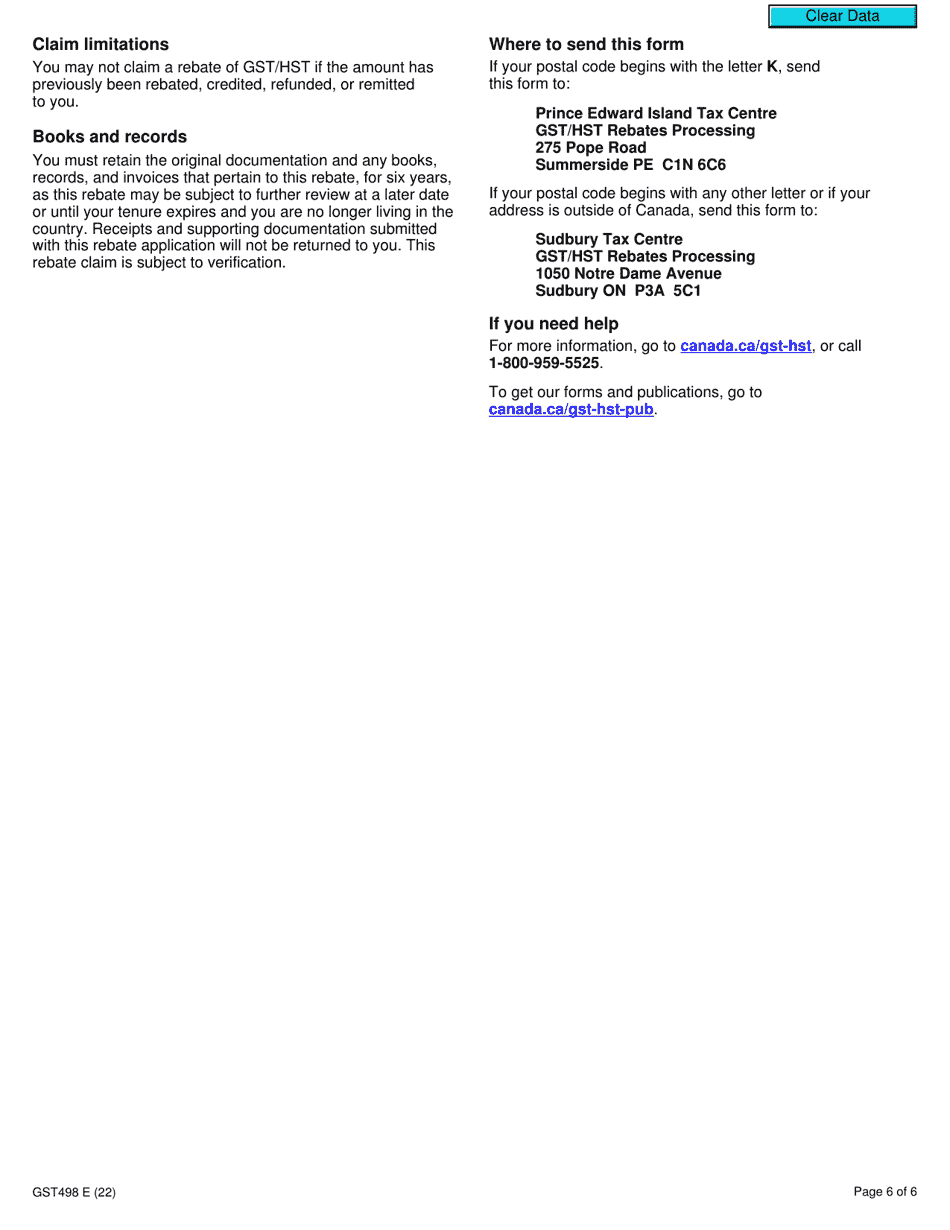

The Form GST498 is used in Canada for foreign representatives, diplomatic missions, consular posts, international organizations, or visiting forces units to apply for a GST/HST rebate. This rebate allows them to recover the GST/HST paid on certain goods and services necessary for their official duties.

The foreign representatives, diplomatic missions, consular posts, international organizations, or visiting forces units themselves file the Form GST498 GST/HST Rebate Application.

Form GST498 Gst/Hst Rebate Application for Foreign Representatives, Diplomatic Missions, Consular Posts, International Organizations, or Visiting Forces Units - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST498?

A: Form GST498 is the GST/HST Rebate Application for Foreign Representatives, Diplomatic Missions, Consular Posts, International Organizations, or Visiting Forces Units in Canada.

Q: Who can use Form GST498?

A: Foreign representatives, diplomatic missions, consular posts, international organizations, or visiting forces units in Canada can use Form GST498.

Q: What is the purpose of Form GST498?

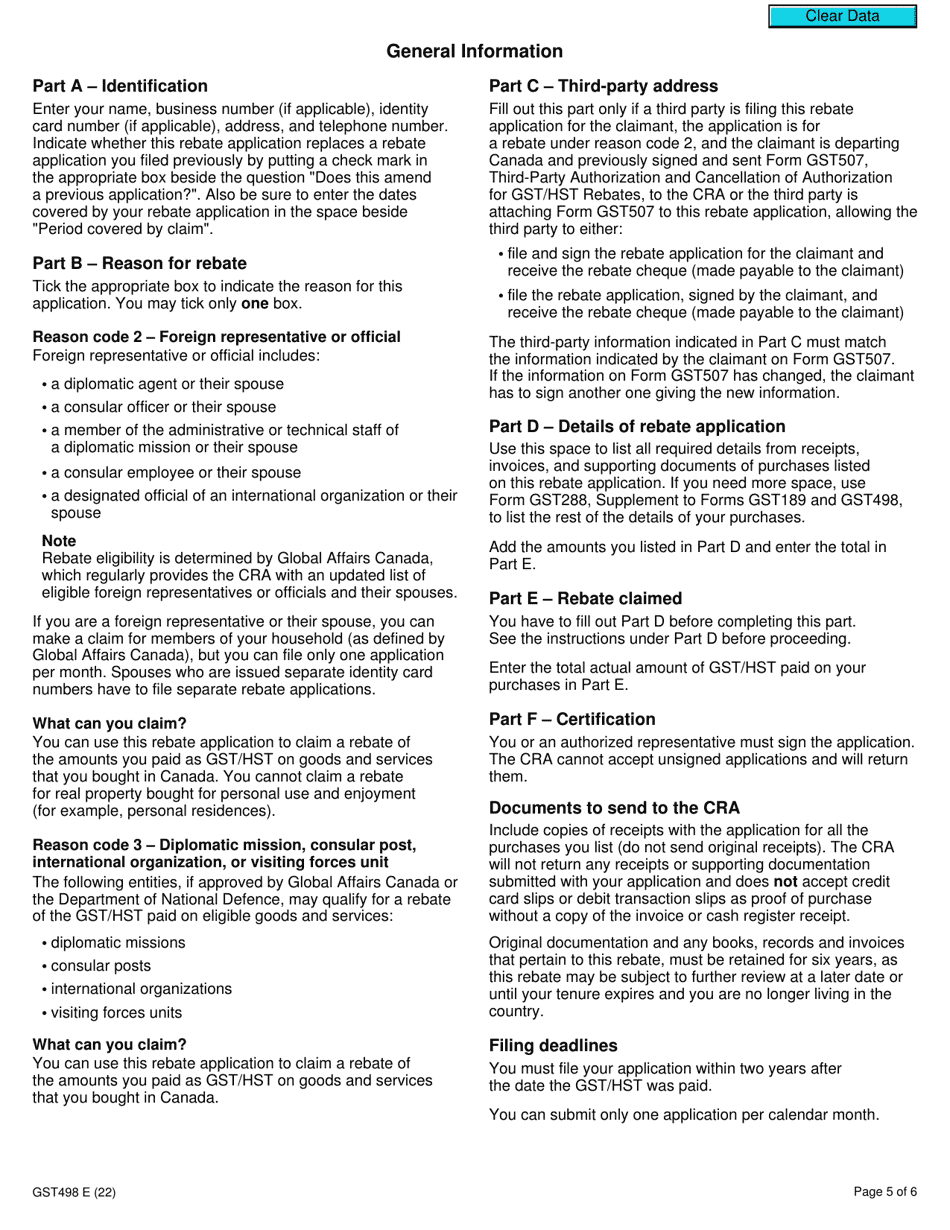

A: The purpose of Form GST498 is to claim a rebate for the GST/HST paid on eligible purchases made in Canada by foreign representatives, diplomatic missions, consular posts, international organizations, or visiting forces units.

Q: What purchases are eligible for the rebate?

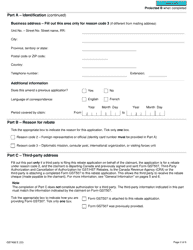

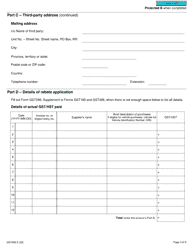

A: Purchases made for official purposes, such as office supplies, vehicles, and services, are usually eligible for the rebate.

Q: Are there any deadlines for submitting Form GST498?

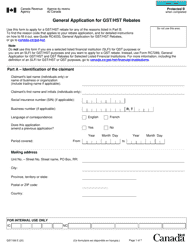

A: Yes, Form GST498 must be submitted within two years from the date of the purchase.

Q: Do I need to include supporting documents with Form GST498?

A: Yes, you will need to include all relevant invoices, receipts, and any other supporting documents with your application.