This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST499-1

for the current year.

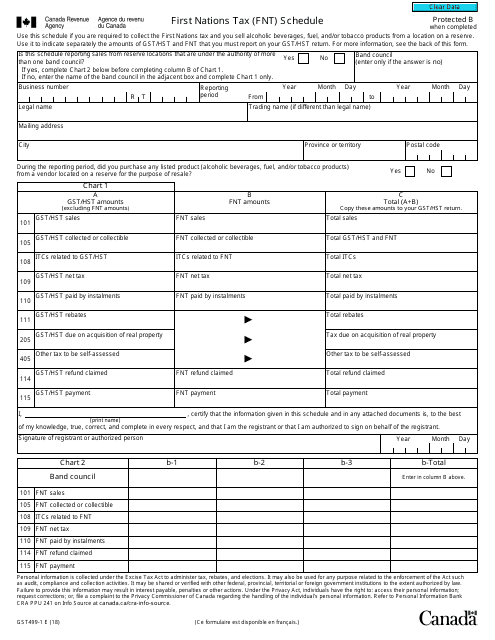

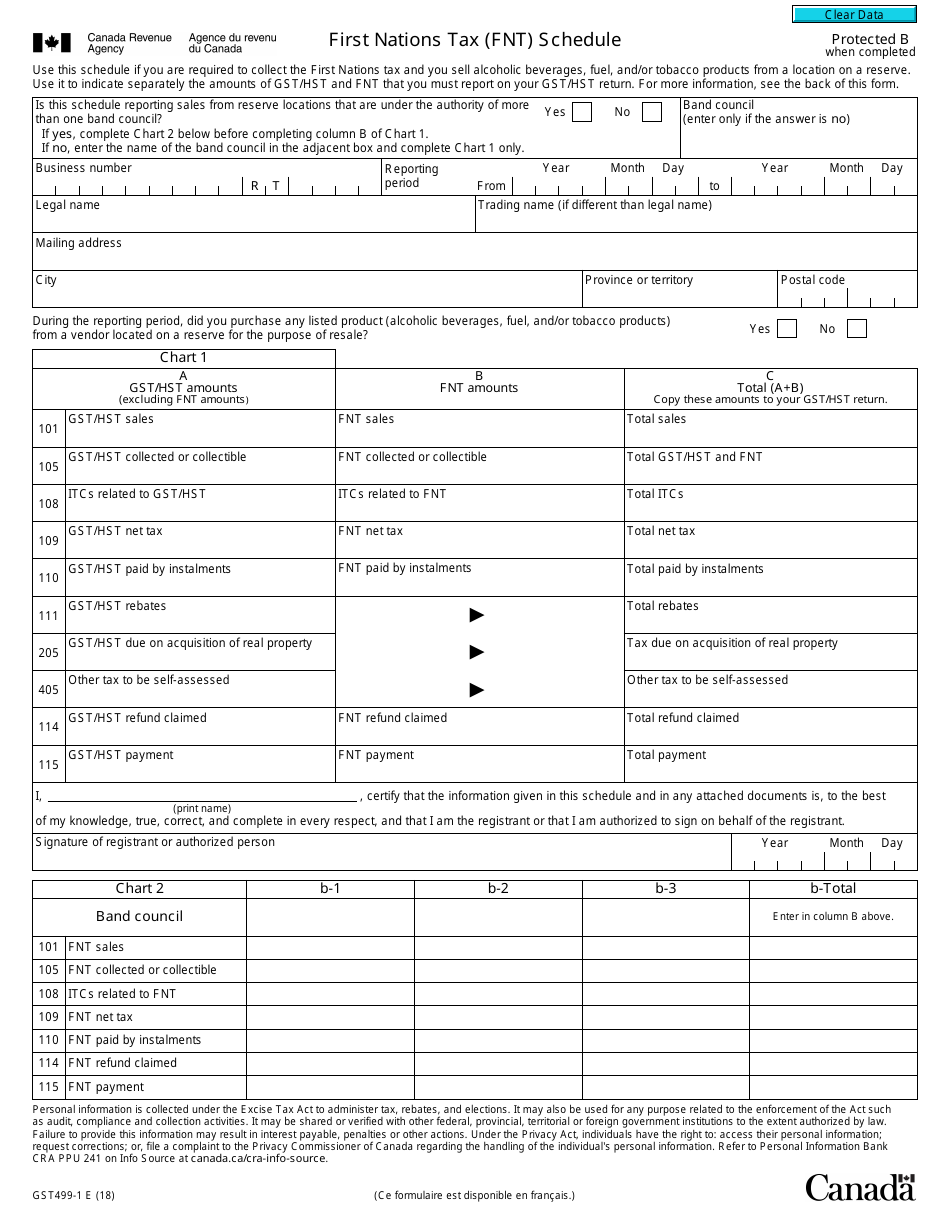

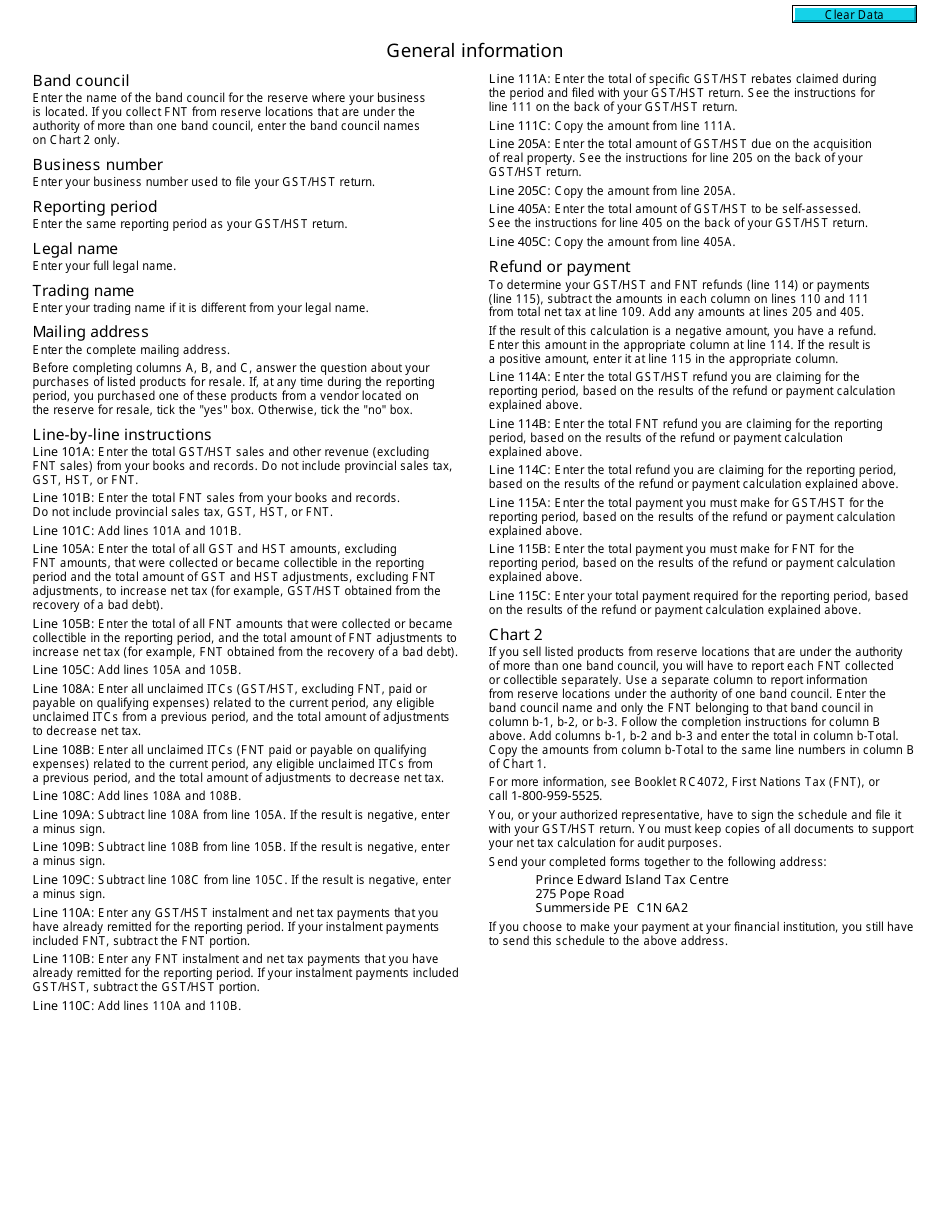

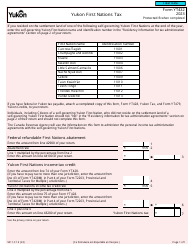

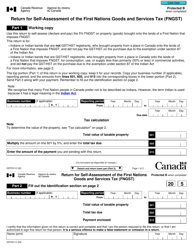

Form GST499-1 First Nations Tax (Fnt) Schedule - Canada

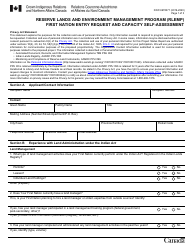

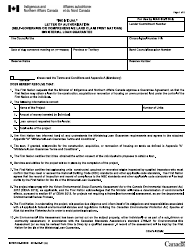

Form GST499-1 First Nations Tax (Fnt) Schedule - Canada is used by First Nations individuals or businesses to report the sales tax they have collected on taxable goods and services on a reserve, as well as any tax exemptions. It helps to comply with the Goods and Services Tax (GST) and Harmonized Sales Tax (HST) rules in Canada.

The First Nations community files the Form GST499-1 First Nations Tax (Fnt) Schedule in Canada.

FAQ

Q: What is Form GST499-1?

A: Form GST499-1 is the First Nations Tax (Fnt) Schedule used in Canada.

Q: Who needs to use Form GST499-1?

A: First Nations businesses that are registered for the Goods and Services Tax (GST) in Canada need to use this form.

Q: What is the purpose of Form GST499-1?

A: The purpose of Form GST499-1 is to report and remit the First Nations Tax (Fnt) in addition to the GST.

Q: How often is Form GST499-1 filed?

A: Form GST499-1 is filed annually, for each fiscal year.

Q: What information is required on Form GST499-1?

A: The form requires information such as the fiscal year, total supplies subject to Fnt, Fnt remitted, and other relevant amounts.

Q: Are there any penalties for late or incorrect filing of Form GST499-1?

A: Yes, there can be penalties for late or incorrect filing of Form GST499-1. It is important to file the form accurately and on time to avoid penalties.

Q: What should I do if I need help with completing Form GST499-1?

A: If you need help with completing Form GST499-1, you can contact the CRA's Business Enquiries line or seek assistance from a tax professional.

Q: Is Form GST499-1 applicable only to First Nations businesses?

A: Yes, Form GST499-1 is specifically designed for First Nations businesses.