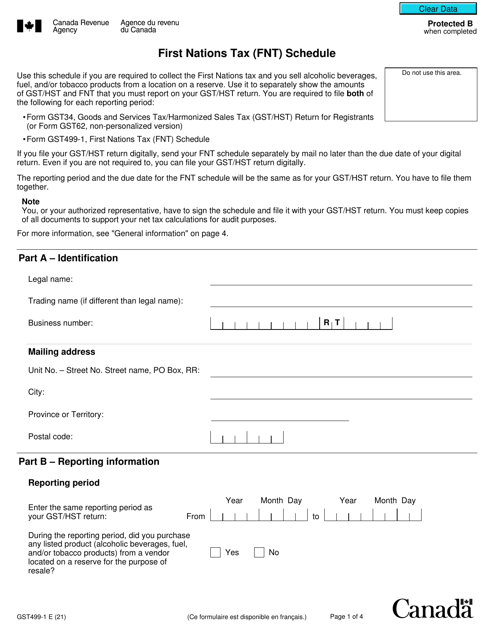

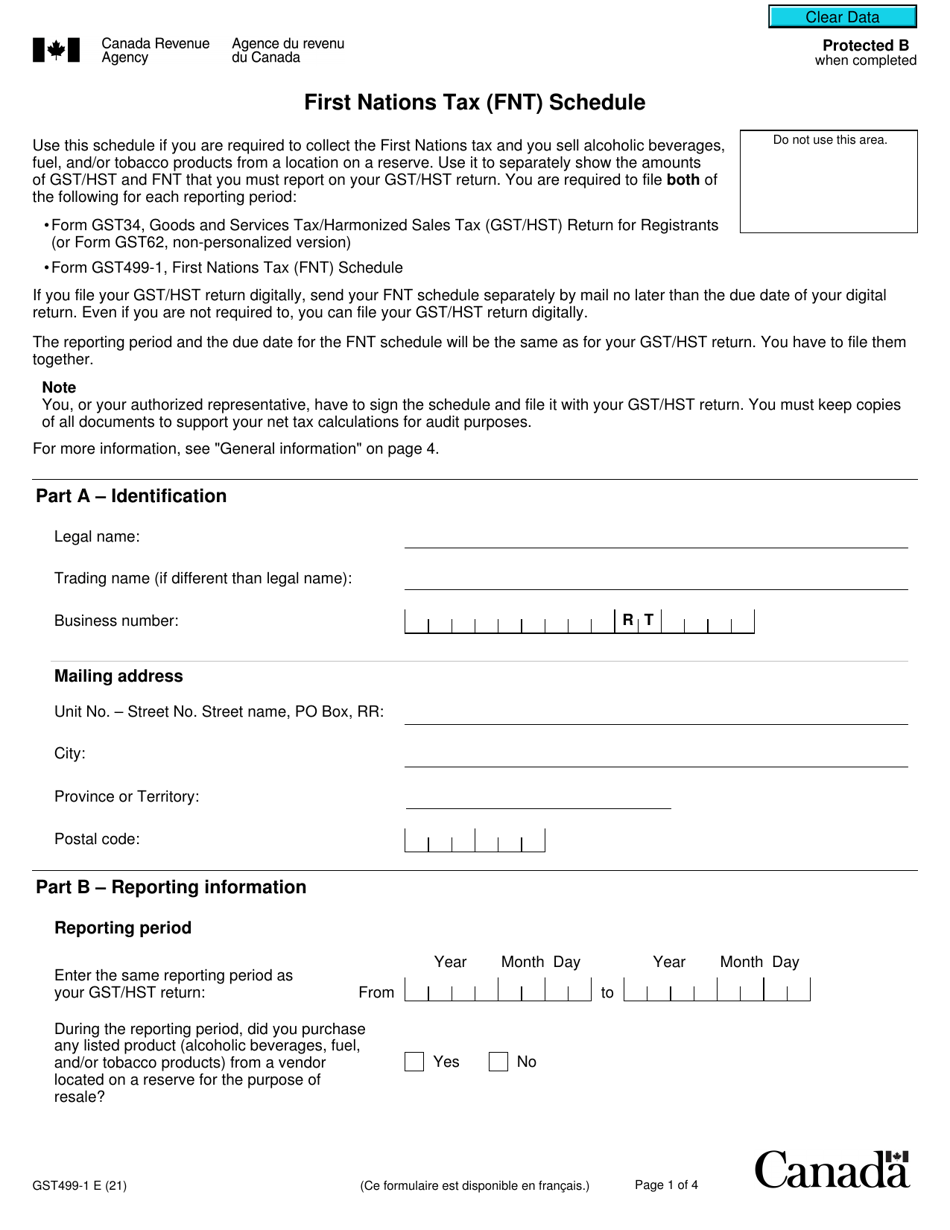

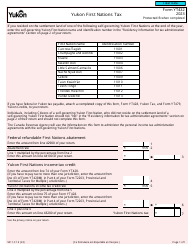

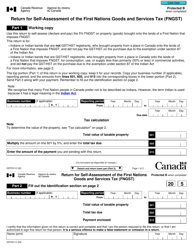

Form GST499-1 First Nations Tax (Fnt) Schedule - Canada

Form GST499-1 First Nations Tax (Fnt) Schedule - Canada is used by First Nations individuals or businesses to report and remit the Goods and Services Tax (GST) and Harmonized Sales Tax (HST) collected on sales made on a reserve or in a prescribed territory. It is specifically for the purpose of reporting taxes related to First Nations communities in Canada.

The Form GST499-1 First Nations Tax (Fnt) Schedule in Canada is filed by First Nations governments.

Form GST499-1 First Nations Tax (Fnt) Schedule - Canada - Frequently Asked Questions (FAQ)

Q: What is the Form GST499-1?

A: The Form GST499-1 is the First Nations Tax (Fnt) Schedule in Canada.

Q: What is the purpose of Form GST499-1?

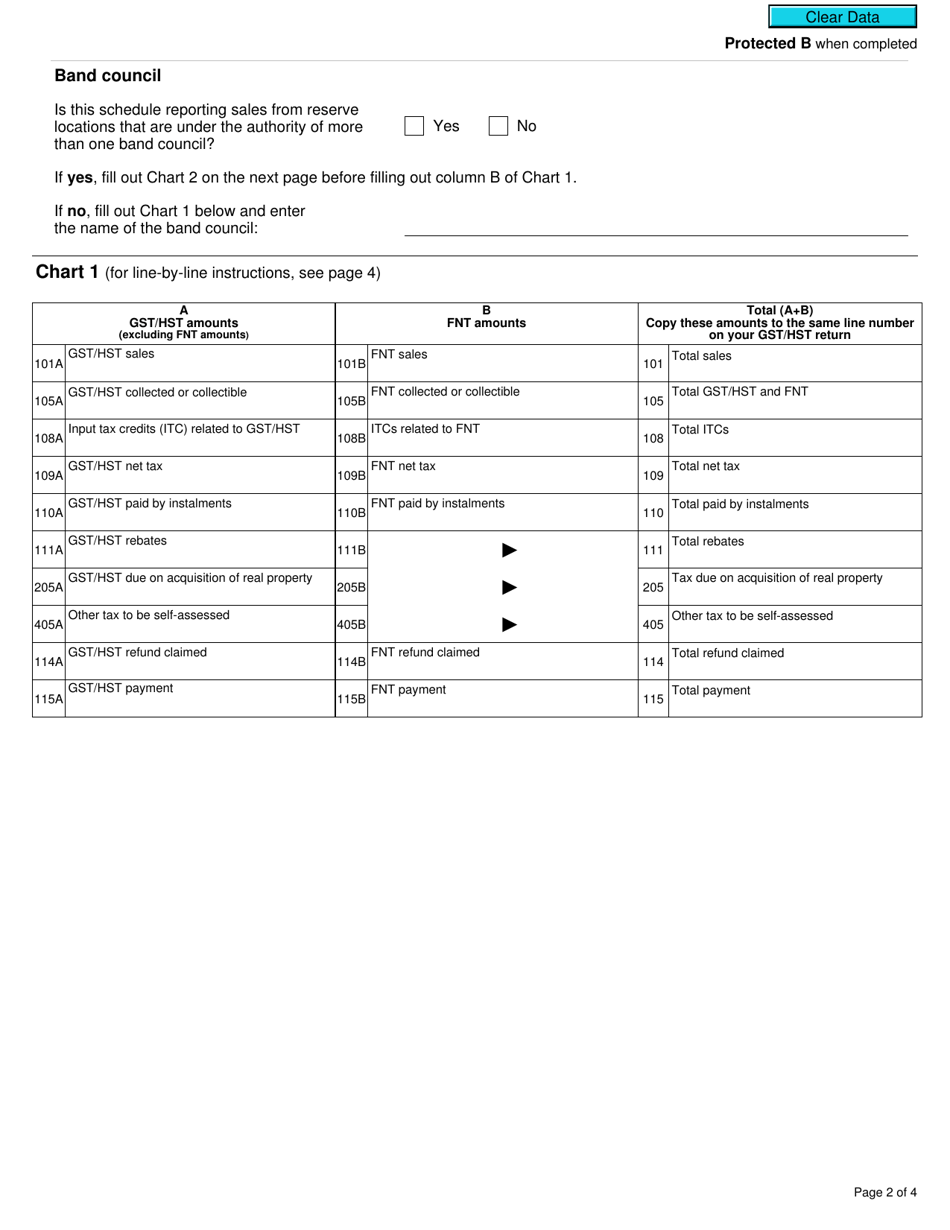

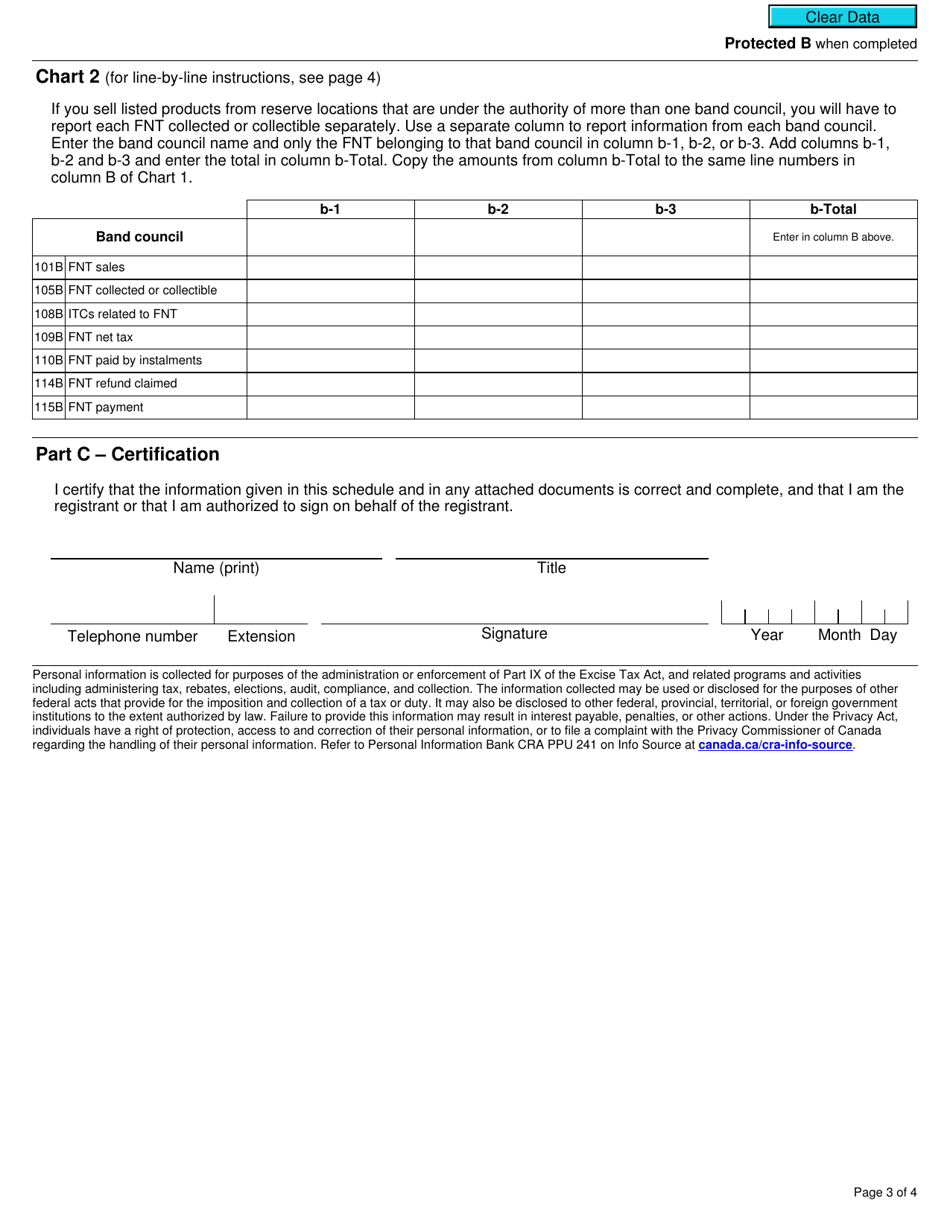

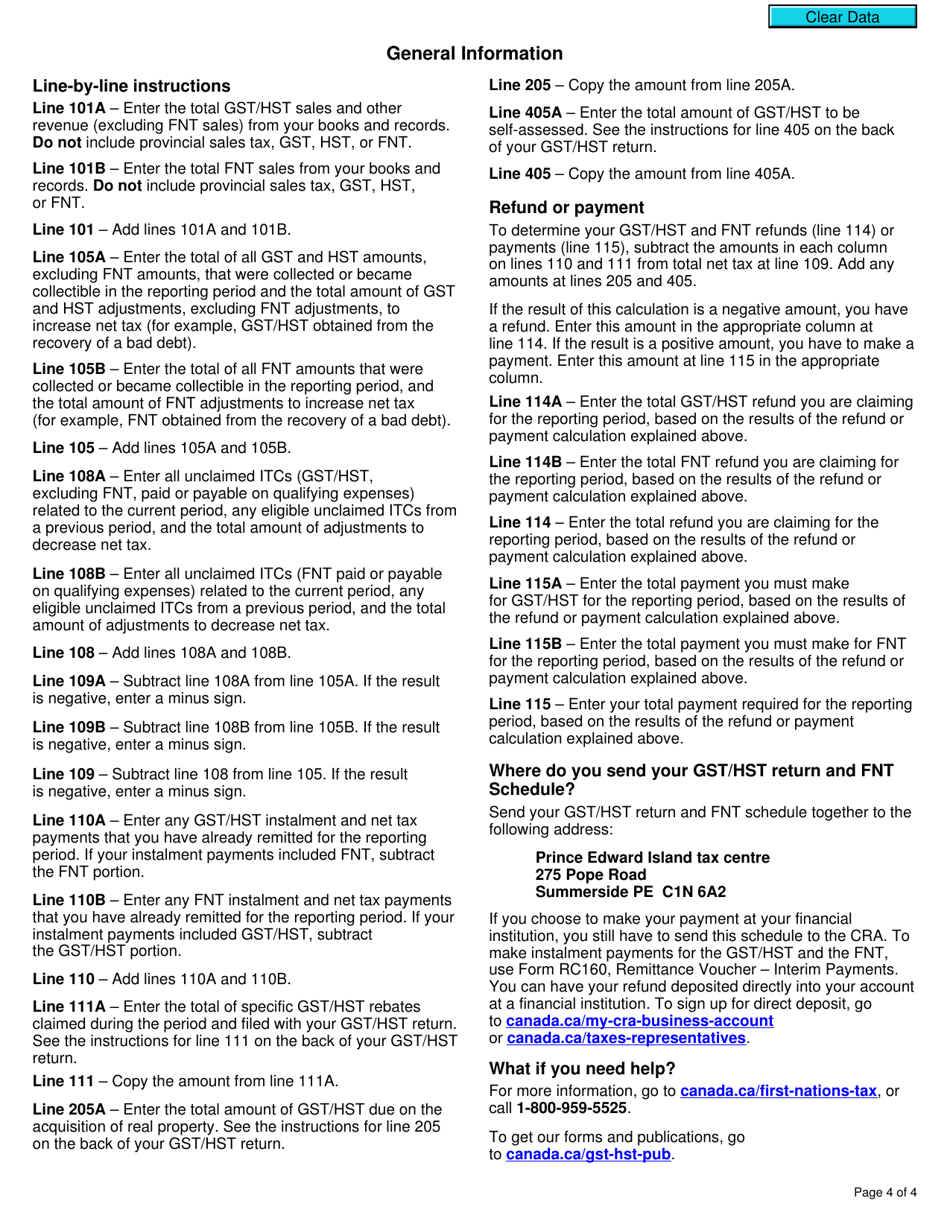

A: The purpose of Form GST499-1 is to report the First Nations Goods and Services Tax (FNGST) and the First Nations Personal Property Tax (FNPT).

Q: Who needs to file Form GST499-1?

A: First Nations individuals and businesses who are required to collect and remit FNGST or FNPT must file Form GST499-1.

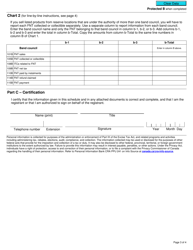

Q: When is the deadline to file Form GST499-1?

A: The deadline to file Form GST499-1 is usually four years from the end of the reporting period, but it is recommended to check with the CRA for the specific deadline.