This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST506

for the current year.

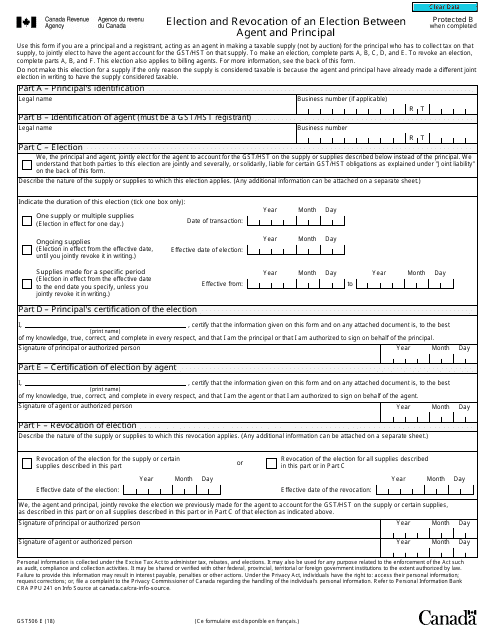

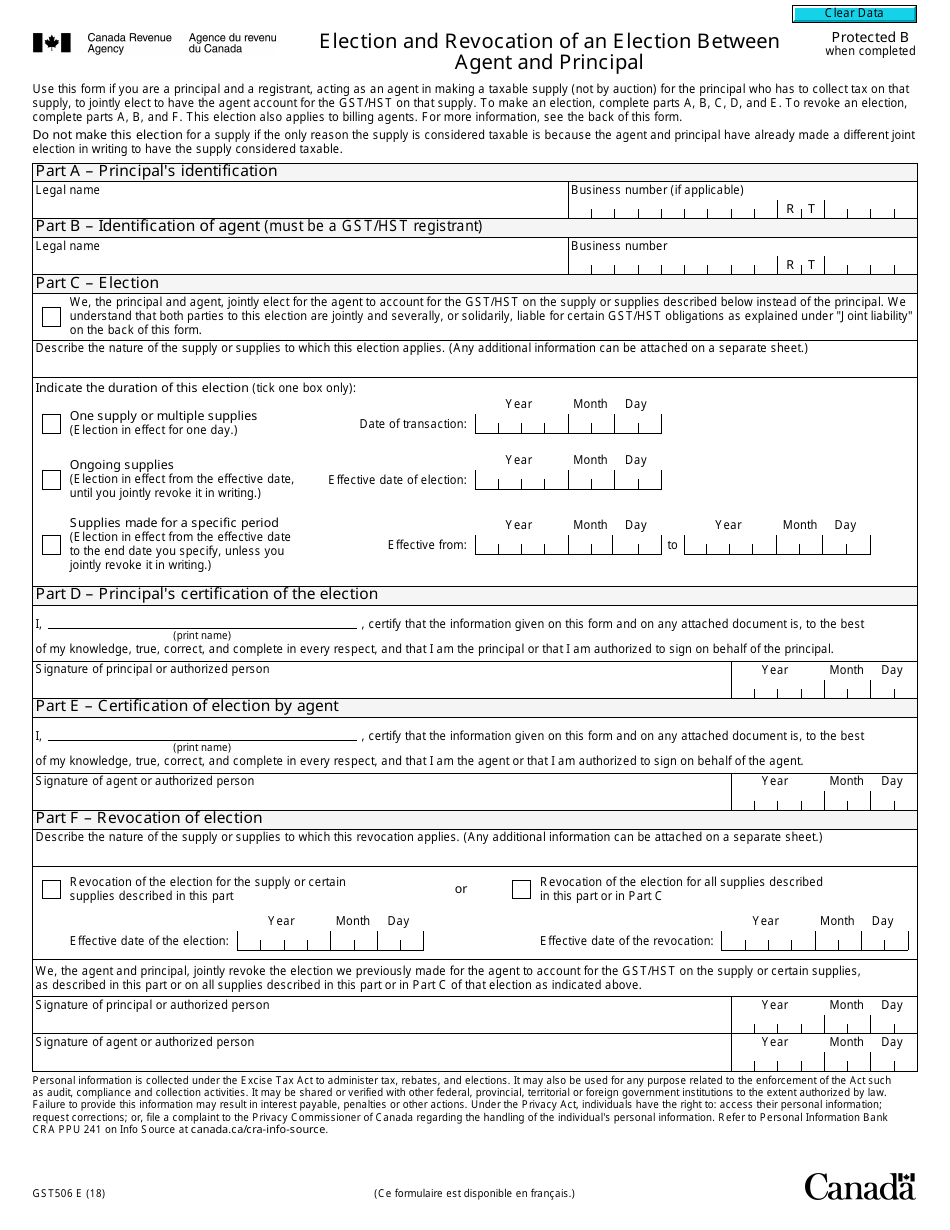

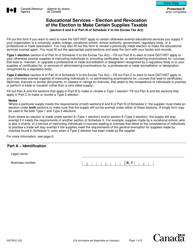

Form GST506 Election and Revocation of an Election Between Agent and Principal - Canada

Form GST506 is a Canadian Revenue Agency form also known as the "Form Gst506 "election And Revocation Of An Election Between Agent And Principal" - Canada" . The latest edition of the form was released in January 1, 2018 and is available for digital filing.

Download a PDF version of the Form GST506 down below or find it on Canadian Revenue Agency Forms website.

FAQ

Q: What is Form GST506?

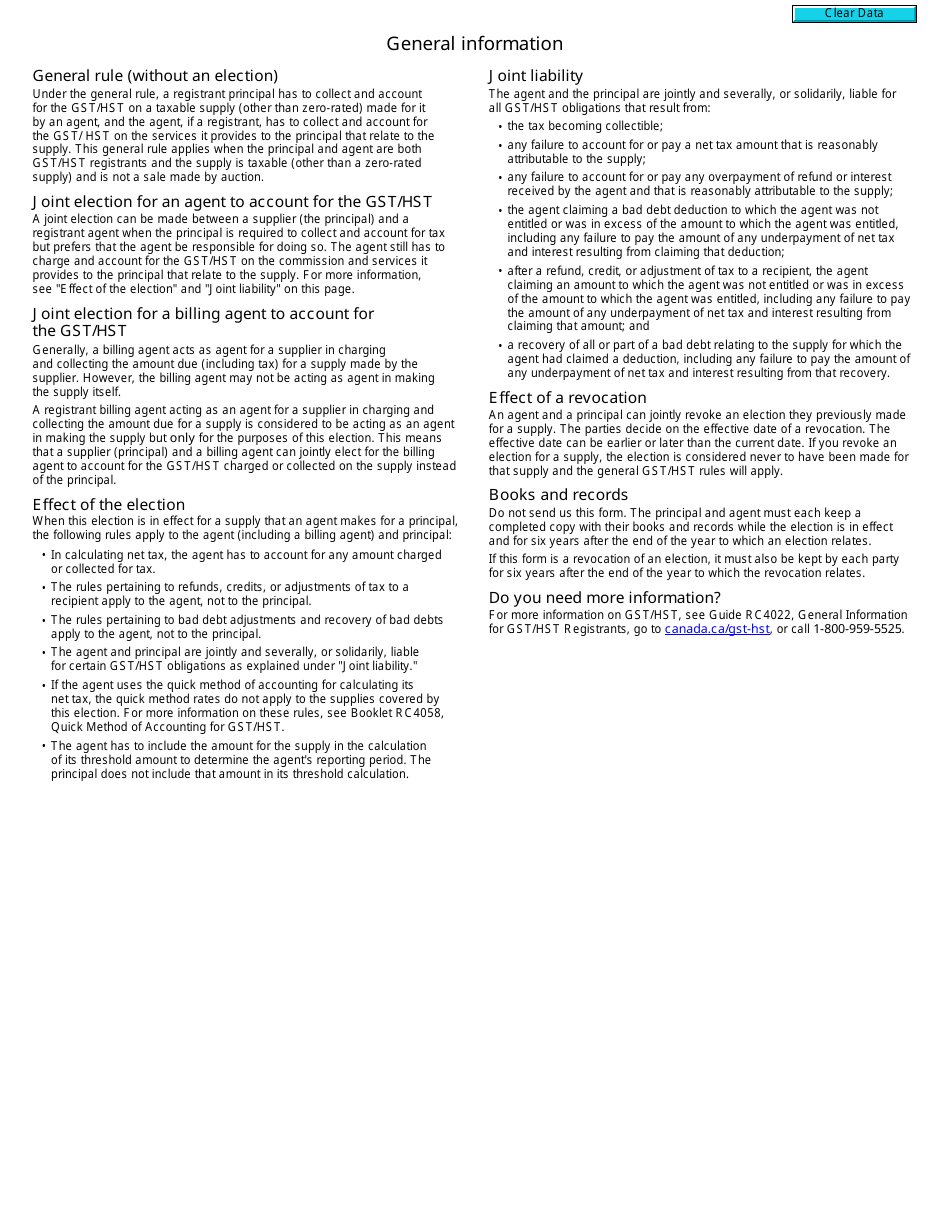

A: Form GST506 is a form used in Canada to make an election or revoke an election between an agent and a principal for Goods and Services Tax (GST) purposes.

Q: What is an election between agent and principal?

A: An election between agent and principal is a legal agreement between two parties where the agent is authorized to act on behalf of the principal for GST purposes.

Q: What is the purpose of making an election?

A: Making an election allows the agent to report and remit GST on behalf of the principal, simplifying the GST process for the principal.

Q: What is the purpose of revoking an election?

A: Revoking an election cancels the authorization for the agent to act on behalf of the principal for GST purposes, allowing the principal to resume reporting and remitting GST themselves.

Q: When should I use Form GST506?

A: You should use Form GST506 when you want to make an election or revoke an election between an agent and a principal for GST purposes in Canada.

Q: Are there any fees associated with filing Form GST506?

A: There are no fees associated with filing Form GST506.

Q: Do I need to submit any supporting documents with Form GST506?

A: You do not need to submit any supporting documents with Form GST506, unless specifically requested by the CRA.

Q: What are the consequences of making an election or revoking an election?

A: The consequences of making an election or revoking an election may include changes in reporting and remittance responsibilities, as well as potential audits or reviews by the CRA.