This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST524

for the current year.

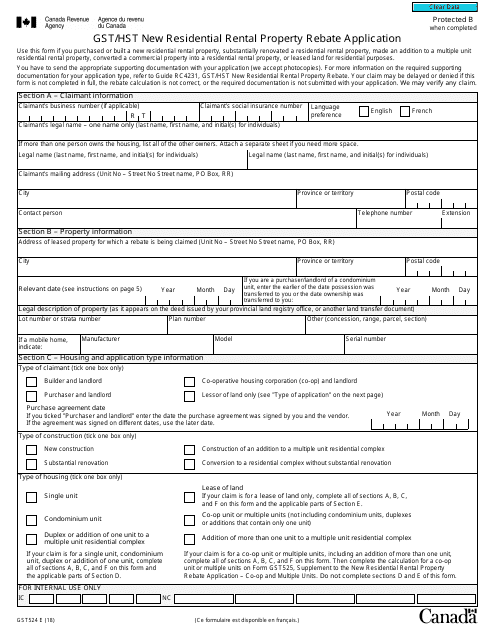

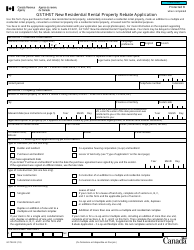

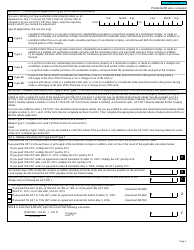

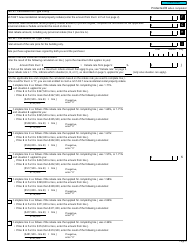

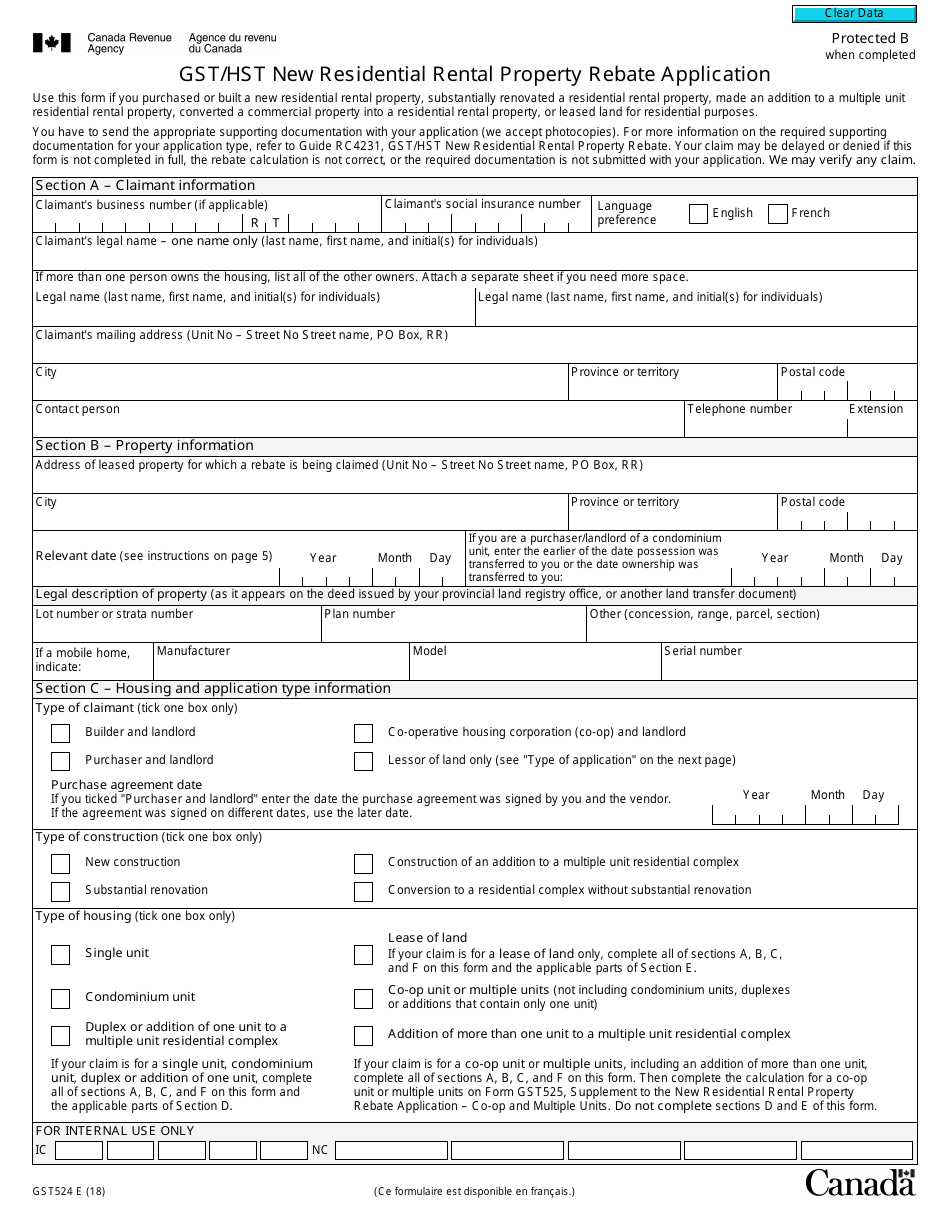

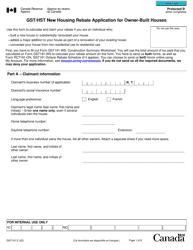

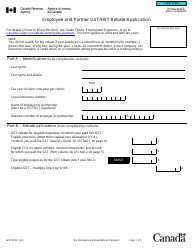

Form GST524 Gst / Hst New Residential Rental Property Rebate Application - Canada

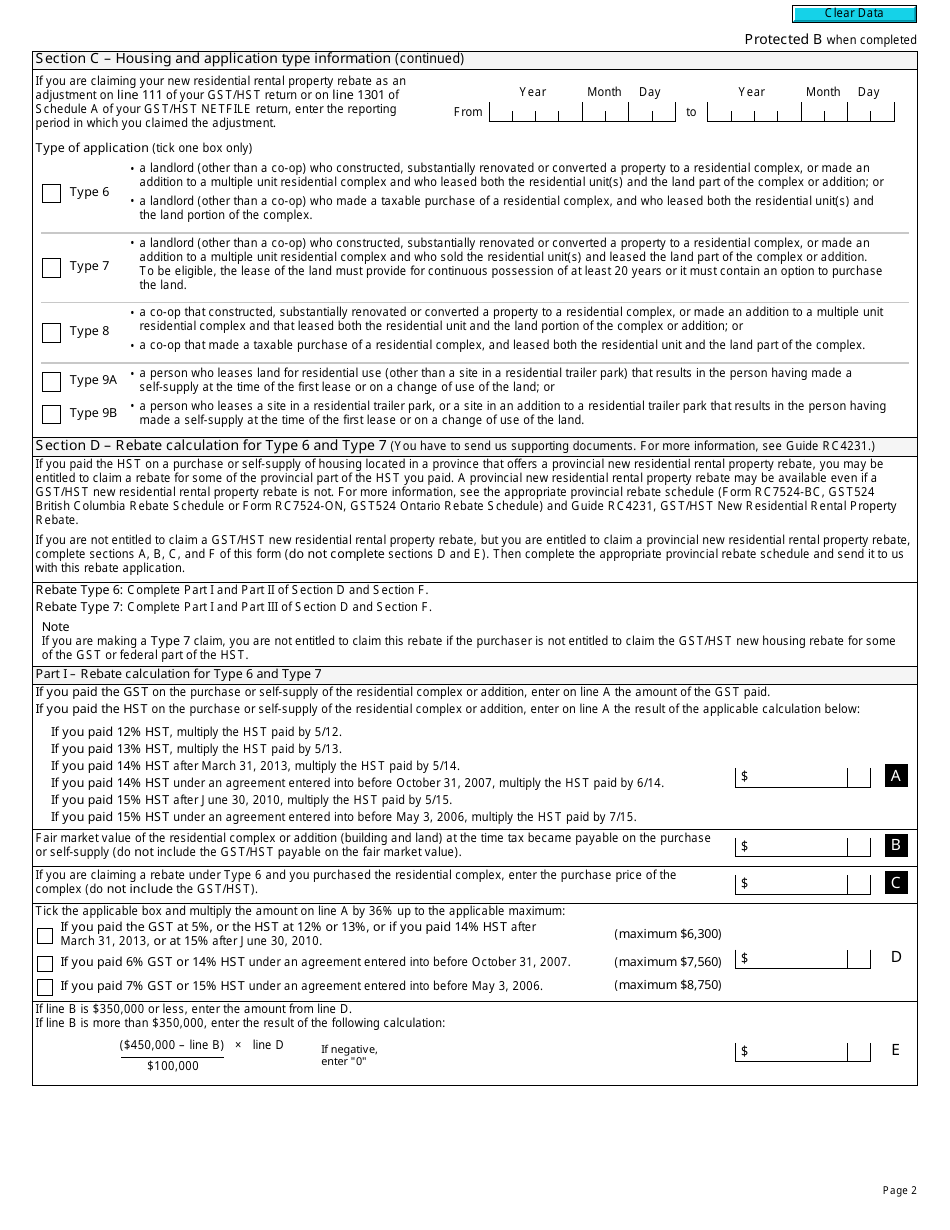

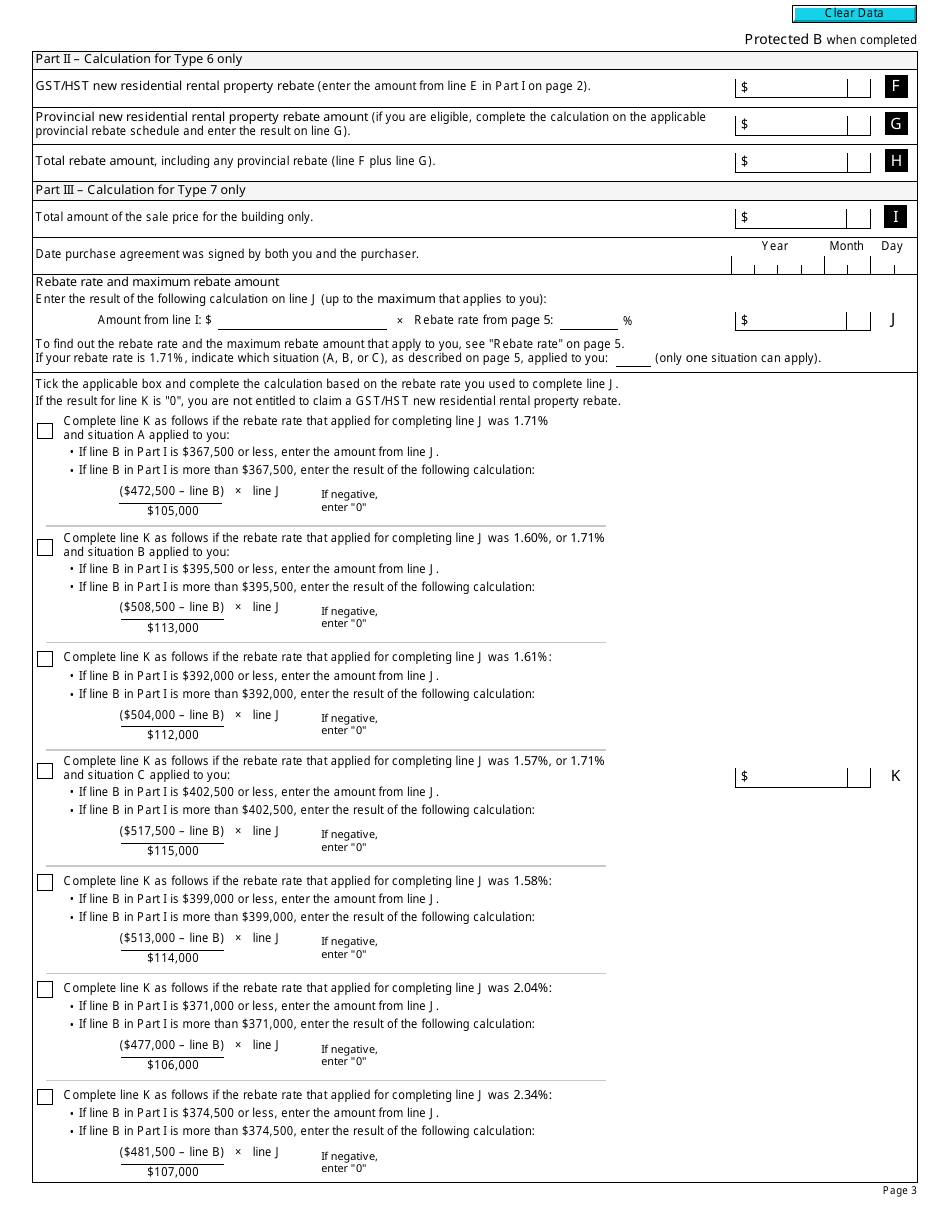

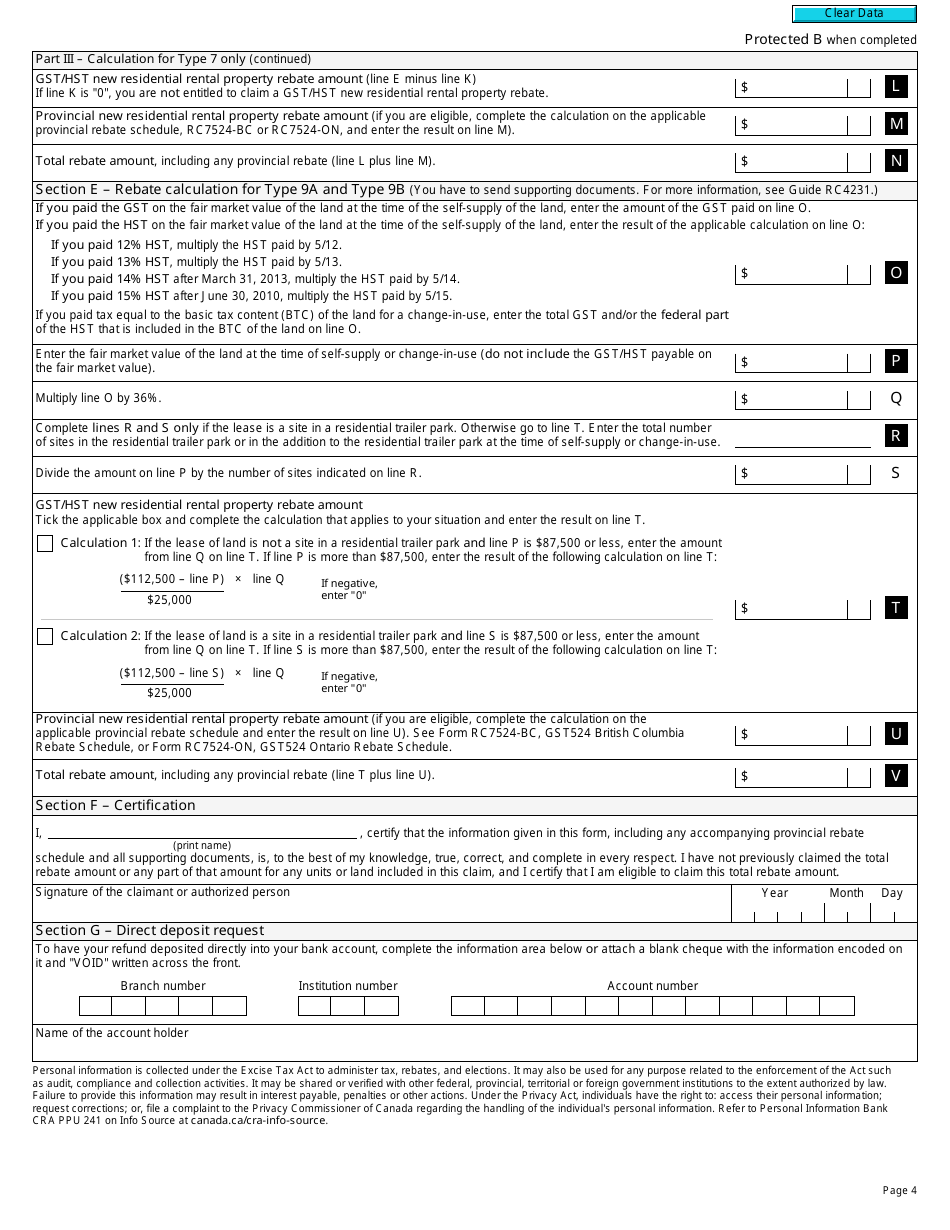

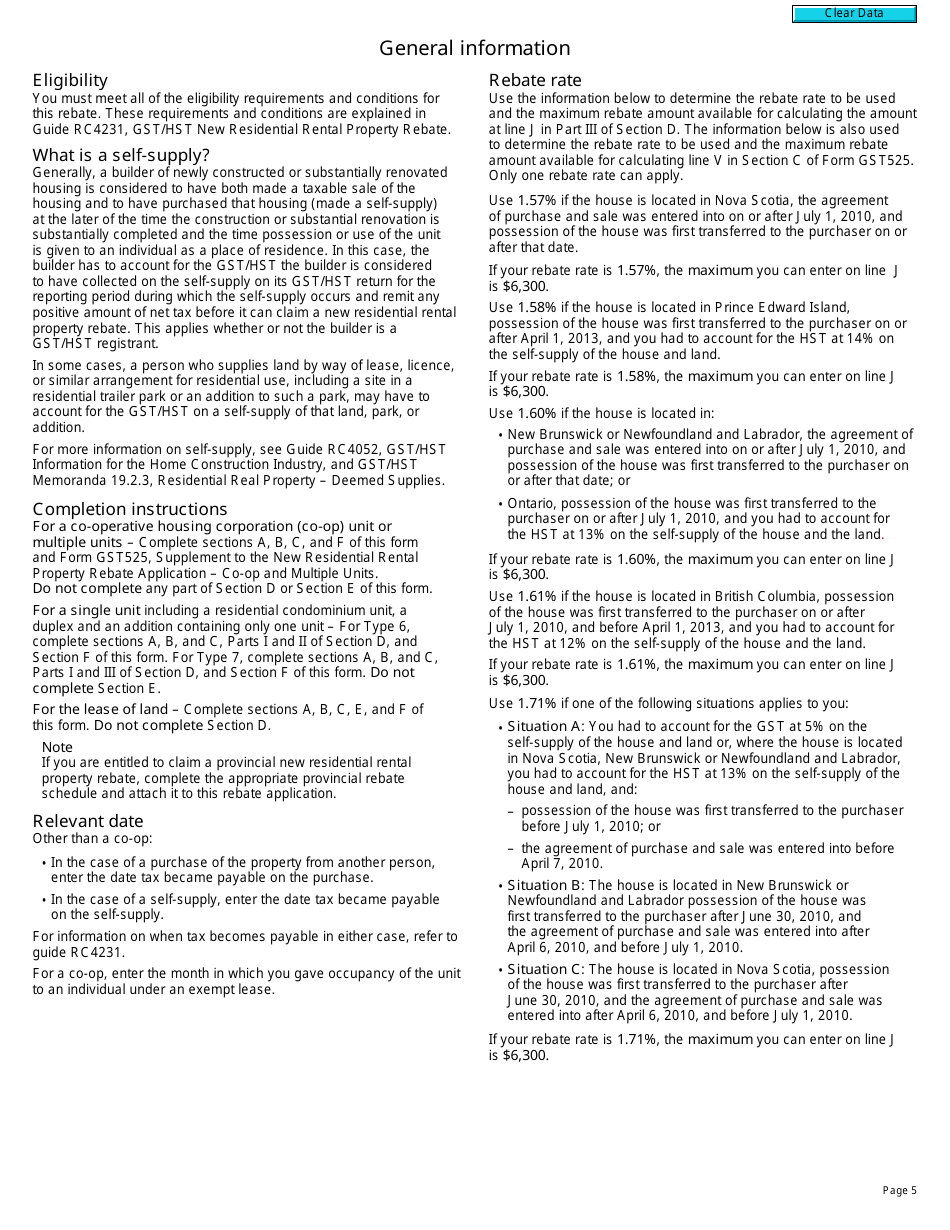

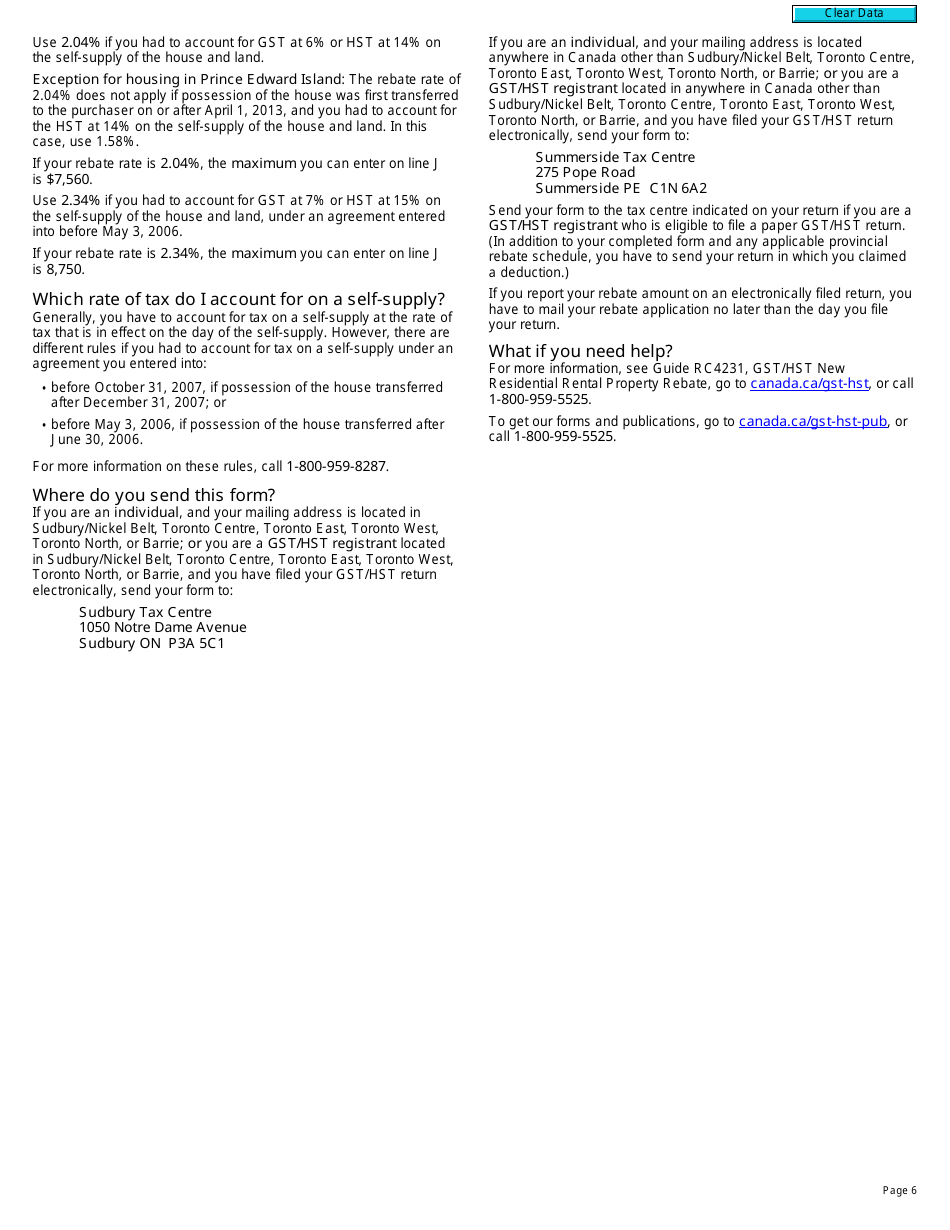

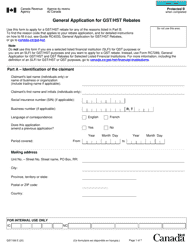

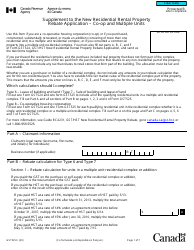

Form GST524 GST/HST New Residential Rental Property Rebate Application is used by landlords or property owners in Canada to apply for a rebate on the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) paid on the purchase or construction of a new rental property. It is specifically for claiming the rebate on the GST/HST paid on the purchase or construction of a new residential rental property.

The Form GST524 GST/HST New Residential Rental Property Rebate Application is typically filed by the property owner or by their authorized representative.

FAQ

Q: What is Form GST524?

A: Form GST524 is the Gst/Hst New Residential Rental Property Rebate Application in Canada.

Q: What is the purpose of Form GST524?

A: Form GST524 is used to apply for the Gst/Hst New Residential Rental Property Rebate in Canada.

Q: Who can use Form GST524?

A: Form GST524 can be used by individuals or businesses who have recently purchased or built a new residential rental property in Canada and want to claim the GST/HST rebate.

Q: What information is required on Form GST524?

A: Form GST524 requires information such as the applicant's personal details, property information, and supporting documents to substantiate the claim.

Q: When should I submit Form GST524?

A: Form GST524 should be submitted within two years from the date the property was purchased or the construction was completed.

Q: Is there a fee to submit Form GST524?

A: No, there is no fee to submit Form GST524.

Q: What happens after I submit Form GST524?

A: After submitting Form GST524, the CRA will review the application and may request additional information if needed. If approved, the rebate will be processed and issued to the applicant.

Q: Can I claim the rebate if I am not a Canadian resident?

A: No, only Canadian residents are eligible to claim the Gst/Hst New Residential Rental Property Rebate.