This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST523-1

for the current year.

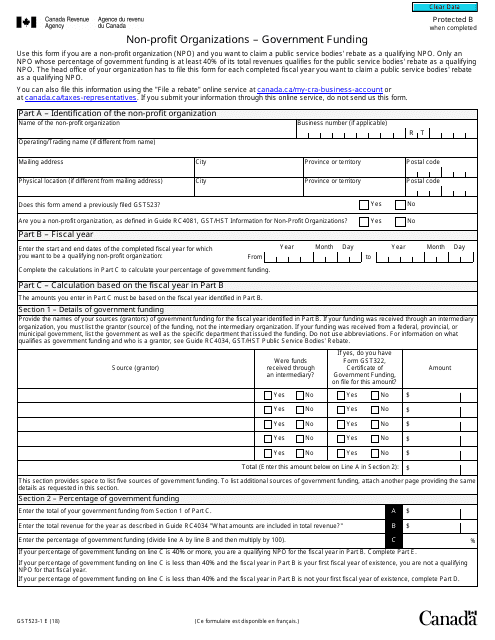

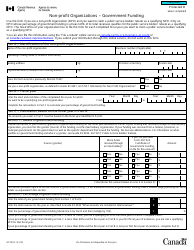

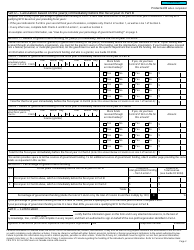

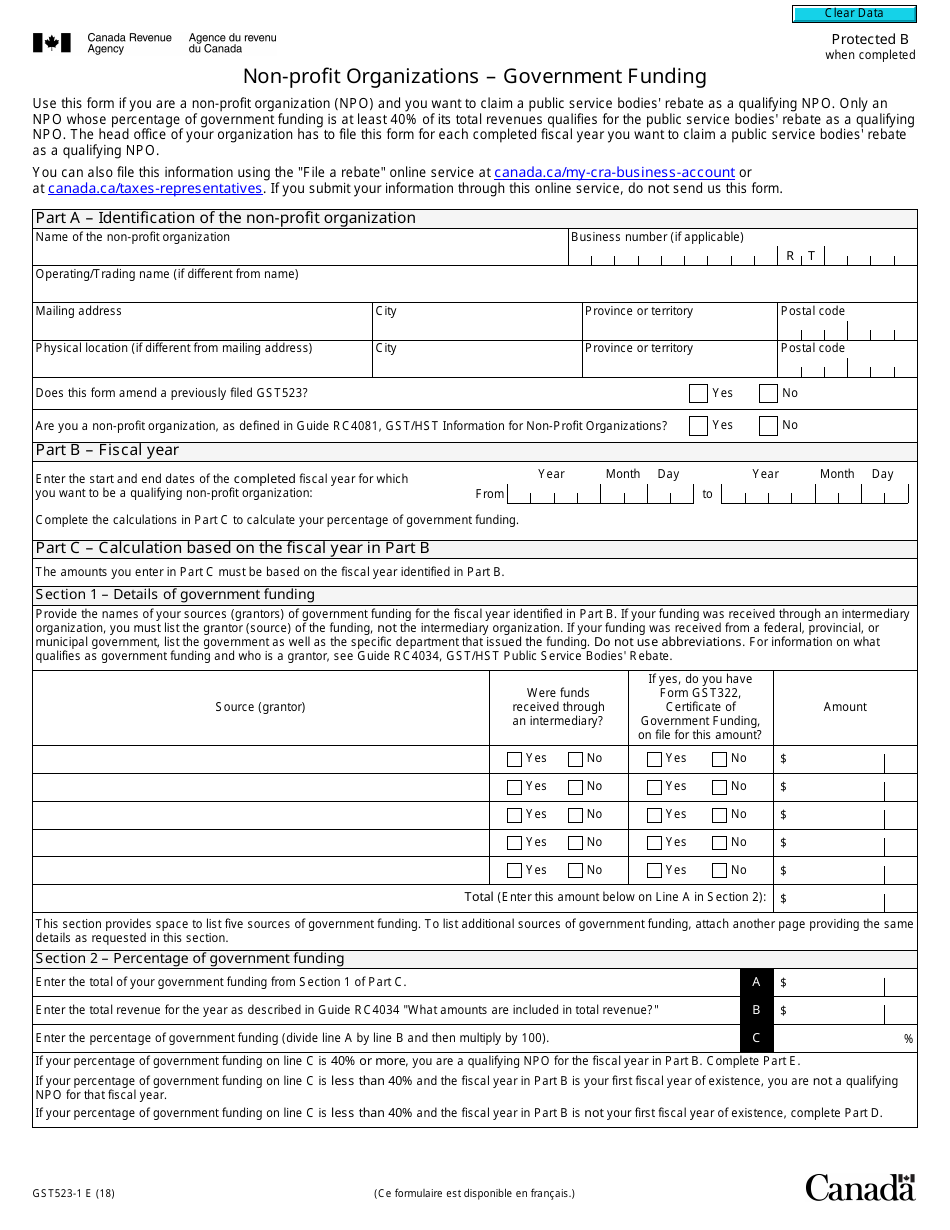

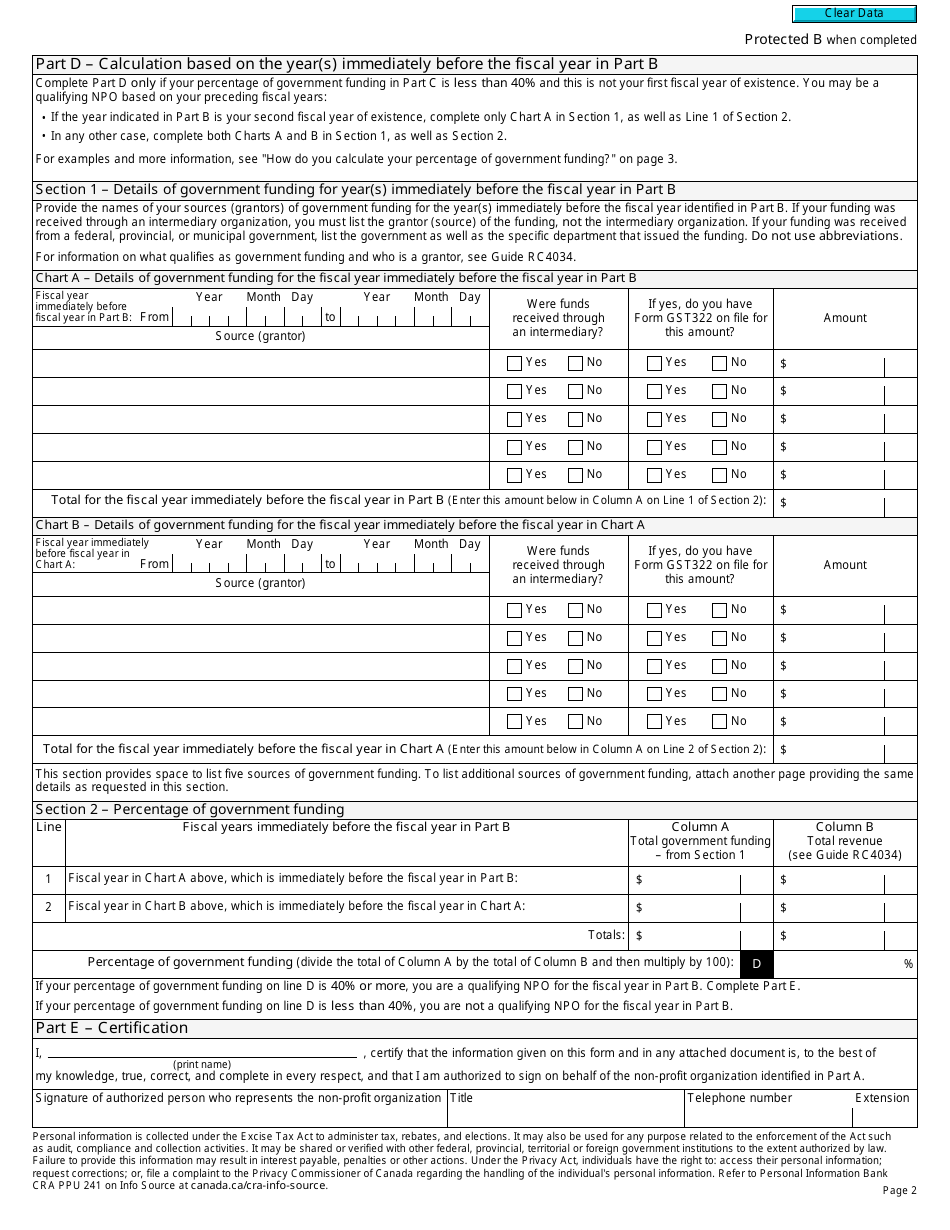

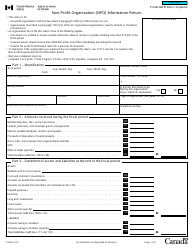

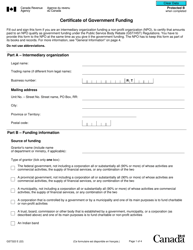

Form GST523-1 Non-profit Organizations - Government Funding - Canada

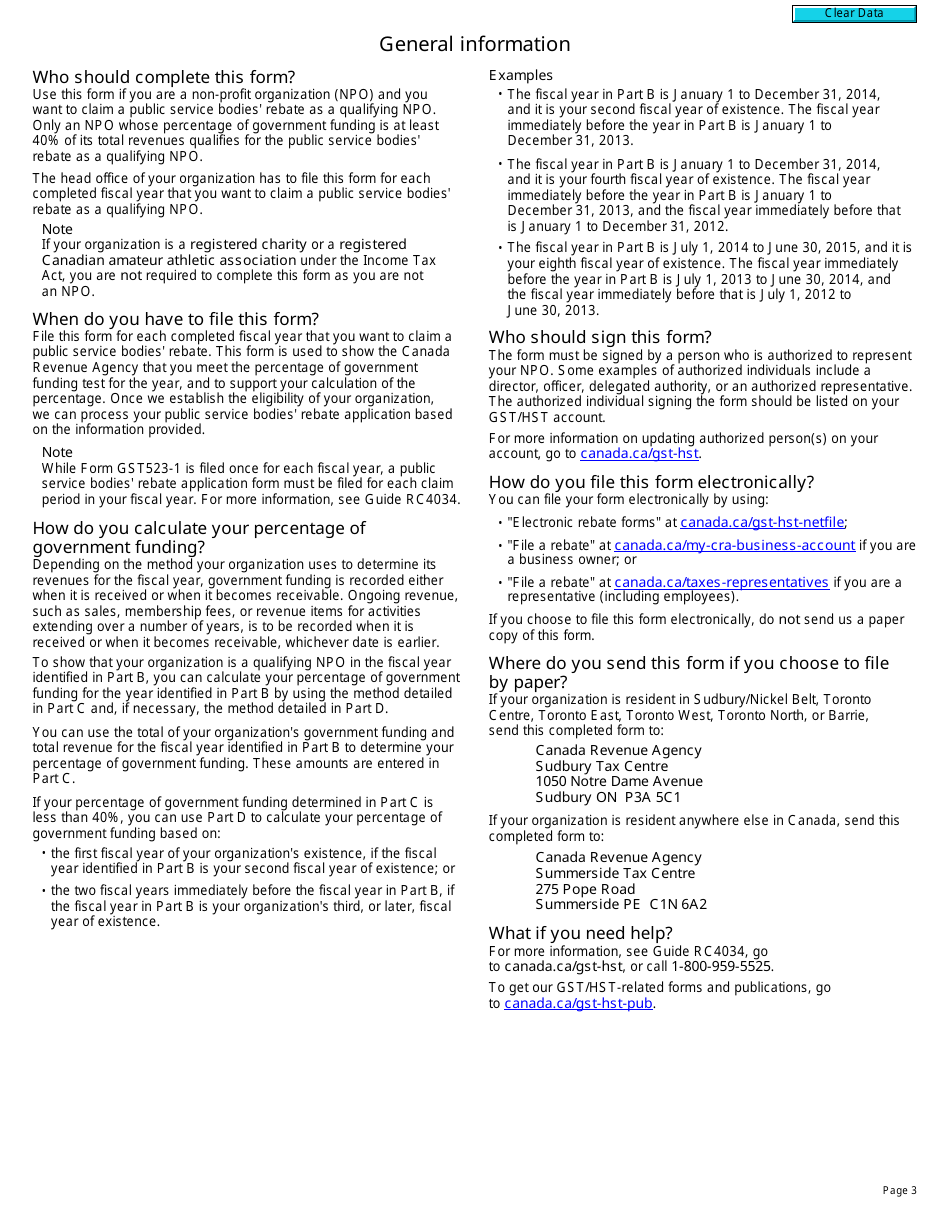

Form GST523-1 Non-profit Organizations - Government Funding is used in Canada by non-profit organizations to claim a refund of the goods and services tax/harmonized sales tax (GST/HST) paid on eligible purchases made with government funding.

Non-profit organizations in Canada are responsible for filing Form GST523-1.

FAQ

Q: What is Form GST523-1?

A: Form GST523-1 is a form used by non-profit organizations in Canada to report government funding.

Q: Who uses Form GST523-1?

A: Non-profit organizations in Canada use Form GST523-1 to report government funding.

Q: What is the purpose of Form GST523-1?

A: The purpose of Form GST523-1 is to report government funding received by non-profit organizations in Canada.

Q: What information needs to be reported on Form GST523-1?

A: Form GST523-1 requires non-profit organizations to report the details of government funding they have received, including the source, amount, and purpose of the funding.

Q: Is Form GST523-1 mandatory for non-profit organizations?

A: Yes, non-profit organizations in Canada are required to file Form GST523-1 if they have received government funding.

Q: Is there a deadline for filing Form GST523-1?

A: Yes, non-profit organizations must file Form GST523-1 within six months after the end of their fiscal year.

Q: Are there any penalties for not filing Form GST523-1?

A: Yes, there can be penalties for late or non-filing of Form GST523-1. It is important for non-profit organizations to file the form on time to avoid penalties.

Q: Can Form GST523-1 be used to claim input tax credits?

A: No, Form GST523-1 is used for reporting government funding and is not related to the claiming of input tax credits.