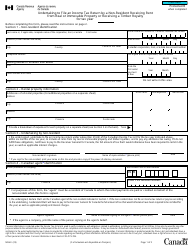

This version of the form is not currently in use and is provided for reference only. Download this version of

Form NR6

for the current year.

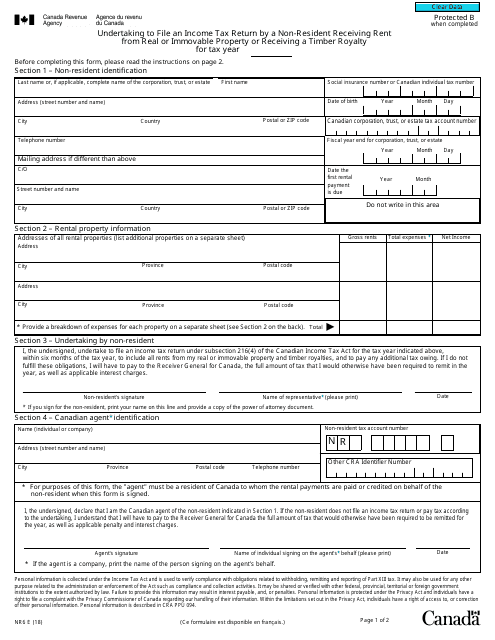

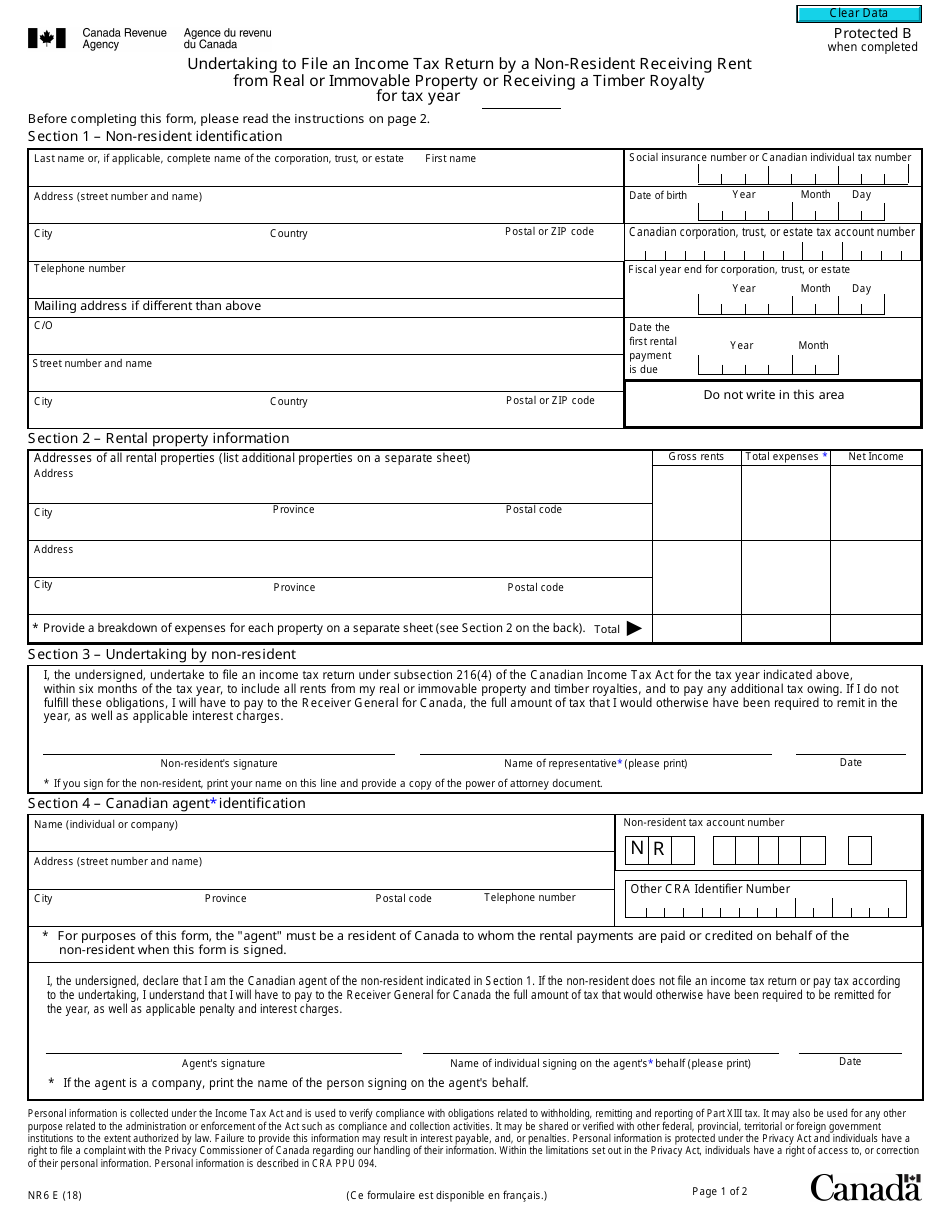

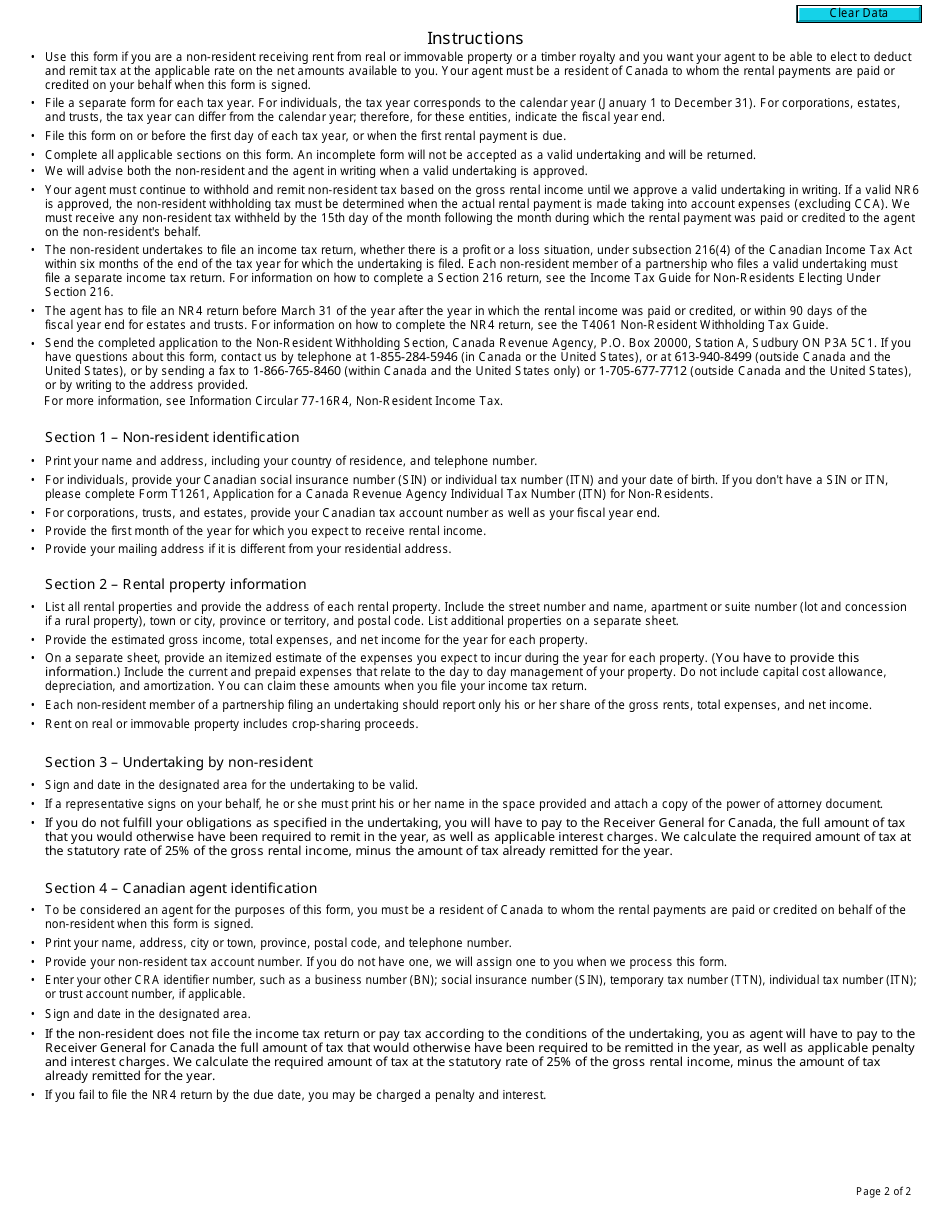

Form NR6 Undertaking to File an Income Tax Return by a Non-resident Receiving Rent From Real or Immovable Property or Receiving a Timber Royalty - Canada

Form NR6 is an undertaking that allows non-residents of Canada who receive rental income or timber royalties from Canadian real estate to have their tax withheld at a reduced rate. By filing this form, the non-resident can declare their expected annual income and claim any applicable deductions or exemptions. This helps to ensure that they are not over-taxed on their Canadian income.

The non-resident who is receiving rent or timber royalty from real or immovable property in Canada is required to file the Form NR6 Undertaking to File an Income Tax Return.

FAQ

Q: Who is required to file Form NR6?

A: Non-resident individuals receiving rent from real or immovable property or receiving a timber royalty in Canada.

Q: What is Form NR6?

A: Form NR6 is an undertaking to file an income tax return by a non-resident.

Q: What is the purpose of Form NR6?

A: The purpose of Form NR6 is to allow non-resident individuals to report rental income from Canadian real or immovable property or timber royalty income.

Q: When should Form NR6 be filed?

A: Form NR6 should be filed on or before the first day of the calendar year to which it applies.

Q: Are there any penalties for non-compliance with Form NR6?

A: Yes, there may be penalties for failure to file Form NR6 or for providing false or misleading information.