This version of the form is not currently in use and is provided for reference only. Download this version of

Maryland Form 500E (COM/RAD-003)

for the current year.

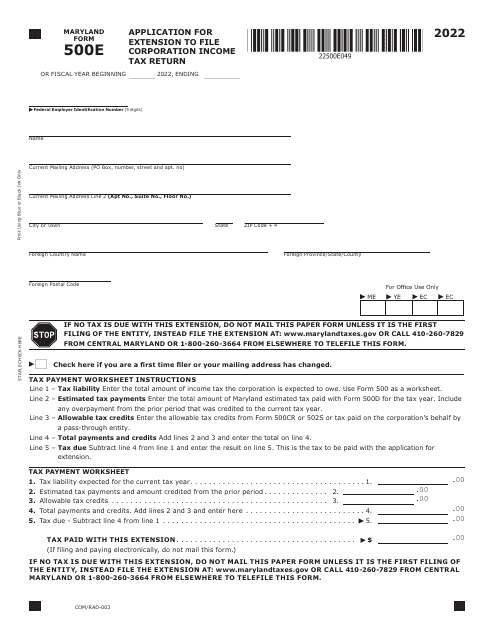

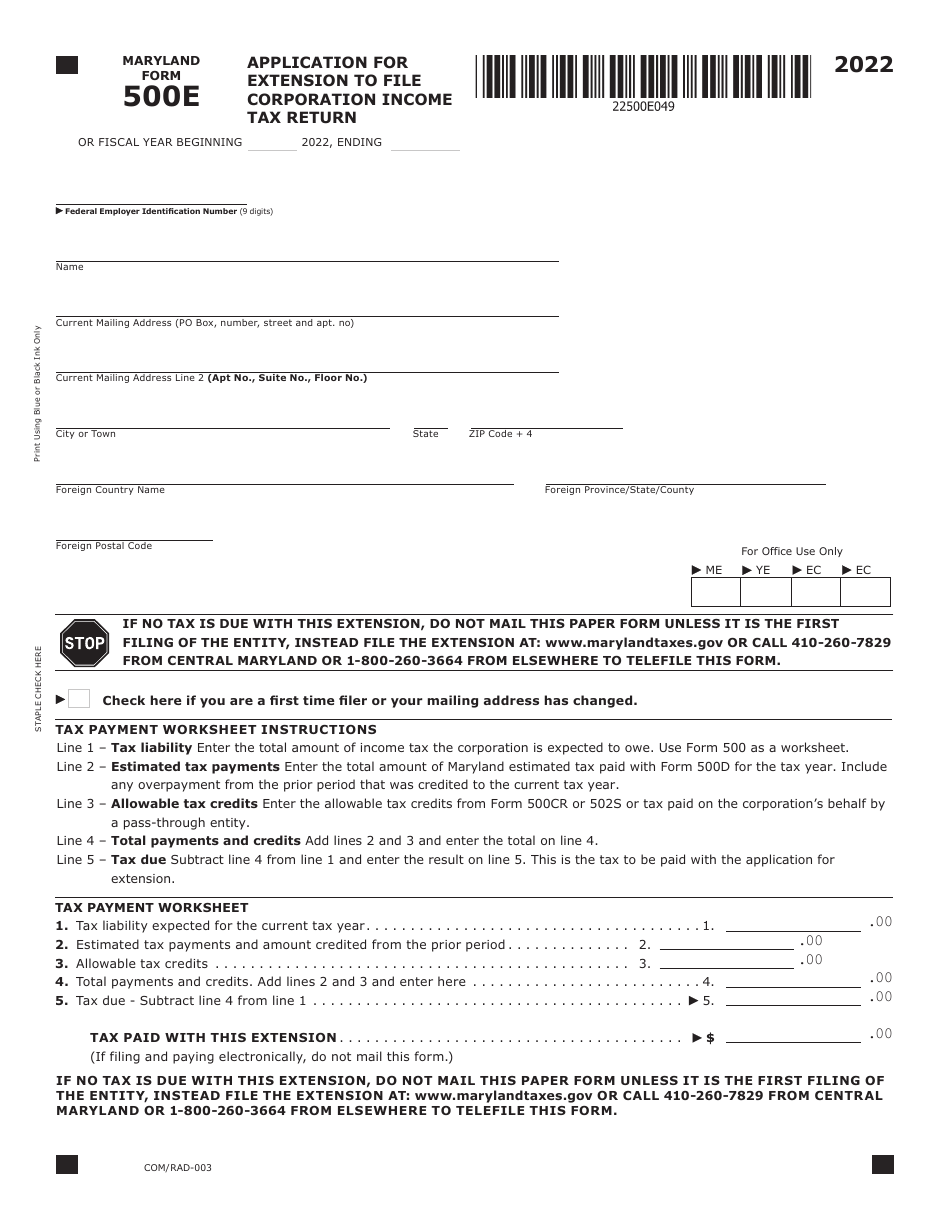

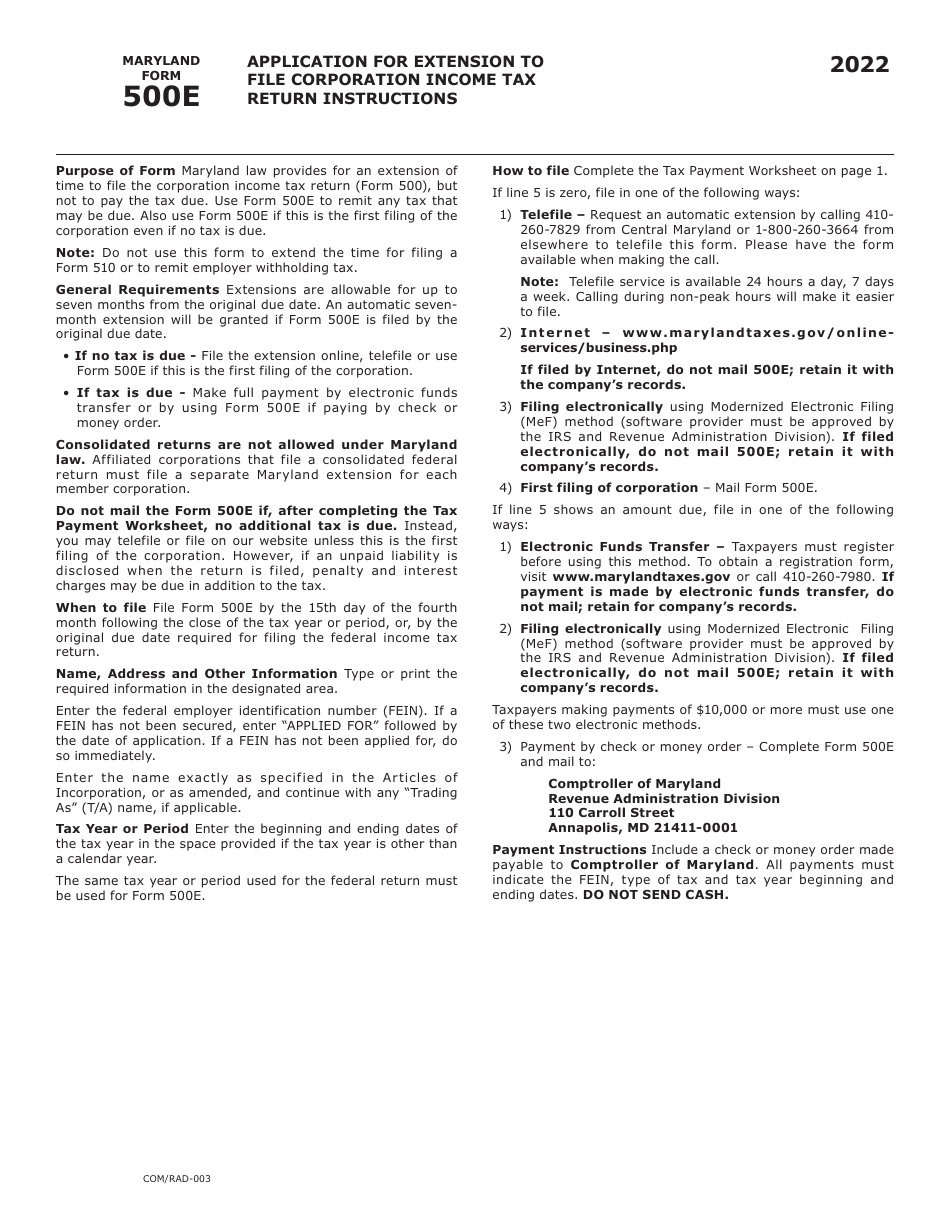

Maryland Form 500E (COM / RAD-003) Application for Extension to File Corporation Income Tax Return - Maryland

What Is Maryland Form 500E (COM/RAD-003)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form 500E?

A: Maryland Form 500E is an Application for Extension to File Corporation Income Tax Return in Maryland.

Q: Who needs to file Maryland Form 500E?

A: Corporations in Maryland who need more time to file their income tax return.

Q: Why would a corporation need to file an extension for their tax return?

A: A corporation may need more time to gather necessary financial information or complete their tax return.

Q: Is there a deadline to file Maryland Form 500E?

A: Yes, Maryland Form 500E must be filed by the original due date of the corporation income tax return, which is typically March 15th.

Q: What happens if I don't file Maryland Form 500E?

A: If you don't file Maryland Form 500E and fail to file the income tax return by the original due date, you may be subject to penalties and interest.

Q: How long is the extension granted by Maryland Form 500E?

A: Maryland Form 500E grants an automatic extension of up to 6 months to file the corporation income tax return.

Q: Do I need to pay any taxes when filing Maryland Form 500E?

A: Yes, if you owe any tax liability, it should be paid along with the extension request to avoid penalties and interest.

Q: Can I file Maryland Form 500E if I am not a corporation?

A: No, Maryland Form 500E is specifically for corporations, not for other types of entities or individuals.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 500E (COM/RAD-003) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.