This version of the form is not currently in use and is provided for reference only. Download this version of

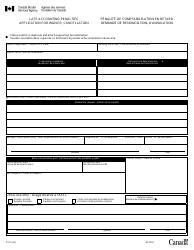

Form R102-R

for the current year.

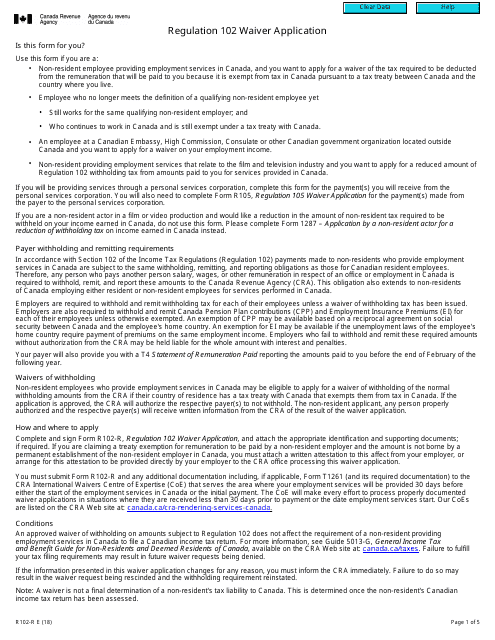

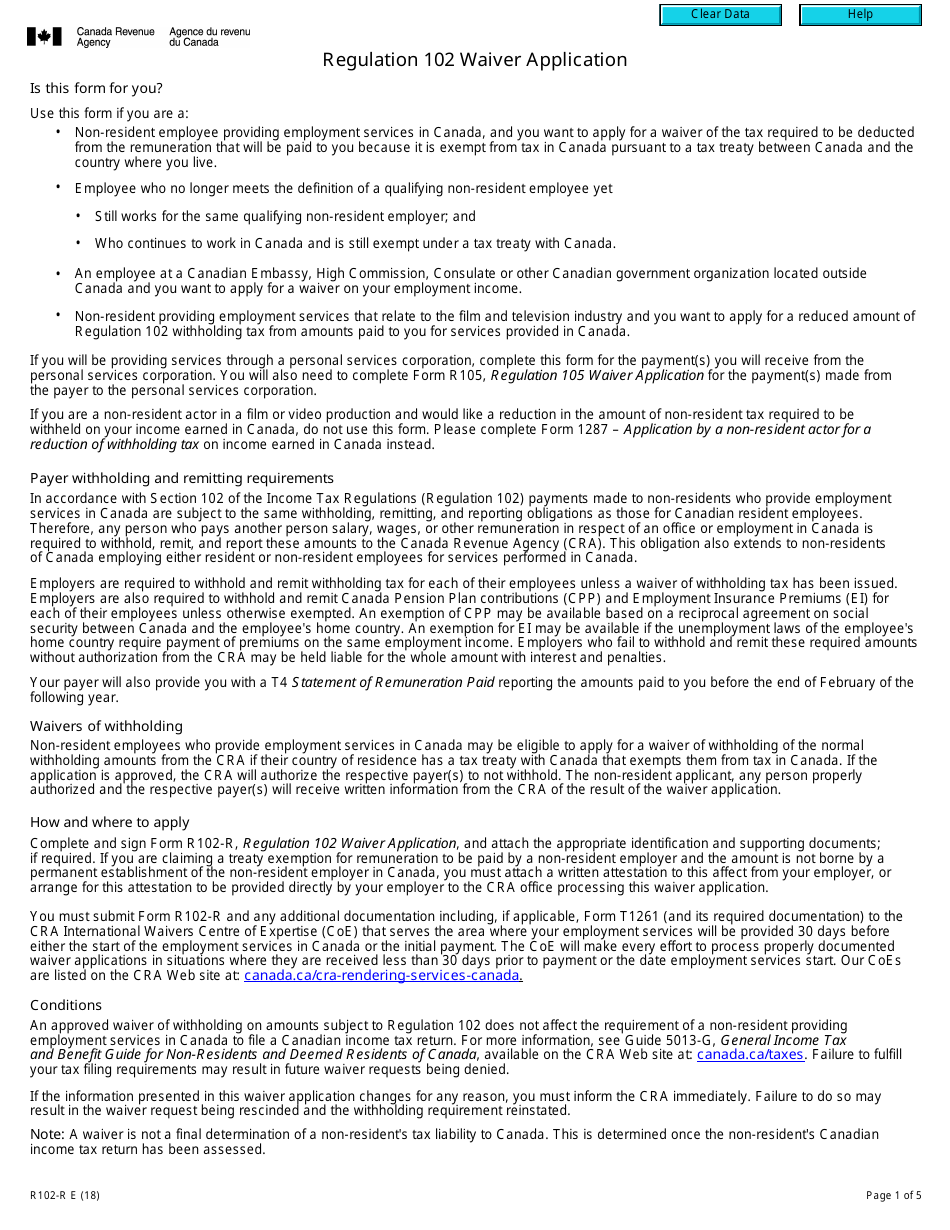

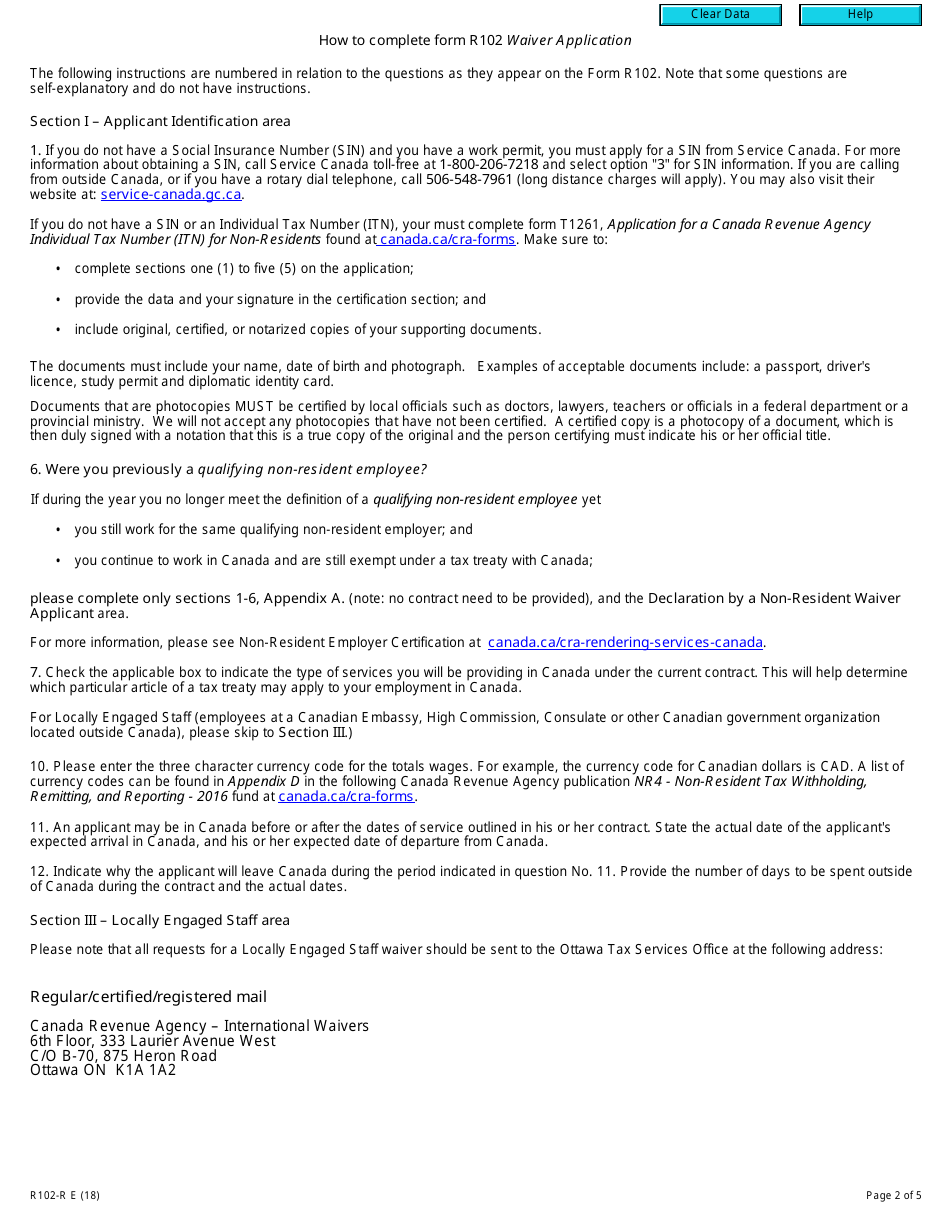

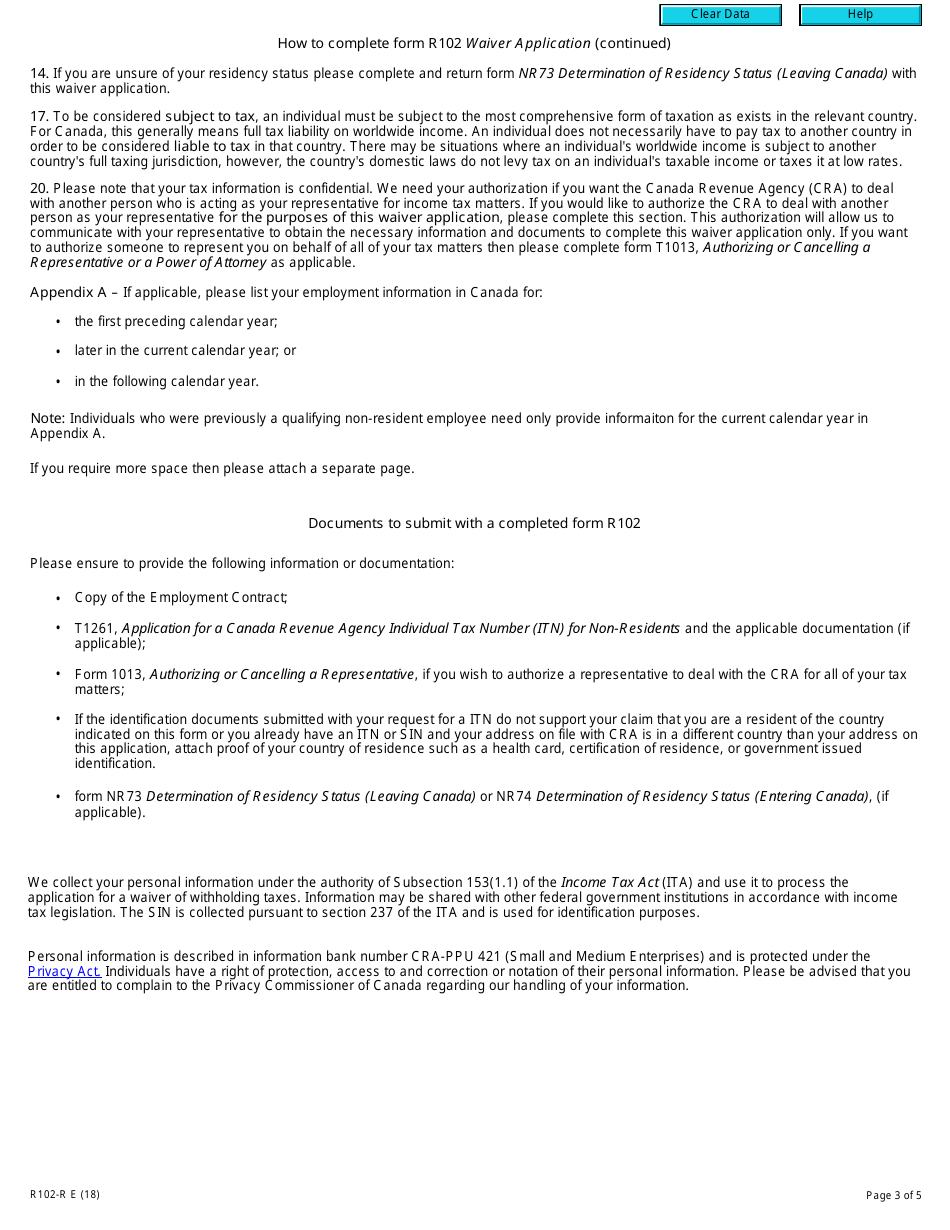

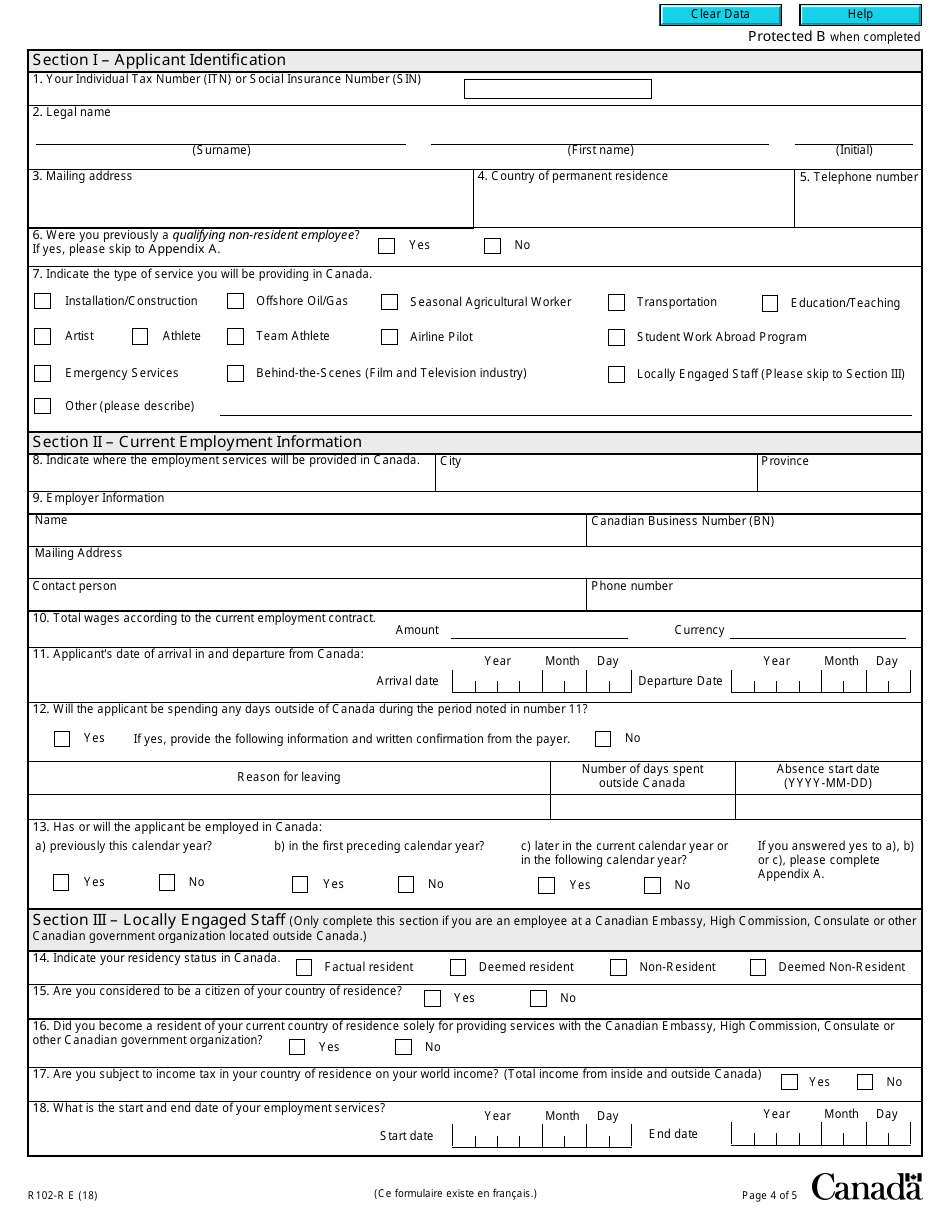

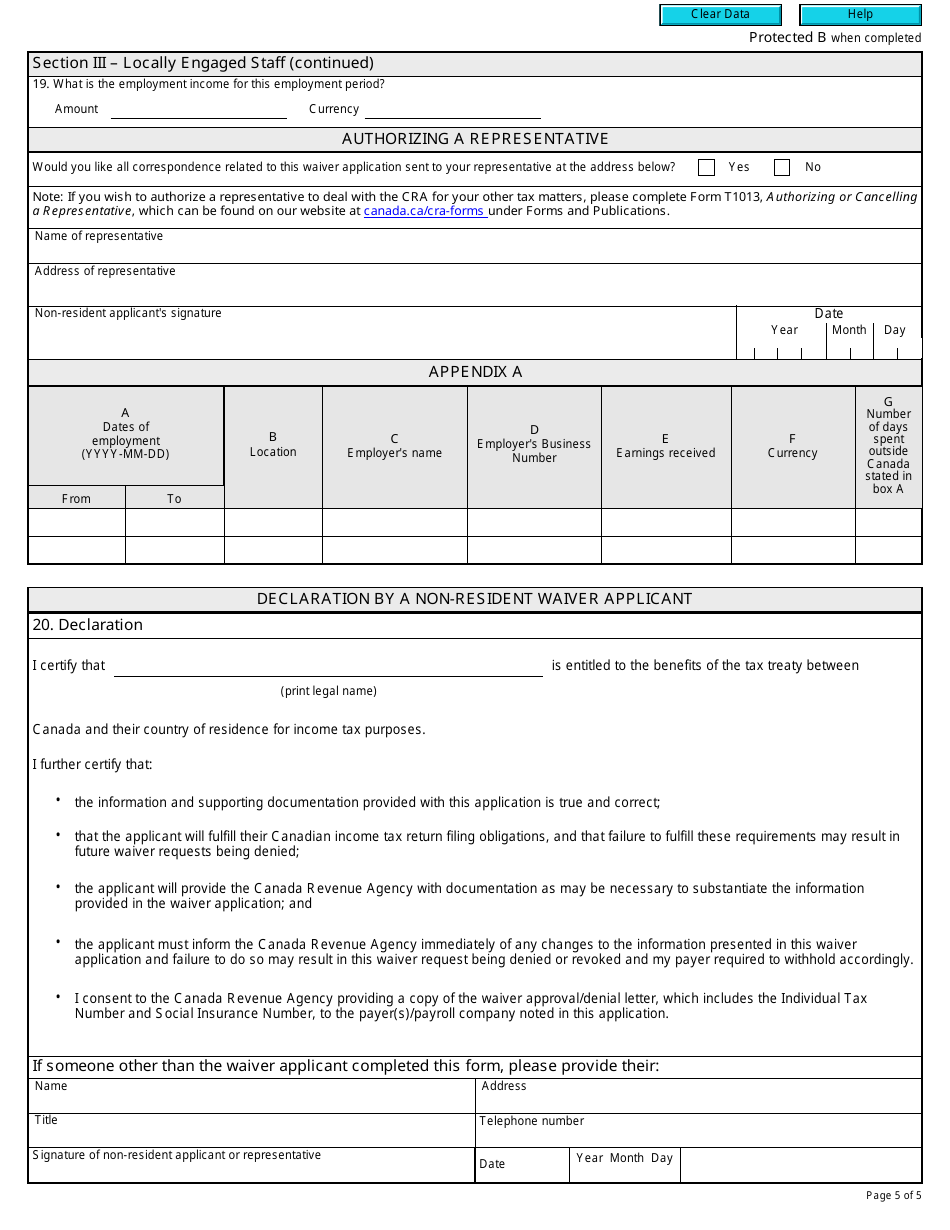

Form R102-R Regulation 102 Waiver Application - Canada

The employer or the authorized representative files the Form R102-R Regulation 102 Waiver Application in Canada.

FAQ

Q: What is Form R102-R?

A: Form R102-R is an application for a Regulation 102 waiver in Canada.

Q: What is Regulation 102?

A: Regulation 102 is a Canadian tax regulation that requires non-resident employers to withhold and remit taxes on certain types of income paid to employees in Canada.

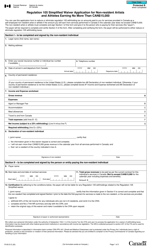

Q: Who needs to complete Form R102-R?

A: Non-resident employers who want to apply for a waiver from the withholding and remittance requirements of Regulation 102 need to complete Form R102-R.

Q: What is the purpose of Form R102-R?

A: The purpose of Form R102-R is to request a waiver from the withholding and remittance requirements of Regulation 102.

Q: How do I submit Form R102-R?

A: Form R102-R must be submitted to the Canada Revenue Agency (CRA) either by mail or by fax.

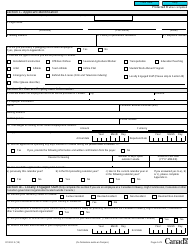

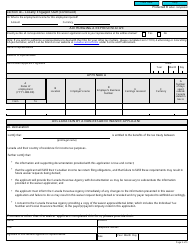

Q: What information is required in Form R102-R?

A: Form R102-R requires information such as the employer's name, address, and business number, as well as details about the employee and the income subject to Regulation 102.

Q: Is there a fee for filing Form R102-R?

A: No, there is no fee for filing Form R102-R.

Q: How long does it take to process a Form R102-R?

A: The processing time for a Form R102-R varies and can take several weeks.

Q: What happens after submitting Form R102-R?

A: After submitting Form R102-R, the CRA will review the application and notify the employer of their decision regarding the waiver request.