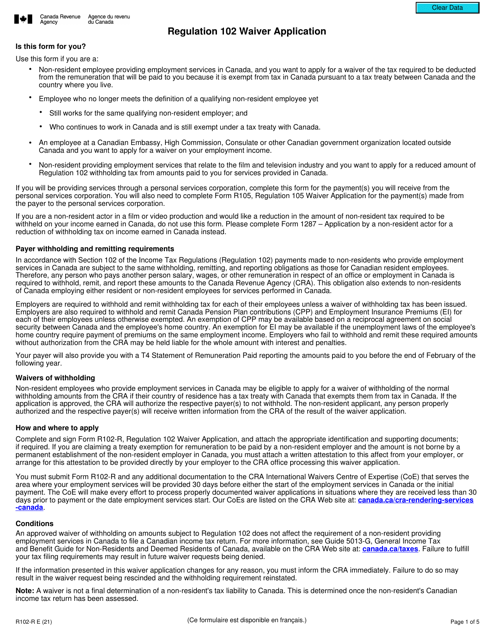

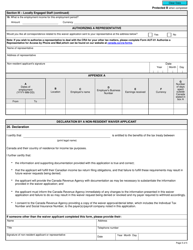

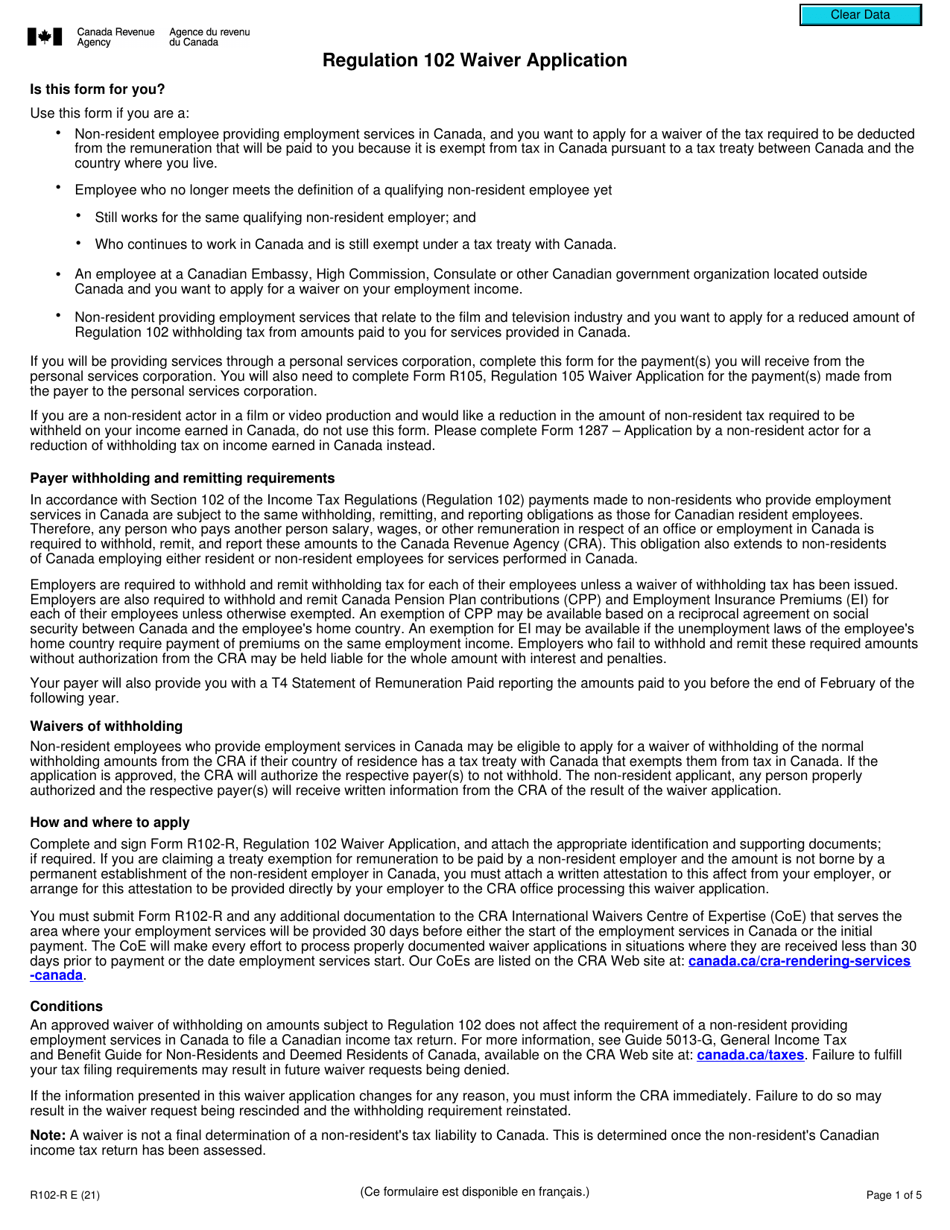

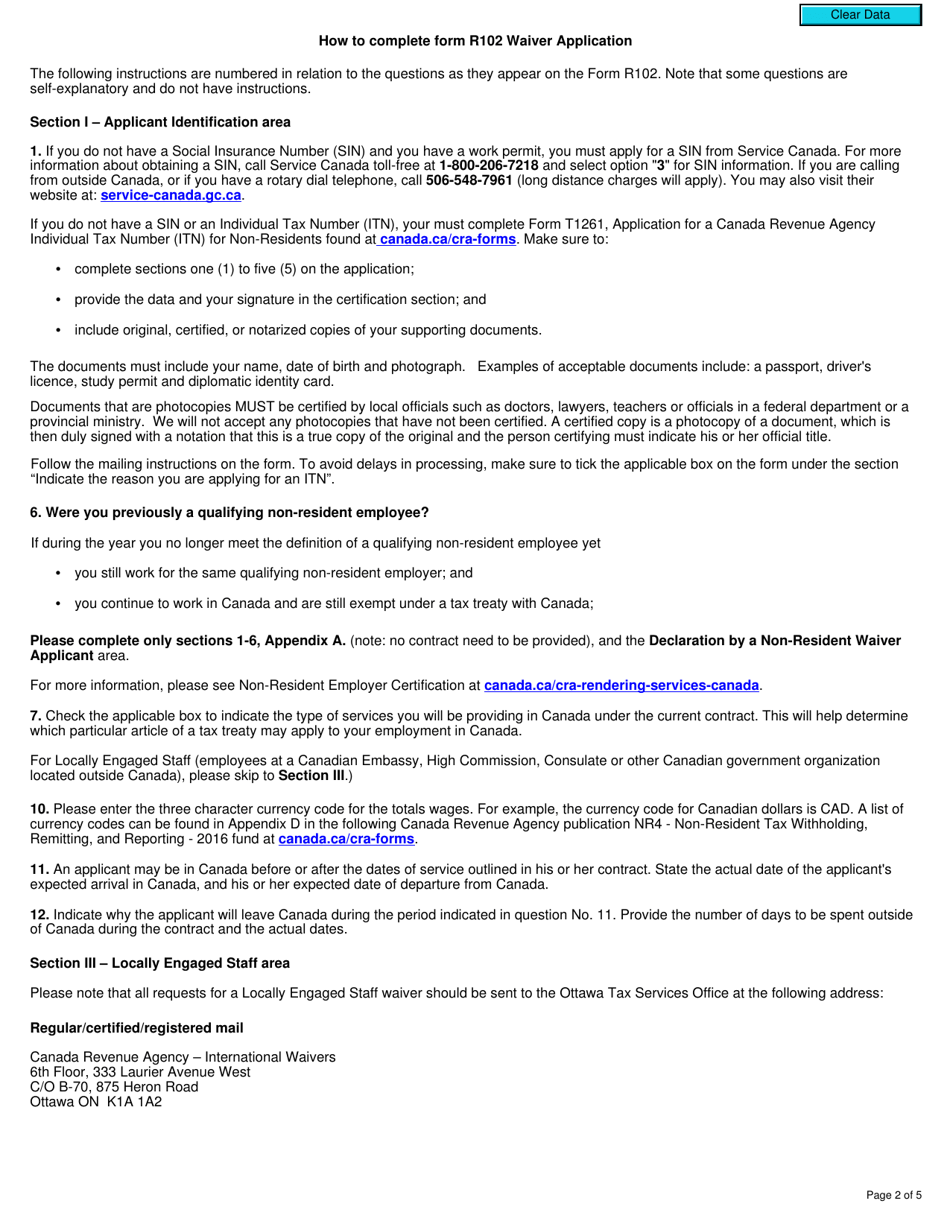

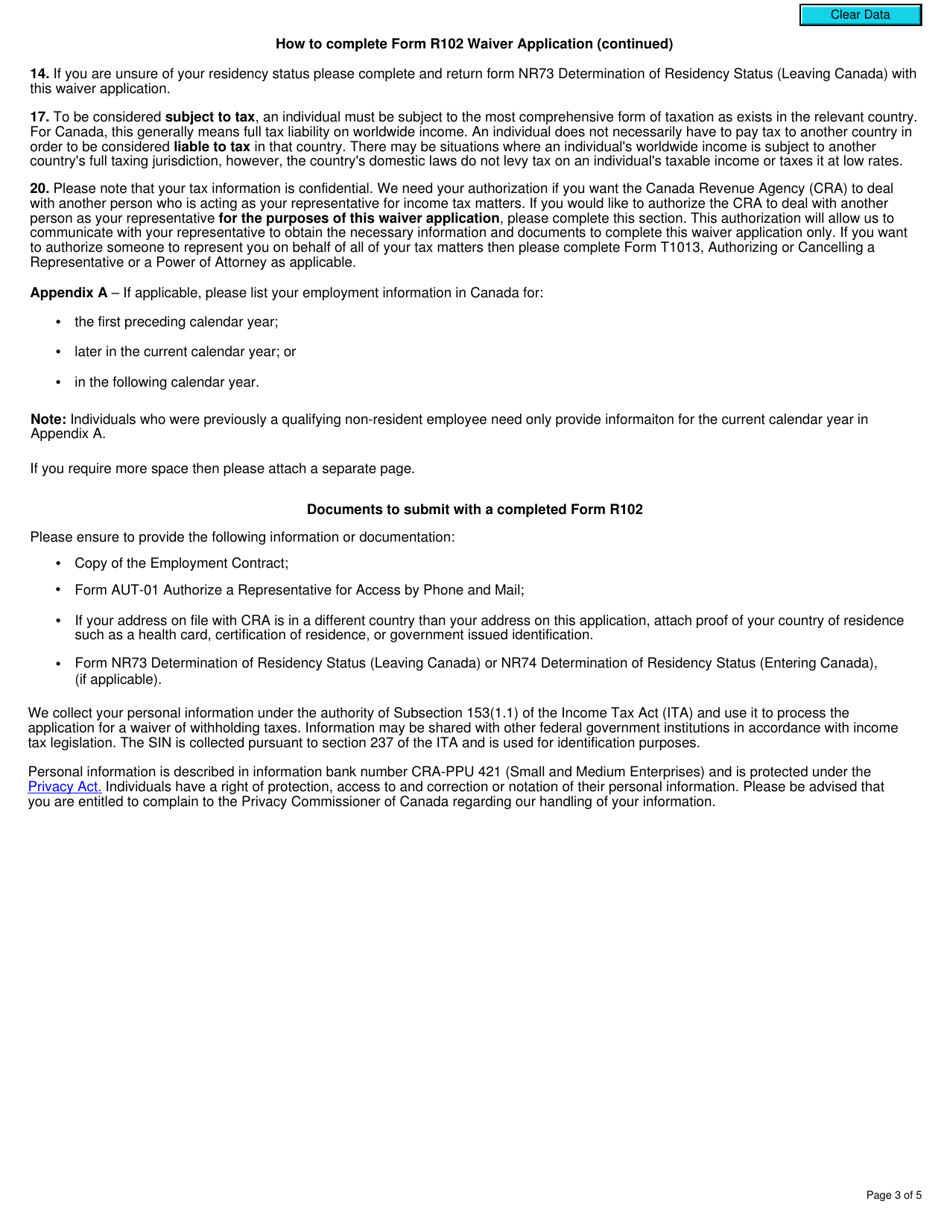

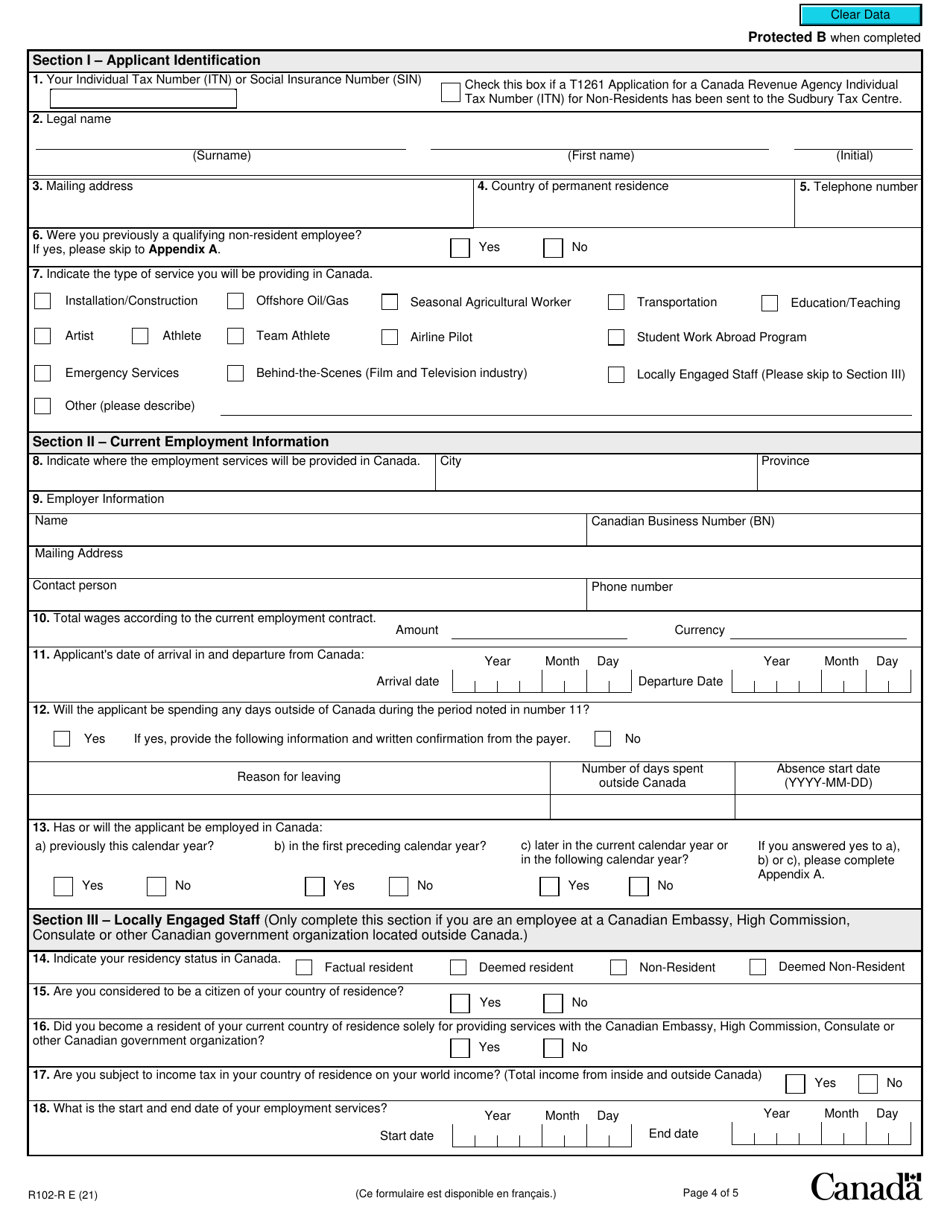

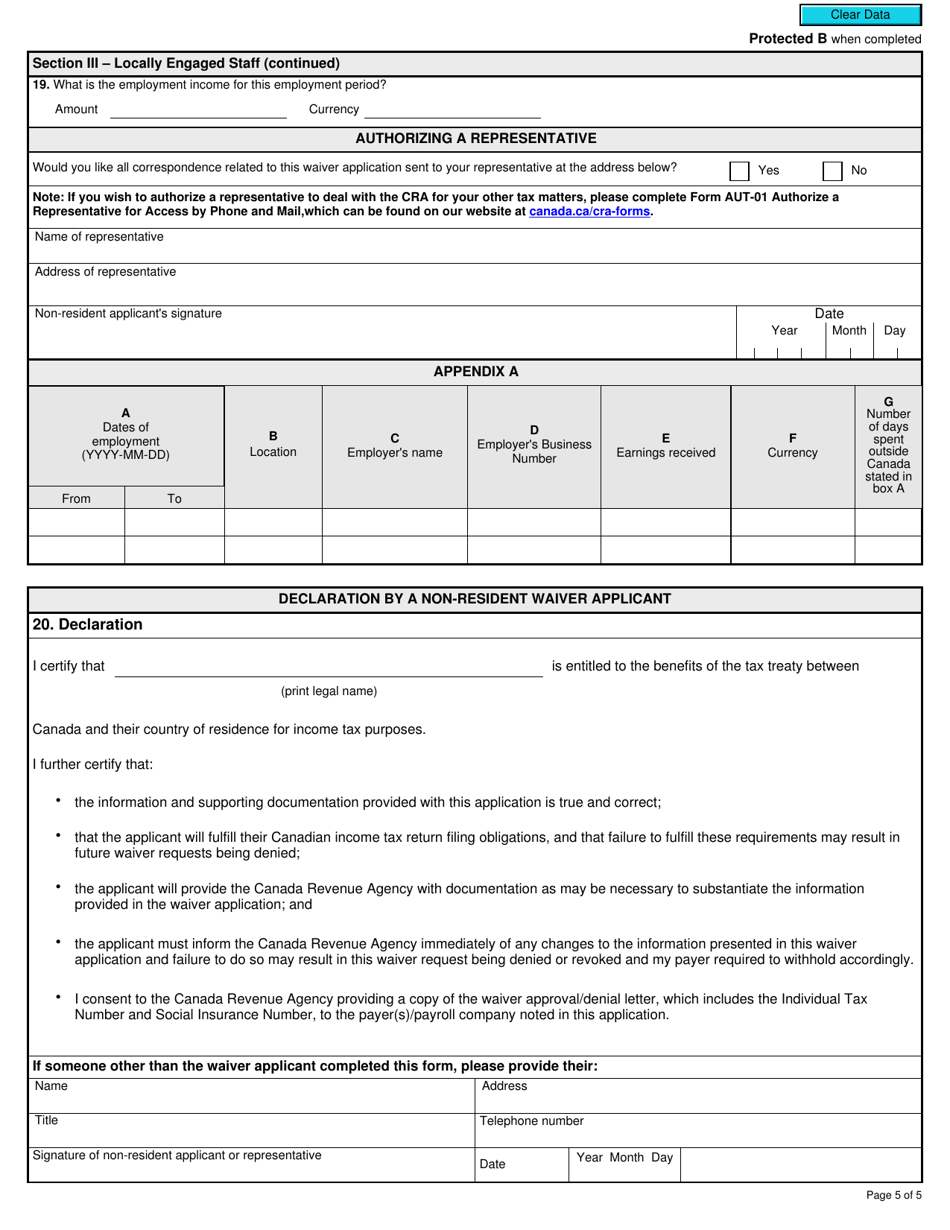

Form R102-R Regulation 102 Waiver Application - Canada

Form R102-R Regulation 102 Waiver Application in Canada is used for applying for a waiver from withholding tax for non-resident employees working in Canada.

The employer files the Form R102-R Regulation 102 Waiver application in Canada.

Form R102-R Regulation 102 Waiver Application - Canada - Frequently Asked Questions (FAQ)

Q: What is a form R102-R?

A: Form R102-R is the Regulation 102 Waiver Application that is required in Canada.

Q: What is Regulation 102?

A: Regulation 102 is a tax regulation in Canada that requires non-resident employers to withhold and remit Canadian income tax on remuneration paid to employees who perform services in Canada.

Q: Who needs to submit the form R102-R?

A: Non-resident employers who are subject to Regulation 102 and wish to apply for a waiver of the withholding requirement need to submit the form R102-R.

Q: What is the purpose of the form R102-R?

A: The form R102-R serves as an application for a waiver of the withholding requirement under Regulation 102 in Canada.

Q: What information is required in the form R102-R?

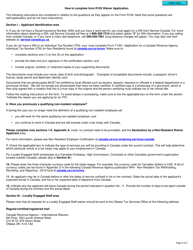

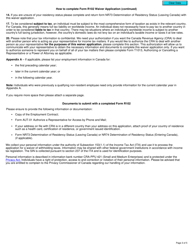

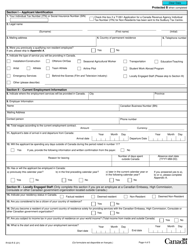

A: The form R102-R requires information about the non-resident employer, the employee, the type of services performed in Canada, and the basis for requesting the waiver.

Q: How long does it take to process the form R102-R?

A: The processing time for the form R102-R may vary, but it generally takes several weeks for the CRA to review and respond to the application.

Q: What happens if the form R102-R is approved?

A: If the form R102-R is approved, the non-resident employer will be granted a waiver of the withholding requirement and will not be required to withhold and remit Canadian income tax on the employee's remuneration.

Q: What happens if the form R102-R is denied?

A: If the form R102-R is denied, the non-resident employer will need to withhold and remit Canadian income tax on the employee's remuneration as required by Regulation 102.