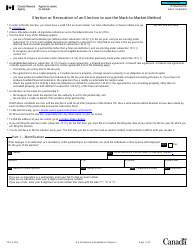

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4530

for the current year.

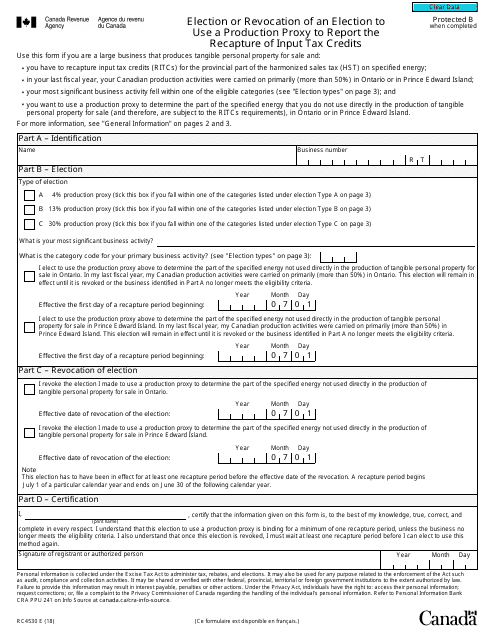

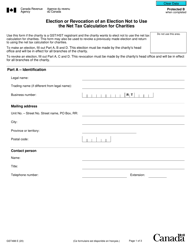

Form RC4530 Election or Revocation of an Election to Use a Production Proxy to Report the Recapture of Input Tax Credits - Canada

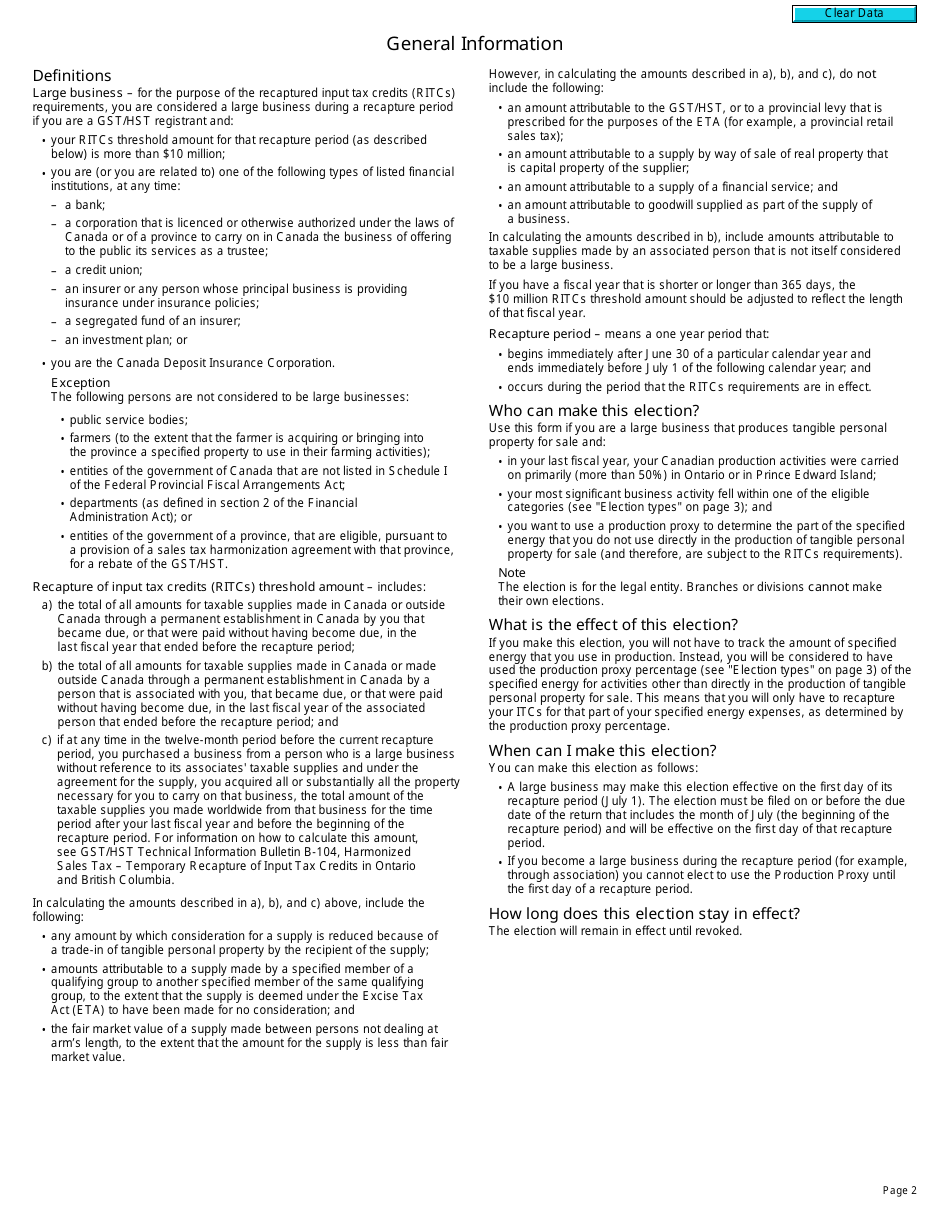

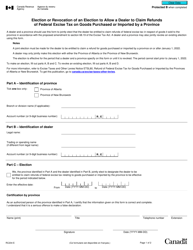

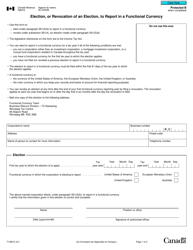

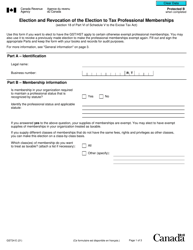

Form RC4530 Election or Revocation of an Election to Use a Production Proxy to Report the Recapture of Input Tax Credits in Canada is used to elect or revoke the election to use the production proxy method to report the recapture of input tax credits. This form is specific to Canada's tax system and is used by businesses to report and manage their taxes accurately.

The person or business who wants to report the recapture of input tax credits in Canada files the Form RC4530.

FAQ

Q: What is the Form RC4530?

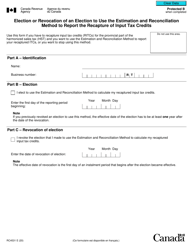

A: Form RC4530 is a form used in Canada for making an election or revocation of an election to use a production proxy to report the recapture of input tax credits.

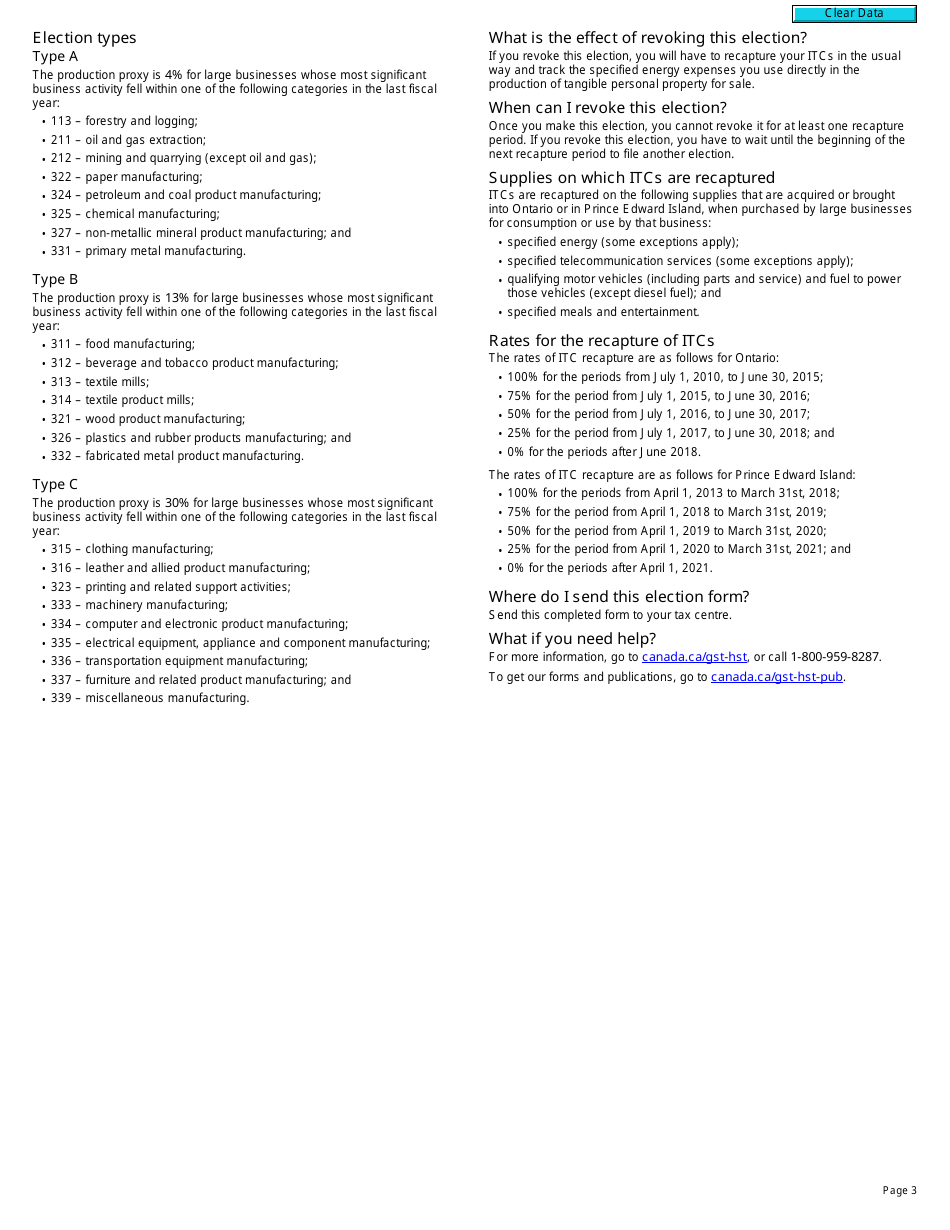

Q: What is a production proxy?

A: A production proxy is a method used by certain industries in Canada to calculate the amount of recaptured input tax credits.

Q: When should the Form RC4530 be filed?

A: The Form RC4530 should be filed by the due date for filing the GST/HST return for the reporting period in which the recapture of input tax credits occurs.

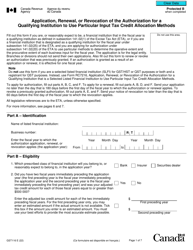

Q: Can I change my election once it has been made?

A: Yes, you can change your election by filing a new Form RC4530 to revoke the previous election.