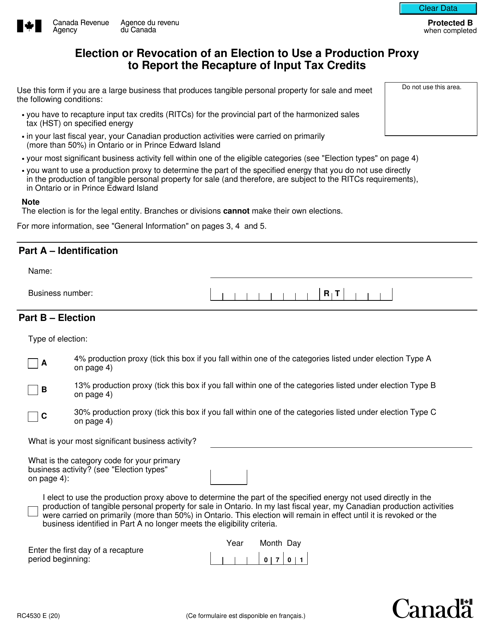

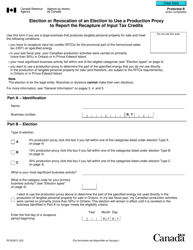

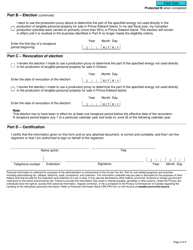

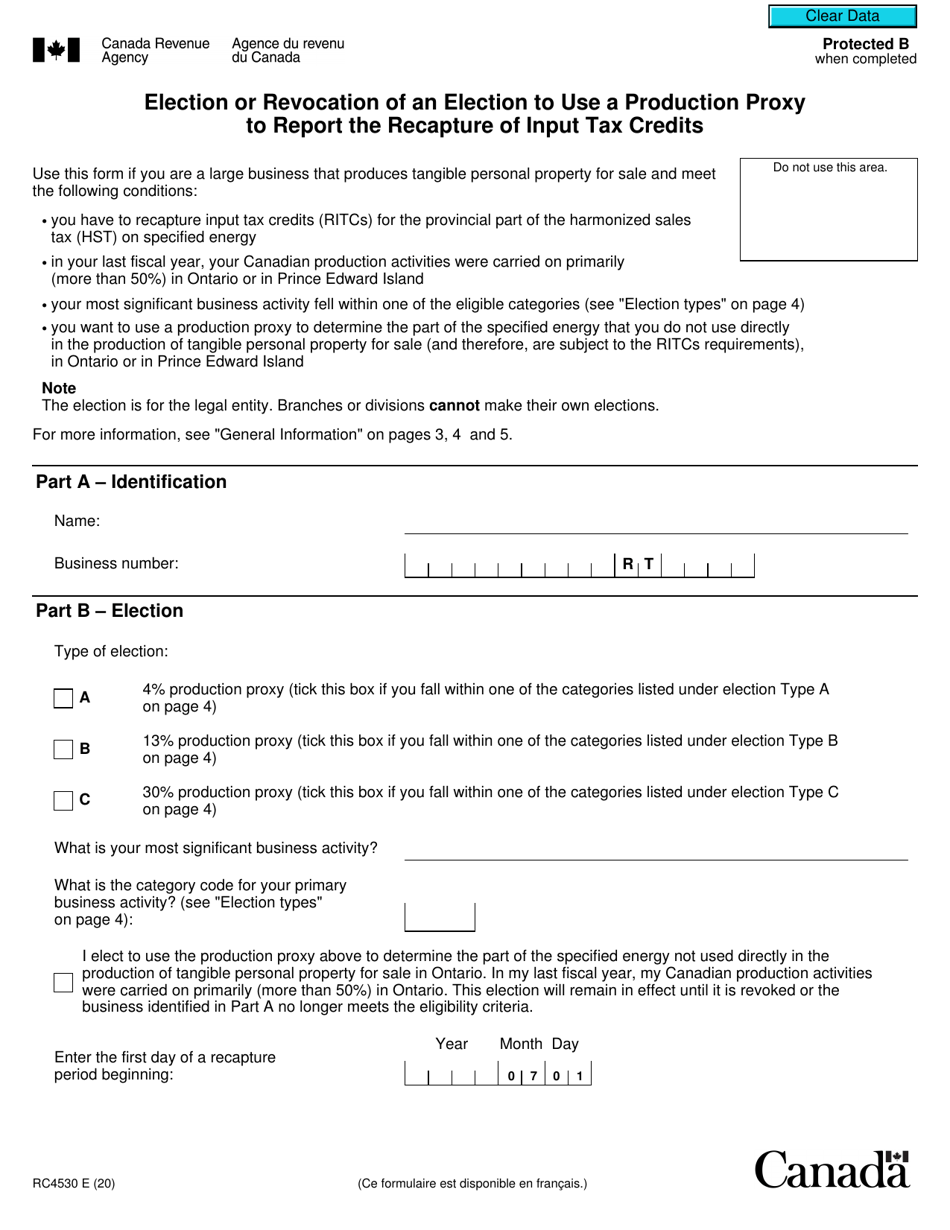

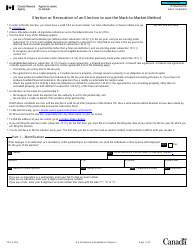

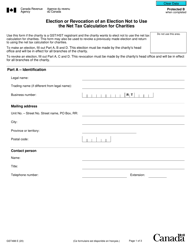

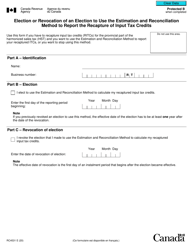

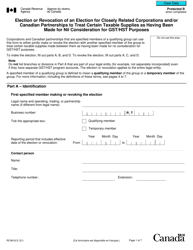

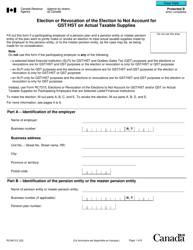

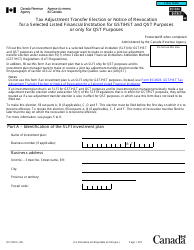

Form RC4530 Election or Revocation of an Election to Use a Production Proxy to Report the Recapture of Input Tax Credits - Canada

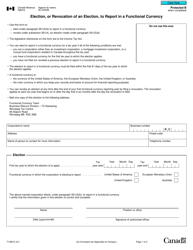

Form RC4530 is used in Canada to elect or revoke the election to use a production proxy for reporting the recapture of input tax credits. This form is specifically related to the Goods and Services Tax (GST) and Harmonized Sales Tax (HST) in Canada.

The Form RC4530 Election or Revocation of an Election to Use a Production Proxy to Report the Recapture of Input Tax Credits in Canada is filed by businesses who want to elect or revoke the election to use a production proxy for reporting the recapture of input tax credits.

Form RC4530 Election or Revocation of an Election to Use a Production Proxy to Report the Recapture of Input Tax Credits - Canada - Frequently Asked Questions (FAQ)

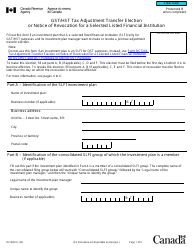

Q: What is Form RC4530?

A: Form RC4530 is used to make an election or revoke an election to use a production proxy to report the recapture of input tax credits in Canada.

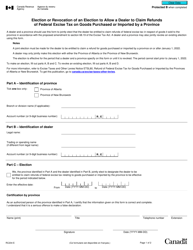

Q: What is a production proxy?

A: A production proxy is a method used to calculate input tax credits for certain industries in Canada, such as farming or fishing.

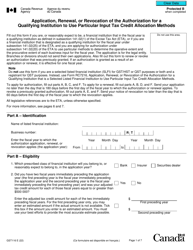

Q: When should I use Form RC4530?

A: You should use Form RC4530 if you want to make or revoke an election to use a production proxy to report the recapture of input tax credits.

Q: What are input tax credits?

A: Input tax credits are credits that businesses can claim to recover the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST) they paid on purchases related to their business.

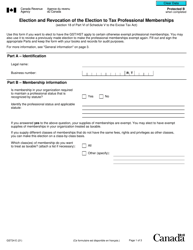

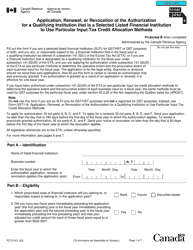

Q: Do I need to consult a tax professional to complete Form RC4530?

A: While it is not required, consulting a tax professional can help ensure that you correctly complete Form RC4530 and understand the implications of making or revoking an election to use a production proxy.

Q: Is there a deadline for submitting Form RC4530?

A: The deadline for submitting Form RC4530 depends on your specific situation. It is best to consult the instructions provided with the form or contact the CRA for more information.