This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4531

for the current year.

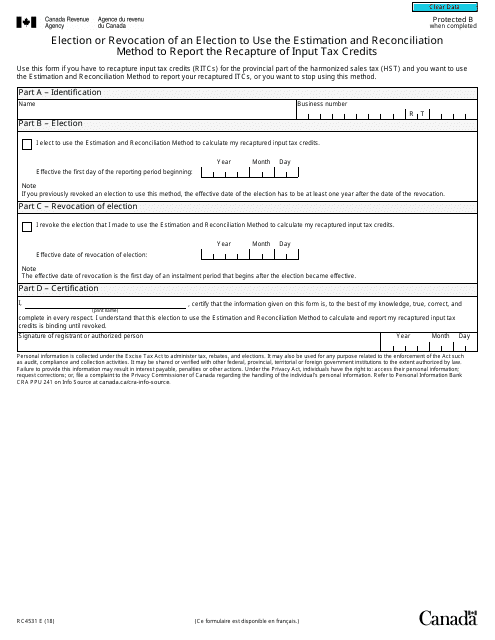

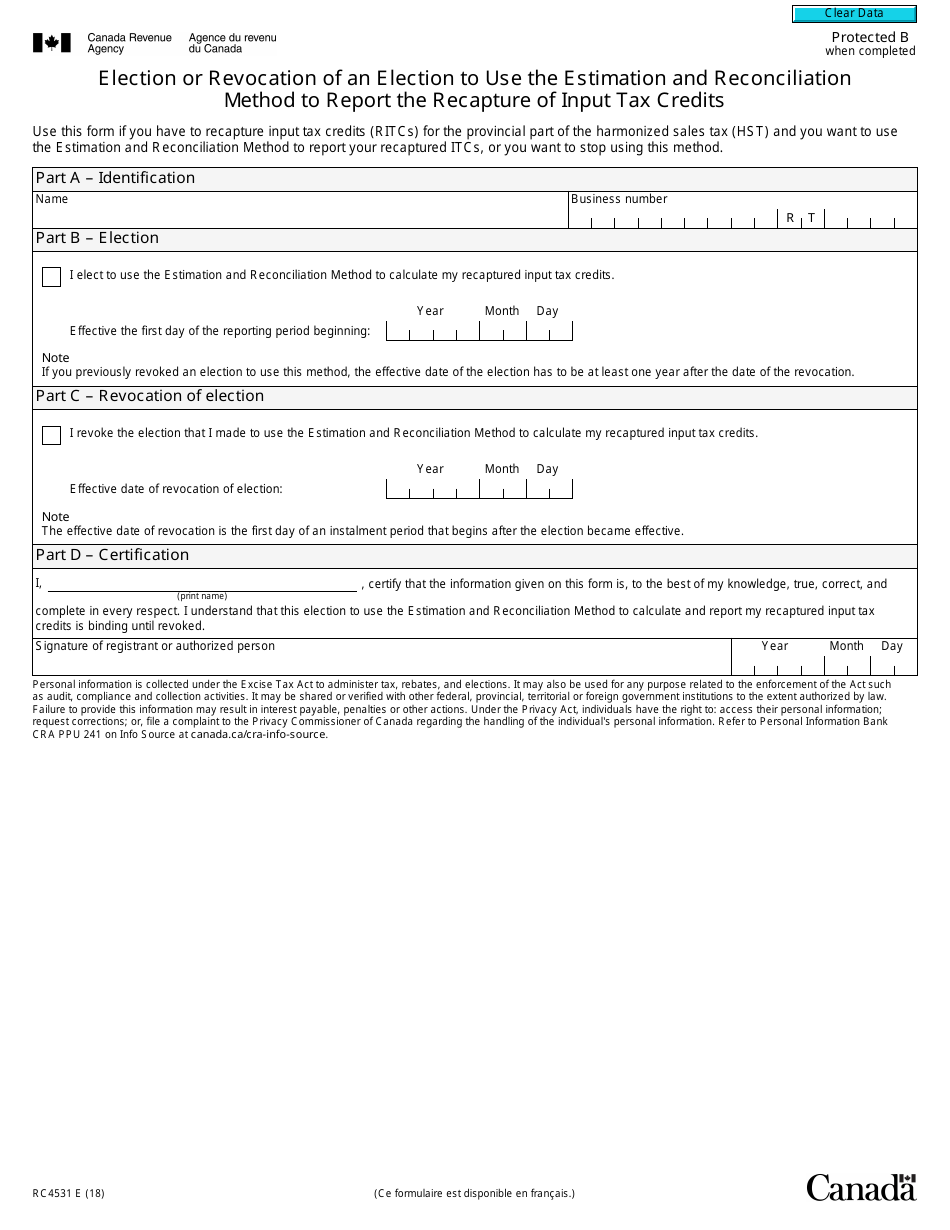

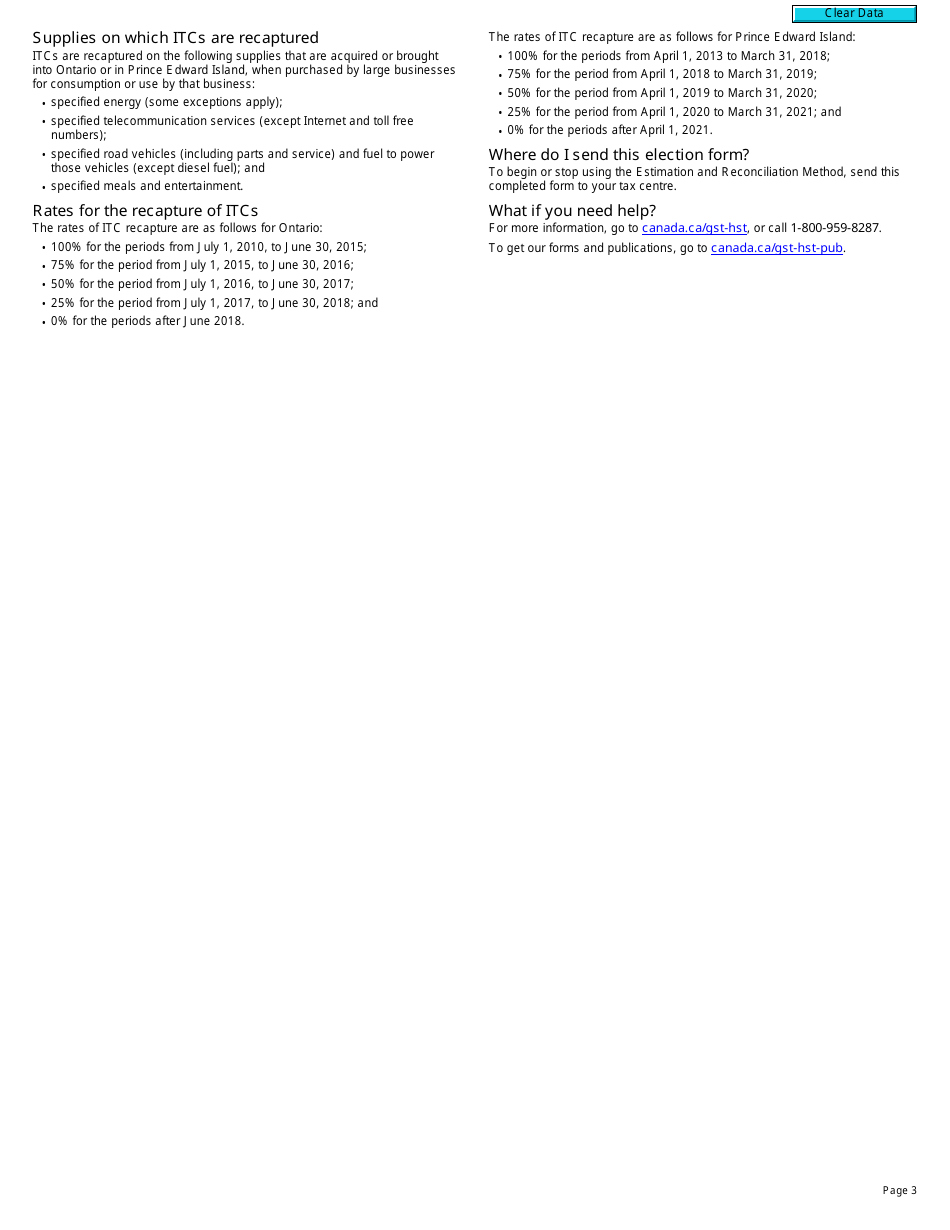

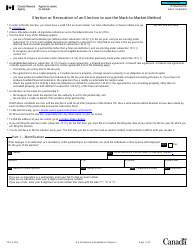

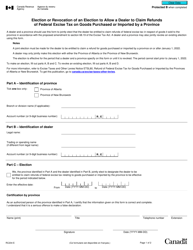

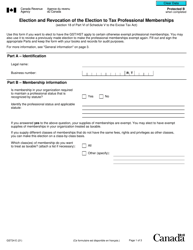

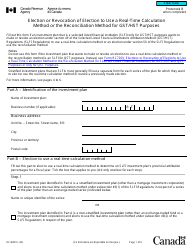

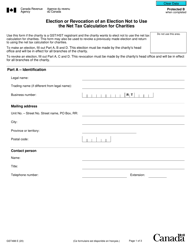

Form RC4531 Election or Revocation of an Election to Use the Estimation and Reconciliation Method to Report the Recapture of Input Tax Credits - Canada

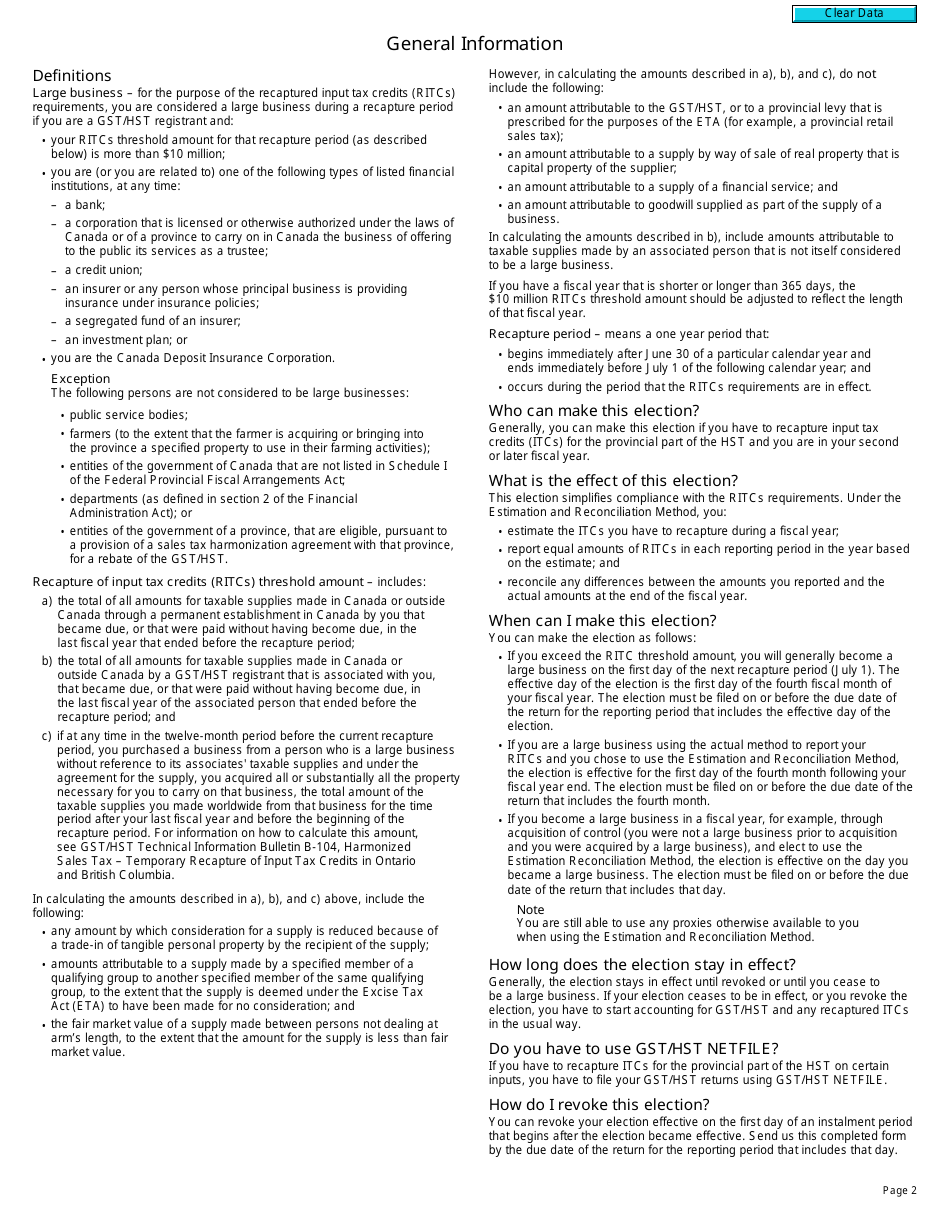

Form RC4531 Election or Revocation of an Election to Use the Estimation and Reconciliation Method to Report the Recapture of Input Tax Credits is used in Canada for reporting and reconciling the recapture of input tax credits. This form allows taxpayers to elect or revoke the election to use the estimation and reconciliation method for reporting the recapture of input tax credits.

The form RC4531 Election or Revocation of an Election to Use the Estimation and Reconciliation Method to Report the Recapture of Input Tax Credits in Canada is filed by businesses that want to use the estimation and reconciliation method to report the recapture of input tax credits.

FAQ

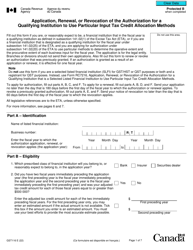

Q: What is Form RC4531 used for?

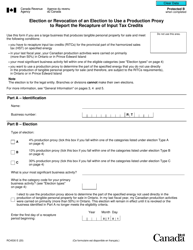

A: Form RC4531 is used for electing or revoking the election to use the Estimation and Reconciliation Method to report the recapture of Input Tax Credits in Canada.

Q: What is the Estimation and Reconciliation Method?

A: The Estimation and Reconciliation Method is a method of reporting the recapture of Input Tax Credits in Canada.

Q: Can I use Form RC4531 to report other tax information?

A: No, Form RC4531 is specifically used for reporting the recapture of Input Tax Credits only.

Q: Do I have to use the Estimation and Reconciliation Method?

A: No, using the Estimation and Reconciliation Method is optional. You can choose to use another method to report the recapture of Input Tax Credits.