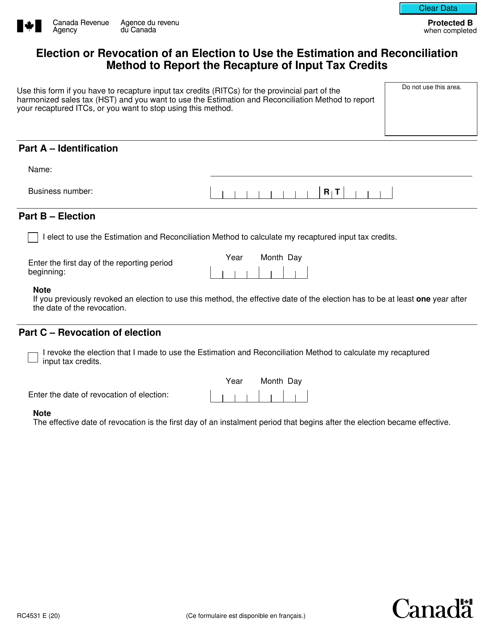

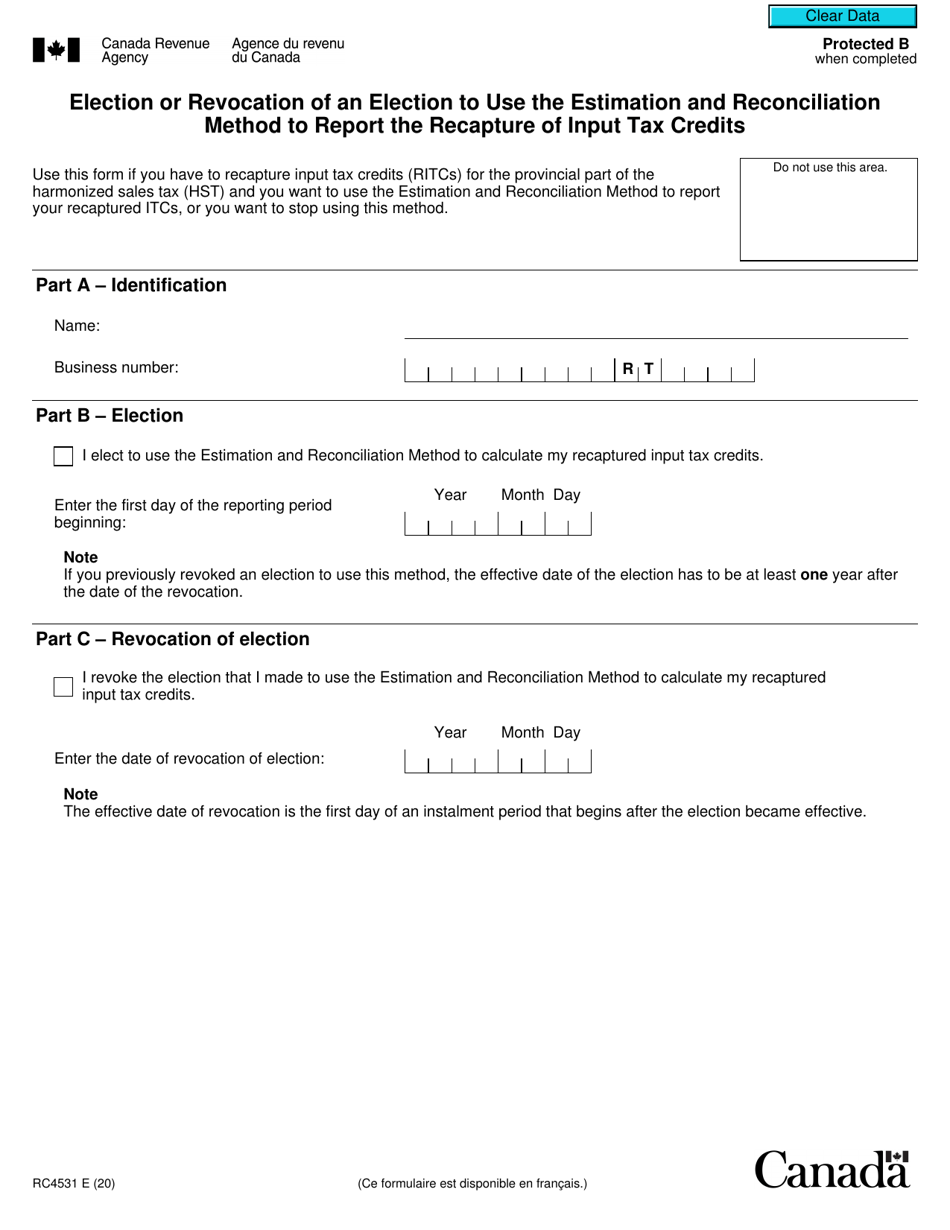

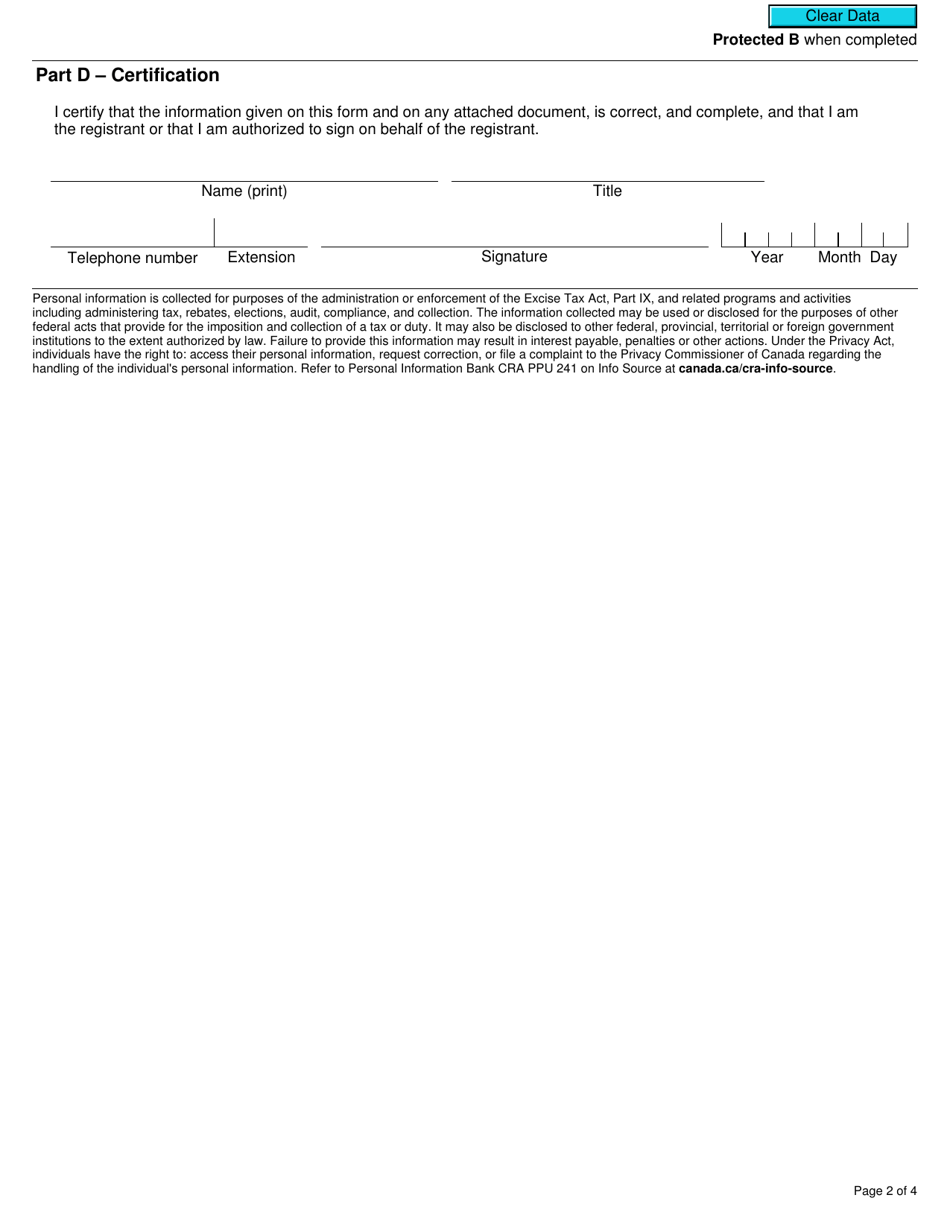

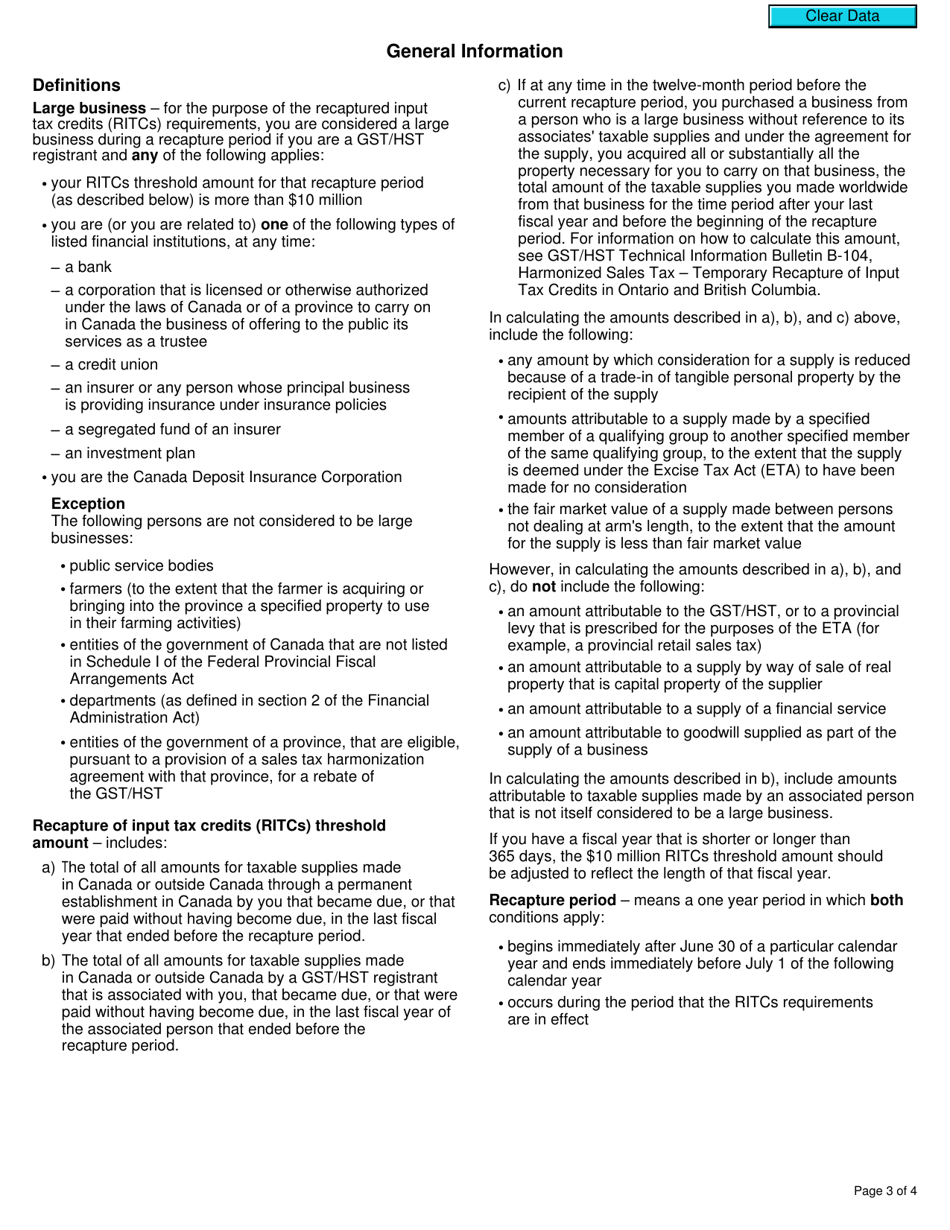

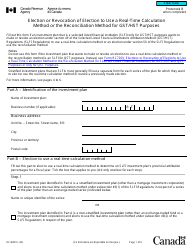

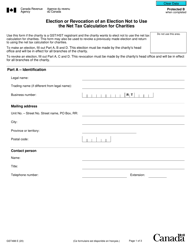

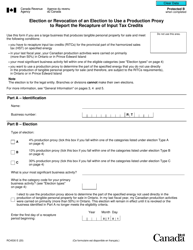

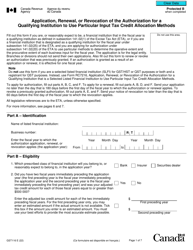

Form RC4531 Election or Revocation of an Election to Use the Estimation and Reconciliation Method to Report the Recapture of Input Tax Credits - Canada

Form RC4531 is used in Canada to make an election or revoke a previously made election to use the estimation and reconciliation method to report the recapture of input tax credits. This form is specifically related to the Goods and Services Tax/Harmonized Sales Tax (GST/HST) system in Canada. The estimation and reconciliation method allows a taxpayer to estimate and report certain adjustments related to input tax credits.

The form RC4531 Election or Revocation of an Election to Use the Estimation and Reconciliation Method to Report the Recapture of Input Tax Credits in Canada is filed by businesses who want to elect or revoke the election to use the estimation and reconciliation method for reporting the recapture of input tax credits.

Form RC4531 Election or Revocation of an Election to Use the Estimation and Reconciliation Method to Report the Recapture of Input Tax Credits - Canada - Frequently Asked Questions (FAQ)

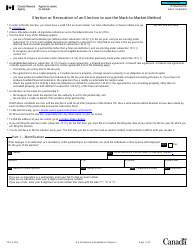

Q: What is Form RC4531?

A: Form RC4531 is a form used in Canada to make and revoke elections to use the Estimation and Reconciliation Method to report the recapture of input tax credits.

Q: What is the Estimation and Reconciliation Method?

A: The Estimation and Reconciliation Method is a method used to report the recapture of input tax credits in Canada.

Q: What is the recapture of input tax credits?

A: The recapture of input tax credits refers to the reversal and recovery of previously claimed tax credits.

Q: Why would I need to make an election using Form RC4531?

A: You may need to make an election using Form RC4531 if you want to use the Estimation and Reconciliation Method to report the recapture of input tax credits.

Q: Can I revoke an election made using Form RC4531?

A: Yes, you can revoke an election made using Form RC4531 by completing and submitting a new form.