This version of the form is not currently in use and is provided for reference only. Download this version of

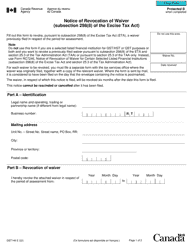

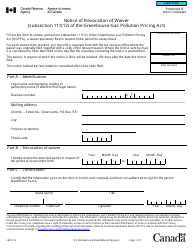

Form RC4600

for the current year.

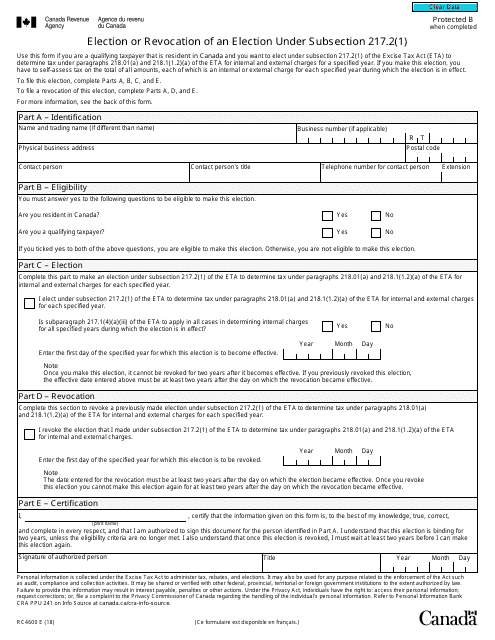

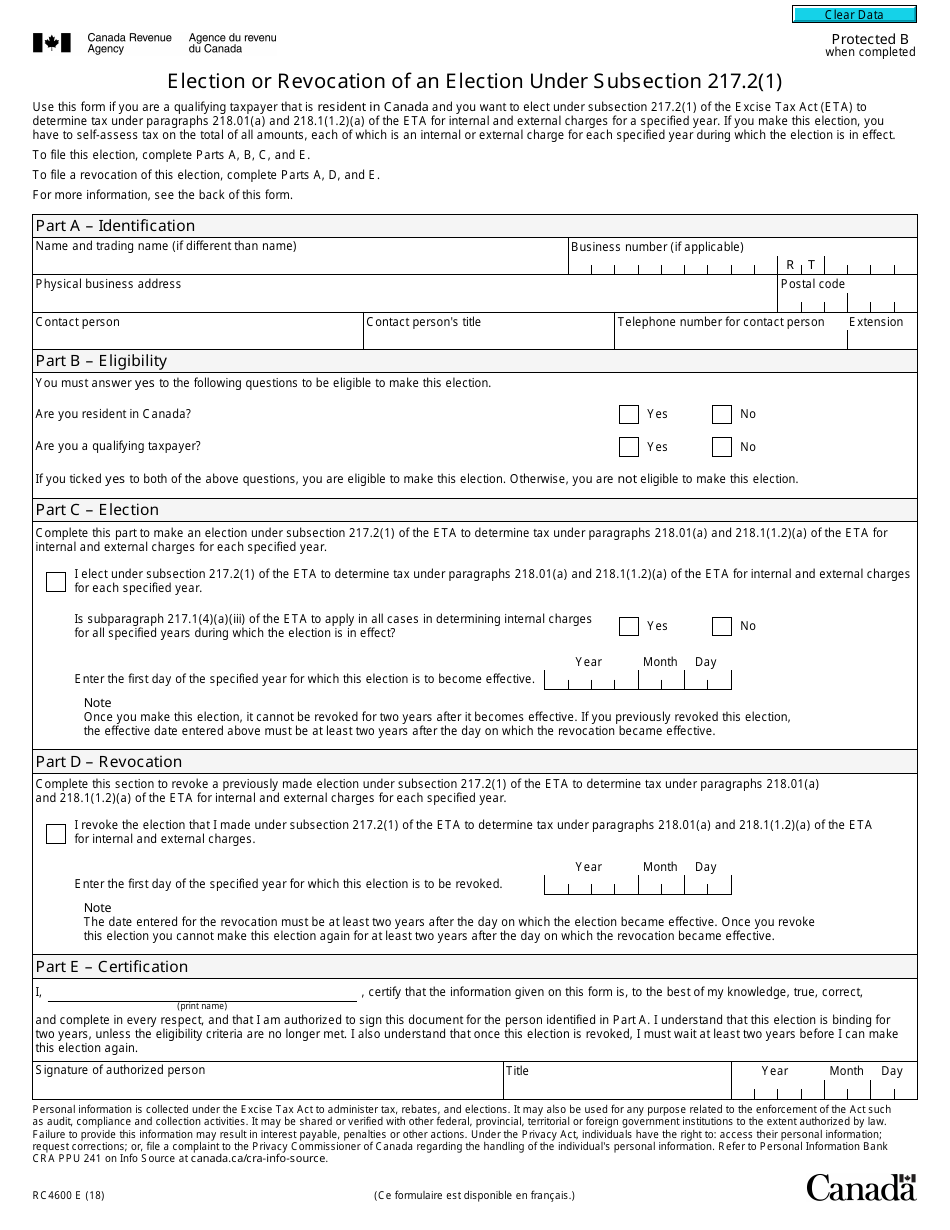

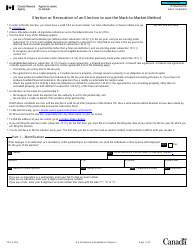

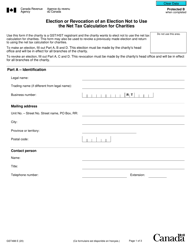

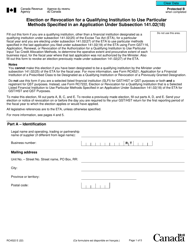

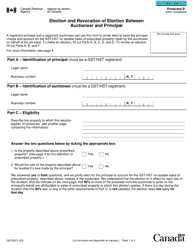

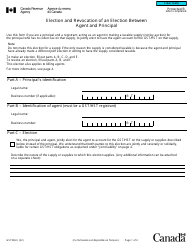

Form RC4600 Election or Revocation of an Election Under Subsection 217.2(1) - Canada

Form RC4600 Election or Revocation of an Election Under Subsection 217.2(1) in Canada is used to elect or revoke the election for a non-resident individual to be taxed under Canadian income tax rules for income earned from employment in Canada.

The Form RC4600, Election or Revocation of an Election Under Subsection 217.2(1), in Canada is filed by individuals who want to elect or revoke the election to report employment income earned in a foreign country while still contributing to the Canadian Pension Plan (CPP).

FAQ

Q: What is RC4600?

A: RC4600 is a form used in Canada to elect or revoke an election under subsection 217.2(1) of the Income Tax Act.

Q: What is the purpose of RC4600?

A: The purpose of RC4600 is to allow individuals to elect or revoke the election to split pension income with their spouse or common-law partner.

Q: Who can use RC4600?

A: Any individual who wants to split their pension income with their spouse or common-law partner can use RC4600.

Q: How do I fill out RC4600?

A: To fill out RC4600, you need to provide your personal information, the personal information of your spouse or common-law partner, and the details of the pension income you want to split.