This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4604

for the current year.

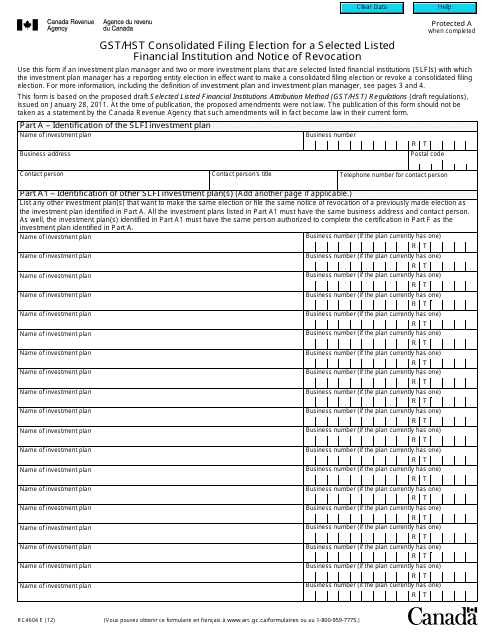

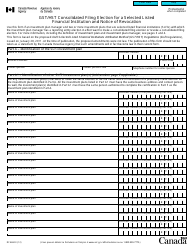

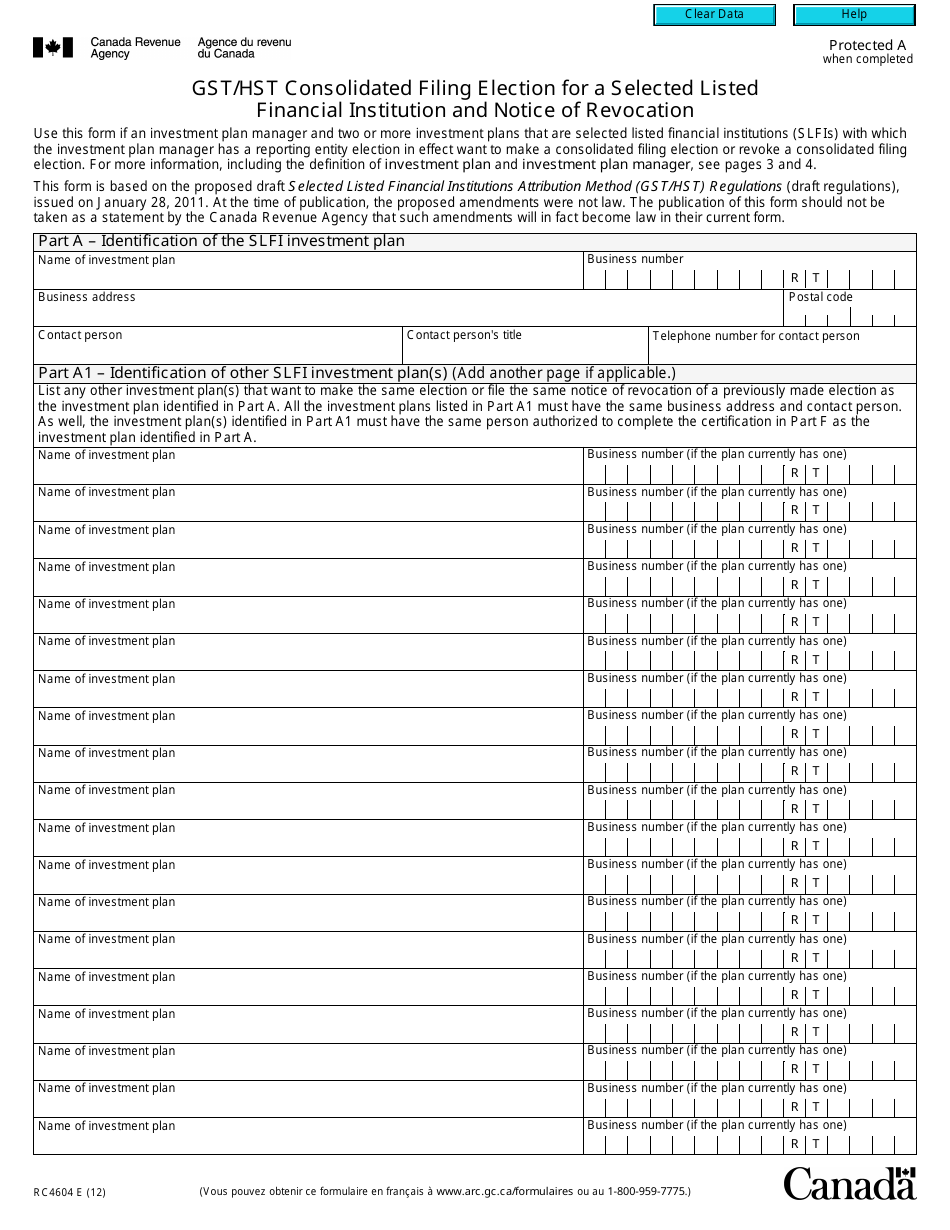

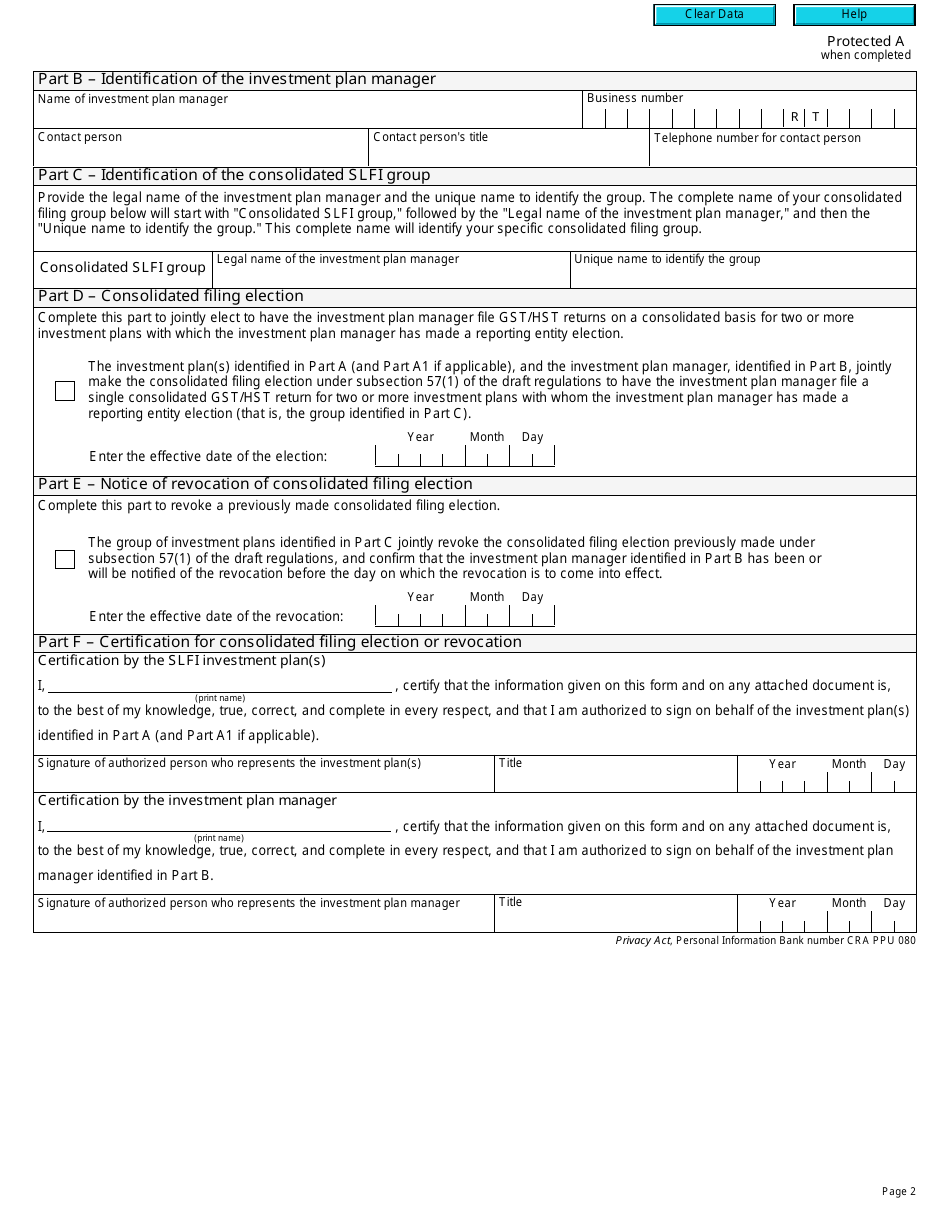

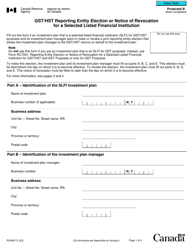

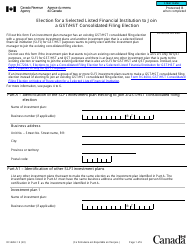

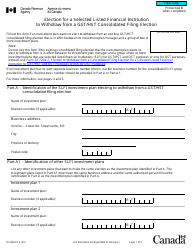

Form RC4604 Gst / Hst Consolidated Filing Election for a Selected Listed Financial Institution and Notice of Revocation - Canada

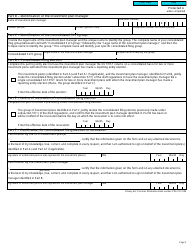

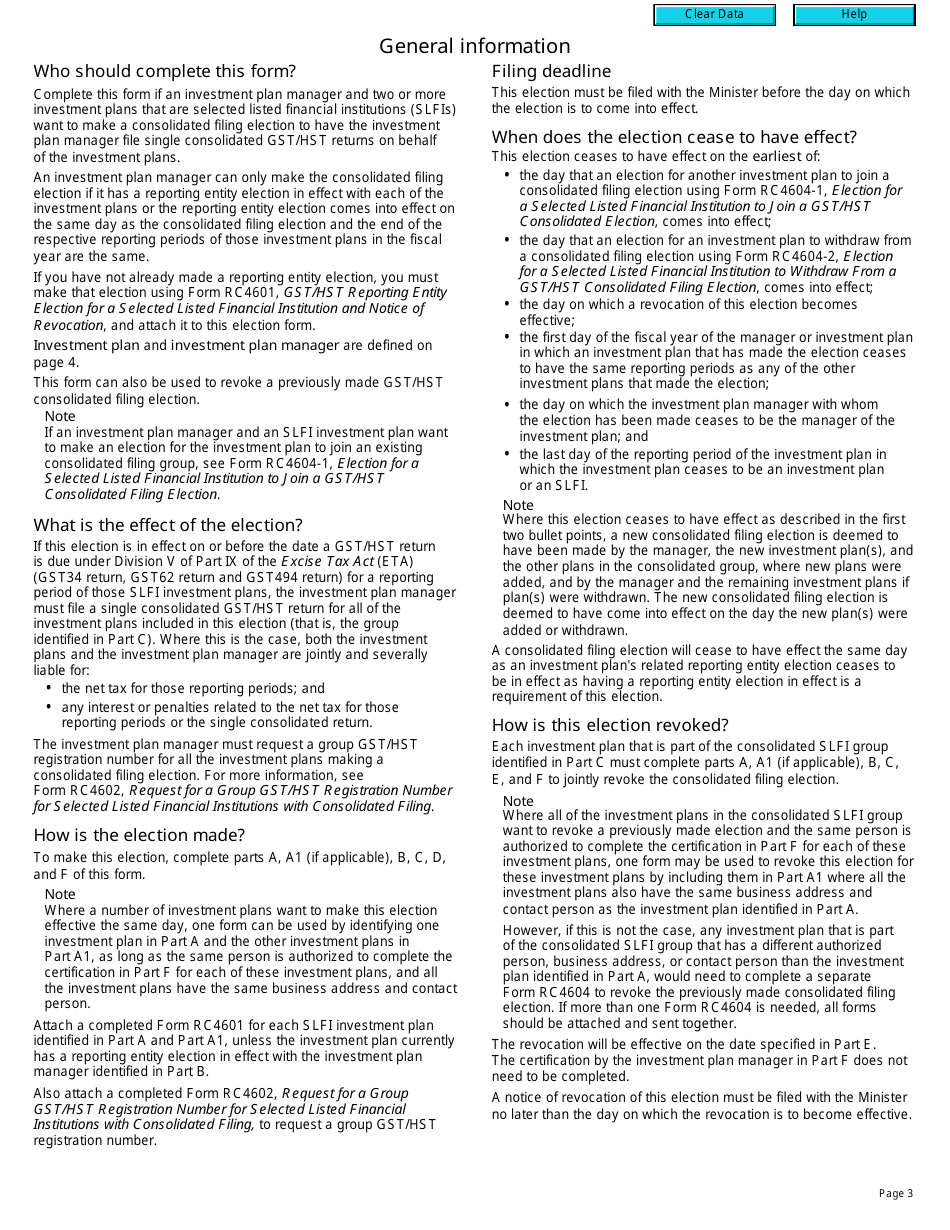

Form RC4604 GST/HST Consolidated Filing Election for a Selected Listed Financial Institution and Notice of Revocation is used in Canada by financial institutions to elect or revoke their ability to file their Goods and Services Tax/Harmonized Sales Tax (GST/HST) returns and financial institution GST/HST returns on a consolidated basis. This form allows financial institutions to streamline their filing process for these taxes.

The Form RC4604 GST/HST Consolidated Filing Election for a Selected Listed Financial Institution and Notice of Revocation in Canada is filed by the Selected Listed Financial Institution itself.

FAQ

Q: What is Form RC4604?

A: Form RC4604 is the GST/HST Consolidated Filing Election for a Selected Listed Financial Institution and Notice of Revocation.

Q: What is the purpose of Form RC4604?

A: The purpose of Form RC4604 is to elect or revoke the option for a listed financial institution to file a consolidated Goods and Services Tax (GST)/Harmonized Sales Tax (HST) return.

Q: What is a listed financial institution?

A: A listed financial institution is a financial institution that is registered under specified provisions of the Excise Tax Act.

Q: What is a consolidated GST/HST return?

A: A consolidated GST/HST return is a single return that includes the GST or HST amounts of all members of a group that has elected to file a consolidated return.

Q: How can I elect or revoke the consolidated filing option?

A: You can elect or revoke the consolidated filing option by completing and submitting Form RC4604 to the Canada Revenue Agency.

Q: Are there any requirements or conditions for filing a consolidated GST/HST return?

A: Yes, there are specific requirements and conditions that must be met in order to file a consolidated GST/HST return. These requirements are outlined in the instructions for Form RC4604.