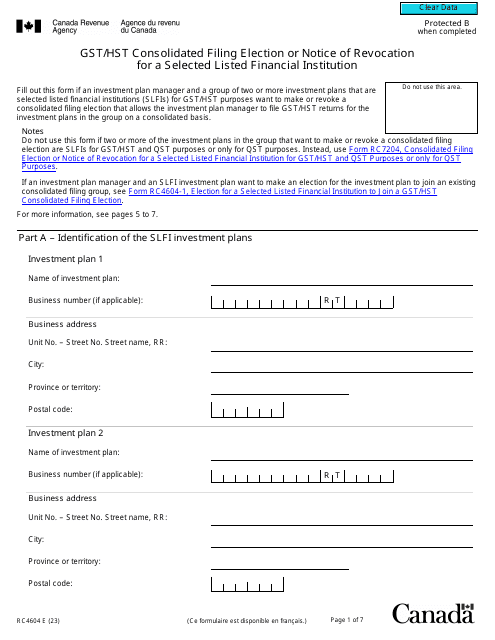

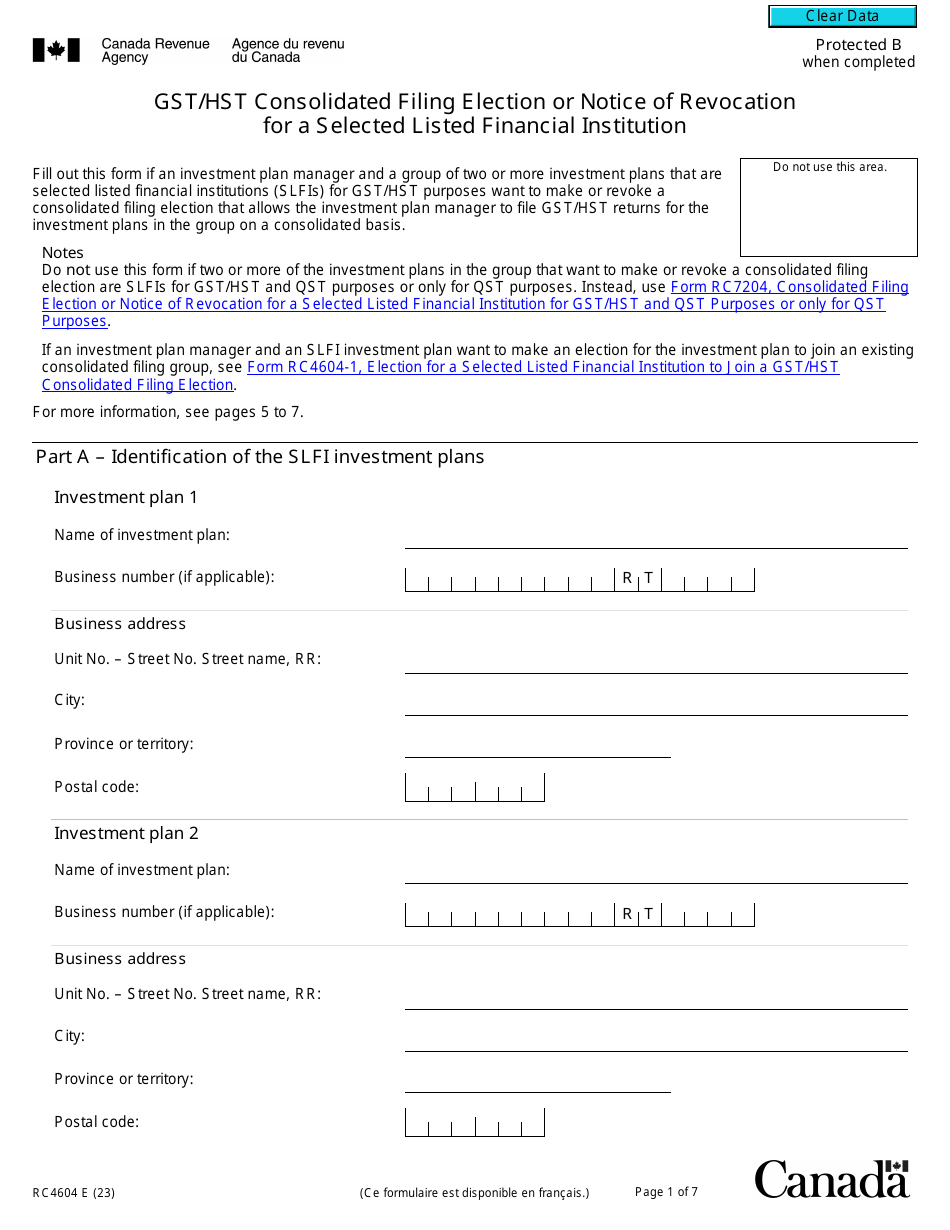

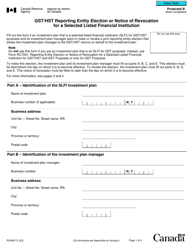

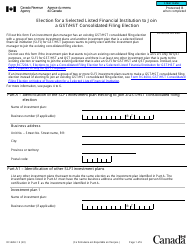

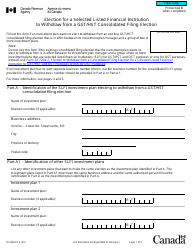

Form RC4604 Gst / Hst Consolidated Filing Election or Notice of Revocation for a Selected Listed Financial Institution - Canada

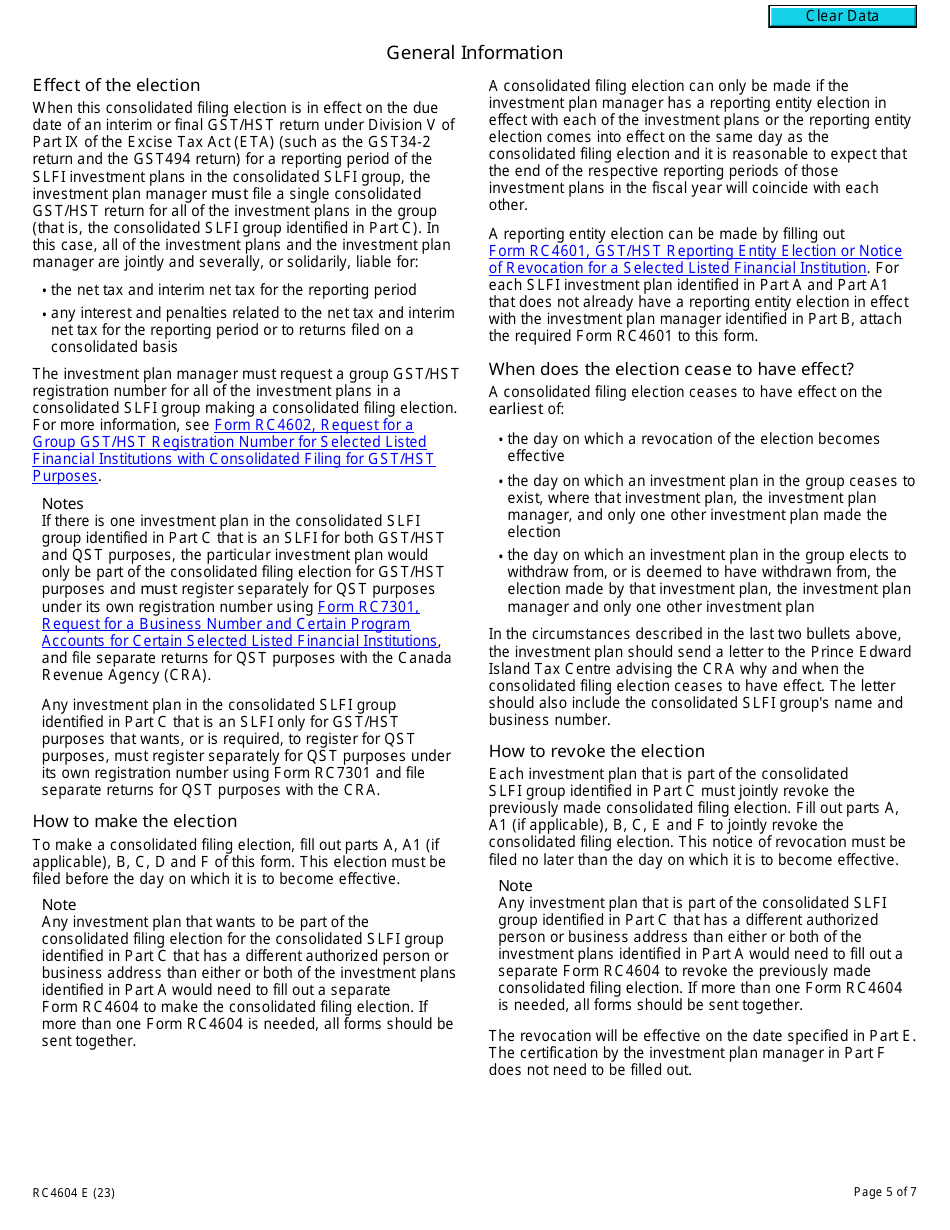

Form RC4604 GST/HST Consolidated Filing Election or Notice of Revocation for a Selected Listed Financial Institution in Canada is used by financial institutions to elect or revoke their election to file a consolidated Goods and Services Tax/Harmonized Sales Tax (GST/HST) return. The form allows the financial institution to report the GST/HST for all its branches or divisions in a single return, simplifying the filing process.

The selected listed financial institution in Canada files the Form RC4604 GST/HST Consolidated Filing Election or Notice of Revocation.

Form RC4604 Gst/Hst Consolidated Filing Election or Notice of Revocation for a Selected Listed Financial Institution - Canada - Frequently Asked Questions (FAQ)

Q: What is the Form RC4604?

A: Form RC4604 is the GST/HST Consolidated Filing Election or Notice of Revocation for a Selected Listed Financial Institution in Canada.

Q: Who can use Form RC4604?

A: Form RC4604 is used by Selected Listed Financial Institutions in Canada to make an election to file a single GST/HST return for multiple related entities.

Q: What is the purpose of Form RC4604?

A: The purpose of Form RC4604 is to simplify the GST/HST filing process for Selected Listed Financial Institutions by allowing them to submit a consolidated return instead of separate returns for each entity.

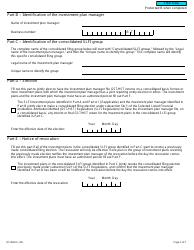

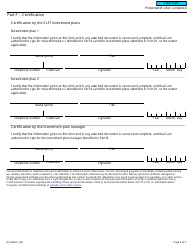

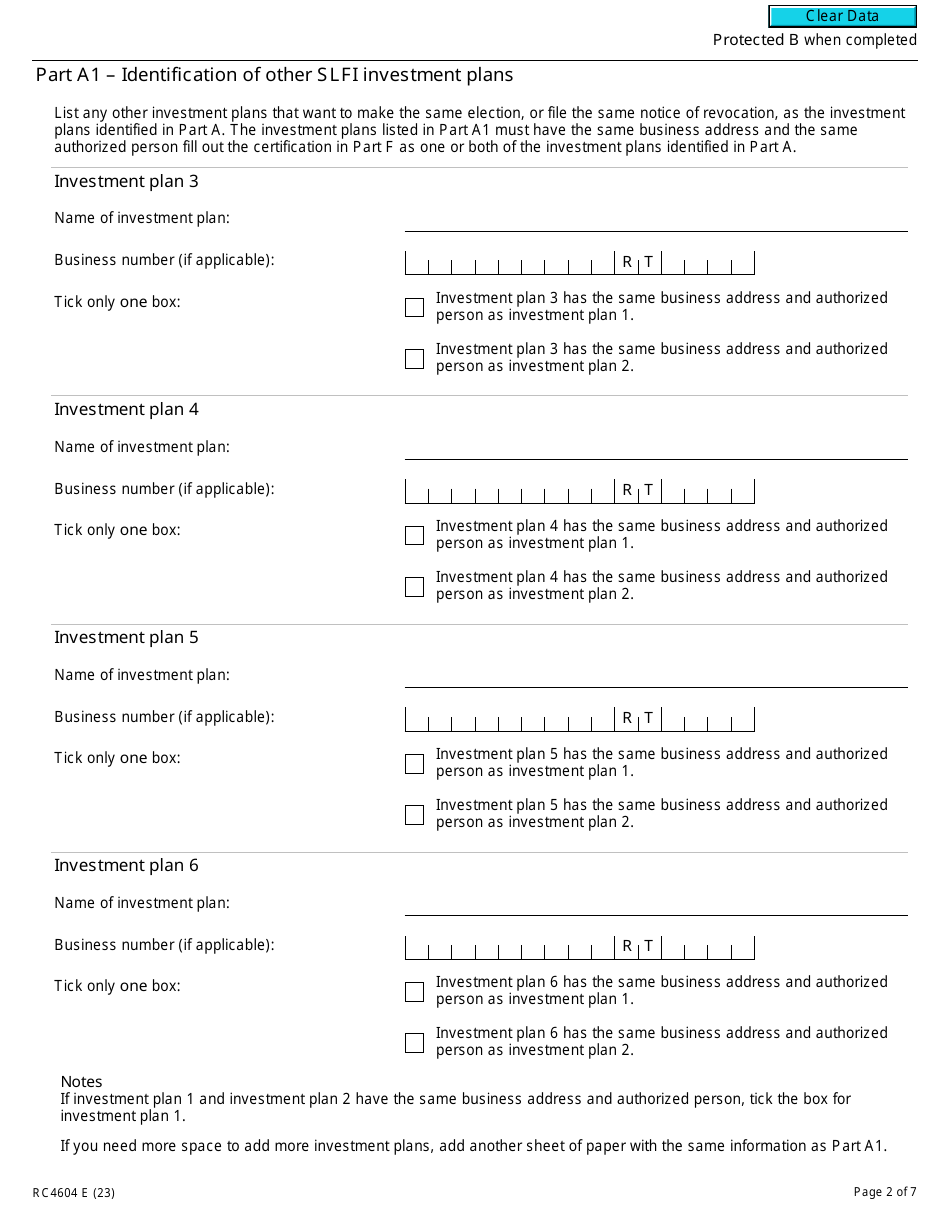

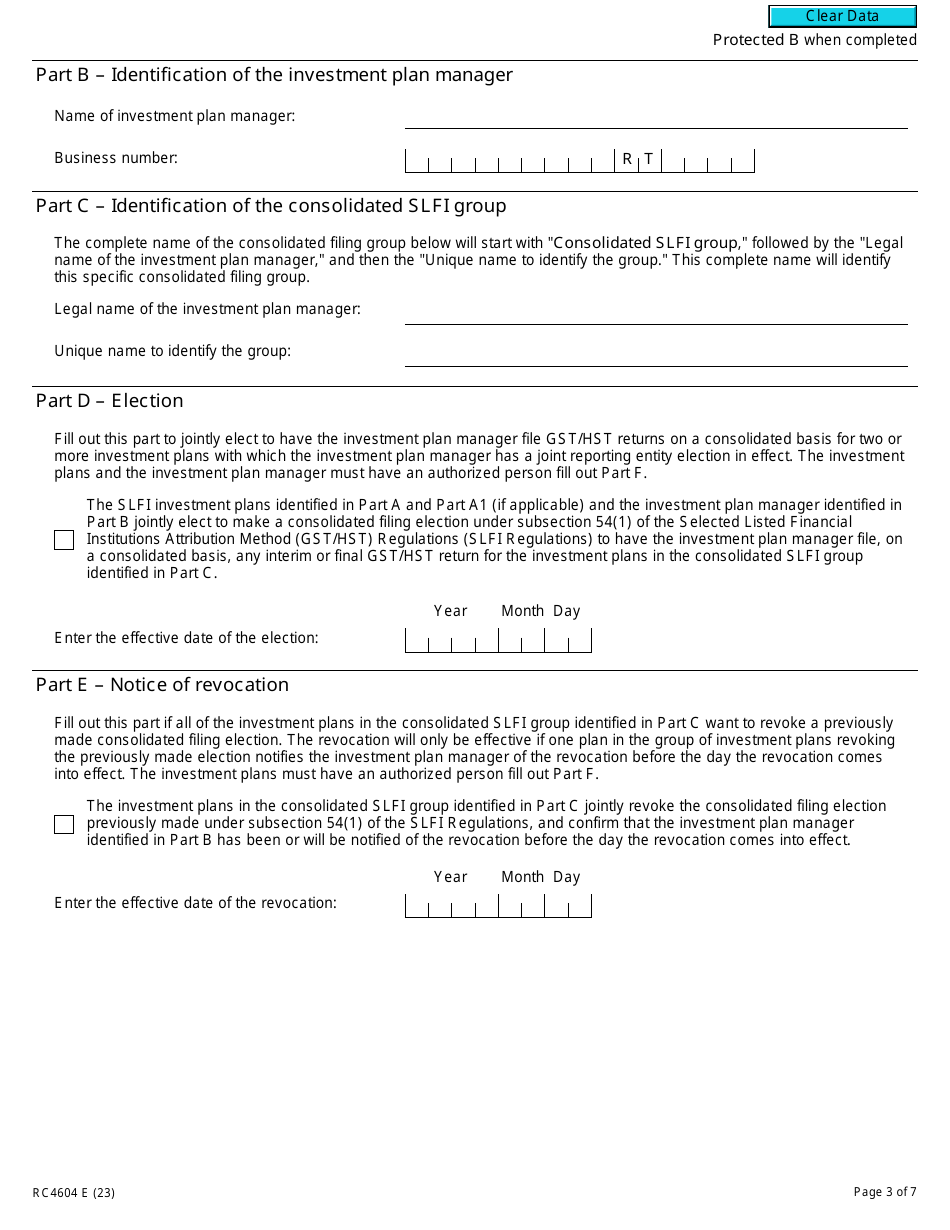

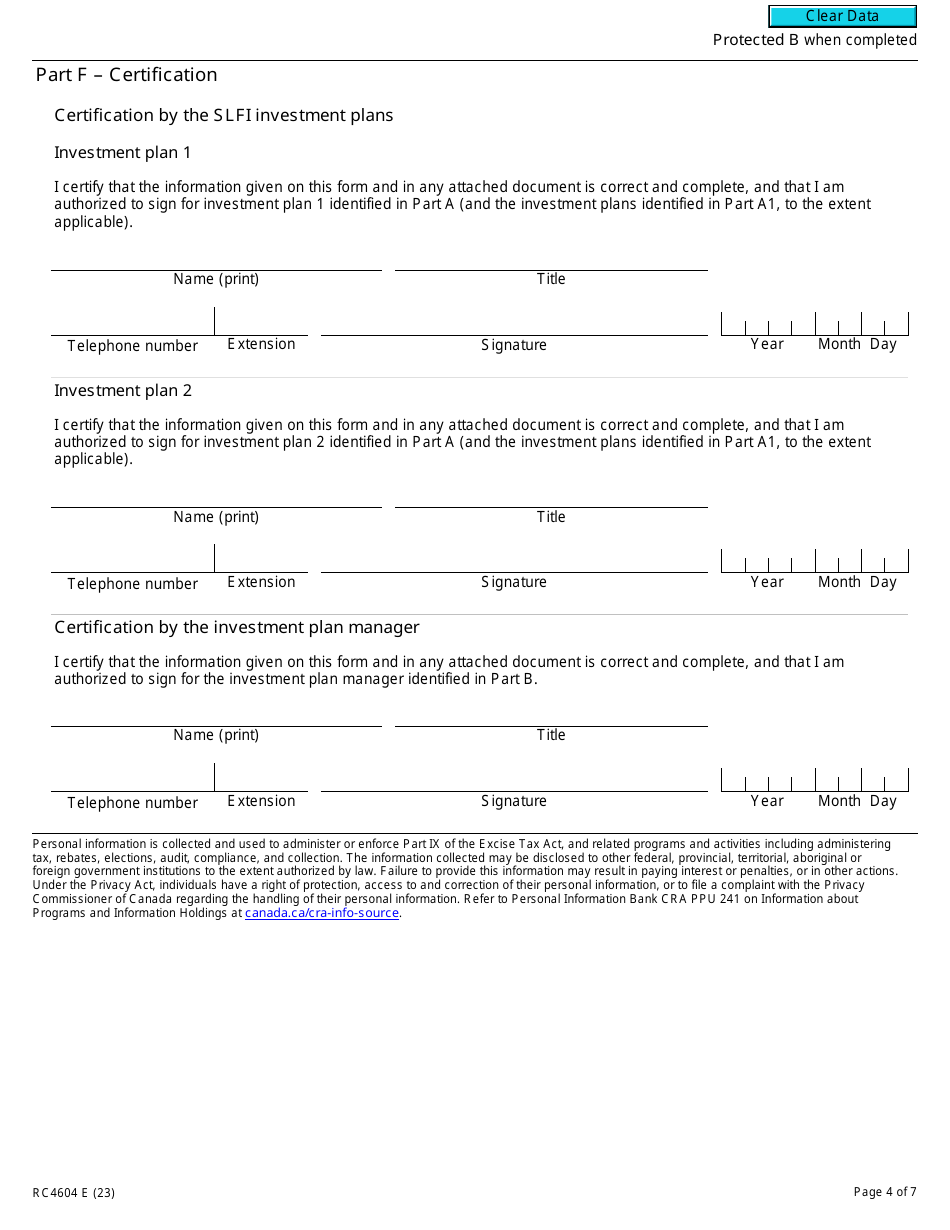

Q: What information is required in Form RC4604?

A: Form RC4604 requires information about the financial institution, related entities, and the election or revocation of the consolidated filing.

Q: Are there any conditions or criteria to be eligible for using Form RC4604?

A: Yes, there are specific conditions and criteria that must be met in order to be eligible to make the consolidated filing election. These include being a Selected Listed Financial Institution and having related entities for which the election is being made.

Q: What should I do if I want to revoke the election made using Form RC4604?

A: If you want to revoke the election made using Form RC4604, you can submit a Notice of Revocation to the CRA.