This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4604-1

for the current year.

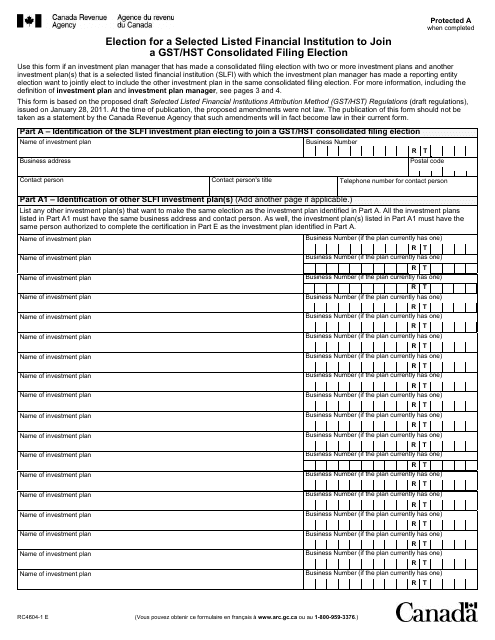

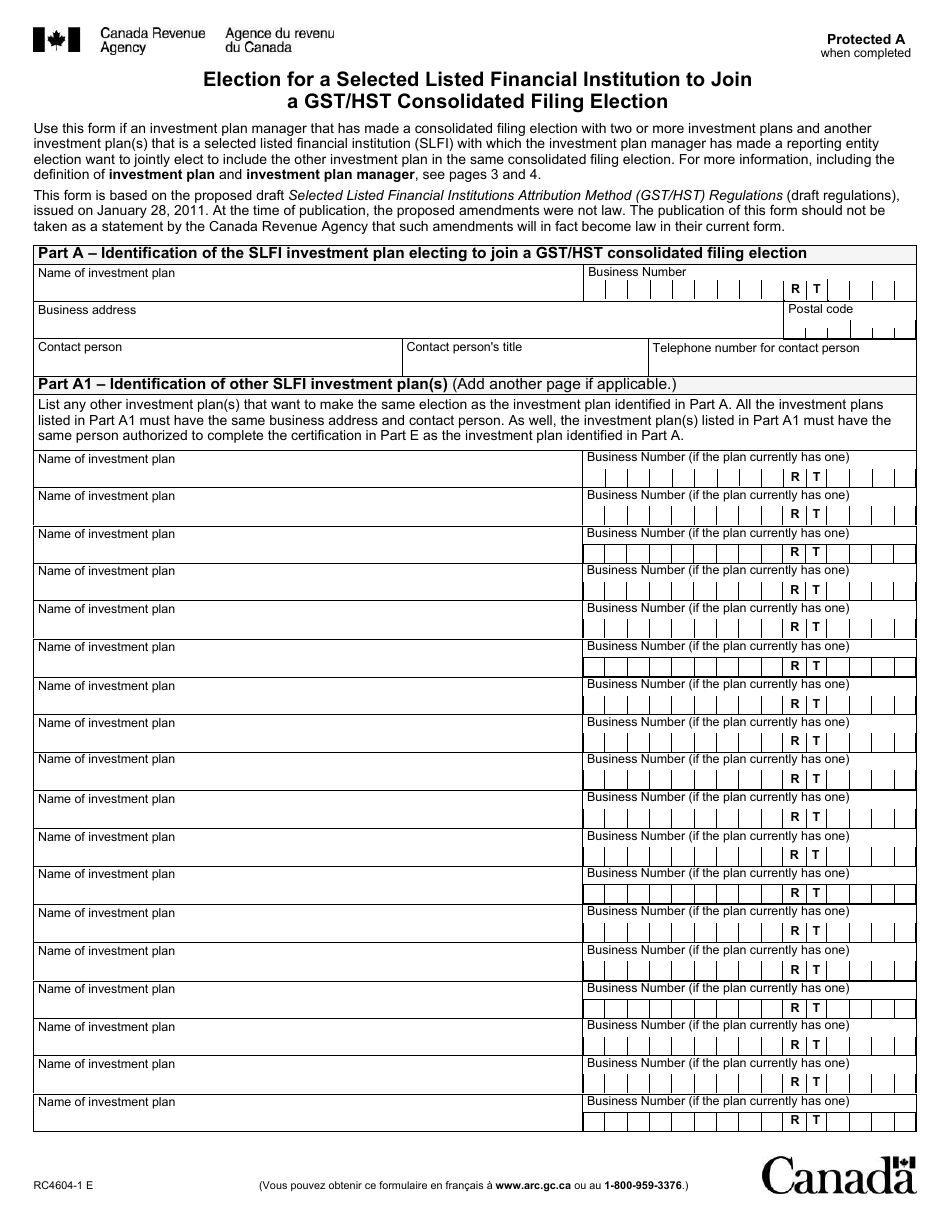

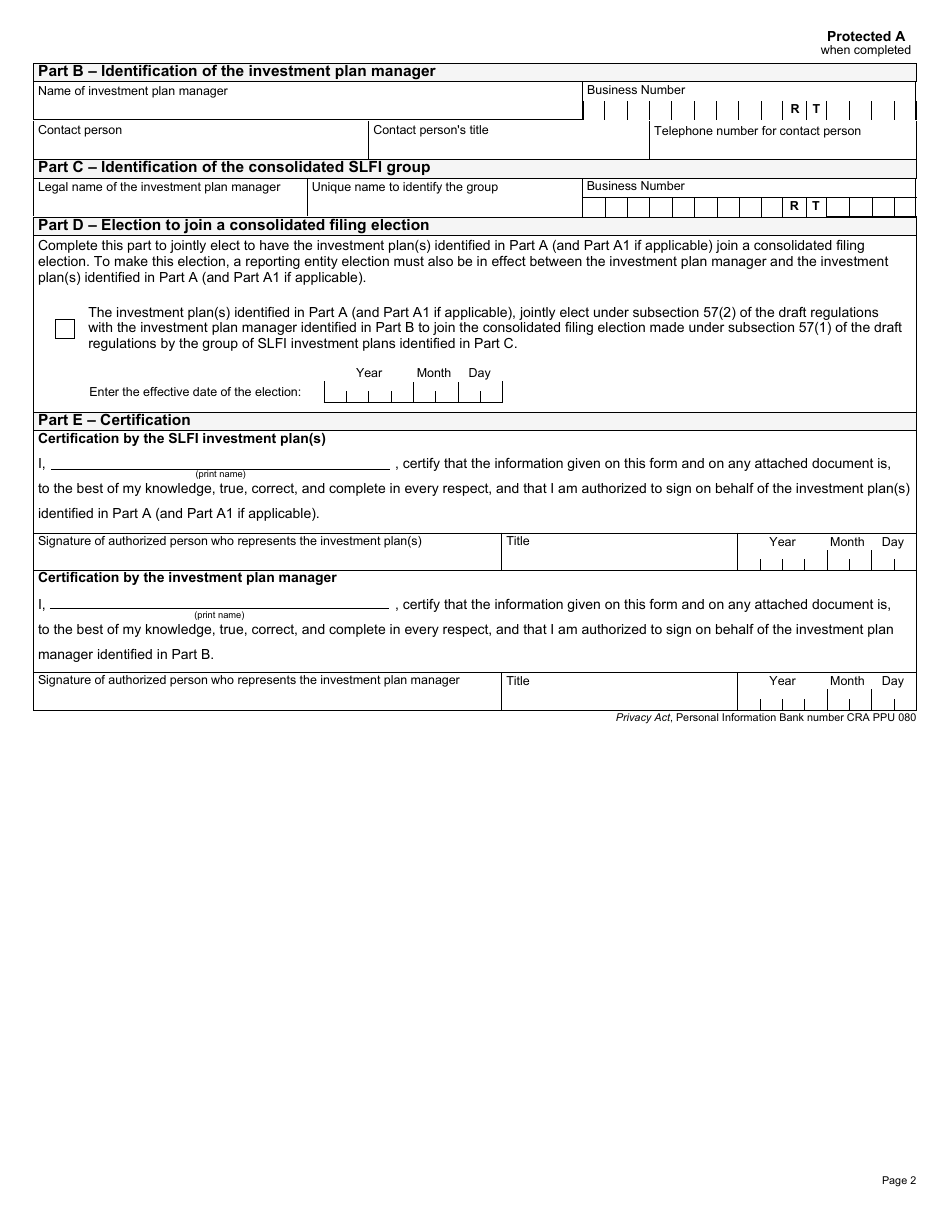

Form RC4604-1 Election for a Selected Listed Financial Institution to Join a Gst / Hst Consolidated Filing Election - Canada

Form RC4604-1 Election for a Selected Listed Financial Institution to Join a GST/HST Consolidated Filing Election in Canada is used to request permission to be included in a consolidated filing for the Goods and Services Tax/Harmonized Sales Tax (GST/HST) purposes.

The selected listed financial institution files the Form RC4604-1 Election for a GST/HST consolidated filing election in Canada.

FAQ

Q: What is Form RC4604-1?

A: Form RC4604-1 is an election form for a selected listed financial institution (SLFI) in Canada to join a GST/HST consolidated filing election.

Q: What is the purpose of Form RC4604-1?

A: The purpose of Form RC4604-1 is to allow a selected listed financial institution (SLFI) to elect to join a GST/HST consolidated filing election in Canada.

Q: Who can use Form RC4604-1?

A: Form RC4604-1 can be used by selected listed financial institutions (SLFIs) in Canada.

Q: What is a selected listed financial institution (SLFI)?

A: A selected listed financial institution (SLFI) is a specified type of financial institution that is required to file a GST/HST return.

Q: What is a GST/HST consolidated filing election?

A: A GST/HST consolidated filing election allows selected listed financial institutions (SLFIs) to file a single GST/HST return for multiple locations.

Q: Are there any deadlines for submitting Form RC4604-1?

A: Yes, Form RC4604-1 must be submitted on or before the day the first GST/HST return for the selected listed financial institution (SLFI) is due.

Q: What should I do if I have questions about Form RC4604-1?

A: If you have questions about Form RC4604-1, you can contact the Canada Revenue Agency for assistance.