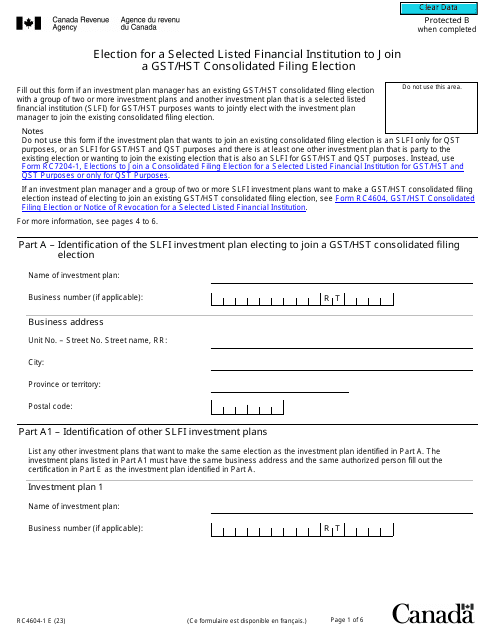

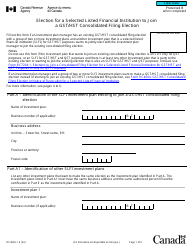

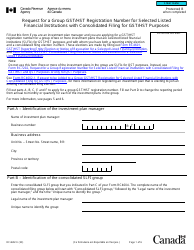

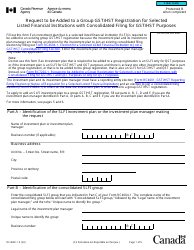

Form RC4604-1 Election for a Selected Listed Financial Institution to Join a Gst / Hst Consolidated Filing Election - Canada

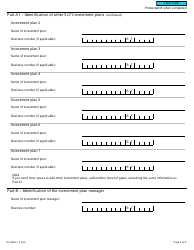

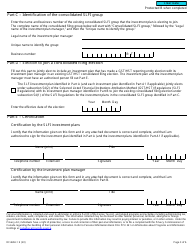

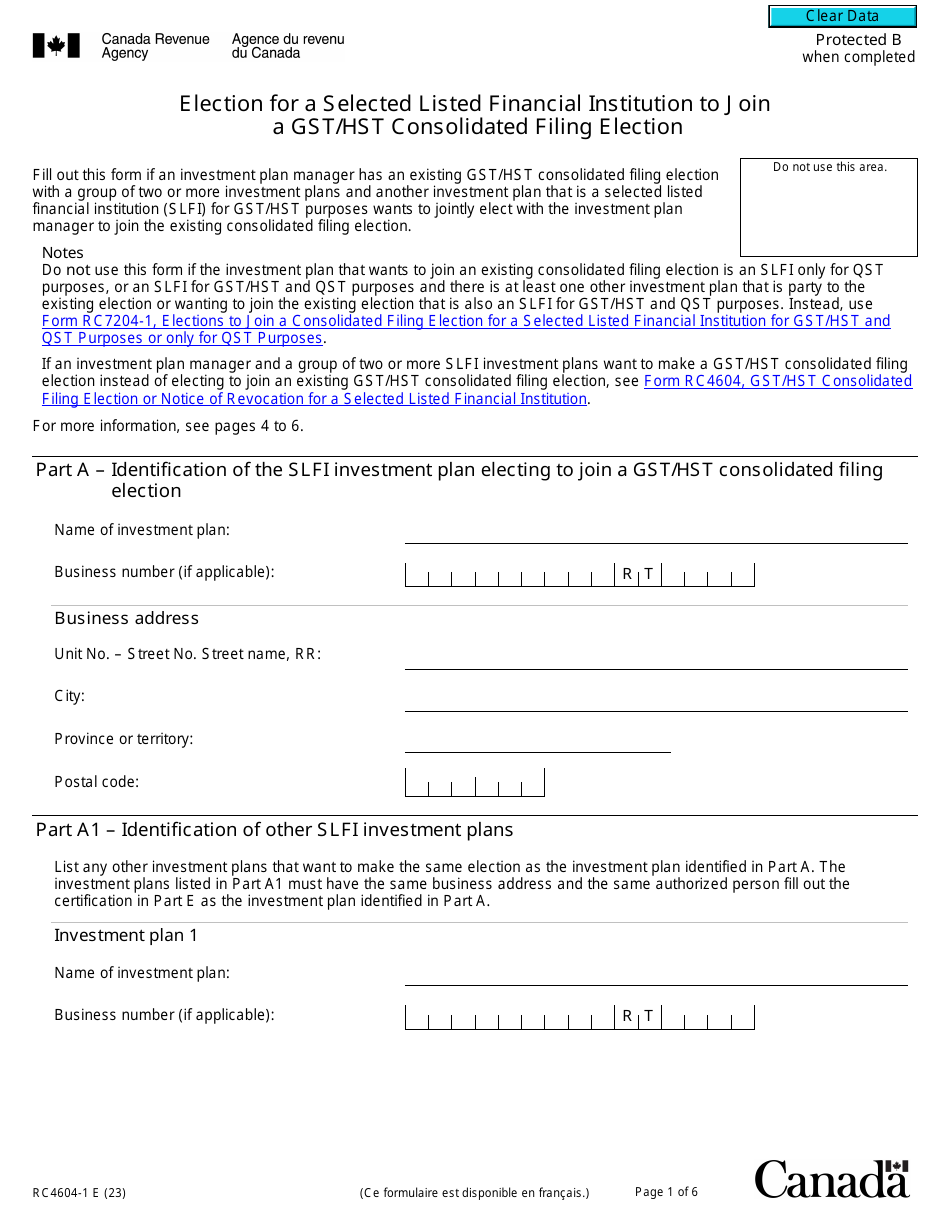

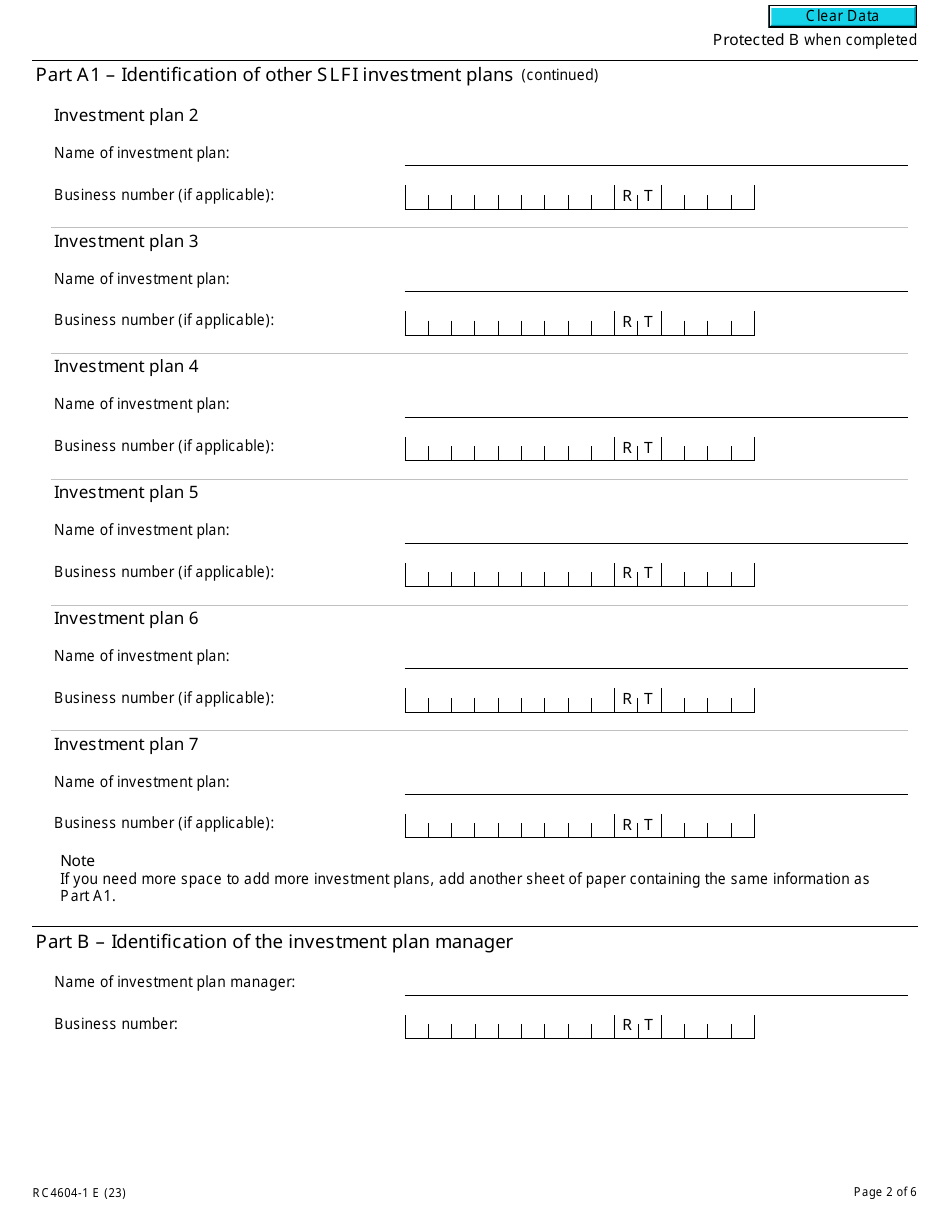

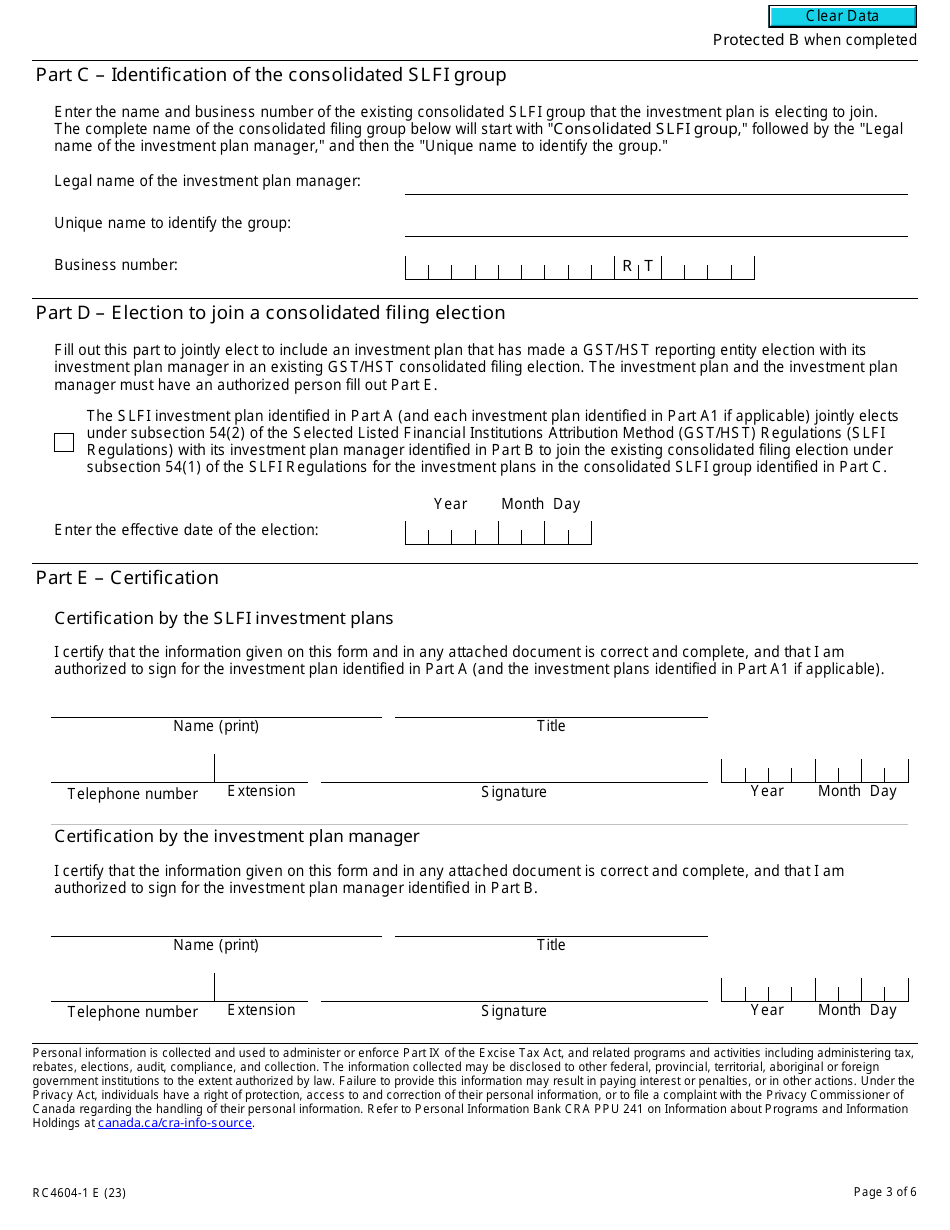

Form RC4604-1 Election for a Selected Listed Financial Institution to Join a GST/HST Consolidated Filing Election is used in Canada by financial institutions to elect to join a consolidated filing arrangement for the Goods and Services Tax (GST) and Harmonized Sales Tax (HST). It allows multiple financial institutions to file a single GST/HST return on behalf of all participating institutions.

The form RC4604-1, Election for a Selected Listed Financial Institution to Join a GST/HST Consolidated Filing Election, is filed by selected listed financial institutions in Canada.

Form RC4604-1 Election for a Selected Listed Financial Institution to Join a Gst/Hst Consolidated Filing Election - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC4604-1?

A: Form RC4604-1 is the election for a selected listed financial institution in Canada to join the GST/HST consolidated filing election.

Q: What is the GST/HST consolidated filing election?

A: The GST/HST consolidated filing election allows selected listed financial institutions in Canada to file a single GST/HST return on behalf of all of their participating members.

Q: Who is eligible to use Form RC4604-1?

A: Selected listed financial institutions in Canada that meet certain criteria are eligible to use Form RC4604-1 to join the GST/HST consolidated filing election.

Q: Is joining the GST/HST consolidated filing election mandatory for selected listed financial institutions?

A: No, joining the GST/HST consolidated filing election is not mandatory. It is an optional election that eligible institutions can choose to make.

Q: How do I complete Form RC4604-1?

A: To complete Form RC4604-1, you will need to provide the required information about your institution and follow the instructions provided on the form.

Q: Are there any deadlines for submitting Form RC4604-1?

A: The deadlines for submitting Form RC4604-1 can vary. It is important to consult the CRA or the instructions on the form for the specific deadline applicable to your situation.

Q: What are the benefits of joining the GST/HST consolidated filing election?

A: Joining the GST/HST consolidated filing election can simplify the filing process for selected listed financial institutions and reduce administrative burden by allowing a single return for all participating members.

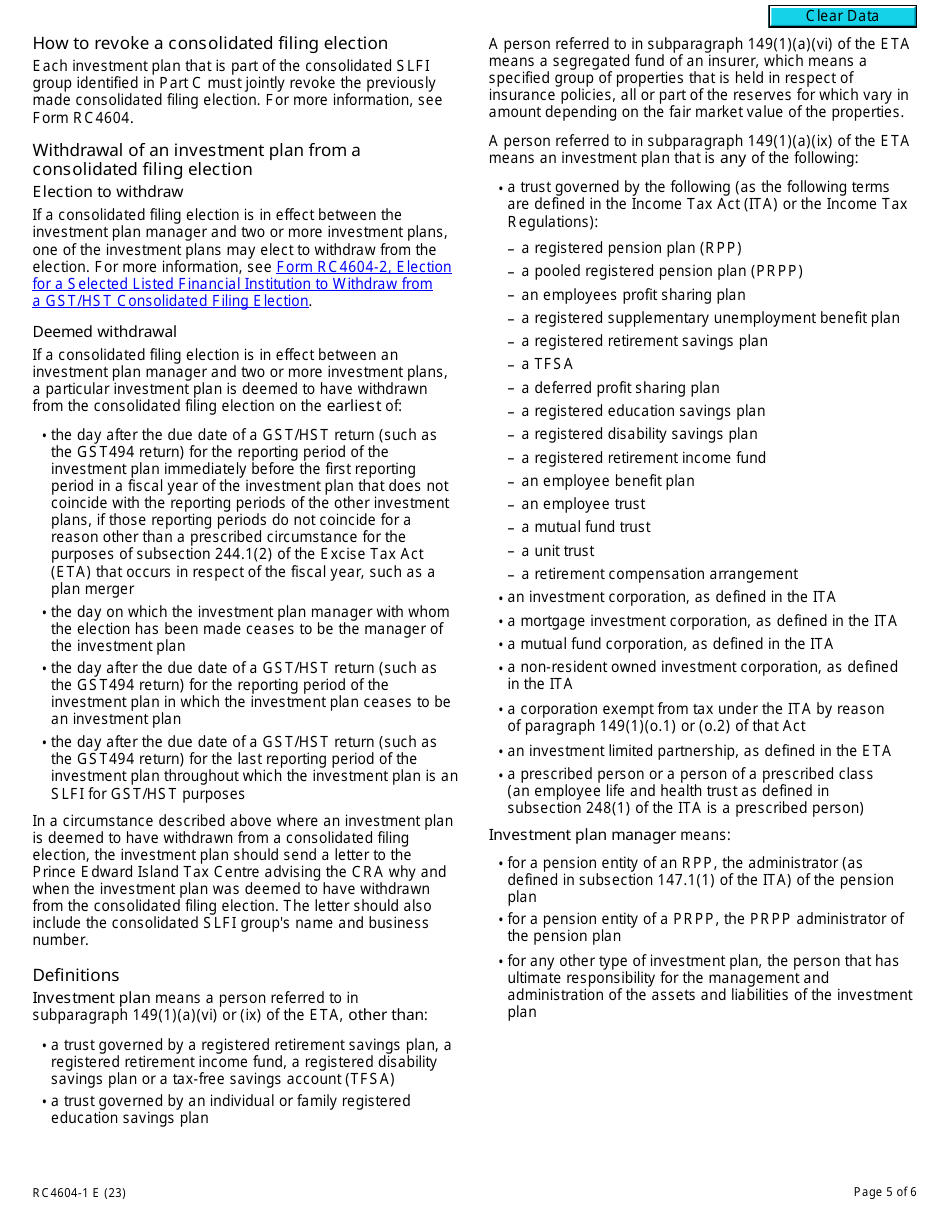

Q: Can a selected listed financial institution leave the GST/HST consolidated filing election?

A: Yes, a selected listed financial institution can leave the GST/HST consolidated filing election by notifying the CRA in writing.