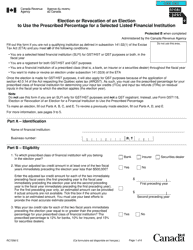

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4606

for the current year.

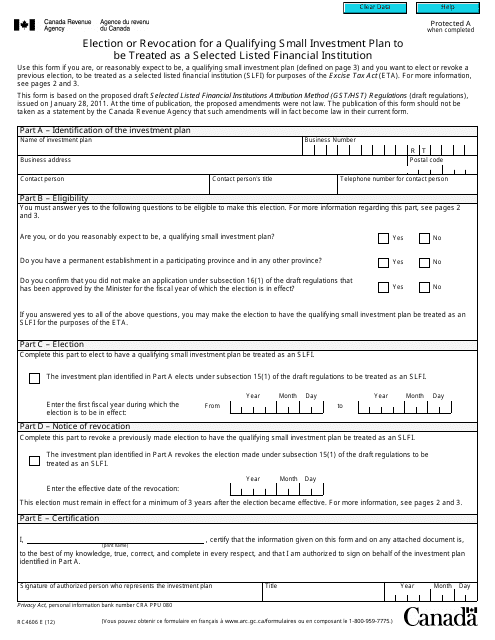

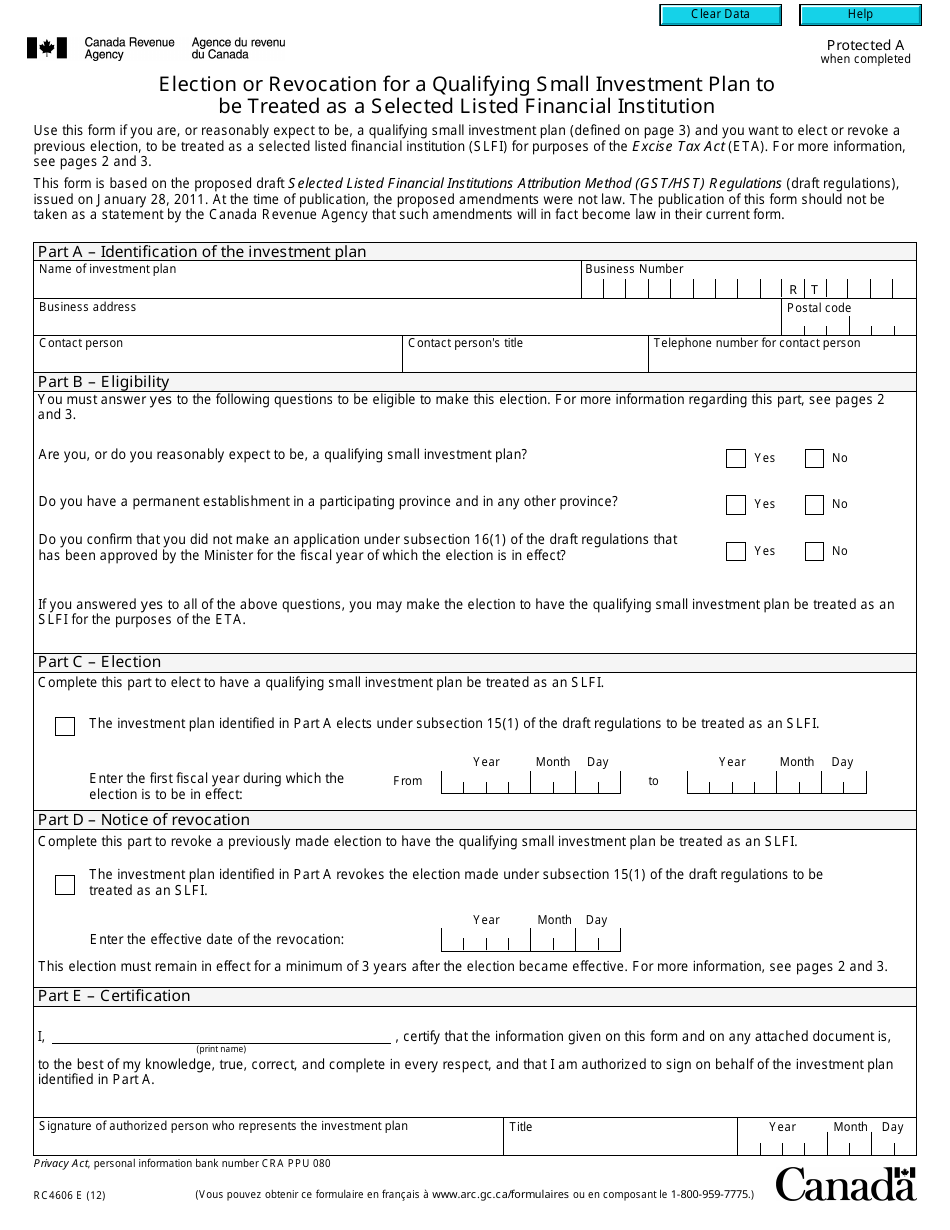

Form RC4606 Election or Revocation for a Qualifying Small Investment Plan to Be Treated as a Selected Listed Financial Institution - Canada

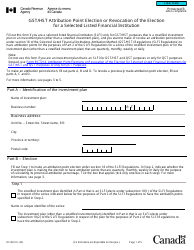

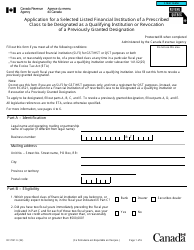

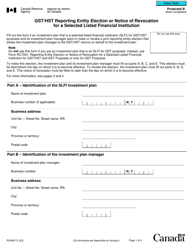

Form RC4606 "Election or Revocation for a Qualifying Small Investment Plan to Be Treated as a Selected Listed Financial Institution" in Canada is used for making an election or revocation for a qualifying small investment plan to be treated as a selected listed financial institution. This form is used for tax purposes and helps determine the tax treatment of the qualifying small investment plan.

The Form RC4606 Election or Revocation for a Qualifying Small Investment Plan to Be Treated as a Selected Listed Financial Institution in Canada is filed by the plan administrator or trustee.

FAQ

Q: What is form RC4606?

A: Form RC4606 is the Election or Revocation form for a Qualifying Small Investment Plan to be treated as a Selected Listed Financial Institution.

Q: Who can use form RC4606?

A: Individuals or entities with a Qualifying Small Investment Plan can use form RC4606.

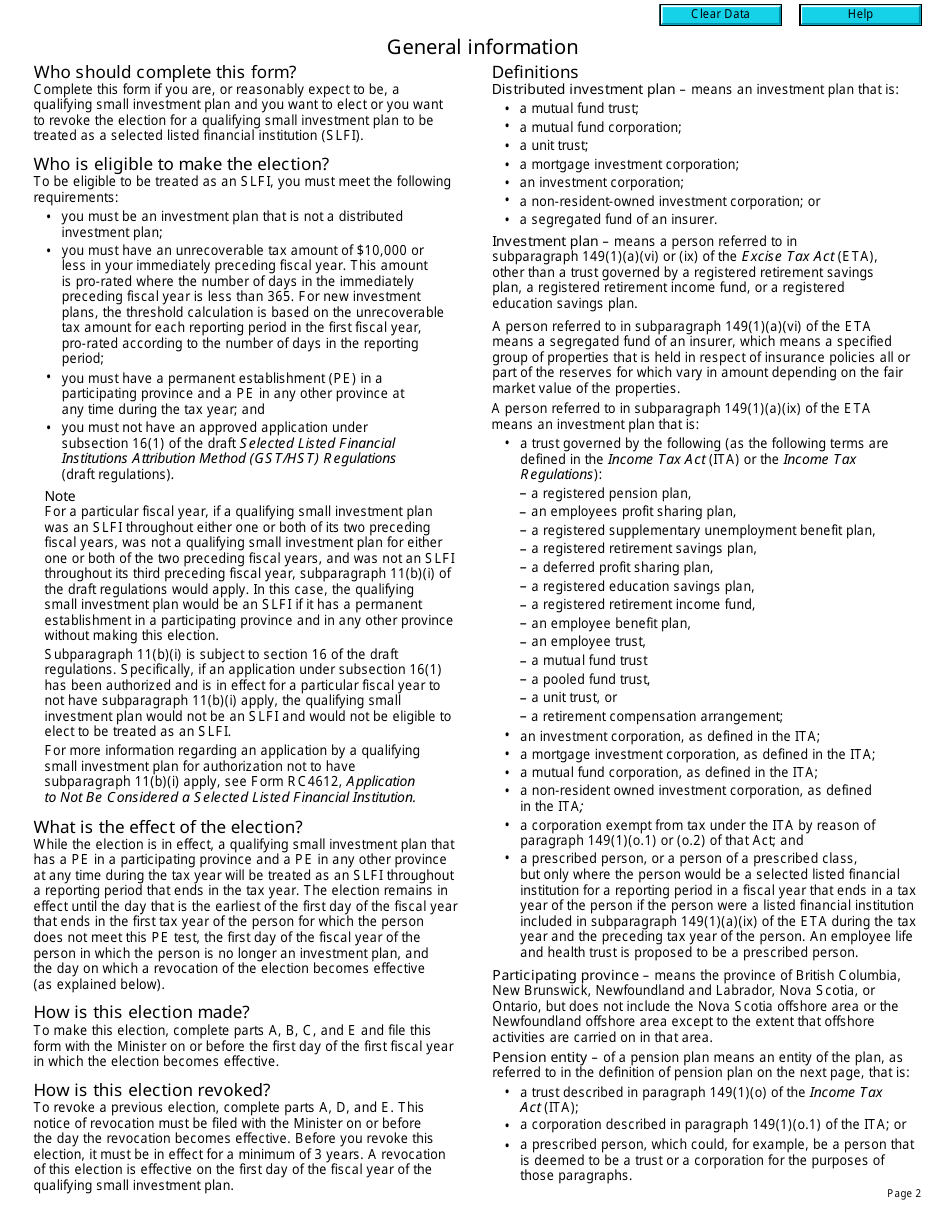

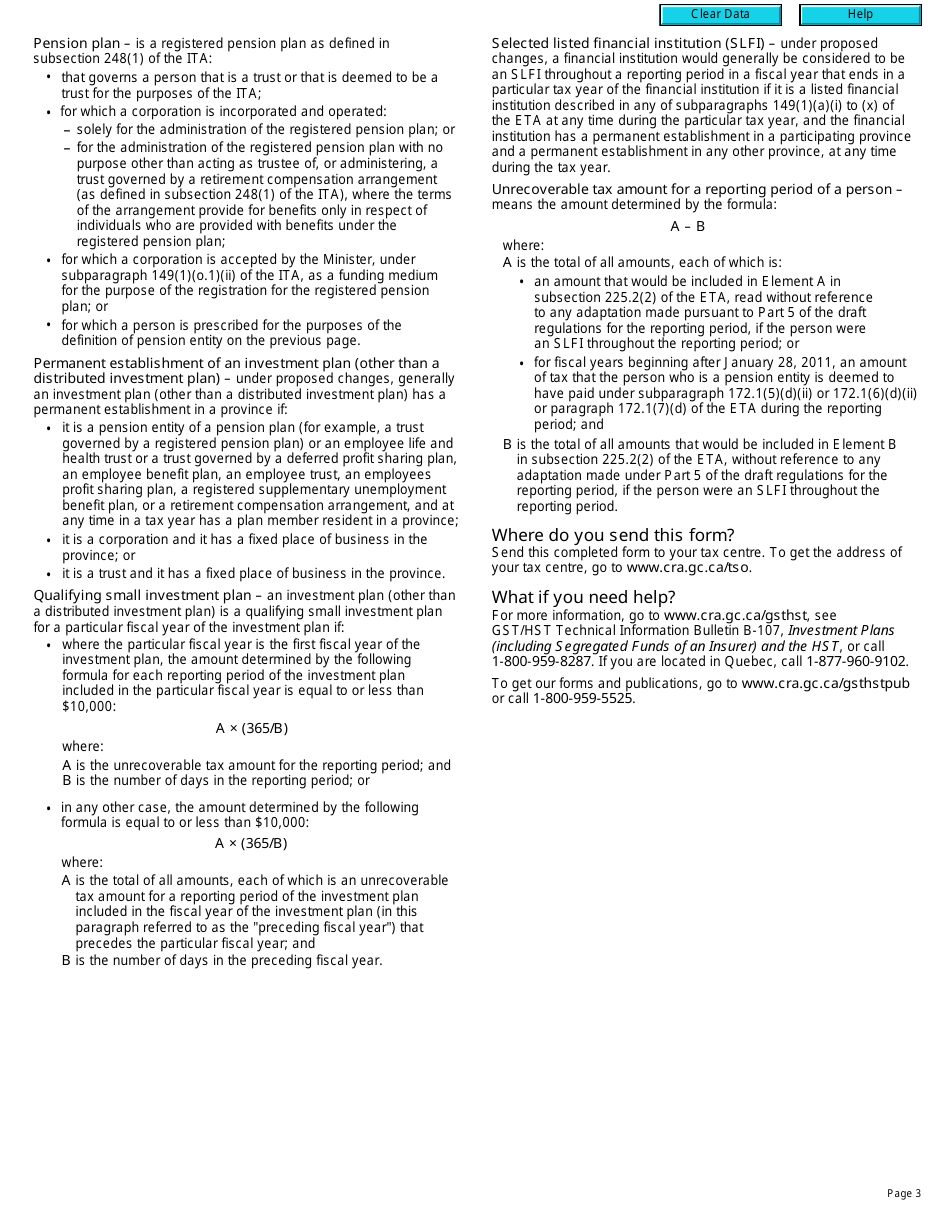

Q: What is a Qualifying Small Investment Plan?

A: A Qualifying Small Investment Plan is a plan with less than $10 million in assets.

Q: What does it mean to be treated as a Selected Listed Financial Institution?

A: Being treated as a Selected Listed Financial Institution means that the plan will be subject to certain requirements and regulations.

Q: Why would someone want to elect or revoke treatment as a Selected Listed Financial Institution?

A: There may be certain tax advantages or compliance requirements associated with being treated as a Selected Listed Financial Institution.

Q: Are there any deadlines for submitting form RC4606?

A: The CRA may have specific deadlines for submitting form RC4606, so it is important to check the latest guidelines and instructions.

Q: Can I get assistance in filling out form RC4606?

A: If you need assistance in filling out form RC4606, you can consult with a tax professional or contact the Canada Revenue Agency (CRA) directly.

Q: What other forms or documents may be required when filing form RC4606?

A: Depending on your specific situation, you may need to include additional forms or documents when filing form RC4606. It is recommended to review the instructions and guidelines provided by the Canada Revenue Agency (CRA).