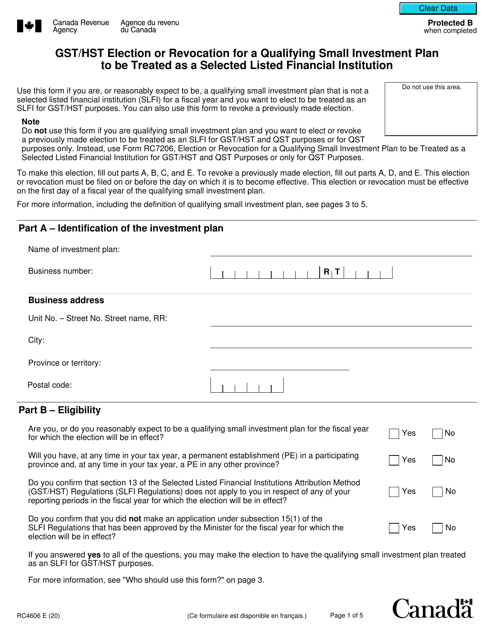

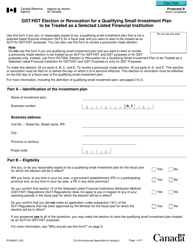

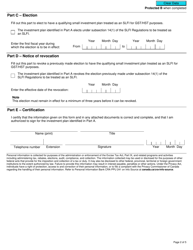

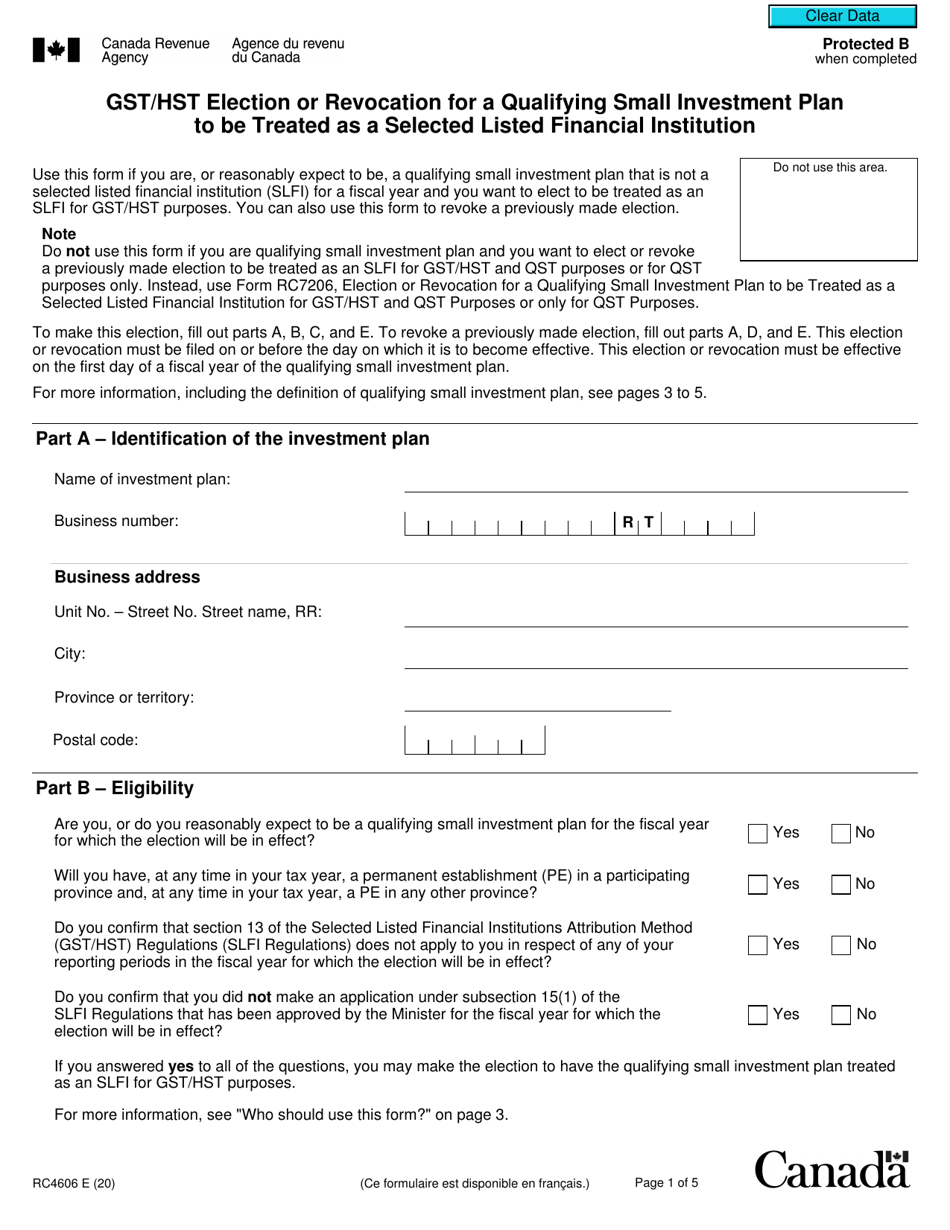

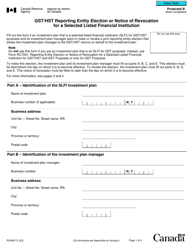

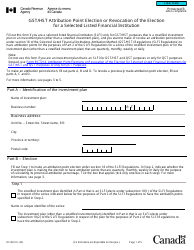

Form RC4606 Gst / Hst Election or Revocation for a Qualifying Small Investment Plan to Be Treated as a Selected Listed Financial Institution - Canada

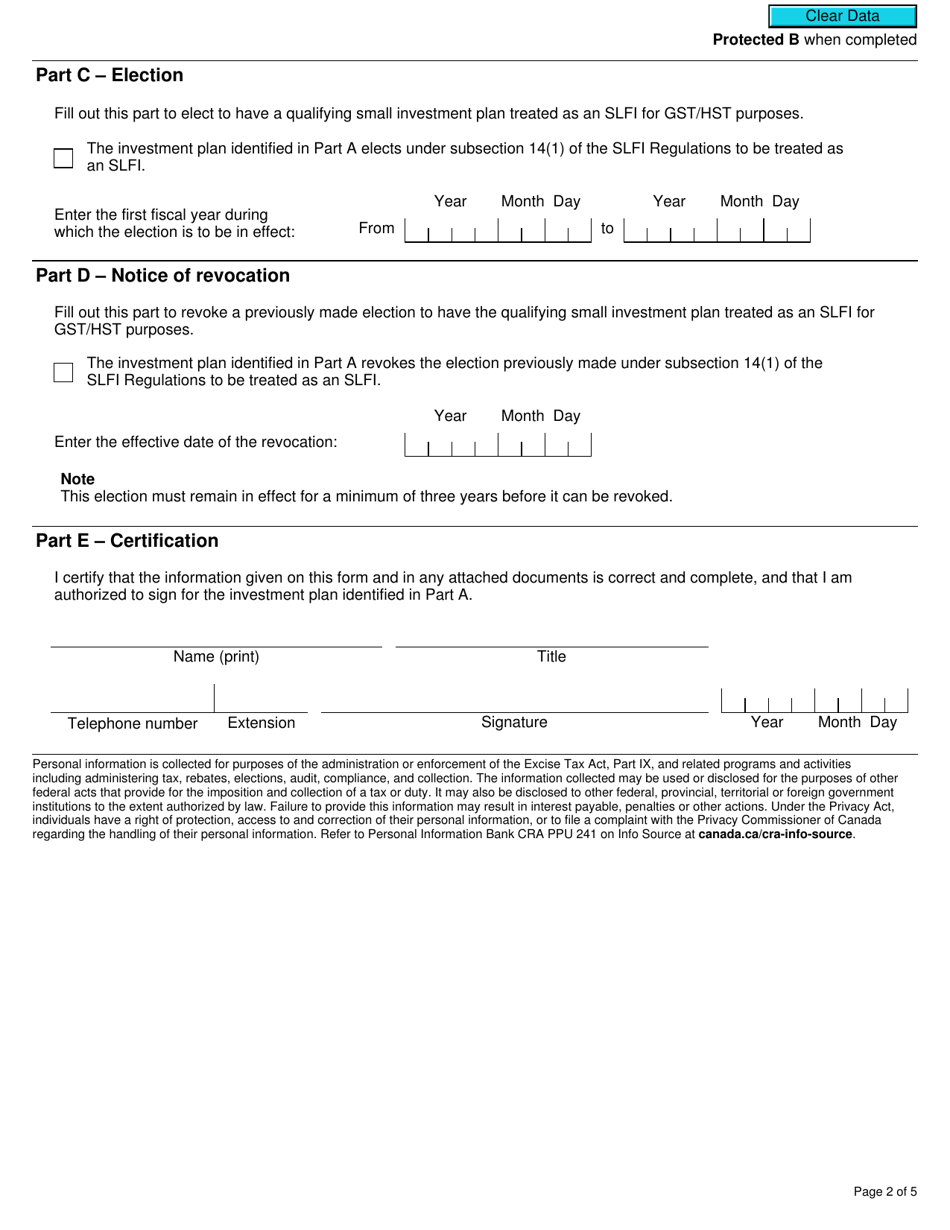

Form RC4606 is used in Canada for electing or revoking the Goods and Services Tax/Harmonized Sales Tax (GST/HST) treatment for a Qualifying Small Investment Plan to be treated as a Selected Listed Financial Institution. This form is used by the plan administrator to make the election or revocation.

The Form RC4606 GST/HST Election or Revocation for a Qualifying Small Investment Plan to be Treated as a Selected Listed Financial Institution is filed by the plan administrator of the qualifying small investment plan in Canada.

Form RC4606 Gst/Hst Election or Revocation for a Qualifying Small Investment Plan to Be Treated as a Selected Listed Financial Institution - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC4606?

A: Form RC4606 is used to make a GST/HST election or revocation for a qualifying small investment plan to be treated as a selected listed financial institution in Canada.

Q: What is a qualifying small investment plan?

A: A qualifying small investment plan refers to a trust governed by a registered retirement savings plan (RRSP), registered retirement income fund (RRIF), pooled registered pension plan (PRPP), or deferred profit sharing plan (DPSP).

Q: What is a selected listed financial institution?

A: A selected listed financial institution is an entity that provides financial services and is required to charge and collect GST/HST.

Q: Why would someone use Form RC4606?

A: One would use Form RC4606 to elect or revoke the treatment of a qualifying small investment plan as a selected listed financial institution for GST/HST purposes.