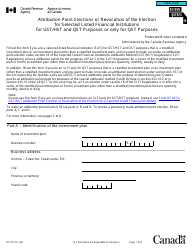

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4616

for the current year.

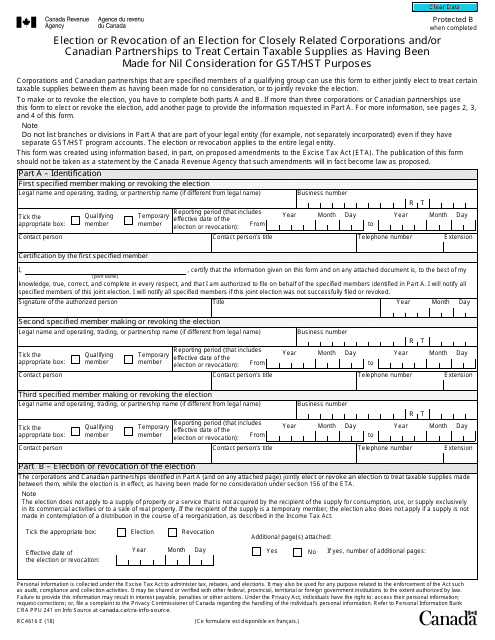

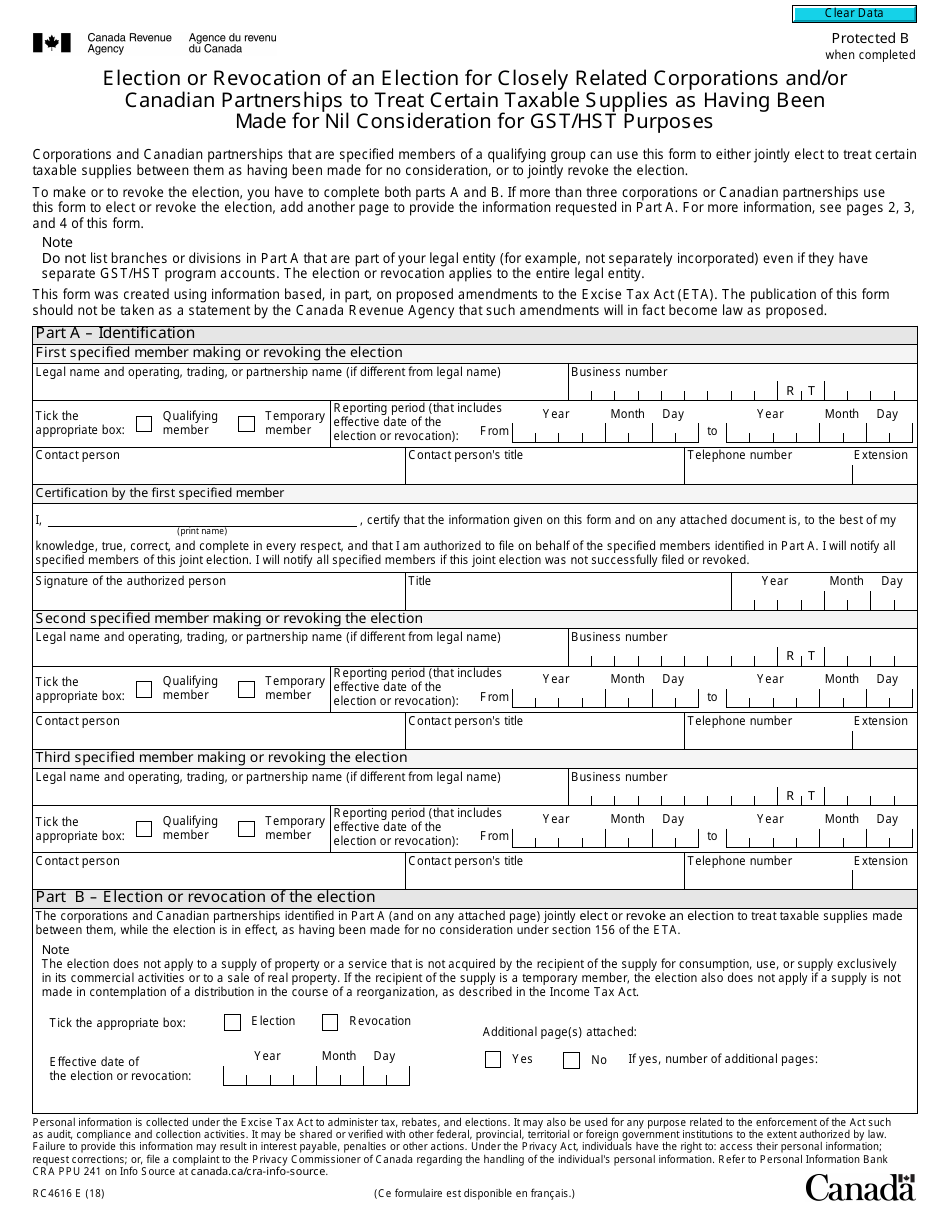

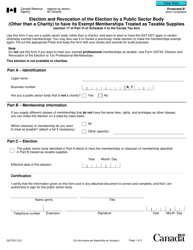

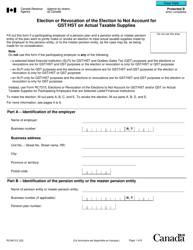

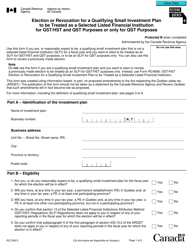

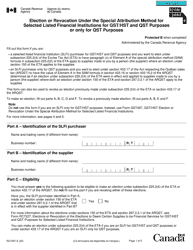

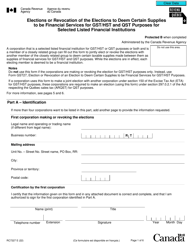

Form RC4616 Election or Revocation of an Election for Closely Related Corporations and / or Canadian Partnerships to Treat Certain Taxable Supplies as Having Been Made for Nil Consideration for Gst / Hst Purposes - Canada

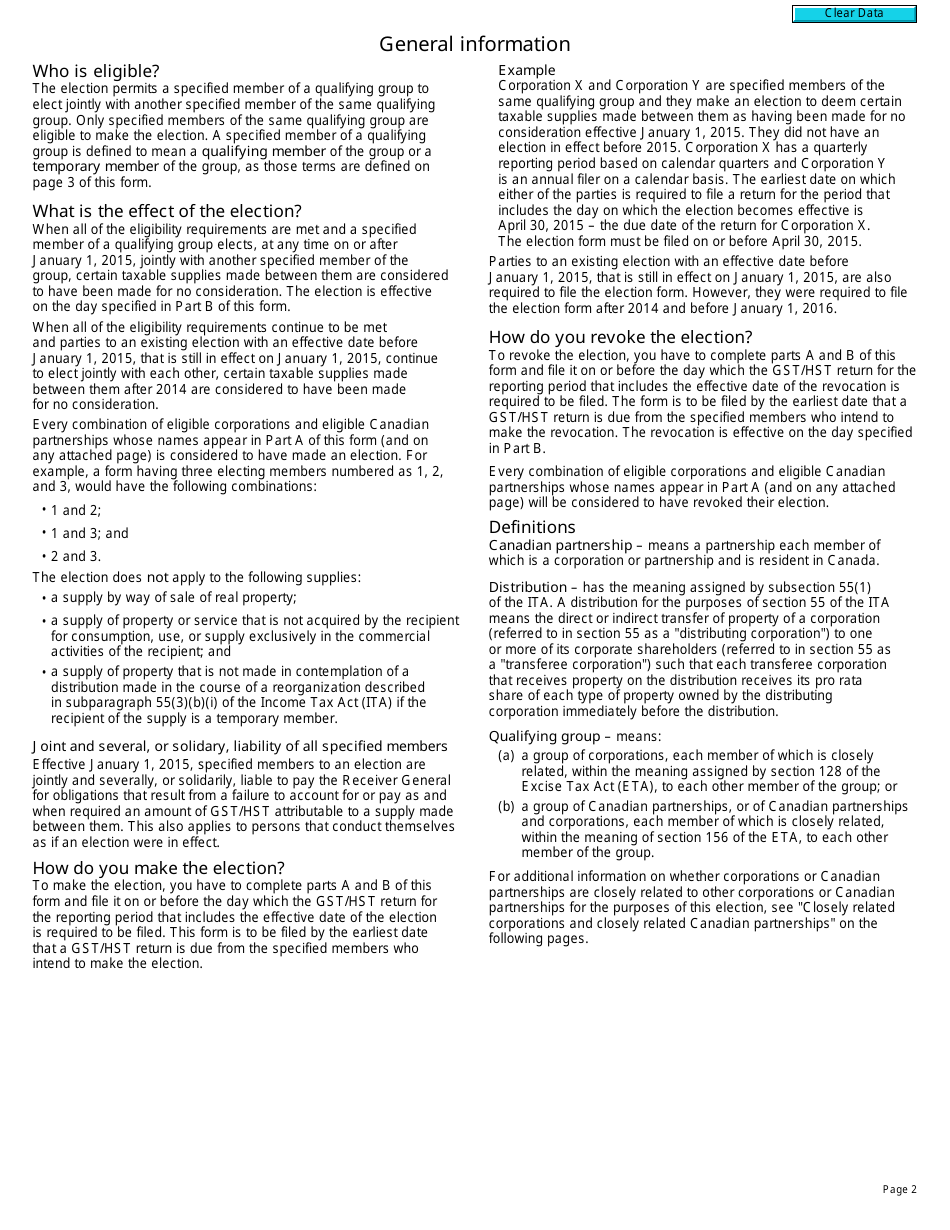

Form RC4616 is used in Canada to make an election or revoke an election for closely related corporations and/or Canadian partnerships to treat certain taxable supplies as having been made for nil consideration for GST/HST purposes. This election allows businesses to minimize their GST/HST obligations in specific situations involving closely related entities.

The Form RC4616 Election or Revocation of an Election for closely related corporations and/or Canadian partnerships to treat certain taxable supplies as having been made for nil consideration for GST/HST purposes in Canada is filed by the corporations or partnerships themselves.

FAQ

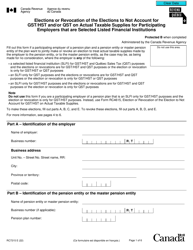

Q: What is Form RC4616?

A: Form RC4616 is a form used in Canada for the election or revocation of an election for closely related corporations and/or Canadian partnerships to treat certain taxable supplies as having been made for nil consideration for GST/HST purposes.

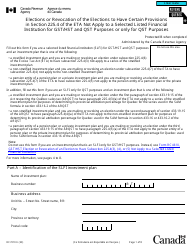

Q: What is the purpose of Form RC4616?

A: The purpose of Form RC4616 is to allow closely related corporations and/or Canadian partnerships to elect or revoke the election to treat certain taxable supplies as having been made for nil consideration for GST/HST purposes.

Q: Who can use Form RC4616?

A: Closely related corporations and/or Canadian partnerships can use Form RC4616.

Q: What is meant by treating taxable supplies as having been made for nil consideration?

A: Treating taxable supplies as having been made for nil consideration means that no GST/HST is charged or collected on those supplies.

Q: Why would a corporation or partnership elect to treat taxable supplies as having been made for nil consideration?

A: A corporation or partnership may elect to treat taxable supplies as having been made for nil consideration to simplify their GST/HST reporting and avoid charging and collecting GST/HST on certain supplies to related parties.