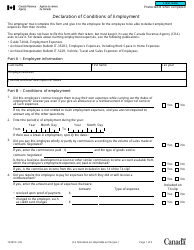

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC521

for the current year.

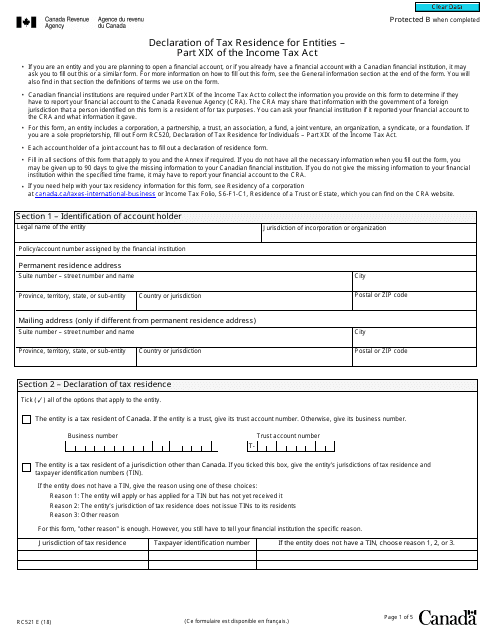

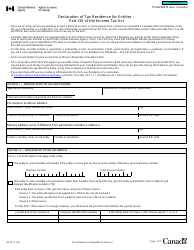

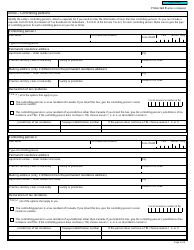

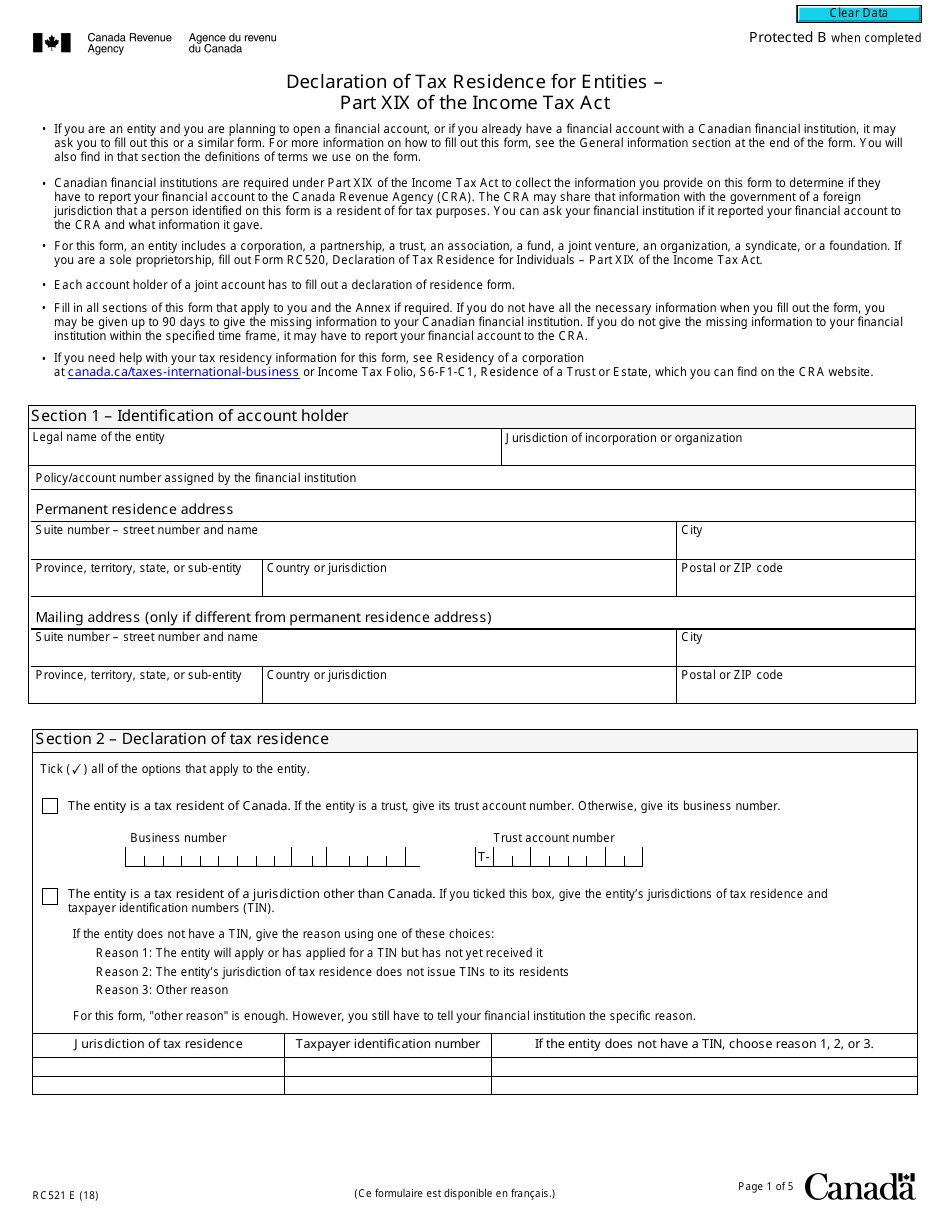

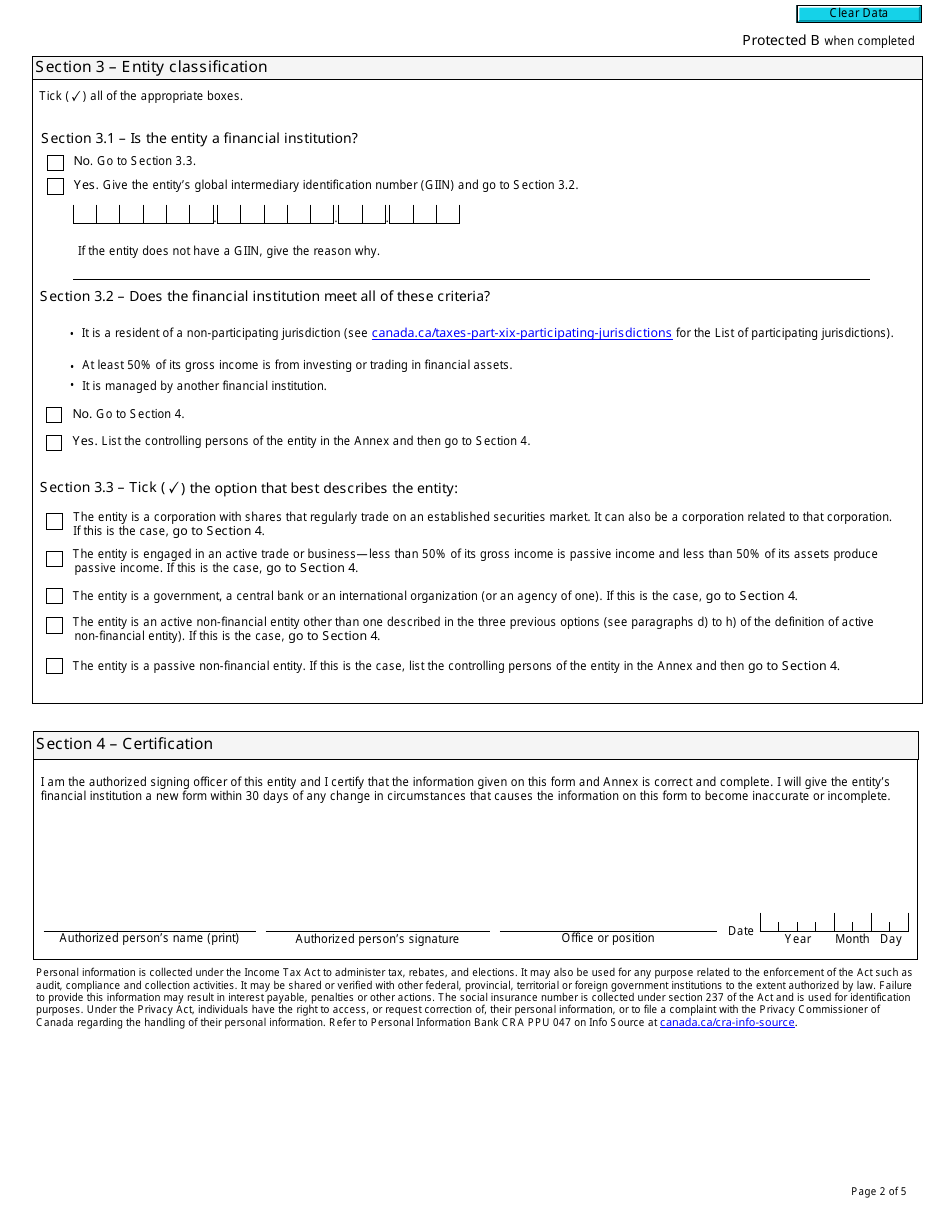

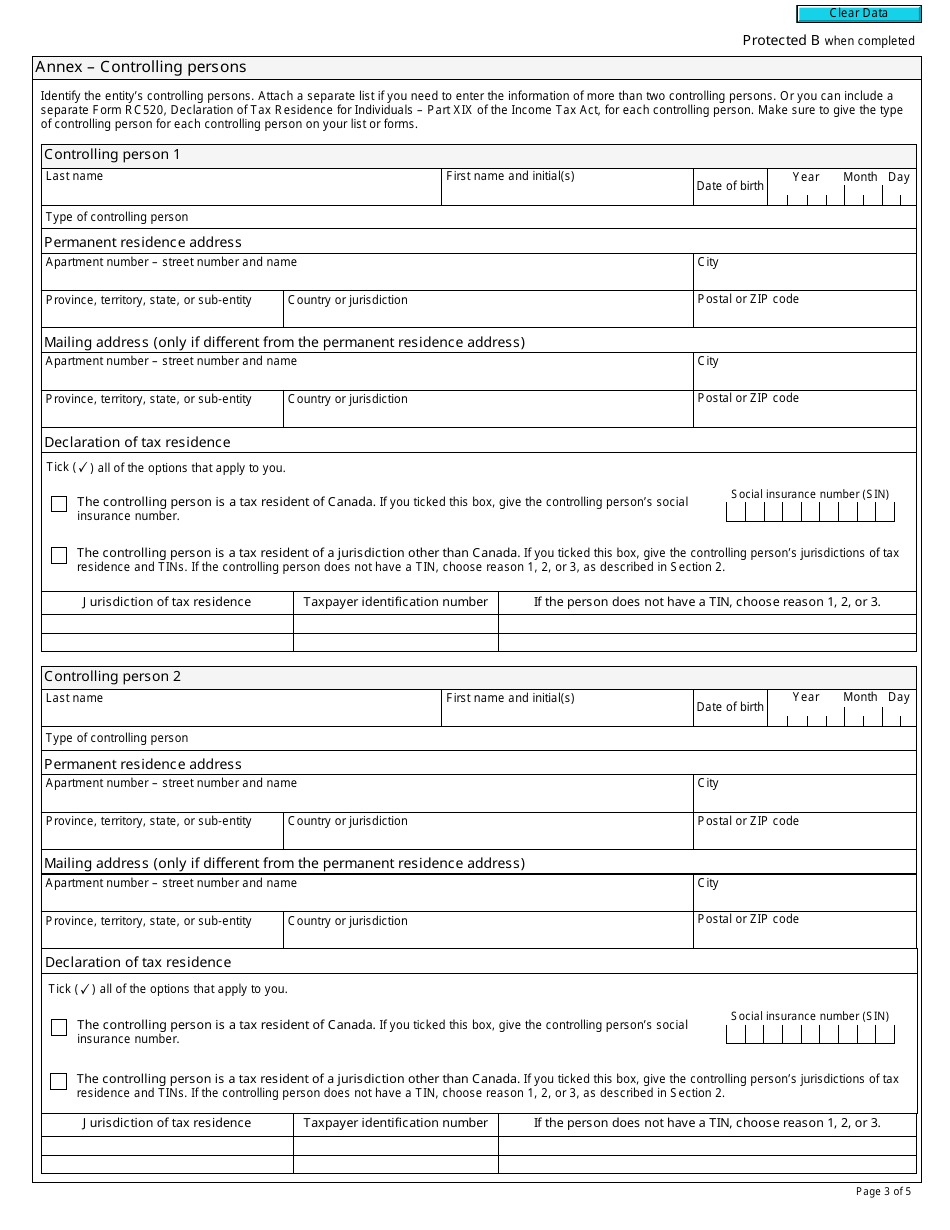

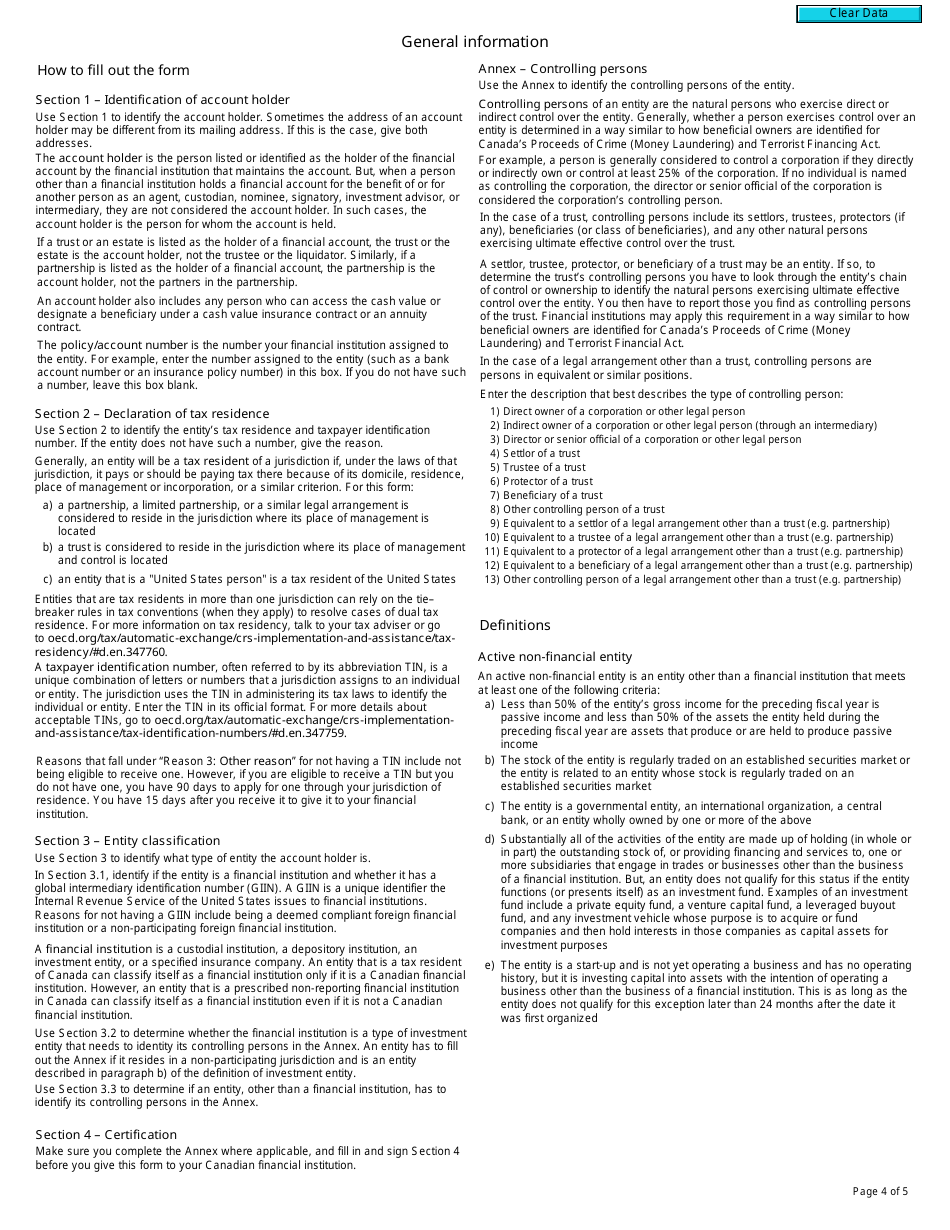

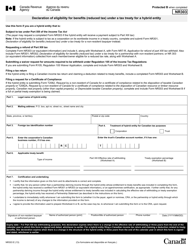

Form RC521 Declaration of Tax Residence for Entities - Part Xix of the Income Tax Act - Canada

Form RC521, Declaration of Tax Residence for Entities, is used in Canada for entities to declare their tax residence status. It is required to determine the entity's eligibility for tax benefits, exemptions, and treaty benefits under the provisions of the Income Tax Act.

The Form RC521 Declaration of Tax Residence for Entities is filed by entities that are claiming treaty benefits or establishing their tax residency under Part XIX of the Income Tax Act in Canada.

FAQ

Q: What is Form RC521?

A: Form RC521 is the Declaration of Tax Residence for Entities.

Q: What is Part XIX of the Income Tax Act?

A: Part XIX of the Income Tax Act is the section that pertains to tax residency for entities.

Q: Who needs to fill out Form RC521?

A: Entities that need to declare their tax residence in Canada need to fill out Form RC521.

Q: What information is required in Form RC521?

A: Form RC521 requires information such as entity type, entity name, business address, tax identification number, and details of the entity's tax residence.

Q: Is Form RC521 mandatory?

A: Yes, entities that need to declare their tax residence in Canada are required to submit Form RC521.

Q: What should I do after filling out Form RC521?

A: After filling out Form RC521, you should keep a copy for your records and submit it to the CRA as instructed on the form.

Q: Are there any penalties for not submitting Form RC521?

A: Failure to submit Form RC521 may result in penalties or additional taxes being imposed by the CRA.

Q: Can I claim tax benefits by filling out Form RC521?

A: Form RC521 is not used to claim tax benefits, but rather to declare tax residence for entities.

Q: Is Form RC521 applicable only to Canadian entities?

A: No, entities outside of Canada can also use Form RC521 to declare their tax residence in Canada.