This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC518

for the current year.

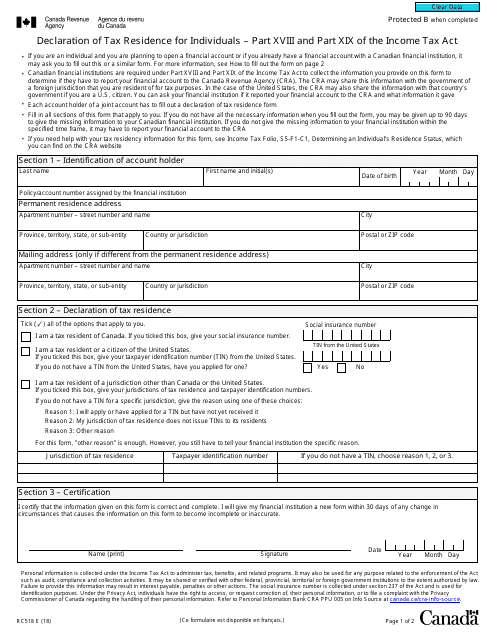

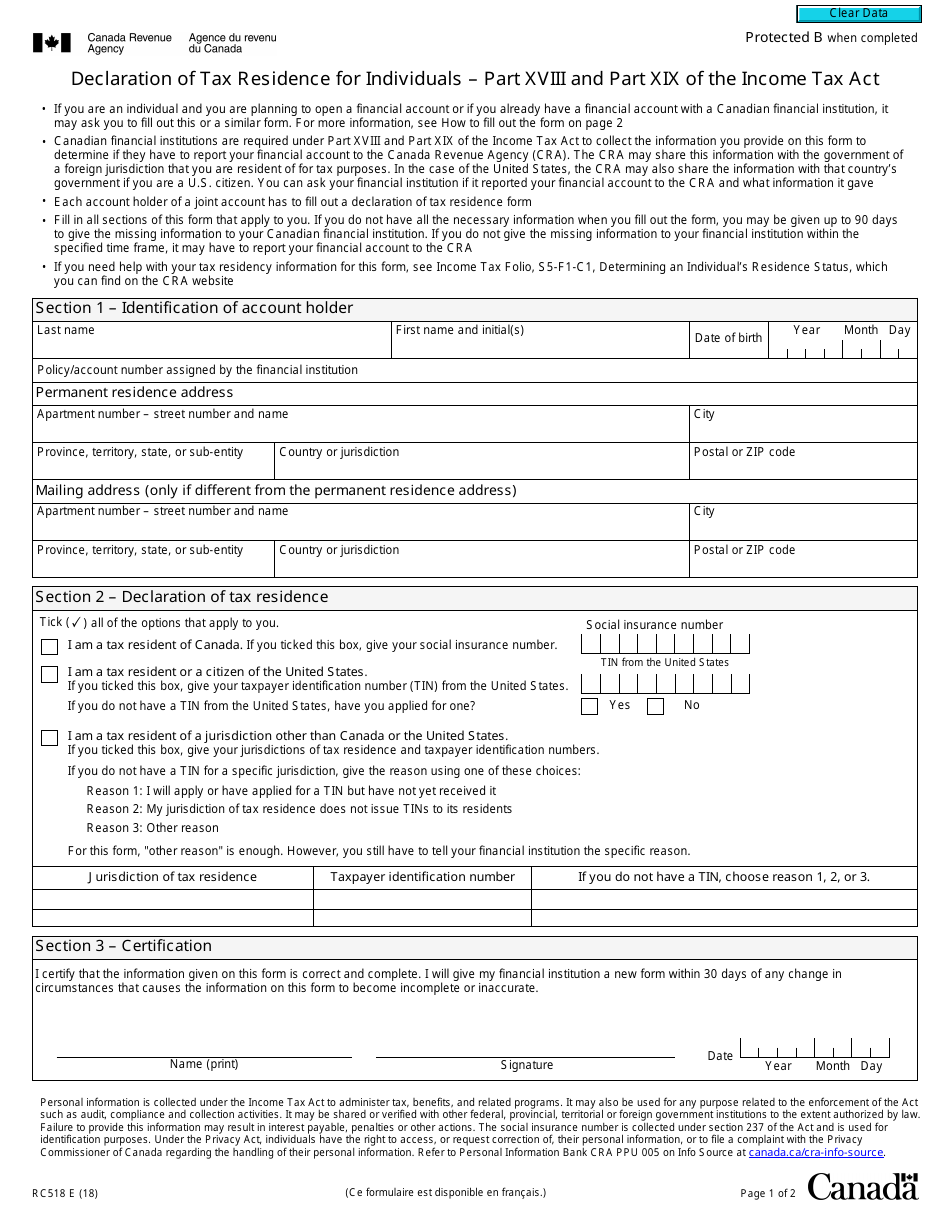

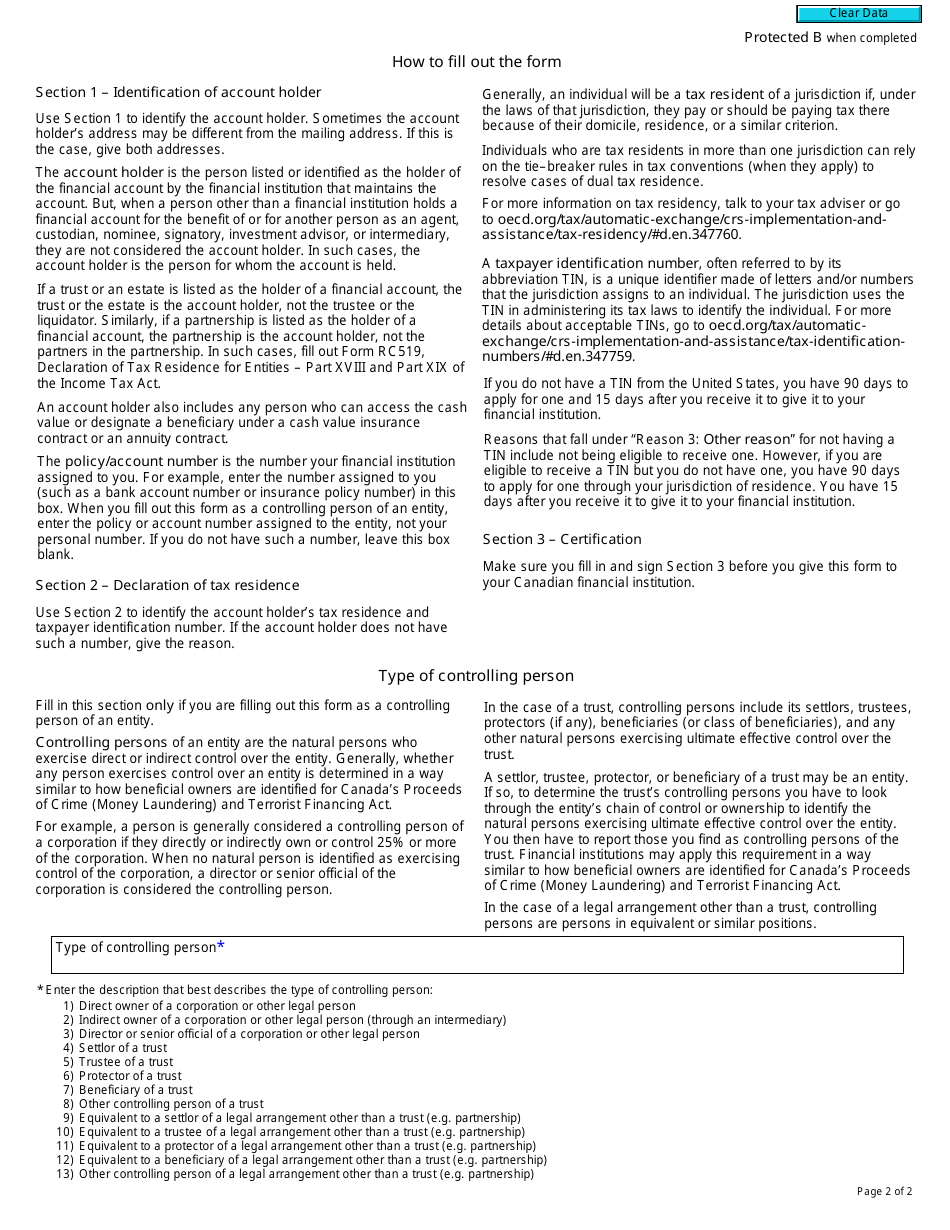

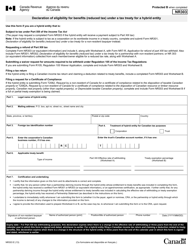

Form RC518 Declaration of Tax Residence for Individuals - Part Xviii and Part Xix of the Income Tax Act - Canada

Form RC518 Declaration of Tax Residence for Individuals is used by individuals who are residents of Canada for income tax purposes. Part XVIII of the Income Tax Act pertains to foreign income while Part XIX deals with non-resident withholding tax. This form is used to declare the individual's tax residence status in order to determine their tax obligations and entitlements in Canada.

The taxpayer is responsible for filing Form RC518 (Declaration of Tax Residence for Individuals) in Canada.

FAQ

Q: What is Form RC518?

A: Form RC518 is a declaration of tax residence for individuals.

Q: What are Part XVIII and Part XIX of the Income Tax Act?

A: Part XVIII and Part XIX of the Income Tax Act in Canada are specific sections related to tax residency and non-residency.

Q: Why is Form RC518 important?

A: Form RC518 is important because it helps individuals declare their tax residence and determine their tax obligations in Canada.

Q: Who needs to fill out Form RC518?

A: Anyone who is an individual and needs to declare their tax residence in Canada should fill out Form RC518.

Q: What information is required in Form RC518?

A: Form RC518 requires information such as personal details, residency status, and supporting documentation.

Q: When should Form RC518 be submitted?

A: Form RC518 should be submitted when an individual wants to declare their tax residence or when requested by the CRA.

Q: Are there any penalties for not submitting Form RC518?

A: Failure to submit Form RC518 when required may result in penalties or additional tax assessments.

Q: Can I change my tax residence after submitting Form RC518?

A: Yes, if your circumstances change, you can update your tax residence by submitting an amended form or notifying the CRA.

Q: Is Form RC518 applicable only to Canadian residents?

A: No, Form RC518 is applicable to both Canadian residents and non-residents who have tax obligations in Canada.