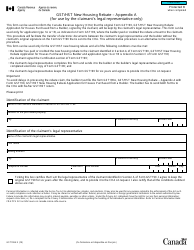

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC7190-ON

for the current year.

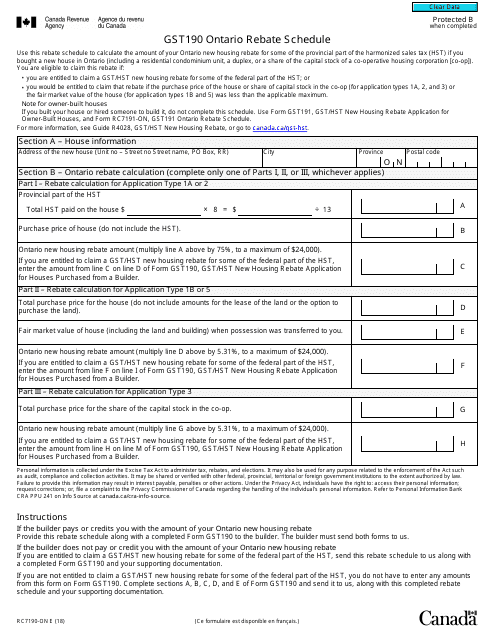

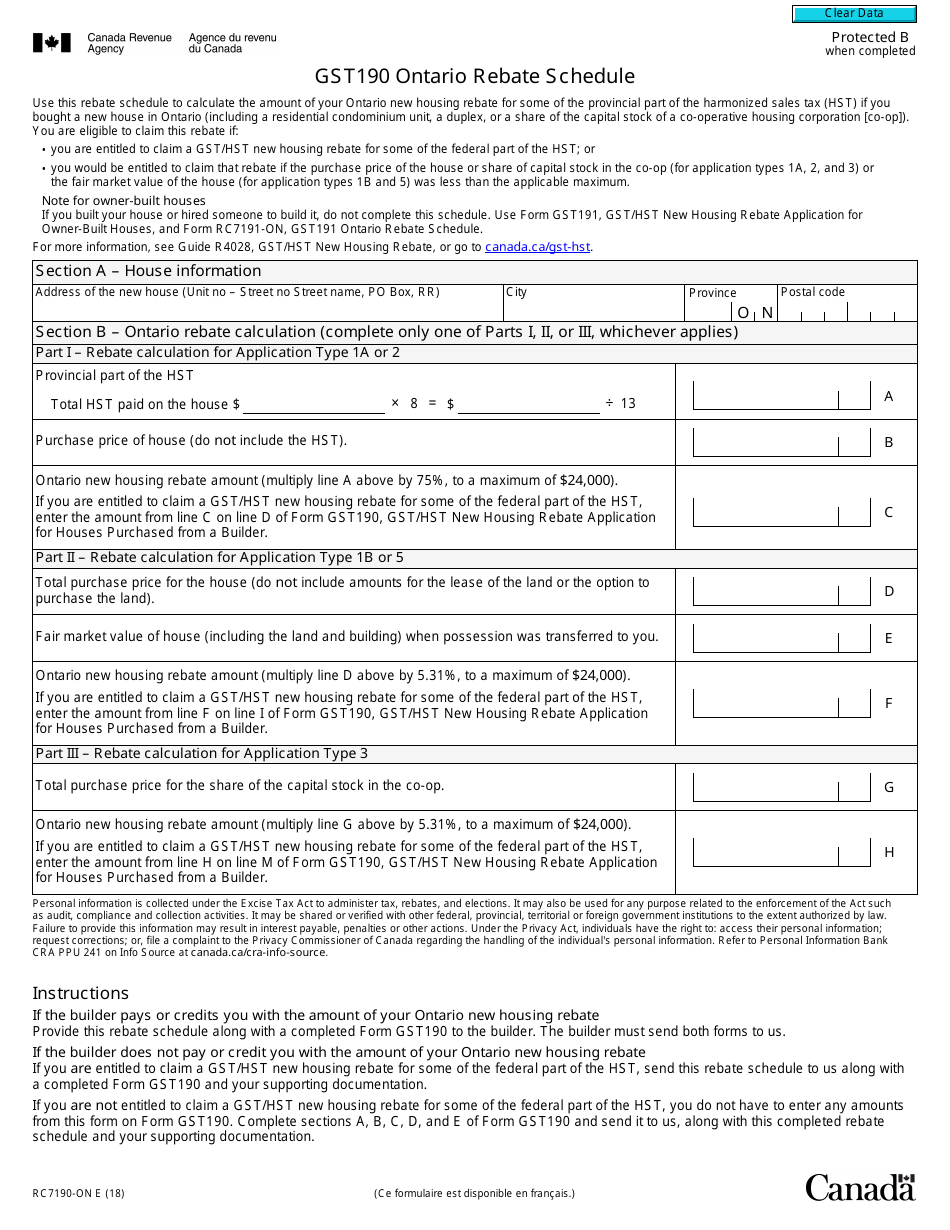

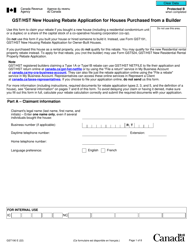

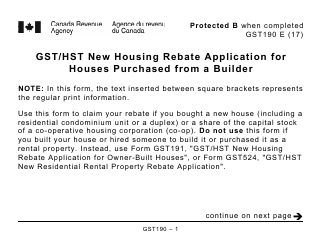

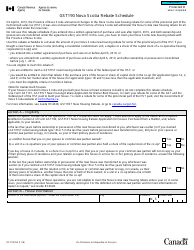

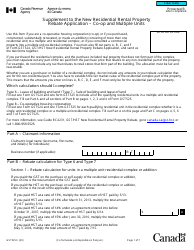

Form RC7190-ON Gst190 Ontario Rebate Schedule - Canada

Form RC7190-ON Gst190 Ontario Rebate Schedule is used in Canada for claiming rebates on the Harmonized Sales Tax (HST) paid on specified purchases in Ontario.

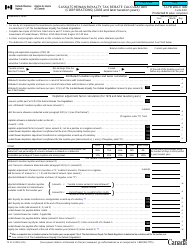

In Ontario, Canada, the Form RC7190-ON GST190 Ontario Rebate Schedule is filed by businesses that are eligible for the Ontario GST/HST rebate.

FAQ

Q: What is Form RC7190-ON?

A: Form RC7190-ON is the GST190 Ontario Rebate Schedule form in Canada.

Q: What is the purpose of the GST190 Ontario Rebate Schedule?

A: The purpose of the GST190 Ontario Rebate Schedule is to claim a GST/HST rebate for residents of Ontario.

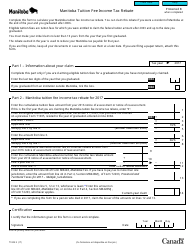

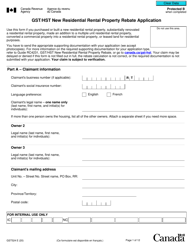

Q: Who is eligible to use the GST190 Ontario Rebate Schedule?

A: Residents of Ontario who meet certain criteria are eligible to use the GST190 Ontario Rebate Schedule.

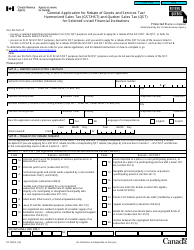

Q: How do I complete the GST190 Ontario Rebate Schedule?

A: You need to provide your personal information, details of the property, and information about the GST/HST paid.

Q: What supporting documents do I need to include with the GST190 Ontario Rebate Schedule?

A: You may need to include documents such as invoices, receipts, and the agreement of purchase and sale.

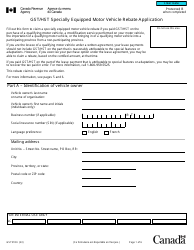

Q: When can I expect to receive the rebate after submitting the GST190 Ontario Rebate Schedule?

A: The processing time for the rebate varies, but it usually takes several weeks to receive the rebate.

Q: Can I claim the GST/HST rebate for a new home using the GST190 Ontario Rebate Schedule?

A: Yes, the GST190 Ontario Rebate Schedule can be used to claim the GST/HST rebate for a new home.