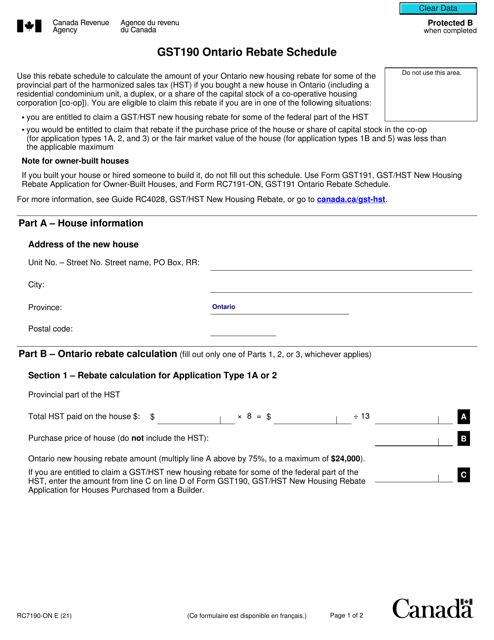

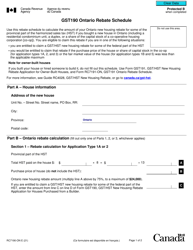

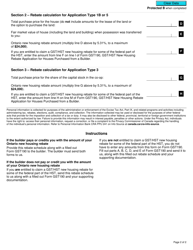

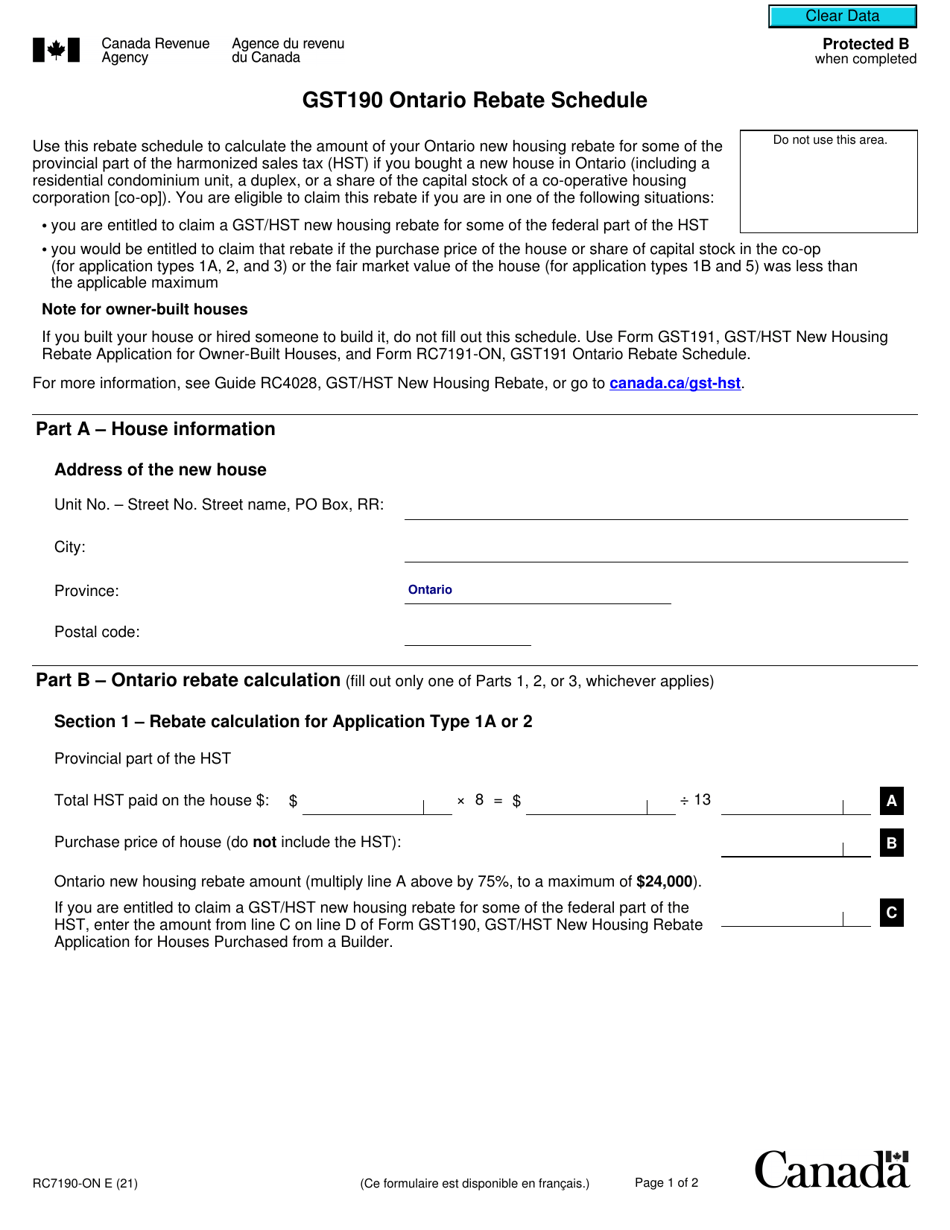

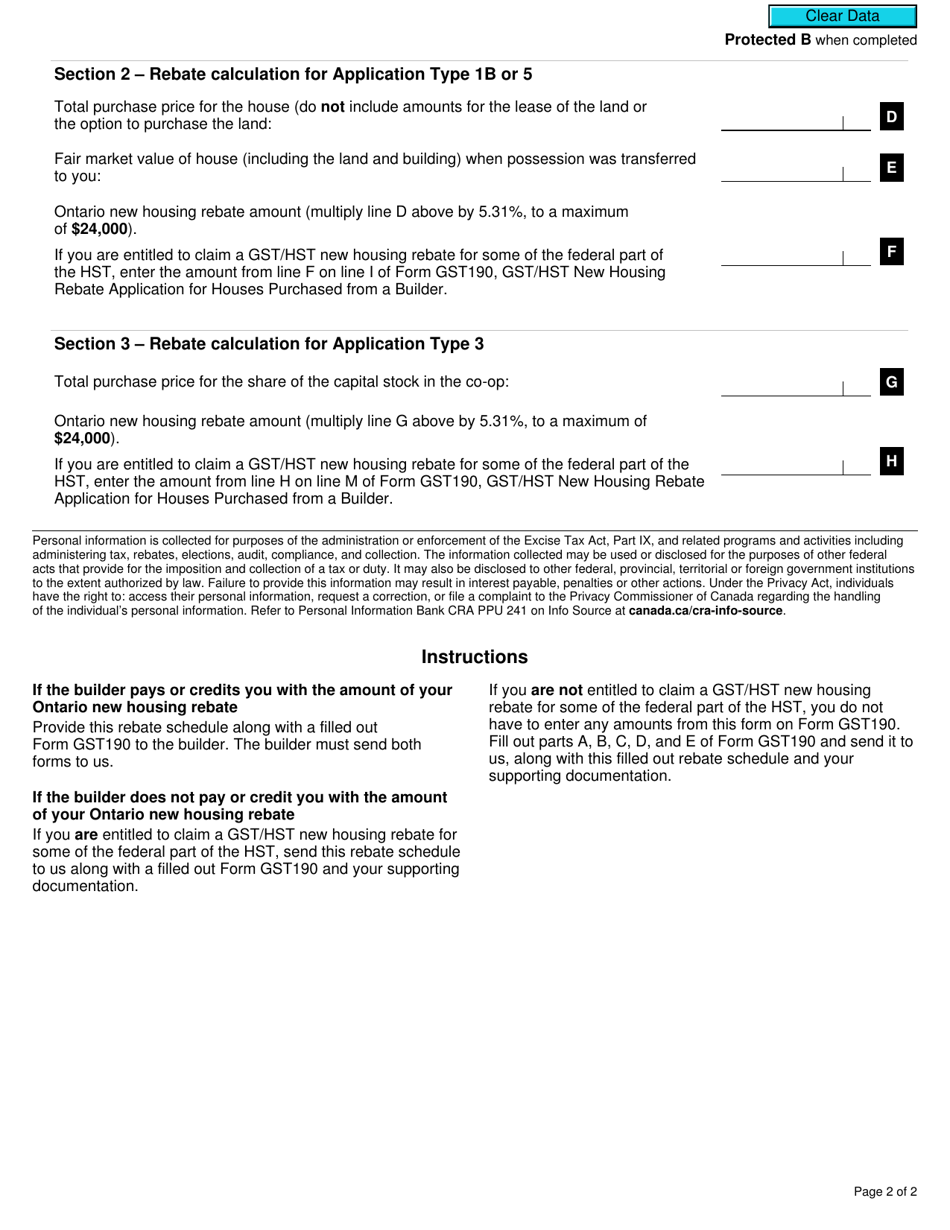

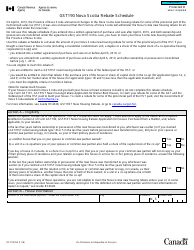

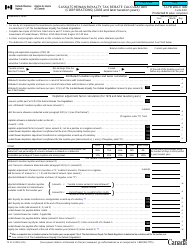

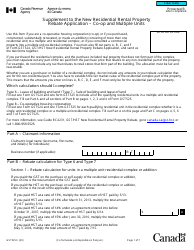

Form RC7190-ON Gst190 Ontario Rebate Schedule - Canada

Form RC7190-ON, also known as the GST190 Ontario Rebate Schedule, is used for claiming a rebate of the goods and services tax/harmonized sales tax (GST/HST) for eligible expenses in the province of Ontario, Canada. It allows individuals to request a refund of the GST/HST paid on certain expenses, such as home renovations or the purchase of a new home. This form is specifically for residents of Ontario who are eligible for the rebate.

The Form RC7190-ON GST190 Ontario Rebate Schedule in Canada is usually filed by individuals or businesses who are claiming the Ontario Rebate for the Goods and Services Tax (GST).

Form RC7190-ON Gst190 Ontario Rebate Schedule - Canada - Frequently Asked Questions (FAQ)

Q: What is the RC7190-ON GST190 Ontario Rebate Schedule?

A: The RC7190-ON GST190 Ontario Rebate Schedule is a form used by businesses in Ontario, Canada to claim a rebate of the Goods and Services Tax/Harmonized Sales Tax (GST/HST) paid on specified goods and services.

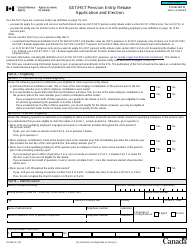

Q: Who can use the RC7190-ON GST190 Ontario Rebate Schedule?

A: The RC7190-ON GST190 Ontario Rebate Schedule can be used by businesses registered for GST/HST in Ontario that qualify for the specified rebates.

Q: What types of goods and services are eligible for the rebate?

A: The RC7190-ON GST190 Ontario Rebate Schedule covers various categories of goods and services, including qualifying medical and assistive devices, certain public service bodies, and specified motor vehicles.

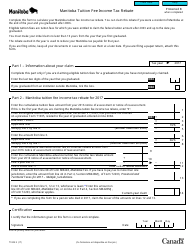

Q: How do I fill out the RC7190-ON GST190 Ontario Rebate Schedule?

A: The RC7190-ON GST190 Ontario Rebate Schedule requires you to provide information about your business, the specific goods and services for which you are claiming a rebate, and the amount of GST/HST paid. Follow the instructions provided with the form to ensure accurate completion.